Sive Morten

Special Consultant to the FPA

- Messages

- 18,655

Fundamentals

As geopolitical tensions and trade wars gradually take back seat either temporary or not, economy factors are taking first stage again. Of course it is naive to think that N. Korea tensions, situation with tariffs and Syria war are totally resolved, they are still "warm" political processes that show some relief and free some room for traditional economy factors that drive market last week, and, I suppose, next week as well.

Last week there were two major events. First is, ECB meeting, second - US IQ GDP release. First is, on ECB. ECB statement was mostly in a row with expectations. M. Draghi has mentioned imroving EU economy conditions and growth pace, but keep future perspectives on interest rate level unclear. Now major consensus suggest that no hints on rate change will happen until September, when QE programme should be closed.

Fathom consulting, that we like to take in consideration, suggests that no rate increase will be until end of the year (or even mid 2019, which negative scenario suggests), despite positive shifts in EU economy.

Personally guys, I support this opinion. EU is not free in its decision. It totally depends on US in this question. D. Trump needs to resolve his own problems and push forward reforms that he intends to take - tax reform, stimulation of domestic production etc. It means that he will use different tools to hold EU progress and economical recovery. US has 150 Bln negative trade balance with EU.

The reason, why I've made a conclusion about EU dependency on US is recent A. Merkel visit to US. She comes to "ask" D. Trump to let some EU companies do not execute Russian sanctions and also try to free EU companies from steel and alluminium tariffs burden. Why "independent" Germany asks for D. Trump to follow or not to follow sanctions? It means that it's not total independent in this question.

It means that D. Trump will use US domination in economy sphere to hold economy progress of "partners" and "rivals" until US will resolve their own problems and tasks. This situation, in turn, makes clear ECB position, that will not make any step without US authorization.

Recent EU data, such IFO institute index, measured economy sentiment has dropped slightly, because tariffs turmoil makes impact on export companies, and Germany is highly depended on export:

Source: Thomson Reuters. Fathom consulting

In recent research Fathom also points on slow down in EU growth:

"Last year, the euro area enjoyed the strongest year of its cyclical upswing, with GDP growing by 2.4%. However, data released for Q1 of this year have moderated slightly, suggesting that the momentum in the currency bloc’s expansion may slow in 2018. Further downward pressure on growth may also stem from tighter ECB policy towards the end of the year."

Fathom uses its own ESI (European Sentiment Indicator), which, as they believe, shows less volatility and better reacts on changes in sentiment. The aggregate ESI for the euro area fell 0.1 percentage points to 1.3% in March — its second monthly decline — as political uncertainty in France and Italy affected consumer confidence.

Despite the indicators weakening since the turn of the year, they remain firmly in expansionary territory.

On balance, Fathom views the weakness evident in the surveys as a signal that first quarter GDP growth for the euro area may be lower than had been expected at the start of the year.

The one conclusion that we could make here - recent changes in economy sentiment stand due D. Trump global trade policy and tariffs. It means that D. Trump and US in particular controls situation and pace of future EU economy growth - may be not totally, but at significant degree.

Now, on US situation and perspectives of US dollar. As I've mentioned in regular videos guys, markets now follow well-known combination, or let's call it cliché - "rising yields on the currency should lead to rising of currency value per se". Logic is simple here. As yields go up, assets, such as bonds and return on assets in this currency become more attractive. This makes carry traders to activate positions in favor if this currency etc...

