- Forex, Gold, BTC Market Analysis | Trading Signals

- Sive Morten- Currencies, Gold, Bitcoin Daily Video

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

FOREX PRO WEEKLY July 14-18, 2014

- Thread starter Sive Morten

- Start date

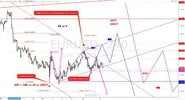

gbpusd

It fits!

So, new HH is possible with following count, all rules/recommendations are obeyed..I do not expect much above 1,7285 because big channel should hold, maybe 1st target 1,72...could be nice Bull trap..

ps

HARD TO BE MORE WRONG! This is not common shape of DZZ so is not acceptable. If breaks above would be 4th penetrating 1st, but I am more for plunge option and 3ED in place...

It fits!

So, new HH is possible with following count, all rules/recommendations are obeyed..I do not expect much above 1,7285 because big channel should hold, maybe 1st target 1,72...could be nice Bull trap..

ps

HARD TO BE MORE WRONG! This is not common shape of DZZ so is not acceptable. If breaks above would be 4th penetrating 1st, but I am more for plunge option and 3ED in place...

Last edited:

K

kaslanci

Guest

Hi sive,

Is it going to be absurd if we expect to see gartley 222 buy pattern instead of butterfly buy on daily eur/usd?

Other issue is that the rule in your book says we should use pivots 1 step higher time frame. But you use monthly pivots on daily time frame and weekly pivots on 4hr and 1hr frames.

please advice.

Is it going to be absurd if we expect to see gartley 222 buy pattern instead of butterfly buy on daily eur/usd?

Other issue is that the rule in your book says we should use pivots 1 step higher time frame. But you use monthly pivots on daily time frame and weekly pivots on 4hr and 1hr frames.

please advice.

Hi sive,

Is it going to be absurd if we expect to see gartley 222 buy pattern instead of butterfly buy on daily eur/usd?

Other issue is that the rule in your book says we should use pivots 1 step higher time frame. But you use monthly pivots on daily time frame and weekly pivots on 4hr and 1hr frames.

please advice.

Agree, theoreticaly&practicaly we could see even crab due North with target above 50% retracement around 1,3780...

Sive Morten

Special Consultant to the FPA

- Messages

- 18,732

Hi sive,

Is it going to be absurd if we expect to see gartley 222 buy pattern instead of butterfly buy on daily eur/usd?

Other issue is that the rule in your book says we should use pivots 1 step higher time frame. But you use monthly pivots on daily time frame and weekly pivots on 4hr and 1hr frames.

please advice.

I'm not quite understand the first question. As "222' Buy as Butterfly "Buy" are patterns of the same direction, but they could start from different points. What a problem with them?

Speaking about levels - I do not see any contradiction here. Weekly as pivots as Fib levels work on any time frame lower. Would you ignore monthly Fib support on daily chart? Or, say, Yearly Pivot point?

That's particularly the task of big picture analysis is - to not skip or miss important level, because if you look only on daily picture you can miss them...

Our book tells "at least" 1 grade higher, but it does not mean that monthly pivots should be ignored on daily chart....

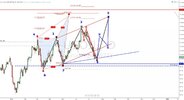

gbpusd

Price hit 162 extension of 1ED as I see it...retrace would be appreciated...I really do not like timing in this count, we should spend 2 weeks in this correction!!! target is to enter 1ED and remain in channel...maybe we get deeper correction? wave 3 is shorter as 1, if 3 is in place, so 5th must be shorter than 3..

Price hit 162 extension of 1ED as I see it...retrace would be appreciated...I really do not like timing in this count, we should spend 2 weeks in this correction!!! target is to enter 1ED and remain in channel...maybe we get deeper correction? wave 3 is shorter as 1, if 3 is in place, so 5th must be shorter than 3..

Similar threads

- Replies

- 5

- Views

- 224

- Replies

- 5

- Views

- 189

- Replies

- 7

- Views

- 768

- Replies

- 14

- Views

- 304

- Replies

- 6

- Views

- 212

- Forex, Gold, BTC Market Analysis | Trading Signals

- Sive Morten- Currencies, Gold, Bitcoin Daily Video