Sive Morten

Special Consultant to the FPA

- Messages

- 18,669

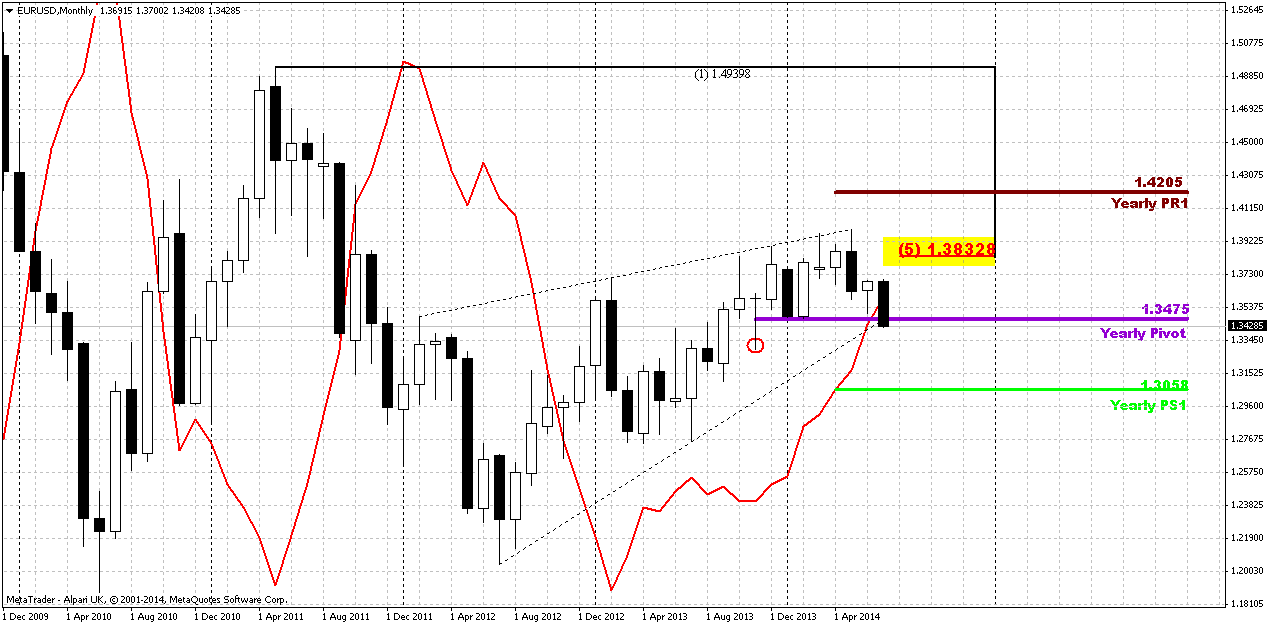

Monthly

The U.S. dollar hit an eight-month high against the euro on Friday after weak data on German business sentiment heightened concerns that geopolitical tensions were weighing on the euro zone economy. Germany's Ifo business climate index, based on a monthly survey of some 7,000 firms, fell to 108.0 in July, marking a third consecutive monthly decline and missing estimates of 109.4, according to a Reuters poll of economists.

"We continue to get strong economic releases out of the United States," said Richard Scalone, co-head of foreign exchange at TJM Brokerage in Chicago. "At the same time, we are getting not-so-great economic releases out of Europe." Scalone said data on Thursday showing that U.S. weekly jobless claims hit their lowest level since 2006 bolstered views of an improving U.S. labor market. Earlier this month, data showed a surge in U.S. nonfarm payrolls growth in June. Analysts said the weak German business sentiment underscored the impact of tensions surrounding Russia and Ukraine on Germany, Europe's biggest economy. The potential impact of hard-hitting sanctions against Russia also likely hurt business confidence in Germany, they said.

European Union ambassadors reached a preliminary agreement on Friday to push ahead with sanctions against Russia but details have yet to be worked out, diplomats said. Analysts have said that the sanctions could hurt European growth by hindering trade between Russia and Germany.

"The geopolitical tension and uncertainty are already exerting a palpable effect on sentiment toward Europe and the euro," said Richard Franulovich, senior currency strategist at Westpac Securities in New York.

The dollar rose against the euro after Commerce Department data showed orders for long-lasting U.S. manufactured goods rose more than expected in June, but analysts said the positive impact faded after traders assessed lackluster details, including downward revisions for May.

Analysts eyed next week's Federal Reserve policy meeting, on Tuesday and Wednesday, and the U.S. government's non-farm payrolls report for July, to be released on Friday. Economists expect U.S. employers to have added 235,000 jobs in July, according to a Reuters poll.

"There is a chance of a bit more hawkish tone to the Fed's statement," said Scalone of TJM Brokerage, in light of recent strong U.S. jobs growth.

So, guys, recent information just confirms our suggestion on coming week. Previously we said that all USD-related assets will be under pressure, since on coming week situation is moderately bullish for USD. Concerning EUR – here is too much difference in sentiment of US and EU fundamental numbers, nice earnings reports from US companies and investors’ expectations on more hawkish Fed speech. These moments probably will lead to gradual USD appreciation on coming week till we will get clarity from the Fed.