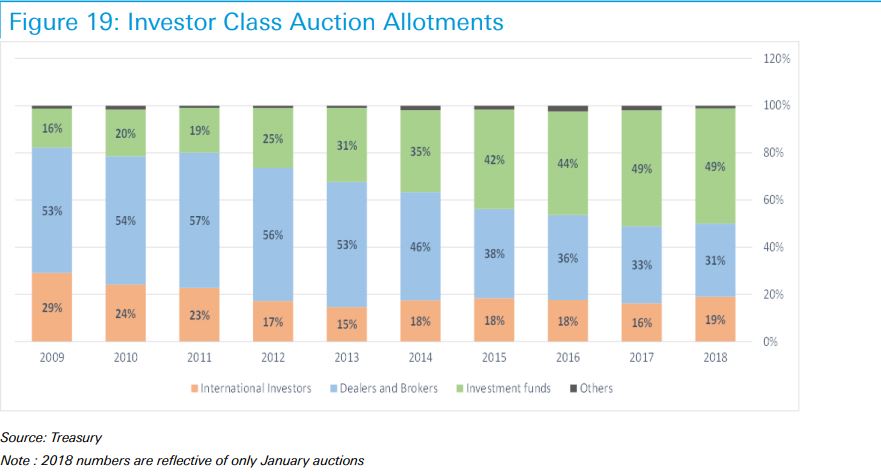

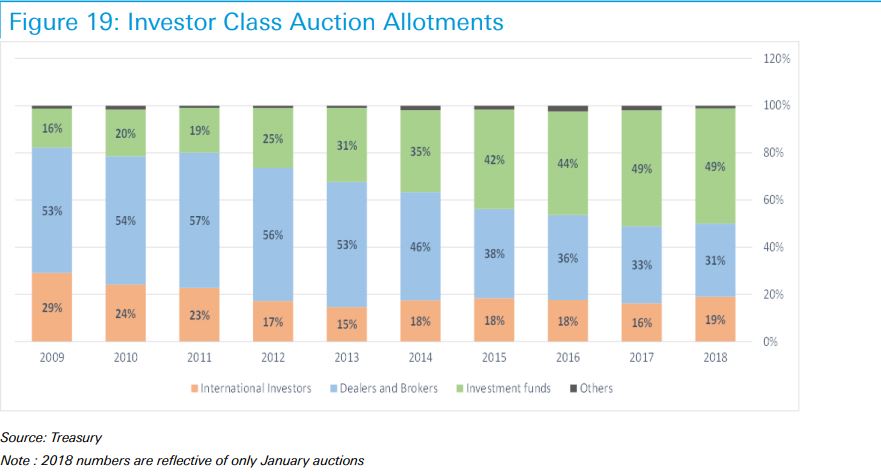

But. All this stuff is true only if we would suggest that fundamental valuation of currency and its country are the same and haven't changed. Does this condition hold in relation to US? Not quite. International demand is gradually dropping, as well as dealers interest to US debt:

Source: MarketWatch.com. Deutsche Bank

According, to WSJ "The European Central Bank estimates that since 2015, eurozone investors have accounted for more than half of foreign purchases of U.S. debt securities. But in 2017, eurozone investors were consistent net sellers of Treasurys, according to official U.S. data."

Next issues, I will put by links, but names talks by themselves:

Turkey repatriates gold out from US

China launch its own oil futures in yuan

So, this is just we've found on a surface, without digging too deep. It means that on a background of US yields rising could stand not only positive issues such as economy improvement, but some negative issues as well. Particular speaking yield is rising by dropping of demand... Taking in consideration of US Treasury spending growth for debt servicing for 200 Bln this year and simultaneously additional spending of 2 Trln due tax cut programme, makes overall situation is rather tricky.

Goldman Sachs also talks about this issue.

Still, in shorter-term view, situation stands not as bad. Recent US data was slightly positive as GDP was released above 2% and sentiment indexes shows positive mood of investors. Fathom consulting also suggests good perspectives for US economy in foreseable future:

"Our US Economic Sentiment Indicator (ESI) may have slipped from 6.8% to 6.3% in March, but this was still one of the highest readings in 21 years. This comes in spite of growing fears of a trade war between the US and China, which many suggested would dampen sentiment and economic activity. Some of these fears may yet be reflected in the ESI reading for April, since some survey responses for March will have been submitted before China-specific tariffs were announced on 22 March.

Given the Q1 data released so far, official GDP growth looks likely to have been 1.5-2.0% (annualized). We have therefore revised down our forecast from 2.6% to 1.7%. However, GDP growth in Q1 has been systematically lower than growth in other quarters since 2000 and we do not think that this marks a slowdown in underlying economic activity; we expect growth to bounce back in Q2."

That's being said, short-term fundamental picture tells that US stands in primary role as they control and drive all economy process with EU. Interest policy difference between Fed and ECB, and specific impact of tariffs to EU economy makes ECB depended from US decisions on this subject. It means that USD has more chances to fortify.

COT Report

As we've mentioned previously CFTC data shows highly saturated speculative long positions on EUR. Sooner or later it should lead to its contraction and this process has been triggered recently. As last CFTC update shows - net speculative long position starts to drop and partially it was unwound.

Drop doesn't look significant yet, but we need to monitor dynamic of this process to catch the tendency. Short-term sentiment due this process looks bearish.

Technicals

Monthly

At monthly time frame we do not have drastic changes by far. Despite recent drop, it is still too small to make impact on monthly picture and we should say that EUR still stands under strong monthly resistance area, as two weeks ago.

