Sive Morten

Special Consultant to the FPA

- Messages

- 18,669

Fundamentals

Reuters reports Investors with sizeable gains from the dollar's strong move upward in recent weeks sold the greenback to capture profits on Friday despite a solid U.S. jobs report that bolstered the case for the Federal Reserve to raise U.S. interest rates later this year.

"It looks like some trimming of positions heading into the weekend, but the strong dollar is still intact," said Camilla Sutton, chief currency strategist at Scotiabank in Toronto.

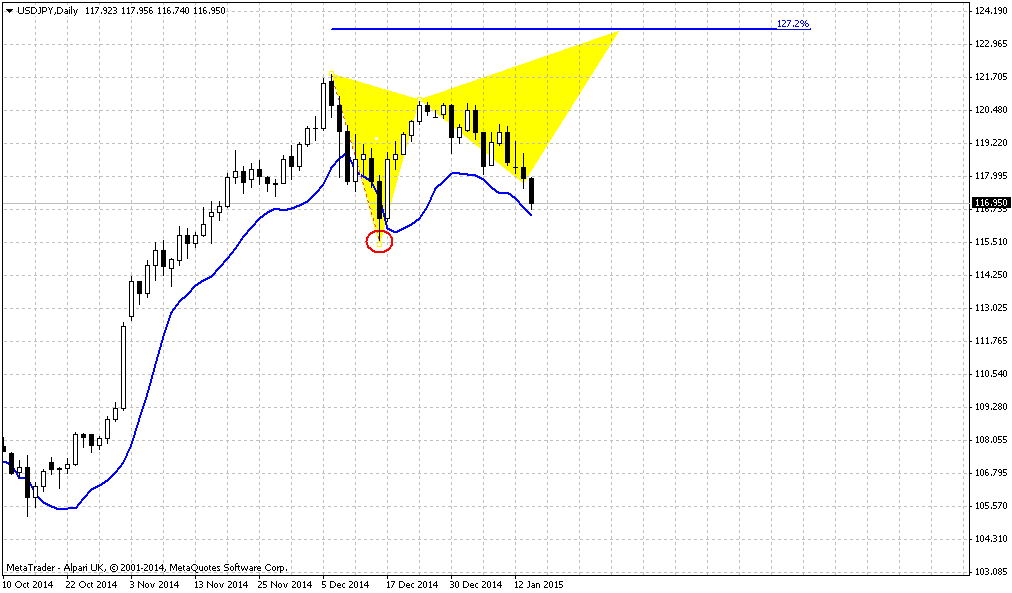

The combination of a strengthening U.S. economy and the Fed positioning itself to raise interest rates at mid-year contrasted against deflationary pressures in the major economies such as the euro zone and Japan, Sutton said.

The European Central Bank and the Bank of Japan are moving their respective monetary policies in the opposite direction of the Fed in the hope of spurring borrowing and investment to boost their moribund economies.

Last month the U.S. economy created an additional 252,000 new non-farm jobs, the 11th straight month of payroll increases above 200,000, marking the longest stretch since 1994. Economists forecast a gain of 240,000 new jobs.

The unemployment rate fell to a 6-1/2-year low of 5.6 percent. However, disappointment in the report came in the form of a five-cent drop in average hourly earnings.

The lack of wage pressures gives the Fed space to wait until the middle of the year before hiking rates.

In contrast to the U.S. data, numbers released on Friday by the euro zone's two biggest economies, Germany and France, fueled speculation the ECB will embark on an aggressive monetary easing when it next meets on Jan 22. Industrial output declined in both countries and German exports fell sharply.

Goldman Sachs cut its long-term forecasts for the euro on Friday, unrelated to the payrolls data. It expects the euro to fall to $1.14 in three months, $1.11 by June and $1.08 by year-end. But it also expects euro parity with the dollar by the end of 2017.

In contrast, PNC Financial Services Group forecasts the euro trading at $1.18 in June and $1.19 by year-end.

At first glance CFTC data shows nothing interesting. Investors mostly keep net short position on AUD for ~ 50 K contracts on CME. But… Take a look at recent dynamic of position. Short position although stands at relatively high level, but stagnates during recent 1-2 months. While Long position has stopped its drop down and starts tender growth. Another moment that seems interesting is that short position takes ~ 80% of total speculative positions and it means that it has very limited potential of increasing. We’ve talked about it previously. When short position reaches some extreme value around 80-85% - probability of reversal or retracement increases significantly. So, looks like AUD is gradually approaching to this moment…

Open interest:

Shorts:

Shorts:

Longs:

Longs:

Although guys, this report we dedicate to AUD, and AUD is mostly Golden currency. Our discussion mostly will stand around technical setups and we have pure technical foundation of our analysis, although it will be as long-term as short-term.

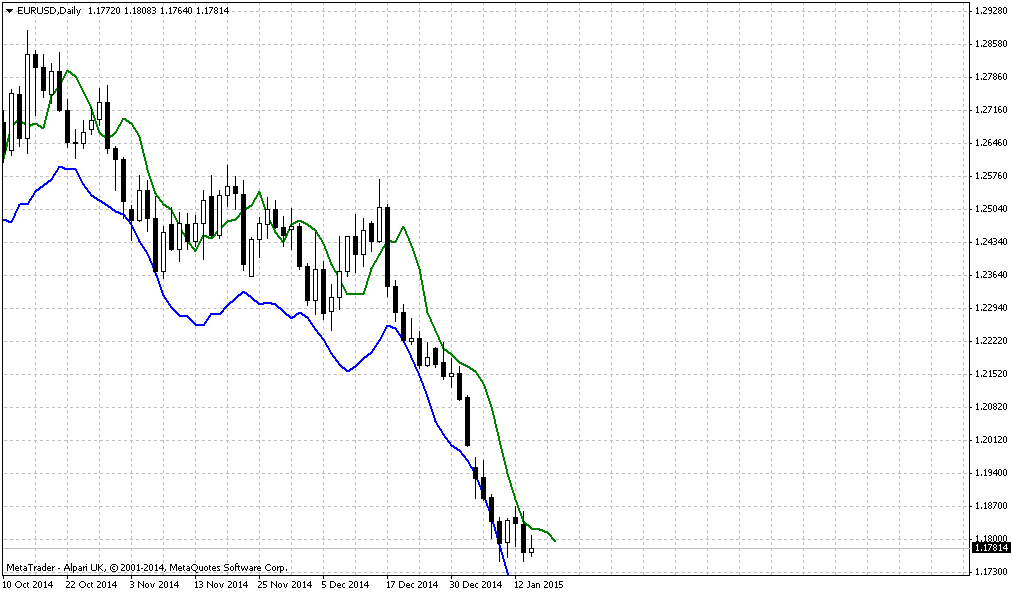

Still we have to say couple of words on EUR. EUR is not interesting right now for immediate trading, but long-term setup is interesting, and we should not miss important moments. First, is – take a look that Goldman Sachs points coincide with our expectation of 1.15 as well…

Second, concerning recent events in France… At first glance it looks like occasional terrorist attack, probably it should not be surprise if we will take into consideration the transparency of France to different nations, migration. Yes, may be some conflict has happened, it could happen… But we call you to think on following moments. Everybody saw video on TV when one of the terrorists shoots police officer. Some experts think that this is not just religious fanaticism. Yes, it could be partially the reason but mostly as add-on or disguise for major action.

