SOLID ECN LLC

Solid ECN Representative

- Messages

- 514

Against the backdrop of the start of the corporate reporting period, corporate news comes to the fore for stock indices. ArcelorMittal SA announced that it intends to acquire a majority stake in the Austrian steel company Voestalpine AG. The preliminary amount of the deal is estimated at 1 billion dollars. The day before, Hermes International SA published its financial results, according to which the quarterly revenue exceeded 3.10 billion euros, and the growth compared to the previous quarter was 33%, thanks to an increase in sales in all segments.

The rally that began in the French bond market in March of this year is continuing now, with popular 10-year bonds yielding 1.334%, up from 0.350% in early March, and conservative 20-year bonds hitting 1.628%, the last time observed at the beginning of 2017.

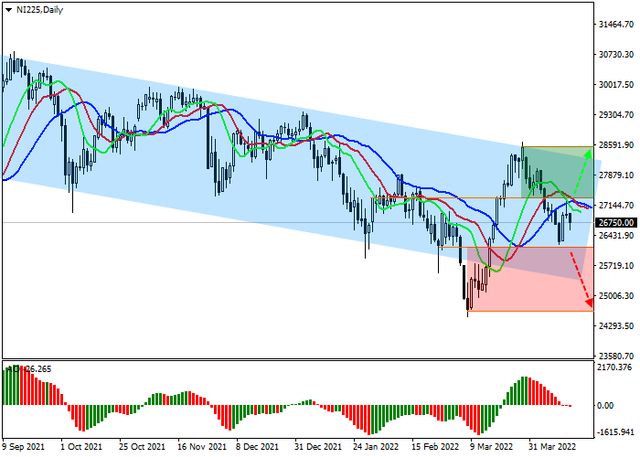

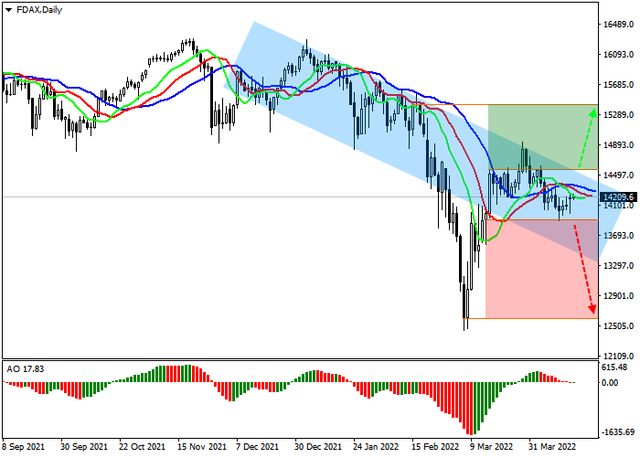

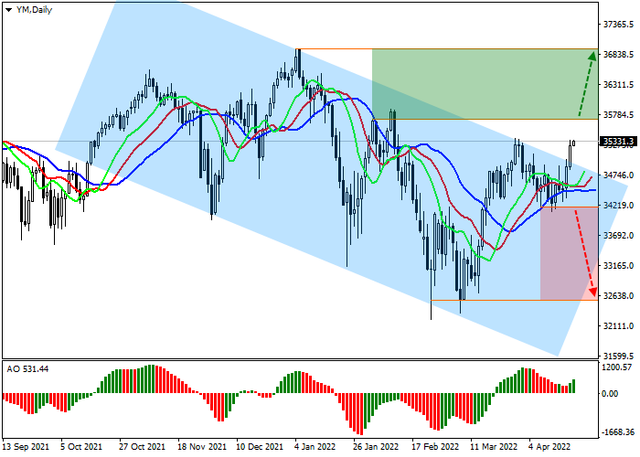

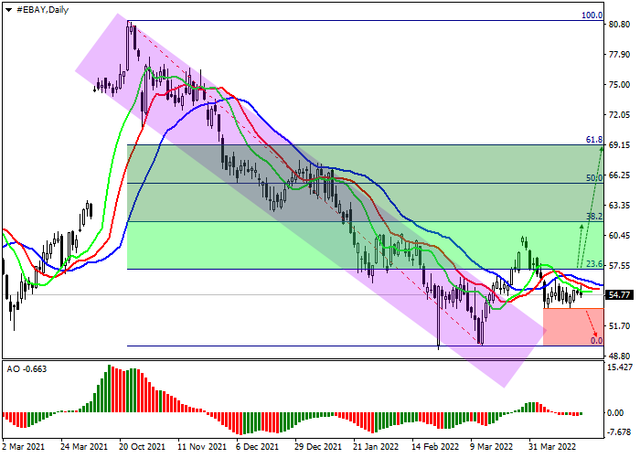

The quotes of the asset are traded as part of a global downtrend, rising in the direction of the resistance line. Technical indicators are holding a local buy signal: the range of EMA fluctuations on the Alligator indicator is about to start expanding in the direction of growth, and the histogram of the AO oscillator is trading in the purchase zone while forming local ascending bars.

Support levels: 6420, 5880 | Resistance levels: 6800, 7150

The rally that began in the French bond market in March of this year is continuing now, with popular 10-year bonds yielding 1.334%, up from 0.350% in early March, and conservative 20-year bonds hitting 1.628%, the last time observed at the beginning of 2017.

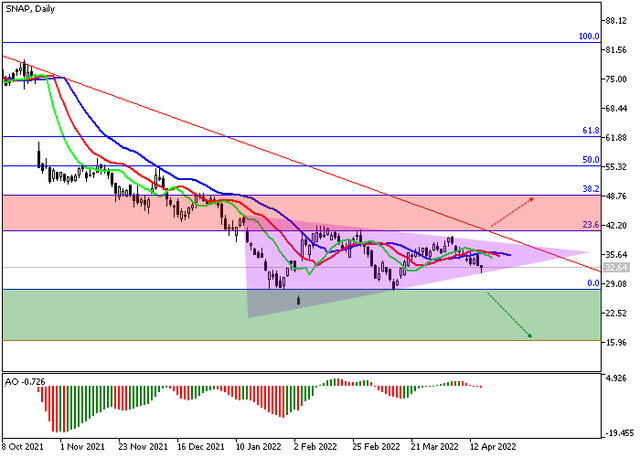

The quotes of the asset are traded as part of a global downtrend, rising in the direction of the resistance line. Technical indicators are holding a local buy signal: the range of EMA fluctuations on the Alligator indicator is about to start expanding in the direction of growth, and the histogram of the AO oscillator is trading in the purchase zone while forming local ascending bars.

Support levels: 6420, 5880 | Resistance levels: 6800, 7150