Here It stands in "Buy" mode, price is coiling under strong resistance of K-resistance 1.2516-1.26, accompanied by YPR1 @ 1.2617 area. There is not overbought on monthly chart.

Still we have to remind here our previous doubts - resistance area is rather strong and current retracement still looks too small to be treated as proportional respect to it. As EUR is back to motion finally, we should keep an eye wether this minor recent drop will trigger the bigger one in nearest future...

Right now we could say only the same thing - either price action should show deeper retracement or tight consolidation just under strong level will suggest upside breakout.

So, conclusion that we've made here few weeks ago totaly was confirmed - "yes" to fluctuations below YPR1, while "no" to upside breakout and moving to next 1.3860 area yet.

On coming week, recent drop at lower time frames will be in focus

Weekly

Due recent drop EUR has erased bullish grabber that stand here for almost two months. Trend has turned bearish on weekly chart and we have clear bearish divergence with MACD right at top and at major monthly resistance.

Here we need to separate different perspectives, based on timing. In longer-term perspective, I would like to remind you that top stands at 1.618 of previous retracement, and actually that was butterfly "Sell". Butterflies, as we know very often become a part of H&S pattern and 1.618 ratio is very typical for it. That's why, if our fundamental suspicions will be correct - next drop could reach 1.1550 area - potential neckline. In this case, as you understand, we will get even far going consequences.

In shorter term, and on coming week in particular, we will monitor price behavior inside flag pattern. Despite recent decrease, nothing criminal has happened yet, market stands inside the flag. As longer market stands inside it, as more chances on upside continuation. So, here we need keep watching wether market will proceed lower or not. Next major support, as you can see stands at 1.1950 - Fib level and weekly OS.

Daily

Here EUR has reached its favorite 50% support area and daily OS. This combination suggests upside bounce. Depending on what bounce it will be - we make the conclusion on EUR perspective. Now 1.2150-1.2170 is an area that should become a barrier.

If EUR will return back above it - chances on upside action will back. If not - then drop will continue to 1.1950 area.

Other words speaking, market should clarify whether this bounce is just a response to OS or, something more.

Intraday

4H chart shows that our suggestion was correct, indeed just OP target has been completed on Friday and downward action stopped. At the same time we have large butterfly "Buy" in place and EUR has reached first 1.27 target. Upside bounce, as you can see already has started.

Next, 1.618 butterfly target stands at 1.1955 ! precisely our daily support area. Here I suspect that another leg down should happen after retracement. Mostly because of recent bearish momentum - drop was rather fast, and, due acceleration right to OP and butterfly target.

It means that 1.2180 area could be suitable for short-term bearish position. It could be either B&B "Sell" (at least) or, downside continuation to next 1.1950 objective point.

1H chart also shows that it will be K-resistance area, channel border and WPP

Conclusion:

Fundamental picture puts EU and EUR in tricky position, where it depends on US and its trade policy as major driving factor right now for EU economy sentiment is tariffs and sanctions. Taking in consideration that US economy and yields are warming up, this makes USD looks stronger in perspectives of few months.

Speaking on technical issues, on coming week we need to solve the riddle concerning retracement. Because this is key for understanding of medium-term perspective. Our trading plan lets us to take short position around 1.2180-1.2190 area.

Completion of just B&B "Sell" target (which is, as we know, 5/8 support) and EUR standing above recent lows should be treated as bullish sign and no shorts should be taken in this case as soon as B&B will be finished.

Conversely, drop below 1.2050 lows should open road to next 1.1950 support area.

The technical portion of Sive's analysis owes a great deal to Joe DiNapoli's methods, and uses a number of Joe's proprietary indicators. Please note that Sive's analysis is his own view of the market and is not endorsed by Joe DiNapoli or any related companies.

As geopolitical tensions and trade wars gradually take back seat either temporary or not, economy factors are taking first stage again. Of course it is naive to think that N. Korea tensions, situation with tariffs and Syria war are totally resolved, they are still "warm" political processes that show some relief and free some room for traditional economy factors that drive market last week, and, I suppose, next week as well.

Last week there were two major events. First is, ECB meeting, second - US IQ GDP release. First is, on ECB. ECB statement was mostly in a row with expectations. M. Draghi has mentioned imroving EU economy conditions and growth pace, but keep future perspectives on interest rate level unclear. Now major consensus suggest that no hints on rate change will happen until September, when QE programme should be closed.

Fathom consulting, that we like to take in consideration, suggests that no rate increase will be until end of the year (or even mid 2019, which negative scenario suggests), despite positive shifts in EU economy.