Here is a comment from French intelligence professional… “There is no religious fanaticism and emotions. Super professionals worked with a cool head. That's an order. It is not clear whose. Have you seen a video on how to kill a police officer? So accurately and safely kill only in Hollywood thrillers. In life - is a rarity. No fanatics are not capable of. They make a lot of mistakes due to emotions. And then - no one wrong gesture. In all murderers was calculated to details. The time of arrival and departure of the editorial board. Masks. The impossibility of identification. Clearly his gunner inside the newspaper. And suddenly these murderers of the highest class is left in the car for the joy of their identity secret services, and (hooray!) Valiant French police finds them. You saw at least one man who got into the car, puts a passport on the seat and still forgets to pick it up. I'm not talking about superkillerah that together "forgot" to the passport in the car. Stupidity! Absurd! Kuashi late brother - the bases, the fanatics who committed religious "feat" to cover up the real killers. Yes, the killer alive. It is practical, reasonable performers whose names we hardly ever know. This is part of a larger geopolitical game, which began in the territory of France, the most vulnerable point of the European Union. "

It is interesting that this has happened right after Hollande Said:

"Putin does not want to annex eastern Ukraine, he told me this. I could not believe it. But this is not the Crimea. He wants Ukraine does not move into the camp of NATO," - said Francois Hollande.

French President Francois Hollande said that economic sanctions against Russia should be stopped, but only if progress in Ukraine. This statement was made by the French leader in an interview with radio station France Inter, excerpts of which results in Le Figaro.

We do not want to scare you, may be we overestimate the core of this event and our comments look like science fiction, but we just call you to think and do not believe blindly what you see or hear on TV… It could be possible that this will be the part of big geopolitical game and trigger solid consequences. May be we’re wrong, we want to be wrong, but we can’t just ignore this way of events. Why we’re talking about it at all – because this could make strong impact on economy … This is the same kind of events as 9/11, but of smaller scale. Somebody believes that 9/11 was “occasional” terrorists attack, but I have different opinion… Anyway, this is not challenge to argue, this is just call to think, analyze and be prepared…