Technical

Today we again will take a look at EUR, because we do not see something really better and more interesting than EUR, at least among the majors. Still we see interesting phenomenon on JPY, but it stands on weekly chart and we will discuss it below.

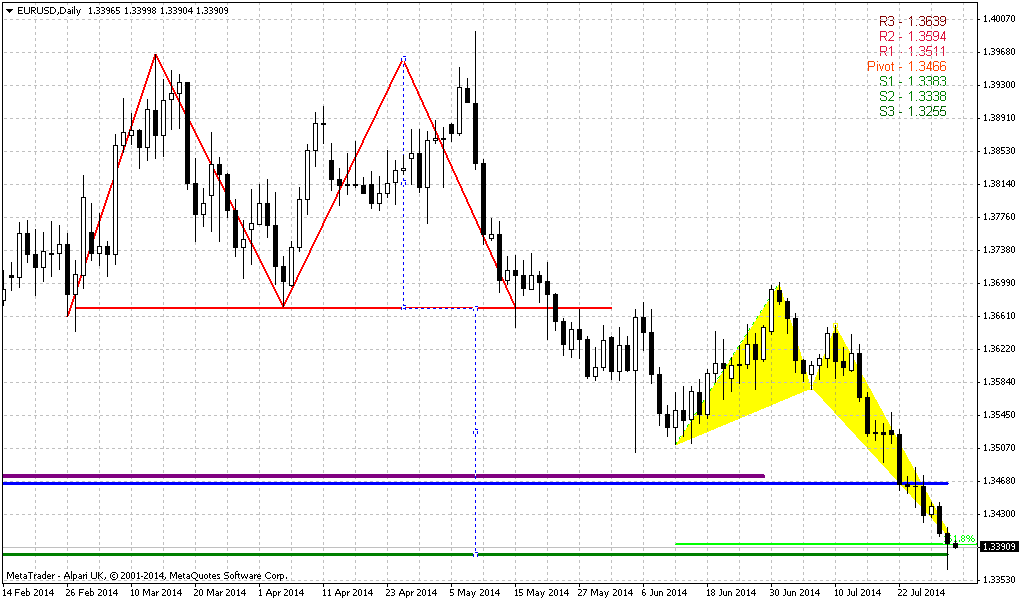

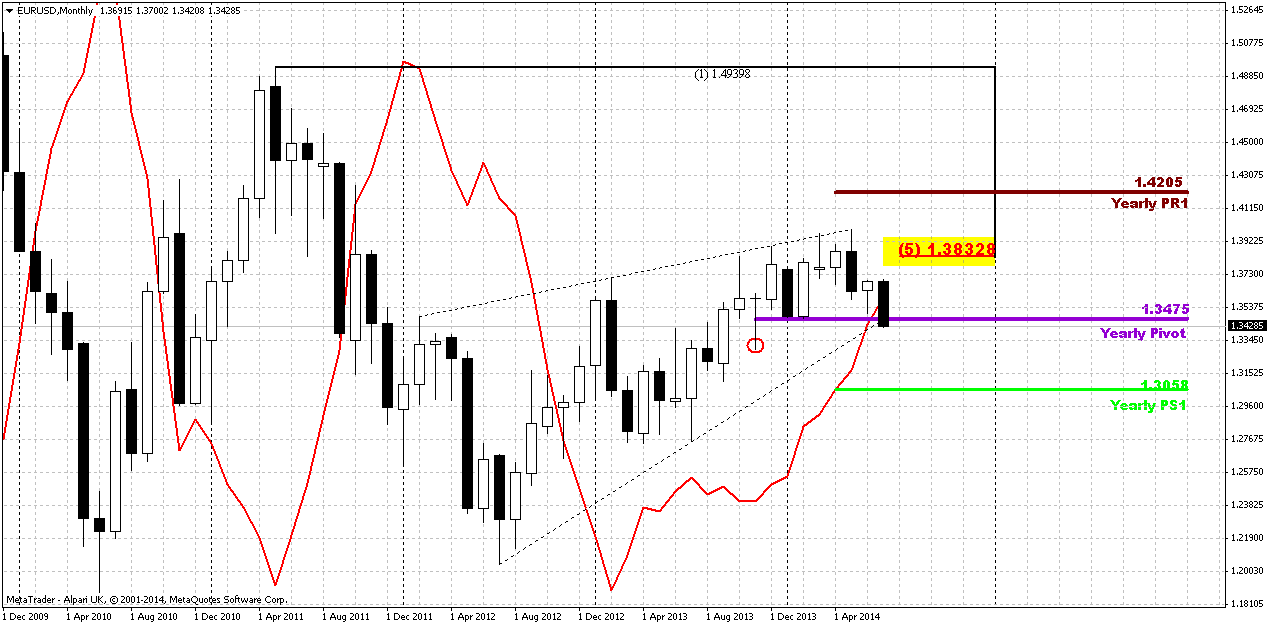

It seems that our suggestions on EUR/USD in general were correct and EUR has continued move down. Now it has passed below 1.3475 area – Yearly pivot point. It does not mean yet that EUR has broken it, since Yearly pivot is rather wide range. Still, now market stands at very significant moment. It is probable that July could become edge month for medium-term direction. As very important data and information stands ahead, EUR still has chances to form something reversal – as we said previously, appearing of bullish grabber right at YPP level definitely will tell us that market should exceed 1.40 level and probably even could reach YPR1~1.42 area. Conversely, failure at YPP will be great challenge on further downward action. In this case nearest downside target stands on YPS1 ~ 1.3060

