SOLID ECN LLC

Solid ECN Representative

- Messages

- 514

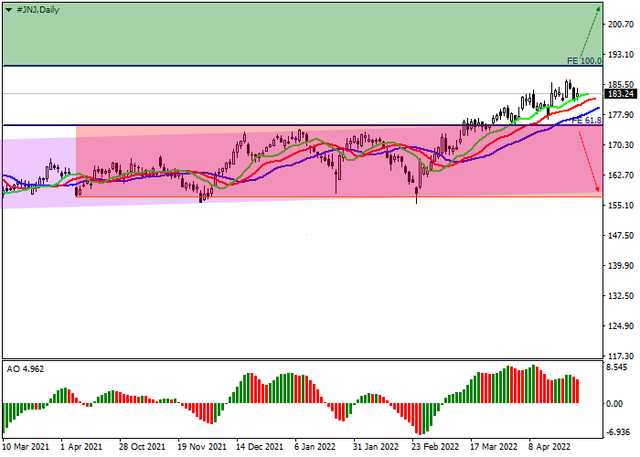

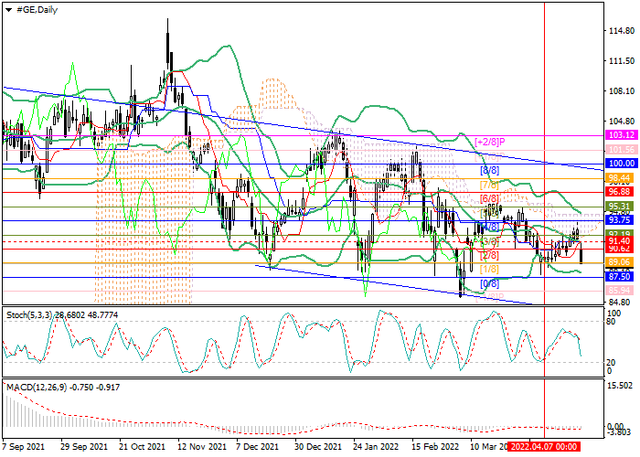

General Electric Co. stocks continue to trade within the mid-term downward channel. Over the past two weeks, the price has attempted to grow and reached 93.74, but then corrected downwards against the background of the statement by the head of the US Fed Jerome Powell about the need for a sharp adjustment of interest rates already at the May meeting of the regulator.

The growth of quotations of the trading instrument may resume if positive financial statements on activities for Q1 2022 are published on Tuesday. It should be noted that during the last four reporting quarters, management reported higher profits than experts expected. Positive dynamics is also possible in Q1 2022, as efforts to reduce the volume of debts, reduce costs and benefits from previously acquired assets will affect financial indicators. According to the estimates of the analytical company Zacks Investment Research, the income of General Electric Co. in the healthcare sector, may amount to 4,206B dollars, which is 2.4% less than the same indicator last year. The profit of the aviation sector may reach 5.896B dollars, which is 18.1% more than in the same period last year. Total earnings per share may amount to 0.23 dollars, and total revenue – to 17.17B dollars. In general, investors will be able to receive 3.16 dollars per share for the year.

In case of a breakdown of 89.06 (Murray [1/8]), the decline may continue to 87.50 (Murray [0/8]), 85.94 (Murray [-1/8]). The key level for the "bulls" is 91.40 (the middle line of the Bollinger Bands). Its breakout will provide growth to 93.75 (Murray [4/8]), 95.31 (Murray [5/8]). Technical indicators signal a decline: the Bollinger Bands and the Stochastic are reversing downwards, the MACD histogram is increasing in the negative zone.

Resistance levels: 91.40, 93.75, 95.31 | Support levels: 89.06, 87.50, 85.94