Technicals

Monthly

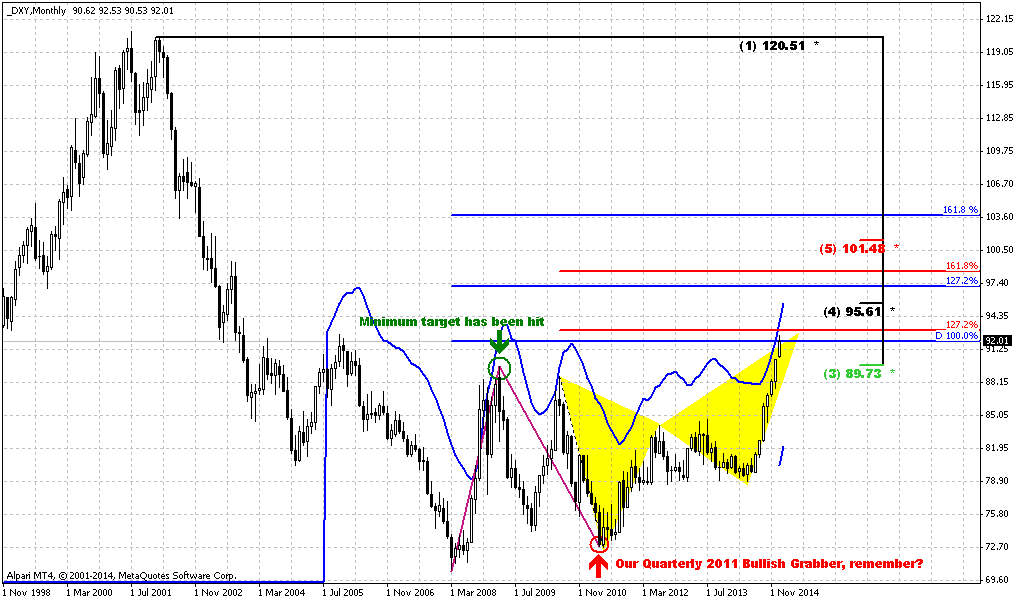

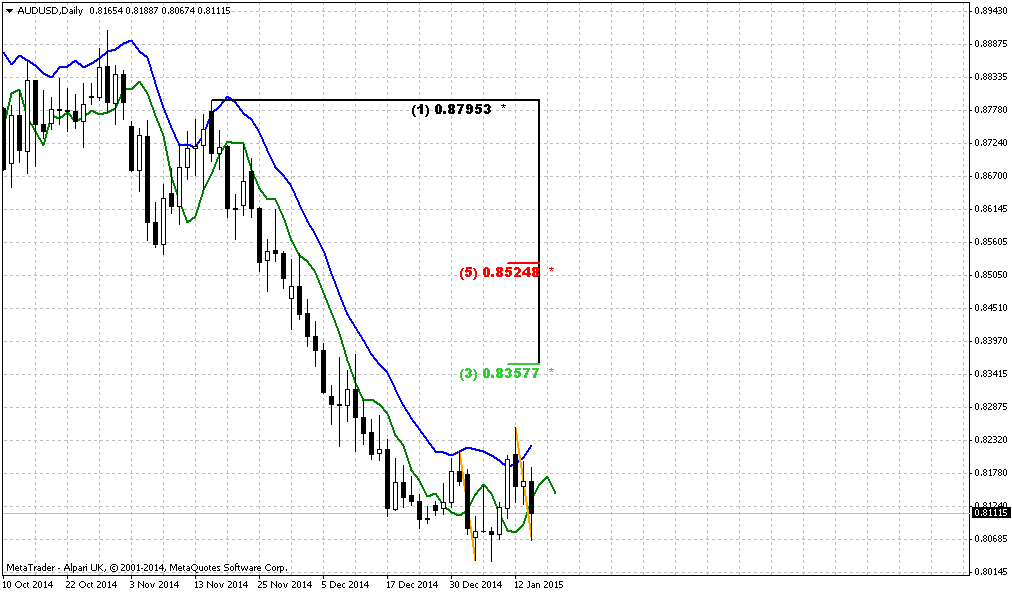

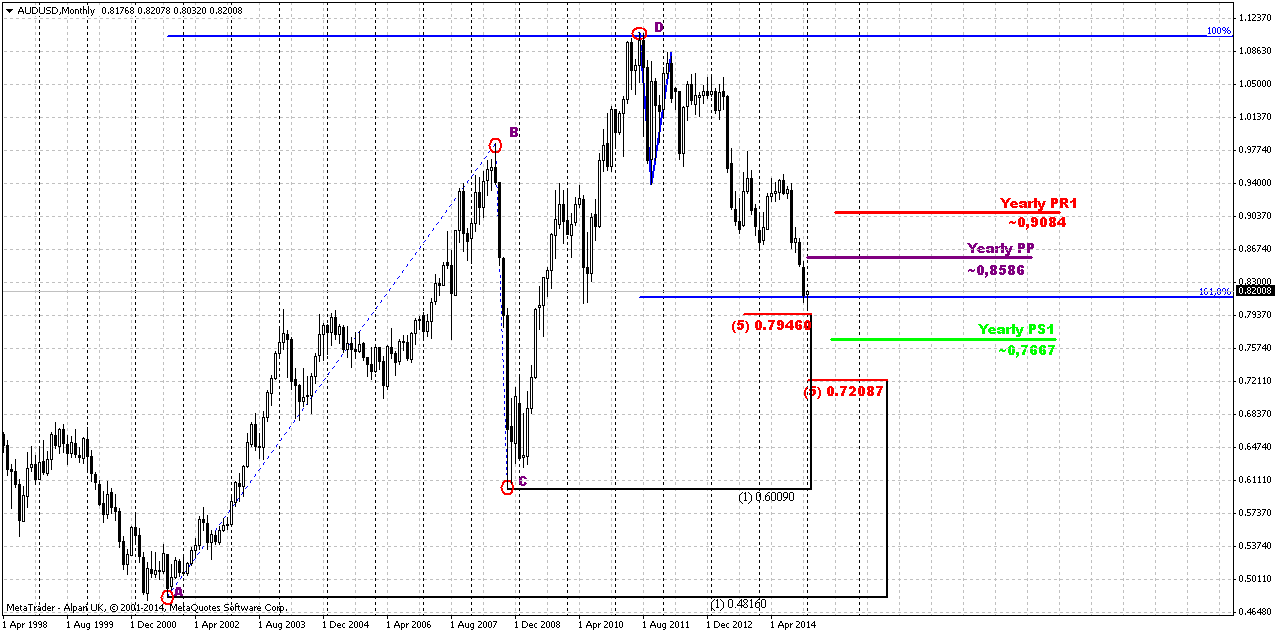

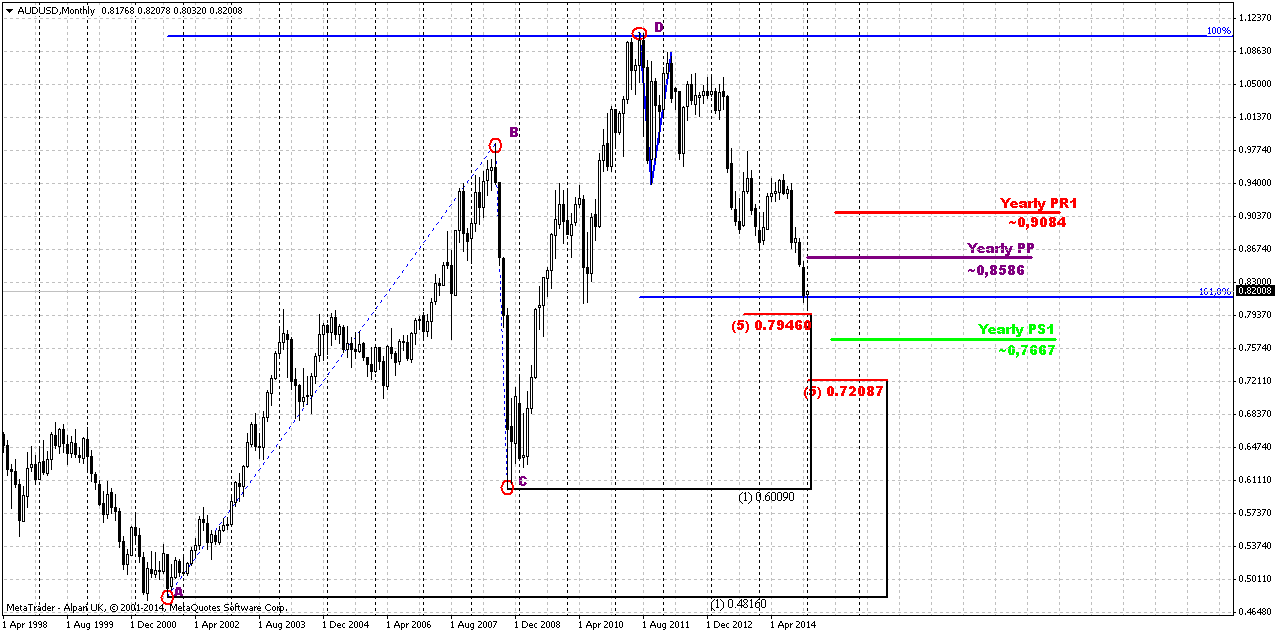

So, now let’s go back to technical analysis on AUD. As you can see current retracement down has started when AUD has completed all times AB=CD pattern on historical record of ~ 1.10 to USD when Gold has hit an area around 1900$ per Oz. Trend is bearish here. AUD is not at oversold on monthly chart. In fact, monthly chart shows major context and reasons why we think that Aussie could show upside action in nearest future on lower time frames. Market has reached ultimate 1.618 target of downward AB-CD pattern and this target coincides with major 5/8 Fib support. This combination creates an Agreement support on monthly chart that works much stronger than ordinary Fib level. And we already see that market feels support. Monthly chart also hints on possible target of upside reaction. Thus, Yearly Pivot has not been tested yet. It doesn’t mean that market couldn’t go any further, but it just tells that if upside action will start – market should touch 0.86 area. This is 400 pips potential to current level…