We’re speaking about as upside as downside scenarios, because right now nothing is lost yet for bulls. Yes, recent action is bearish and overall situation stands a bit more in favor of bears, but just minor hint on dovish policy could turn market from top to bottom. In recent time Fed very often dissapoints investors and rethorical question why this couldn’t happen again? From that point of view it seems possible, especially if we recall Bernanke statements on private dinners, where he said that Fed will keep rates low longer than investors would like it. Thus, monthly grabber could be some kind of prophecy for this event. Actually we do not much care whether Fed will push USD up or down. We will be winners anyway, since we mostly need action in any direction and this probably will happen.

Technically market stands in tight range since 2014. Thus, 1.33-1.3850 is an area of “indecision”. While market stands inside of it we can talk about neither upward breakout nor downward reversal. At least, reversal identification could be done with yearly pivot – if market will continue to move lower, this could be early sign of changing sentiment.

That’s being said, market stands around crucial area and July could clarify what will happen next. All we need on monthly chart is patience... Now market is preparing for plunge down, but dovish surprise from the Fed is not excluded.

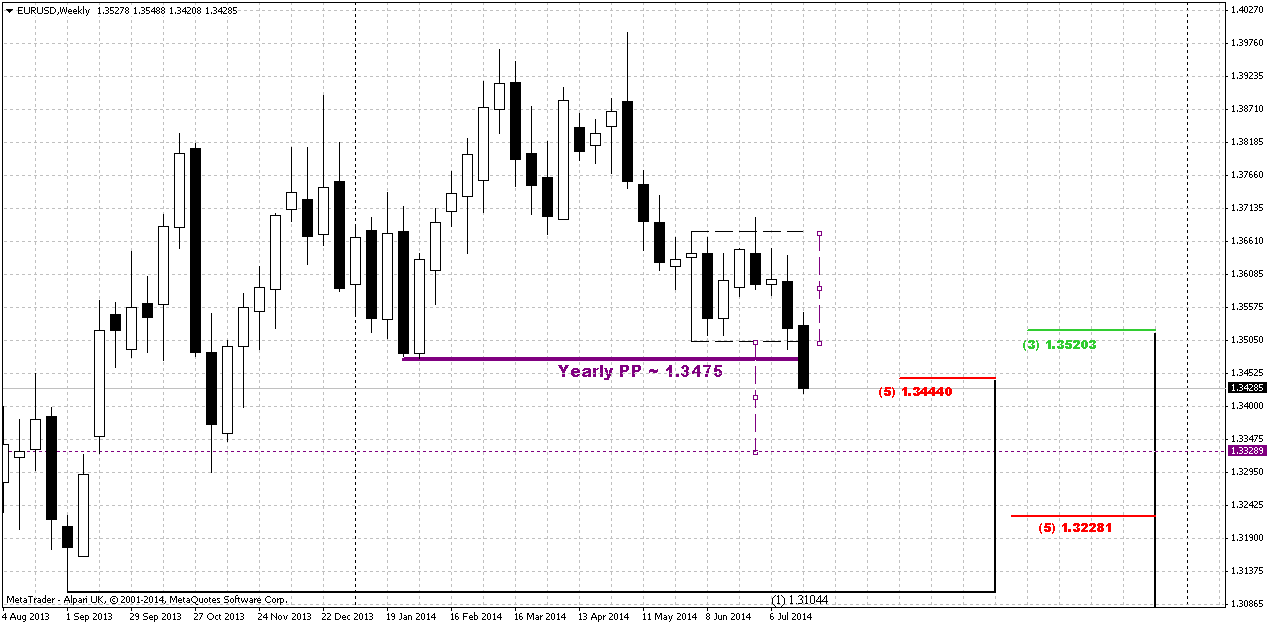

Weekly

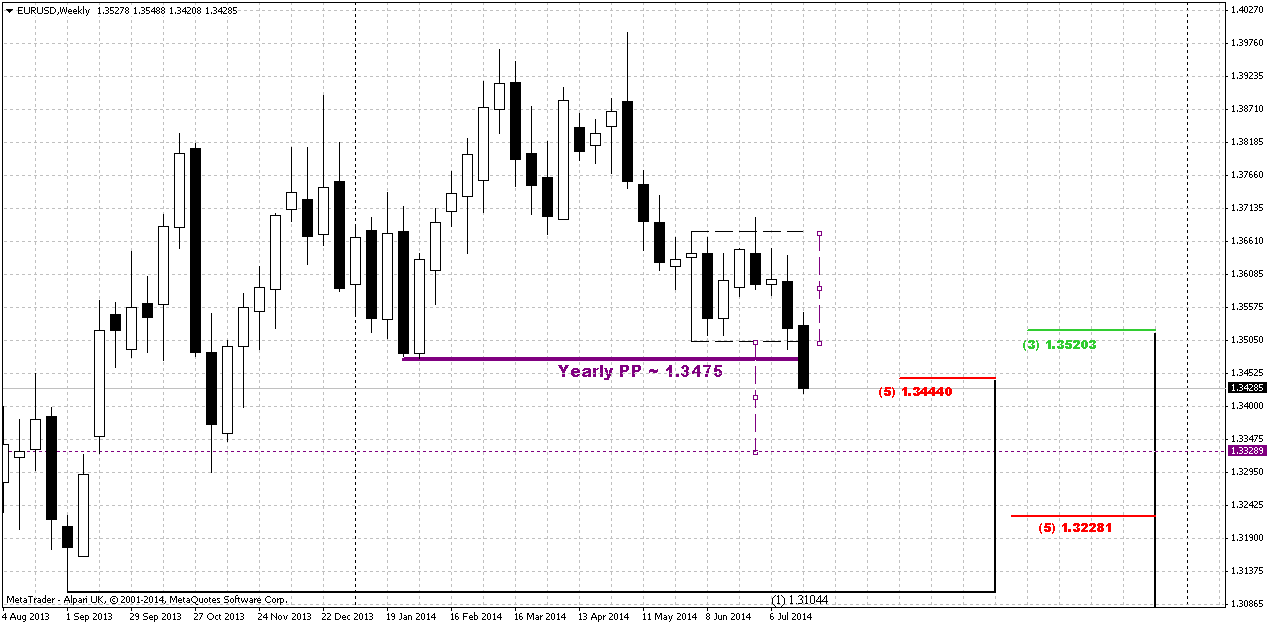

On previous week market has shown solid donward action. Trend holds bearish here, but market is not at oversold. On weekly chart market does not give us any patterns to trade immediately. Still, weekly picture contains some important issues.

First of all – action below MPS1. This confirms that market stands in strong bearish trend that should continue. Another important moment that market is breaking through rock hard support – Weekly K-support, YPP, MPS1 and that was also AB=CD 1.618 support as we mentioned it on previous week. But right now price stands slightly below all this stuff.

Here again, we can return to range of hammer pattern. Now it is clear that market has broken it down. As we’ve said previously, when market forms long candle it usually holds following price action for some time, because market needs to accustom to new range. At the same time this will increase potential energy of breakout. Now breakout has happened. Usual destination point is 2 times length of the hammer to the downside. This area stands around 50% support (EUR most prefferable level, right?) around 1.3330 area. Below we can find only 5/8 support area 1.3230 and Agreement (btw BNP Paribas in letter to his clients has mentioned that they expect to see 1.32 area, but I do not remember the timing).

So, the fact that market forces in strong support and stands below it assumes that it could reach weekly target. At the same time, we have closer targets on daily chart and it will probably depend on pace till Fed meeting. If EUR decline pace will be fast then it could reach weekly target as well, prior 30th of July.

