GlossaryEditor

Glossary Editor

- Messages

- 48

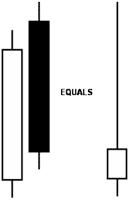

Dark Cloud Cover is a term for a strong up candle with obvious price-increasing price-action. Due to market upside momentum, the next trading period ( a black candle) opens above the highs of the prior white candle. But then, bearish pressure totally overcomes the bullish move and negates all the bull’s work to push prices higher. The perfect Dark Cloud Cover assumes that the closing price of the black candle should be below the middle of the white candle. The open price of the black candle should be above the highs of white candle, as in the picture. This pattern would be treated as confirmed if the market forms next a black candle of even smaller size.

This is a bearish reversal pattern and usually it appears after some upside move, on tops, or under resistance levels. It gives us early notification that the market has reached some resistance and could bounce to the downside or even reverse forming a candlestick bearish reversal pattern. This pattern consists of two candles. The first one should represent a good strong up candle with small shadows (or even without them).

Some easier conditions could be applied, especially in liquid markets (such as Forex). So, this is normal, if the black candle shows an open price just above the closing price of the white candle rather than above the high. Also, the close of the black candle does not have to be so low , as in the picture, but the lower the close of the black candle relative the white one, all the more decisive . If the close of the black candle does not even reach the middle of the white candle, then this pattern is treated as not sufficient and demands additional confirmation from future price action – for example, solid continuation of a down move after the pattern has been formed.

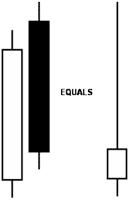

This is a bearish reversal pattern and usually it appears after some upside move, on tops, or under resistance levels. It gives us early notification that the market has reached some resistance and could bounce to the downside or even reverse forming a candlestick bearish reversal pattern. This pattern consists of two candles. The first one should represent a good strong up candle with small shadows (or even without them).

Some easier conditions could be applied, especially in liquid markets (such as Forex). So, this is normal, if the black candle shows an open price just above the closing price of the white candle rather than above the high. Also, the close of the black candle does not have to be so low , as in the picture, but the lower the close of the black candle relative the white one, all the more decisive . If the close of the black candle does not even reach the middle of the white candle, then this pattern is treated as not sufficient and demands additional confirmation from future price action – for example, solid continuation of a down move after the pattern has been formed.

“Dark Cloud Cover” on a daily Gold chart