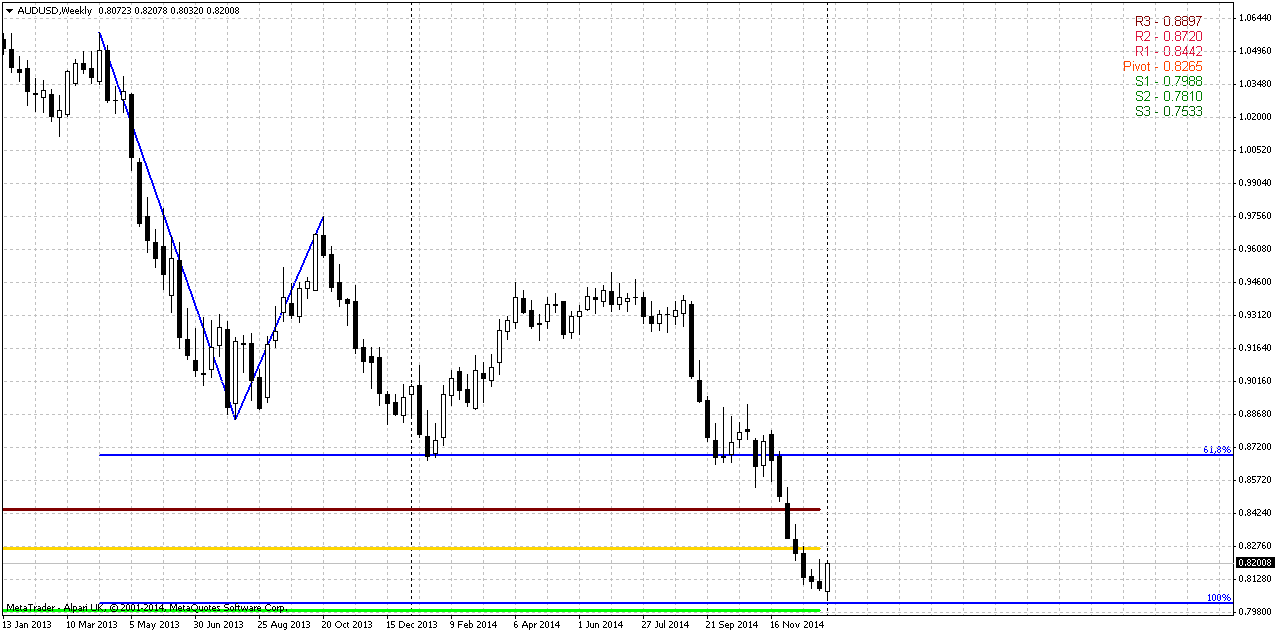

Weekly

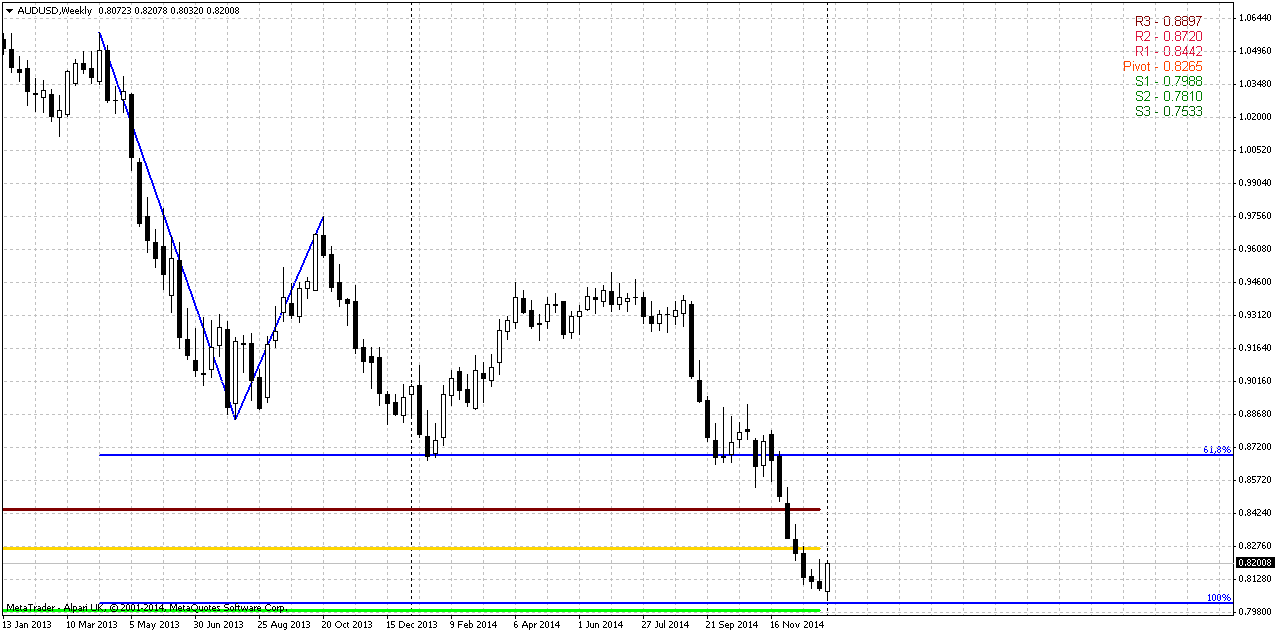

Weekly chart provides additional support levels to current level. Thus, we have most recent completed AB=CD pattern. CD leg is flatter and points on possible deep upside retracement. And take a look – this is also MPS1.

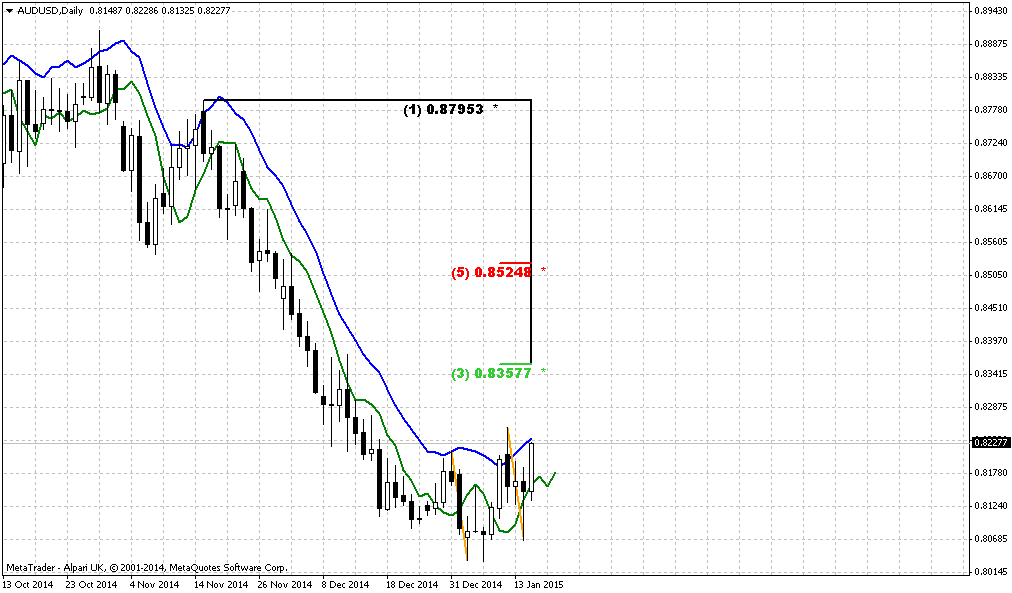

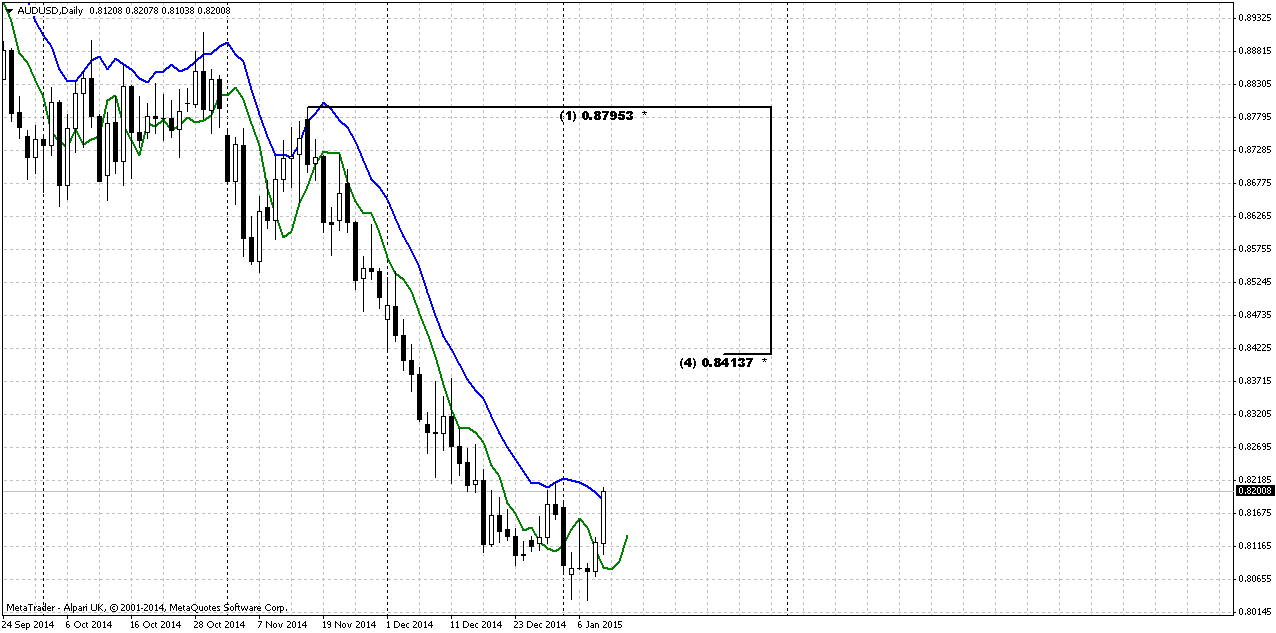

Daily

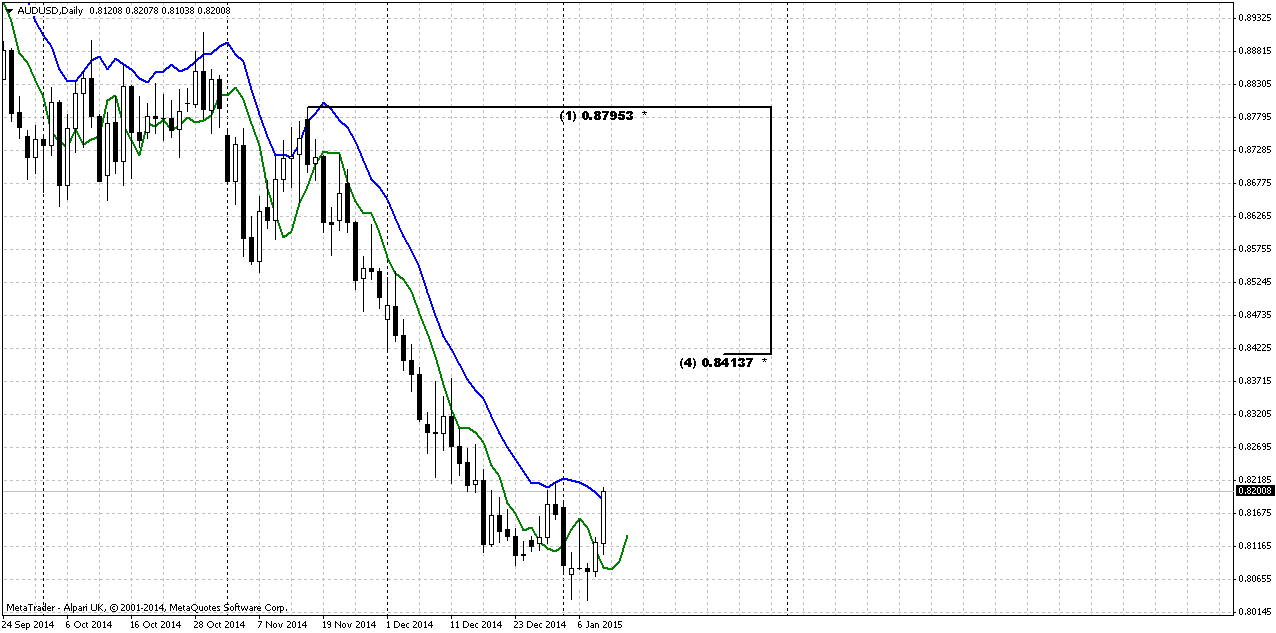

Daily chart shows result of support that stands on monthly and weekly charts. Reaction of the market has led to appearing of DRPO “Buy” pattern that has been confirmed on Thursday and started to work yesterday. We’ve talked on these moments in our updates, right?