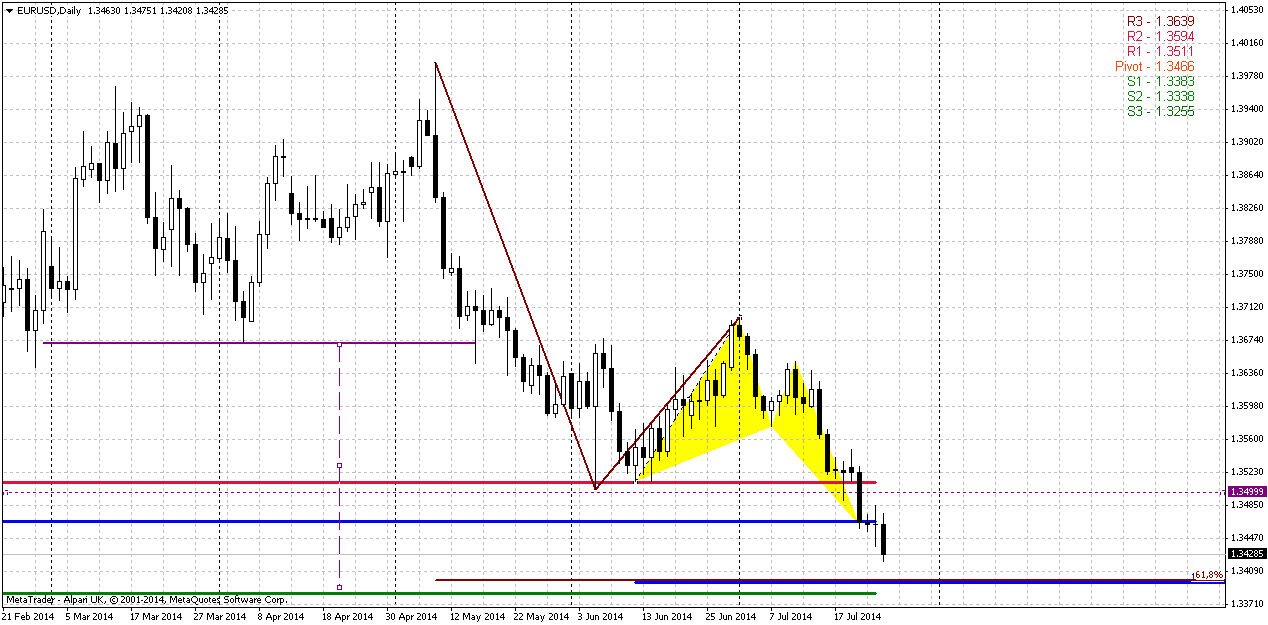

Daily

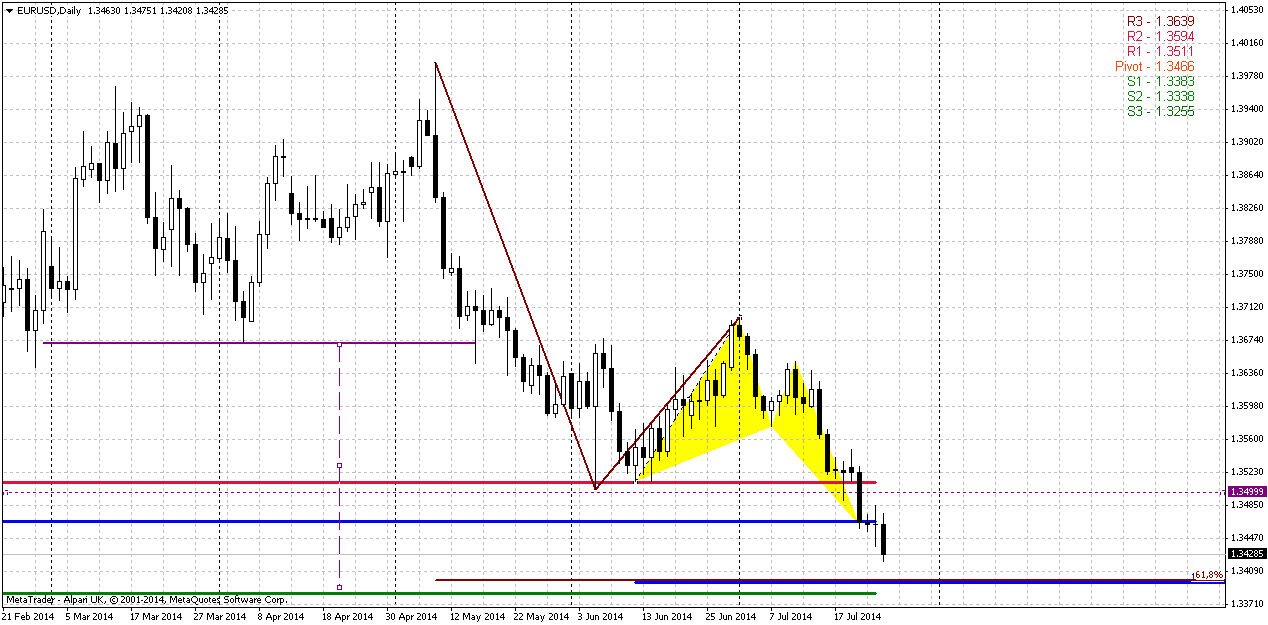

Trend is bearish on daily, market is not at oversold. Based in this picture our task for beginning of the weak is relatively simple – wait for reaching of next significant level at 1.3380. This will be 1.618 butterfly, Double Top target, WPS1 and minor 0.618 target of AB=CD down. It is difficult to count on any, even minor retracement prior it will be hit, since market has passed through all significant supports already. As we’ve suggested on previous week – retracements from support were really shy and it could mean that EUR stands under serious pressure.