Personally guys, I support this opinion. EU is not free in its decision. It totally depends on US in this question. D. Trump needs to resolve his own problems and push forward reforms that he intends to take - tax reform, stimulation of domestic production etc. It means that he will use different tools to hold EU progress and economical recovery. US has 150 Bln negative trade balance with EU.

The reason, why I've made a conclusion about EU dependency on US is recent A. Merkel visit to US. She comes to "ask" D. Trump to let some EU companies do not execute Russian sanctions and also try to free EU companies from steel and alluminium tariffs burden. Why "independent" Germany asks for D. Trump to follow or not to follow sanctions? It means that it's not total independent in this question.

It means that D. Trump will use US domination in economy sphere to hold economy progress of "partners" and "rivals" until US will resolve their own problems and tasks. This situation, in turn, makes clear ECB position, that will not make any step without US authorization.

Recent EU data, such IFO institute index, measured economy sentiment has dropped slightly, because tariffs turmoil makes impact on export companies, and Germany is highly depended on export:

Source: Thomson Reuters. Fathom consulting

In recent research Fathom also points on slow down in EU growth:

"Last year, the euro area enjoyed the strongest year of its cyclical upswing, with GDP growing by 2.4%. However, data released for Q1 of this year have moderated slightly, suggesting that the momentum in the currency bloc’s expansion may slow in 2018. Further downward pressure on growth may also stem from tighter ECB policy towards the end of the year."

Fathom uses its own ESI (European Sentiment Indicator), which, as they believe, shows less volatility and better reacts on changes in sentiment. The aggregate ESI for the euro area fell 0.1 percentage points to 1.3% in March — its second monthly decline — as political uncertainty in France and Italy affected consumer confidence.

Despite the indicators weakening since the turn of the year, they remain firmly in expansionary territory.

On balance, Fathom views the weakness evident in the surveys as a signal that first quarter GDP growth for the euro area may be lower than had been expected at the start of the year.

The one conclusion that we could make here - recent changes in economy sentiment stand due D. Trump global trade policy and tariffs. It means that D. Trump and US in particular controls situation and pace of future EU economy growth - may be not totally, but at significant degree.

Now, on US situation and perspectives of US dollar. As I've mentioned in regular videos guys, markets now follow well-known combination, or let's call it cliché - "rising yields on the currency should lead to rising of currency value per se". Logic is simple here. As yields go up, assets, such as bonds and return on assets in this currency become more attractive. This makes carry traders to activate positions in favor if this currency etc...

But. All this stuff is true only if we would suggest that fundamental valuation of currency and its country are the same and haven't changed. Does this condition hold in relation to US? Not quite. International demand is gradually dropping, as well as dealers interest to US debt:

Source: MarketWatch.com. Deutsche Bank

According, to WSJ "The European Central Bank estimates that since 2015, eurozone investors have accounted for more than half of foreign purchases of U.S. debt securities. But in 2017, eurozone investors were consistent net sellers of Treasurys, according to official U.S. data."

Next issues, I will put by links, but names talks by themselves:

Turkey repatriates gold out from US

China launch its own oil futures in yuan

So, this is just we've found on a surface, without digging too deep. It means that on a background of US yields rising could stand not only positive issues such as economy improvement, but some negative issues as well. Particular speaking yield is rising by dropping of demand... Taking in consideration of US Treasury spending growth for debt servicing for 200 Bln this year and simultaneously additional spending of 2 Trln due tax cut programme, makes overall situation is rather tricky.

Goldman Sachs also talks about this issue.

Still, in shorter-term view, situation stands not as bad. Recent US data was slightly positive as GDP was released above 2% and sentiment indexes shows positive mood of investors. Fathom consulting also suggests good perspectives for US economy in foreseable future:

"Our US Economic Sentiment Indicator (ESI) may have slipped from 6.8% to 6.3% in March, but this was still one of the highest readings in 21 years. This comes in spite of growing fears of a trade war between the US and China, which many suggested would dampen sentiment and economic activity. Some of these fears may yet be reflected in the ESI reading for April, since some survey responses for March will have been submitted before China-specific tariffs were announced on 22 March.

Given the Q1 data released so far, official GDP growth looks likely to have been 1.5-2.0% (annualized). We have therefore revised down our forecast from 2.6% to 1.7%. However, GDP growth in Q1 has been systematically lower than growth in other quarters since 2000 and we do not think that this marks a slowdown in underlying economic activity; we expect growth to bounce back in Q2."