Minimum target of DRPO pattern is 50% resistance of its thrust down, i.e. 0.8415 area. As we’ve seen it on weekly chart – this is also MPR1, right? So, it means that potential of DRPO could be enough to push market right to YPP.

Still, right now AUD stands at daily overbought and some retracement should happen in the beginning of the week.

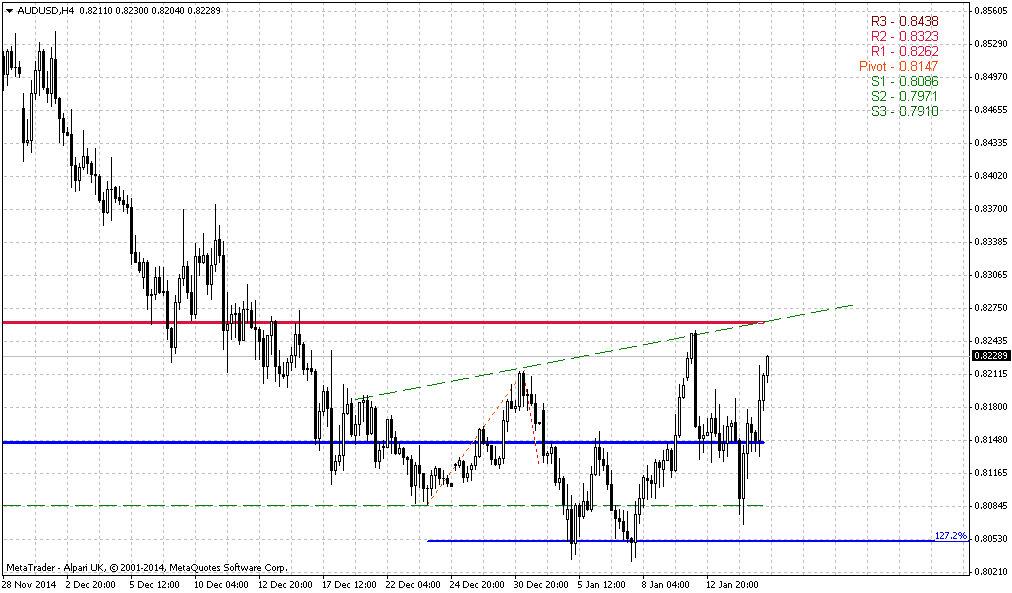

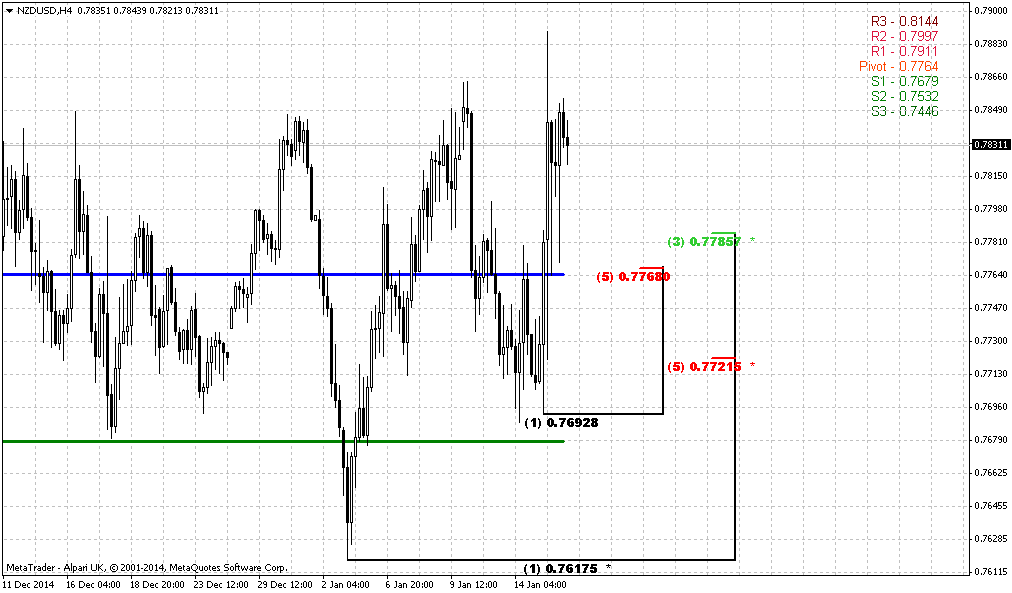

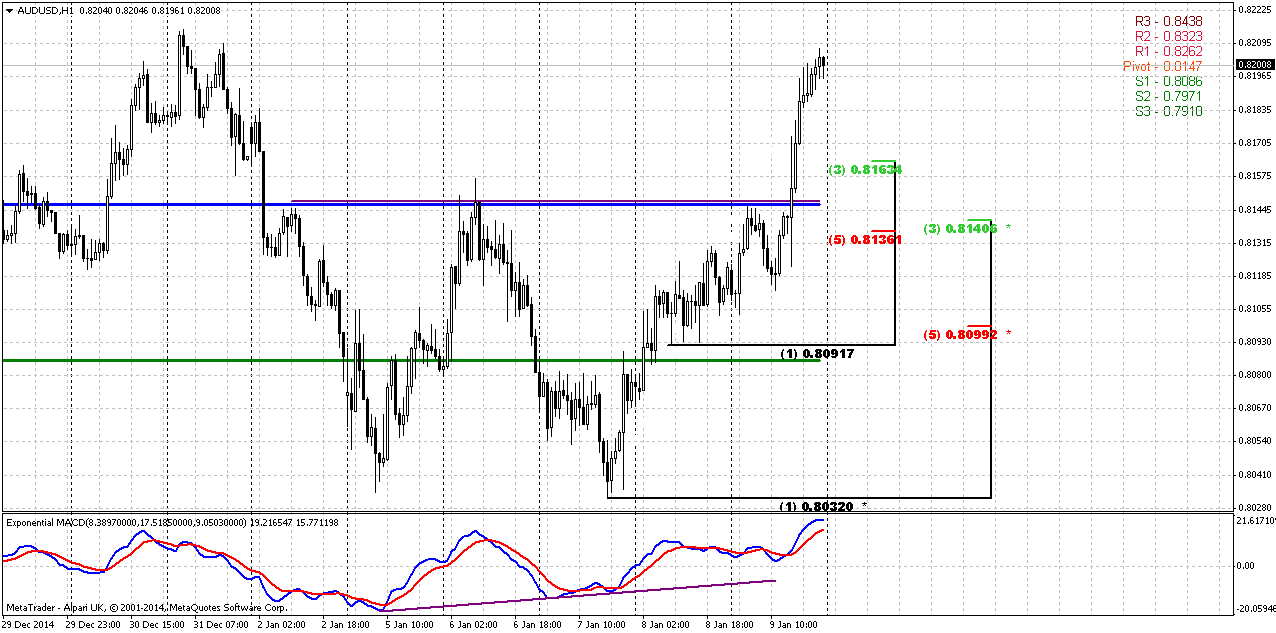

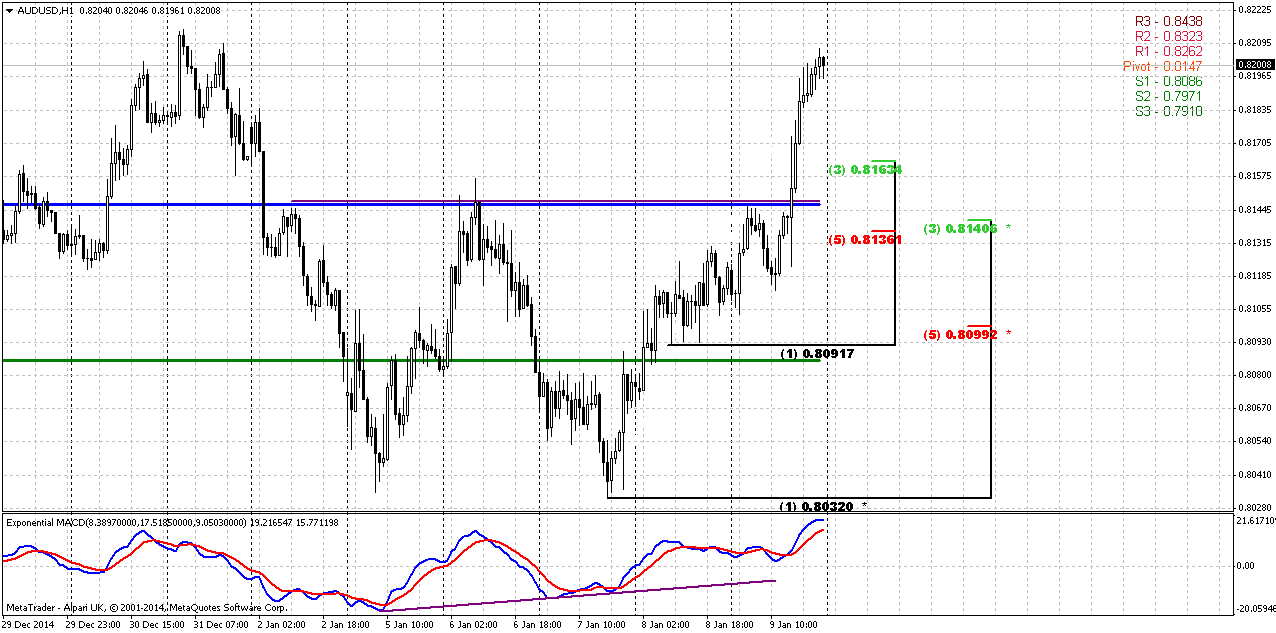

Hourly

So, double bottom pattern that we’ve discussed previously has started to work. Market shows pretty nice rally here. Still, daily overbought could lead to some retracement. Most interesting level for us is strong support around 0.81 area. It includes K-support, neckline and WPP @ 0.8150. We are not interested with first Fib level mostly because market is overbought on daily – retracement should be deeper.

Conclusion:

Currently it is difficult to make conclusion on AUD – how it will behave within a year. All that we could say is that its downside potential is limited due to its strong relation with Gold. Gold itself stands right now around 1200 area and theoretically could drop to 1000$. But 1000$ will be price that approximately equals to mining expenses.

Still, we’re mostly interesting with tactical setup on AUD, although on long-term charts. Strong support could provide power to AUD for some rally on lower charts. Most probable target stands at Yearly Pivot around 0.85-0.86 area.

The technical portion of Sive's analysis owes a great deal to Joe DiNapoli's methods, and uses a number of Joe's proprietary indicators. Please note that Sive's analysis is his own view of the market and is not endorsed by Joe DiNapoli or any related companies.

Reuters reports Investors with sizeable gains from the dollar's strong move upward in recent weeks sold the greenback to capture profits on Friday despite a solid U.S. jobs report that bolstered the case for the Federal Reserve to raise U.S. interest rates later this year.

"It looks like some trimming of positions heading into the weekend, but the strong dollar is still intact," said Camilla Sutton, chief currency strategist at Scotiabank in Toronto.

The combination of a strengthening U.S. economy and the Fed positioning itself to raise interest rates at mid-year contrasted against deflationary pressures in the major economies such as the euro zone and Japan, Sutton said.

The European Central Bank and the Bank of Japan are moving their respective monetary policies in the opposite direction of the Fed in the hope of spurring borrowing and investment to boost their moribund economies.

Last month the U.S. economy created an additional 252,000 new non-farm jobs, the 11th straight month of payroll increases above 200,000, marking the longest stretch since 1994. Economists forecast a gain of 240,000 new jobs.

The unemployment rate fell to a 6-1/2-year low of 5.6 percent. However, disappointment in the report came in the form of a five-cent drop in average hourly earnings.

The lack of wage pressures gives the Fed space to wait until the middle of the year before hiking rates.

In contrast to the U.S. data, numbers released on Friday by the euro zone's two biggest economies, Germany and France, fueled speculation the ECB will embark on an aggressive monetary easing when it next meets on Jan 22. Industrial output declined in both countries and German exports fell sharply.

Goldman Sachs cut its long-term forecasts for the euro on Friday, unrelated to the payrolls data. It expects the euro to fall to $1.14 in three months, $1.11 by June and $1.08 by year-end. But it also expects euro parity with the dollar by the end of 2017.