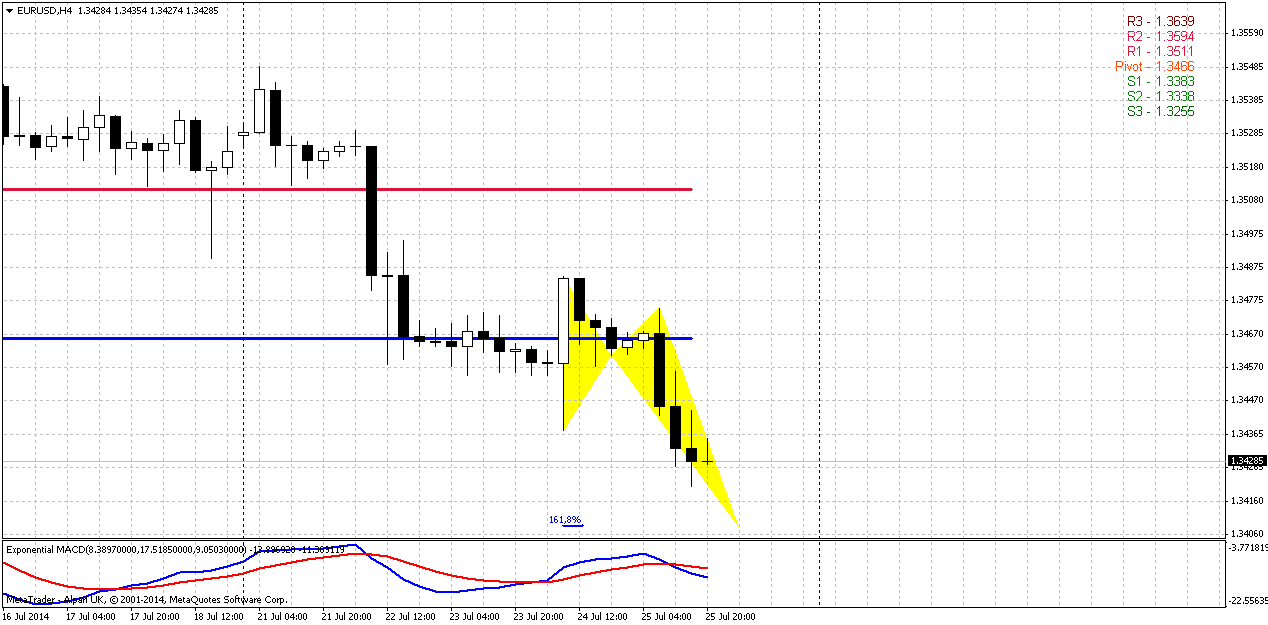

4-hour

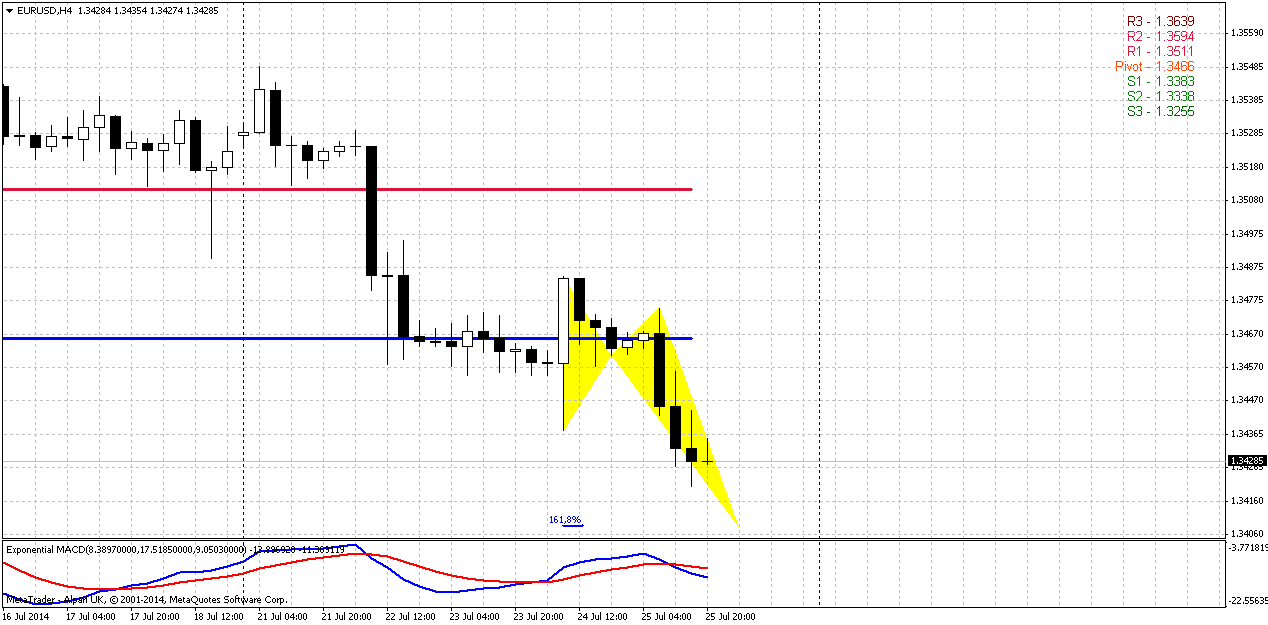

Here trend is bearish. Nothing really interesting, guys, here. Yes, we have this hint on butterfly “buy” at 1.3408, but this is probably just “noise” around major levels. Major question will still stand around price action speed. If downward action will be fast, then market could move even lower than 1.3380, but this level is major one for next week. Our riding on downward action within previous 2 weeks was really nice and next important decision we probably will make only in August. Market right now stands very close to target and the potential room to it is not as important and not very attractive for trading.

Conclusion:

So, guys, EUR has reached hot point on big picture – edge of YPP, trend breakeven point and support area. Till the end of July we probably should get further direction. Although currently situation stands in favor of USD, but we can’t exclude surprises from Fed. Thus, it is not safe to take strategical positions right now and better to wait for beginning of the August.

In short-term situation tactical target at 1.3380 stands relatively close and to be honest our journey on the way to it is coming to an end. Thus, we can’t call you to take new short position since there is rather shy room till this area. But we should not think that we miss something, since with end of July clarity we probably will get new solid direction (despite whether it will be up or down) and will have enough time to take position.

The technical portion of Sive's analysis owes a great deal to Joe DiNapoli's methods, and uses a number of Joe's proprietary indicators. Please note that Sive's analysis is his own view of the market and is not endorsed by Joe DiNapoli or any related companies.