That's being said, short-term fundamental picture tells that US stands in primary role as they control and drive all economy process with EU. Interest policy difference between Fed and ECB, and specific impact of tariffs to EU economy makes ECB depended from US decisions on this subject. It means that USD has more chances to fortify.

COT Report

As we've mentioned previously CFTC data shows highly saturated speculative long positions on EUR. Sooner or later it should lead to its contraction and this process has been triggered recently. As last CFTC update shows - net speculative long position starts to drop and partially it was unwound.

Drop doesn't look significant yet, but we need to monitor dynamic of this process to catch the tendency. Short-term sentiment due this process looks bearish.

Technicals

Monthly

At monthly time frame we do not have drastic changes by far. Despite recent drop, it is still too small to make impact on monthly picture and we should say that EUR still stands under strong monthly resistance area, as two weeks ago.

Here It stands in "Buy" mode, price is coiling under strong resistance of K-resistance 1.2516-1.26, accompanied by YPR1 @ 1.2617 area. There is not overbought on monthly chart.

Still we have to remind here our previous doubts - resistance area is rather strong and current retracement still looks too small to be treated as proportional respect to it. As EUR is back to motion finally, we should keep an eye wether this minor recent drop will trigger the bigger one in nearest future...

Right now we could say only the same thing - either price action should show deeper retracement or tight consolidation just under strong level will suggest upside breakout.

So, conclusion that we've made here few weeks ago totaly was confirmed - "yes" to fluctuations below YPR1, while "no" to upside breakout and moving to next 1.3860 area yet.

On coming week, recent drop at lower time frames will be in focus

Weekly

Due recent drop EUR has erased bullish grabber that stand here for almost two months. Trend has turned bearish on weekly chart and we have clear bearish divergence with MACD right at top and at major monthly resistance.

Here we need to separate different perspectives, based on timing. In longer-term perspective, I would like to remind you that top stands at 1.618 of previous retracement, and actually that was butterfly "Sell". Butterflies, as we know very often become a part of H&S pattern and 1.618 ratio is very typical for it. That's why, if our fundamental suspicions will be correct - next drop could reach 1.1550 area - potential neckline. In this case, as you understand, we will get even far going consequences.

In shorter term, and on coming week in particular, we will monitor price behavior inside flag pattern. Despite recent decrease, nothing criminal has happened yet, market stands inside the flag. As longer market stands inside it, as more chances on upside continuation. So, here we need keep watching wether market will proceed lower or not. Next major support, as you can see stands at 1.1950 - Fib level and weekly OS.

Daily

Here EUR has reached its favorite 50% support area and daily OS. This combination suggests upside bounce. Depending on what bounce it will be - we make the conclusion on EUR perspective. Now 1.2150-1.2170 is an area that should become a barrier.

If EUR will return back above it - chances on upside action will back. If not - then drop will continue to 1.1950 area.

Other words speaking, market should clarify whether this bounce is just a response to OS or, something more.

Intraday

4H chart shows that our suggestion was correct, indeed just OP target has been completed on Friday and downward action stopped. At the same time we have large butterfly "Buy" in place and EUR has reached first 1.27 target. Upside bounce, as you can see already has started.

Next, 1.618 butterfly target stands at 1.1955 ! precisely our daily support area. Here I suspect that another leg down should happen after retracement. Mostly because of recent bearish momentum - drop was rather fast, and, due acceleration right to OP and butterfly target.

It means that 1.2180 area could be suitable for short-term bearish position. It could be either B&B "Sell" (at least) or, downside continuation to next 1.1950 objective point.

1H chart also shows that it will be K-resistance area, channel border and WPP

Conclusion:

Fundamental picture puts EU and EUR in tricky position, where it depends on US and its trade policy as major driving factor right now for EU economy sentiment is tariffs and sanctions. Taking in consideration that US economy and yields are warming up, this makes USD looks stronger in perspectives of few months.

Speaking on technical issues, on coming week we need to solve the riddle concerning retracement. Because this is key for understanding of medium-term perspective. Our trading plan lets us to take short position around 1.2180-1.2190 area.

Completion of just B&B "Sell" target (which is, as we know, 5/8 support) and EUR standing above recent lows should be treated as bullish sign and no shorts should be taken in this case as soon as B&B will be finished.

Conversely, drop below 1.2050 lows should open road to next 1.1950 support area.

The technical portion of Sive's analysis owes a great deal to Joe DiNapoli's methods, and uses a number of Joe's proprietary indicators. Please note that Sive's analysis is his own view of the market and is not endorsed by Joe DiNapoli or any related companies.