In contrast, PNC Financial Services Group forecasts the euro trading at $1.18 in June and $1.19 by year-end.

At first glance CFTC data shows nothing interesting. Investors mostly keep net short position on AUD for ~ 50 K contracts on CME. But… Take a look at recent dynamic of position. Short position although stands at relatively high level, but stagnates during recent 1-2 months. While Long position has stopped its drop down and starts tender growth. Another moment that seems interesting is that short position takes ~ 80% of total speculative positions and it means that it has very limited potential of increasing. We’ve talked about it previously. When short position reaches some extreme value around 80-85% - probability of reversal or retracement increases significantly. So, looks like AUD is gradually approaching to this moment…

Open interest:

Although guys, this report we dedicate to AUD, and AUD is mostly Golden currency. Our discussion mostly will stand around technical setups and we have pure technical foundation of our analysis, although it will be as long-term as short-term.

Still we have to say couple of words on EUR. EUR is not interesting right now for immediate trading, but long-term setup is interesting, and we should not miss important moments. First, is – take a look that Goldman Sachs points coincide with our expectation of 1.15 as well…

Second, concerning recent events in France… At first glance it looks like occasional terrorist attack, probably it should not be surprise if we will take into consideration the transparency of France to different nations, migration. Yes, may be some conflict has happened, it could happen… But we call you to think on following moments. Everybody saw video on TV when one of the terrorists shoots police officer. Some experts think that this is not just religious fanaticism. Yes, it could be partially the reason but mostly as add-on or disguise for major action.

Here is a comment from French intelligence professional… “There is no religious fanaticism and emotions. Super professionals worked with a cool head. That's an order. It is not clear whose. Have you seen a video on how to kill a police officer? So accurately and safely kill only in Hollywood thrillers. In life - is a rarity. No fanatics are not capable of. They make a lot of mistakes due to emotions. And then - no one wrong gesture. In all murderers was calculated to details. The time of arrival and departure of the editorial board. Masks. The impossibility of identification. Clearly his gunner inside the newspaper. And suddenly these murderers of the highest class is left in the car for the joy of their identity secret services, and (hooray!) Valiant French police finds them. You saw at least one man who got into the car, puts a passport on the seat and still forgets to pick it up. I'm not talking about superkillerah that together "forgot" to the passport in the car. Stupidity! Absurd! Kuashi late brother - the bases, the fanatics who committed religious "feat" to cover up the real killers. Yes, the killer alive. It is practical, reasonable performers whose names we hardly ever know. This is part of a larger geopolitical game, which began in the territory of France, the most vulnerable point of the European Union. "

It is interesting that this has happened right after Hollande Said:

"Putin does not want to annex eastern Ukraine, he told me this. I could not believe it. But this is not the Crimea. He wants Ukraine does not move into the camp of NATO," - said Francois Hollande.