The U.S. dollar hit an eight-month high against the euro on Friday after weak data on German business sentiment heightened concerns that geopolitical tensions were weighing on the euro zone economy. Germany's Ifo business climate index, based on a monthly survey of some 7,000 firms, fell to 108.0 in July, marking a third consecutive monthly decline and missing estimates of 109.4, according to a Reuters poll of economists.

"We continue to get strong economic releases out of the United States," said Richard Scalone, co-head of foreign exchange at TJM Brokerage in Chicago. "At the same time, we are getting not-so-great economic releases out of Europe." Scalone said data on Thursday showing that U.S. weekly jobless claims hit their lowest level since 2006 bolstered views of an improving U.S. labor market. Earlier this month, data showed a surge in U.S. nonfarm payrolls growth in June. Analysts said the weak German business sentiment underscored the impact of tensions surrounding Russia and Ukraine on Germany, Europe's biggest economy. The potential impact of hard-hitting sanctions against Russia also likely hurt business confidence in Germany, they said.

European Union ambassadors reached a preliminary agreement on Friday to push ahead with sanctions against Russia but details have yet to be worked out, diplomats said. Analysts have said that the sanctions could hurt European growth by hindering trade between Russia and Germany.

"The geopolitical tension and uncertainty are already exerting a palpable effect on sentiment toward Europe and the euro," said Richard Franulovich, senior currency strategist at Westpac Securities in New York.

The dollar rose against the euro after Commerce Department data showed orders for long-lasting U.S. manufactured goods rose more than expected in June, but analysts said the positive impact faded after traders assessed lackluster details, including downward revisions for May.

Analysts eyed next week's Federal Reserve policy meeting, on Tuesday and Wednesday, and the U.S. government's non-farm payrolls report for July, to be released on Friday. Economists expect U.S. employers to have added 235,000 jobs in July, according to a Reuters poll.

"There is a chance of a bit more hawkish tone to the Fed's statement," said Scalone of TJM Brokerage, in light of recent strong U.S. jobs growth.

So, guys, recent information just confirms our suggestion on coming week. Previously we said that all USD-related assets will be under pressure, since on coming week situation is moderately bullish for USD. Concerning EUR – here is too much difference in sentiment of US and EU fundamental numbers, nice earnings reports from US companies and investors’ expectations on more hawkish Fed speech. These moments probably will lead to gradual USD appreciation on coming week till we will get clarity from the Fed.

Technical

Today we again will take a look at EUR, because we do not see something really better and more interesting than EUR, at least among the majors. Still we see interesting phenomenon on JPY, but it stands on weekly chart and we will discuss it below.

It seems that our suggestions on EUR/USD in general were correct and EUR has continued move down. Now it has passed below 1.3475 area – Yearly pivot point. It does not mean yet that EUR has broken it, since Yearly pivot is rather wide range. Still, now market stands at very significant moment. It is probable that July could become edge month for medium-term direction. As very important data and information stands ahead, EUR still has chances to form something reversal – as we said previously, appearing of bullish grabber right at YPP level definitely will tell us that market should exceed 1.40 level and probably even could reach YPR1~1.42 area. Conversely, failure at YPP will be great challenge on further downward action. In this case nearest downside target stands on YPS1 ~ 1.3060

We’re speaking about as upside as downside scenarios, because right now nothing is lost yet for bulls. Yes, recent action is bearish and overall situation stands a bit more in favor of bears, but just minor hint on dovish policy could turn market from top to bottom. In recent time Fed very often dissapoints investors and rethorical question why this couldn’t happen again? From that point of view it seems possible, especially if we recall Bernanke statements on private dinners, where he said that Fed will keep rates low longer than investors would like it. Thus, monthly grabber could be some kind of prophecy for this event. Actually we do not much care whether Fed will push USD up or down. We will be winners anyway, since we mostly need action in any direction and this probably will happen.

Technically market stands in tight range since 2014. Thus, 1.33-1.3850 is an area of “indecision”. While market stands inside of it we can talk about neither upward breakout nor downward reversal. At least, reversal identification could be done with yearly pivot – if market will continue to move lower, this could be early sign of changing sentiment.

That’s being said, market stands around crucial area and July could clarify what will happen next. All we need on monthly chart is patience... Now market is preparing for plunge down, but dovish surprise from the Fed is not excluded.

Weekly

On previous week market has shown solid donward action. Trend holds bearish here, but market is not at oversold. On weekly chart market does not give us any patterns to trade immediately. Still, weekly picture contains some important issues.

First of all – action below MPS1. This confirms that market stands in strong bearish trend that should continue. Another important moment that market is breaking through rock hard support – Weekly K-support, YPP, MPS1 and that was also AB=CD 1.618 support as we mentioned it on previous week. But right now price stands slightly below all this stuff.