French President Francois Hollande said that economic sanctions against Russia should be stopped, but only if progress in Ukraine. This statement was made by the French leader in an interview with radio station France Inter, excerpts of which results in Le Figaro.

We do not want to scare you, may be we overestimate the core of this event and our comments look like science fiction, but we just call you to think and do not believe blindly what you see or hear on TV… It could be possible that this will be the part of big geopolitical game and trigger solid consequences. May be we’re wrong, we want to be wrong, but we can’t just ignore this way of events. Why we’re talking about it at all – because this could make strong impact on economy … This is the same kind of events as 9/11, but of smaller scale. Somebody believes that 9/11 was “occasional” terrorists attack, but I have different opinion… Anyway, this is not challenge to argue, this is just call to think, analyze and be prepared…

Technicals

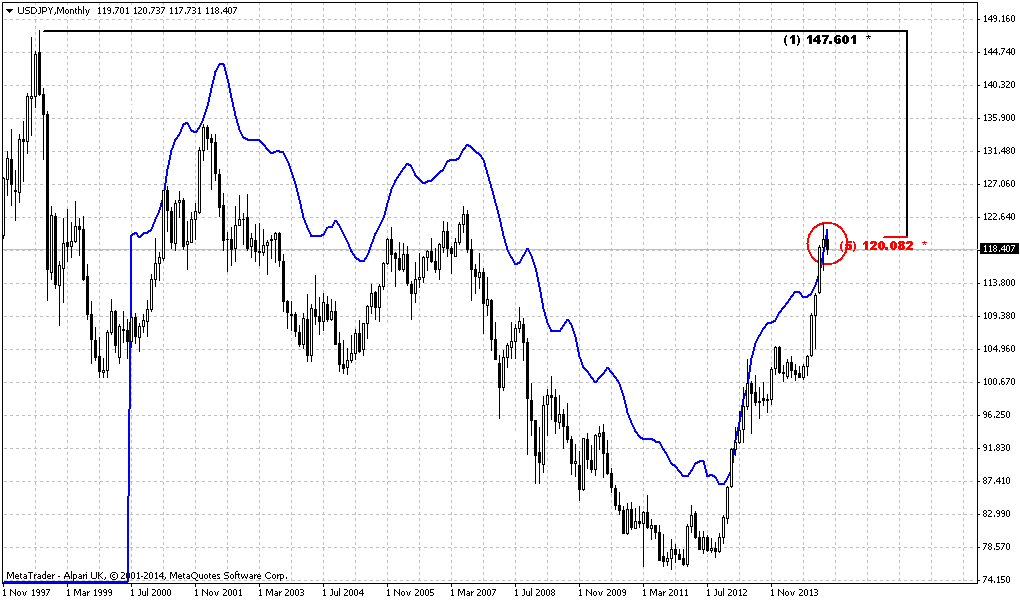

Monthly

So, now let’s go back to technical analysis on AUD. As you can see current retracement down has started when AUD has completed all times AB=CD pattern on historical record of ~ 1.10 to USD when Gold has hit an area around 1900$ per Oz. Trend is bearish here. AUD is not at oversold on monthly chart. In fact, monthly chart shows major context and reasons why we think that Aussie could show upside action in nearest future on lower time frames. Market has reached ultimate 1.618 target of downward AB-CD pattern and this target coincides with major 5/8 Fib support. This combination creates an Agreement support on monthly chart that works much stronger than ordinary Fib level. And we already see that market feels support. Monthly chart also hints on possible target of upside reaction. Thus, Yearly Pivot has not been tested yet. It doesn’t mean that market couldn’t go any further, but it just tells that if upside action will start – market should touch 0.86 area. This is 400 pips potential to current level…

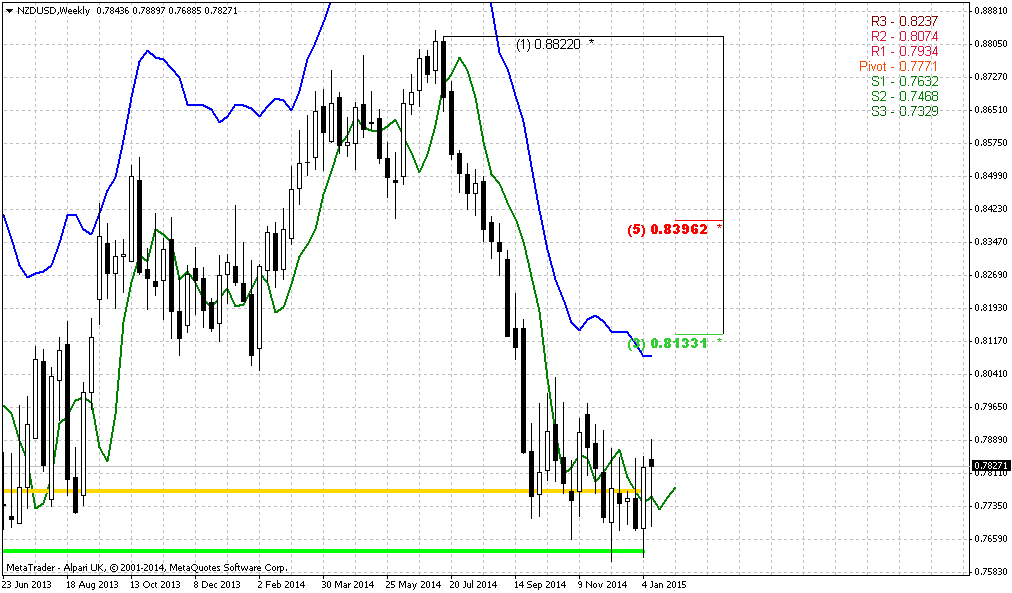

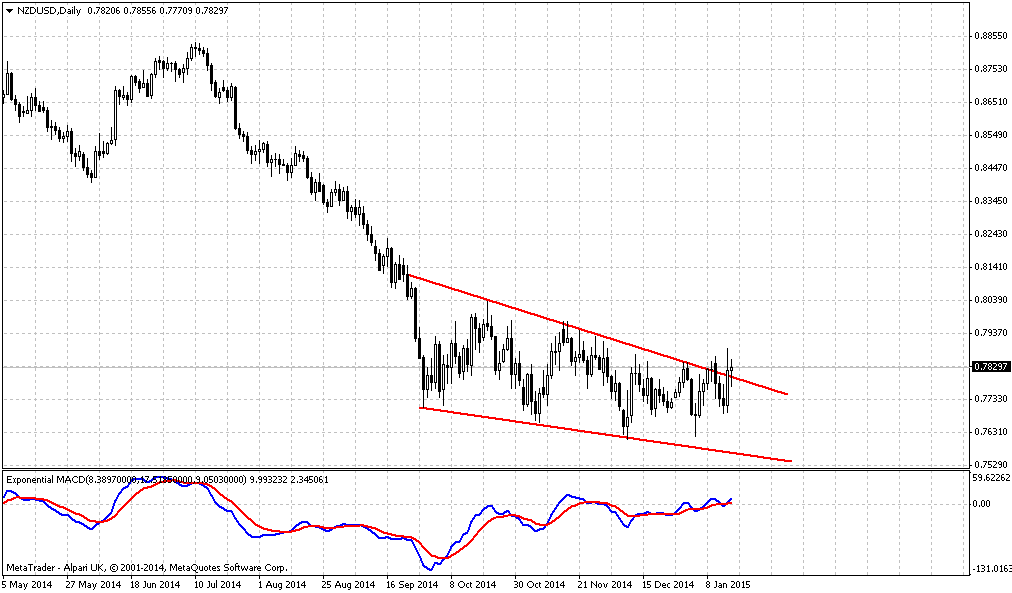

Weekly

Weekly chart provides additional support levels to current level. Thus, we have most recent completed AB=CD pattern. CD leg is flatter and points on possible deep upside retracement. And take a look – this is also MPS1.

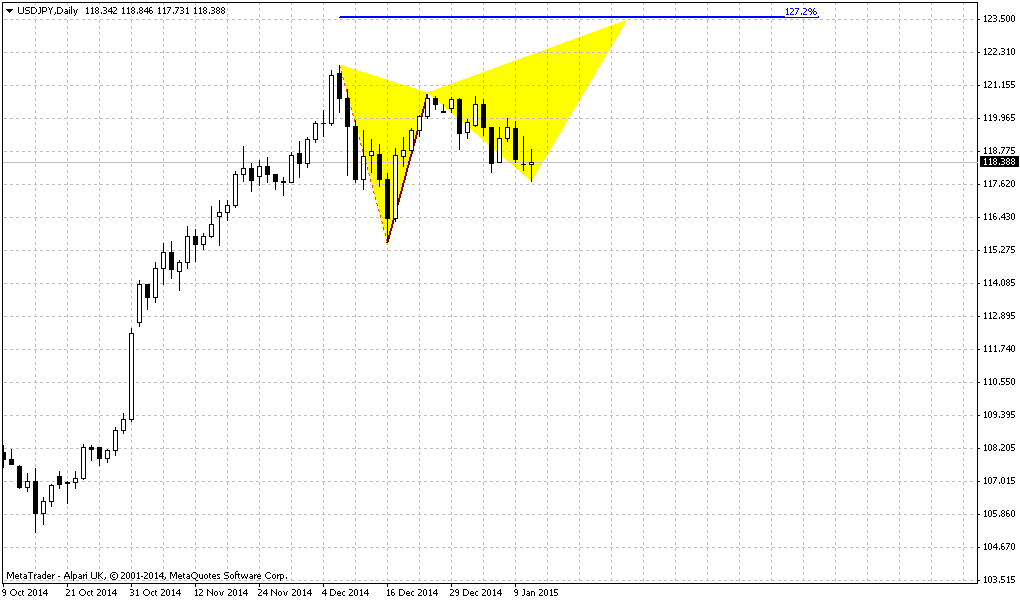

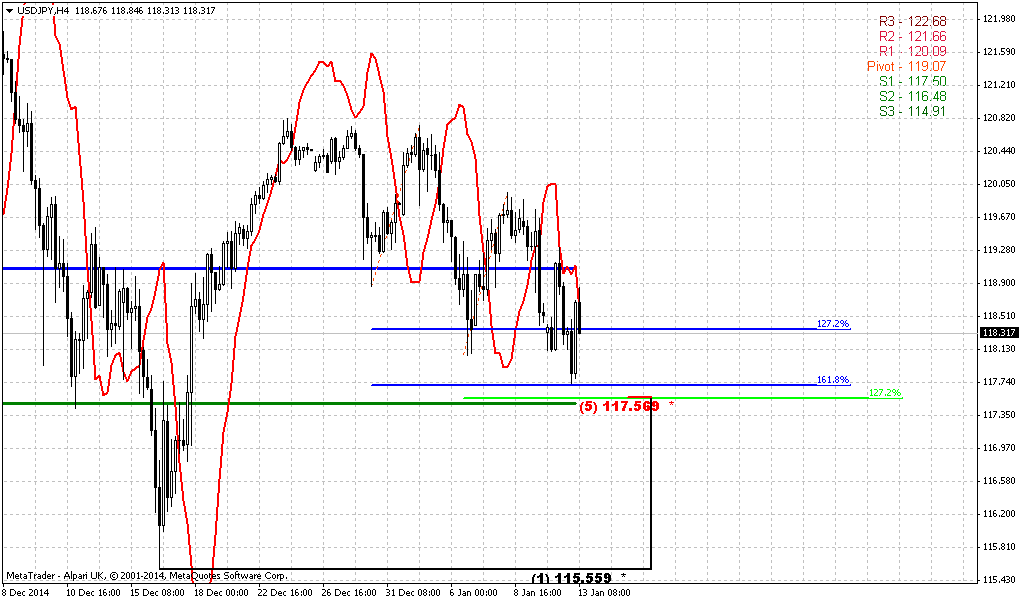

Daily

Daily chart shows result of support that stands on monthly and weekly charts. Reaction of the market has led to appearing of DRPO “Buy” pattern that has been confirmed on Thursday and started to work yesterday. We’ve talked on these moments in our updates, right?

Minimum target of DRPO pattern is 50% resistance of its thrust down, i.e. 0.8415 area. As we’ve seen it on weekly chart – this is also MPR1, right? So, it means that potential of DRPO could be enough to push market right to YPP.

Still, right now AUD stands at daily overbought and some retracement should happen in the beginning of the week.

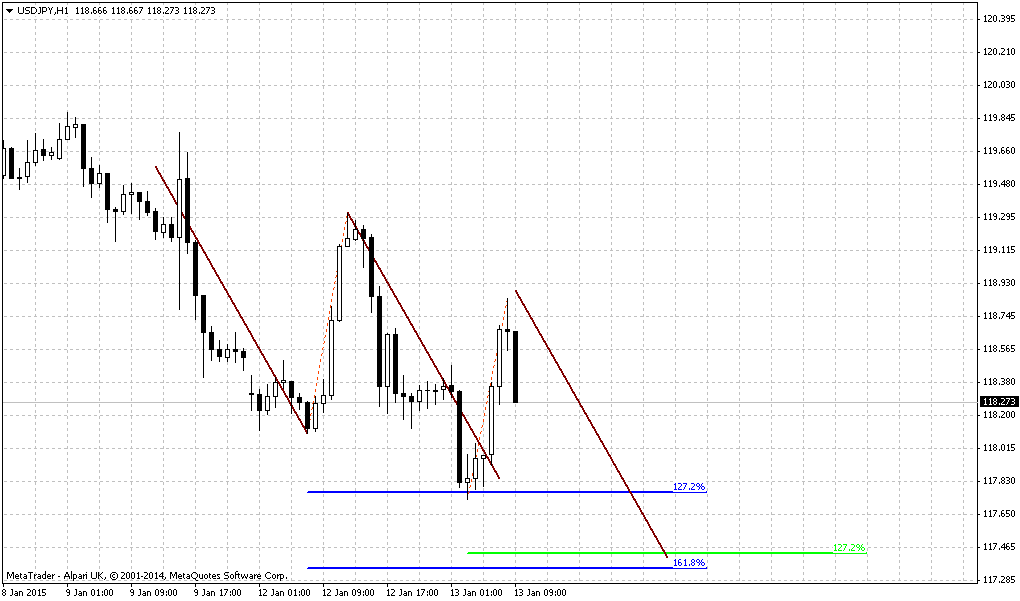

Hourly

So, double bottom pattern that we’ve discussed previously has started to work. Market shows pretty nice rally here. Still, daily overbought could lead to some retracement. Most interesting level for us is strong support around 0.81 area. It includes K-support, neckline and WPP @ 0.8150. We are not interested with first Fib level mostly because market is overbought on daily – retracement should be deeper.

Conclusion:

Currently it is difficult to make conclusion on AUD – how it will behave within a year. All that we could say is that its downside potential is limited due to its strong relation with Gold. Gold itself stands right now around 1200 area and theoretically could drop to 1000$. But 1000$ will be price that approximately equals to mining expenses.

Still, we’re mostly interesting with tactical setup on AUD, although on long-term charts. Strong support could provide power to AUD for some rally on lower charts. Most probable target stands at Yearly Pivot around 0.85-0.86 area.

The technical portion of Sive's analysis owes a great deal to Joe DiNapoli's methods, and uses a number of Joe's proprietary indicators. Please note that Sive's analysis is his own view of the market and is not endorsed by Joe DiNapoli or any related companies.