Here again, we can return to range of hammer pattern. Now it is clear that market has broken it down. As we’ve said previously, when market forms long candle it usually holds following price action for some time, because market needs to accustom to new range. At the same time this will increase potential energy of breakout. Now breakout has happened. Usual destination point is 2 times length of the hammer to the downside. This area stands around 50% support (EUR most prefferable level, right?) around 1.3330 area. Below we can find only 5/8 support area 1.3230 and Agreement (btw BNP Paribas in letter to his clients has mentioned that they expect to see 1.32 area, but I do not remember the timing).

So, the fact that market forces in strong support and stands below it assumes that it could reach weekly target. At the same time, we have closer targets on daily chart and it will probably depend on pace till Fed meeting. If EUR decline pace will be fast then it could reach weekly target as well, prior 30th of July.

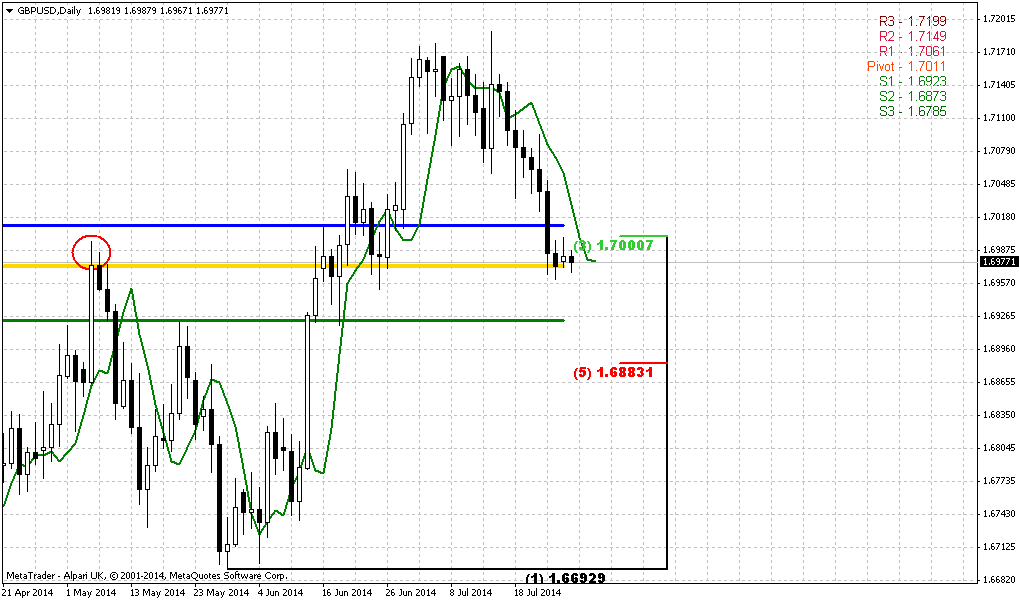

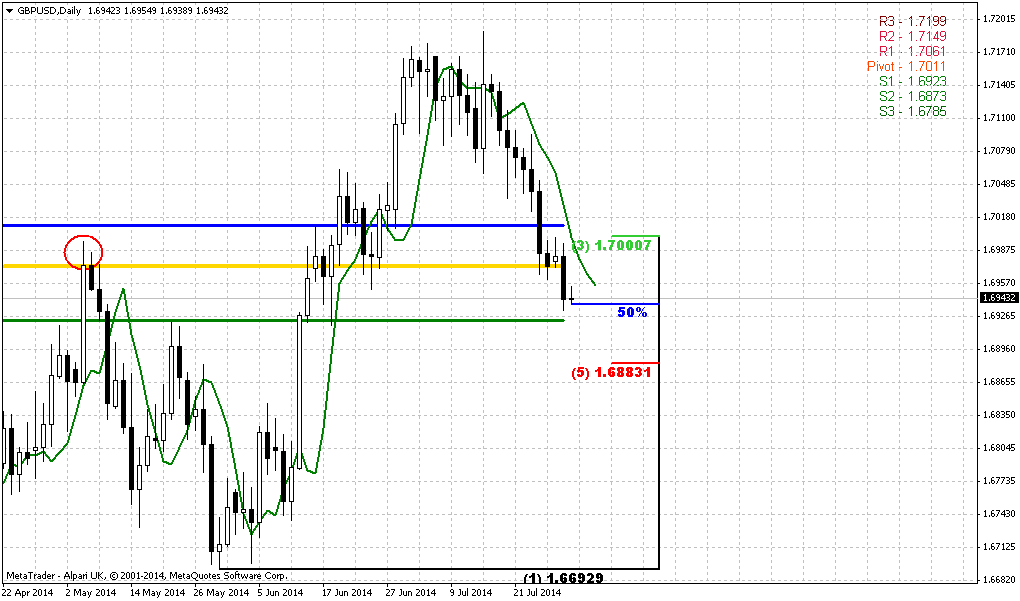

Daily

Trend is bearish on daily, market is not at oversold. Based in this picture our task for beginning of the weak is relatively simple – wait for reaching of next significant level at 1.3380. This will be 1.618 butterfly, Double Top target, WPS1 and minor 0.618 target of AB=CD down. It is difficult to count on any, even minor retracement prior it will be hit, since market has passed through all significant supports already. As we’ve suggested on previous week – retracements from support were really shy and it could mean that EUR stands under serious pressure.

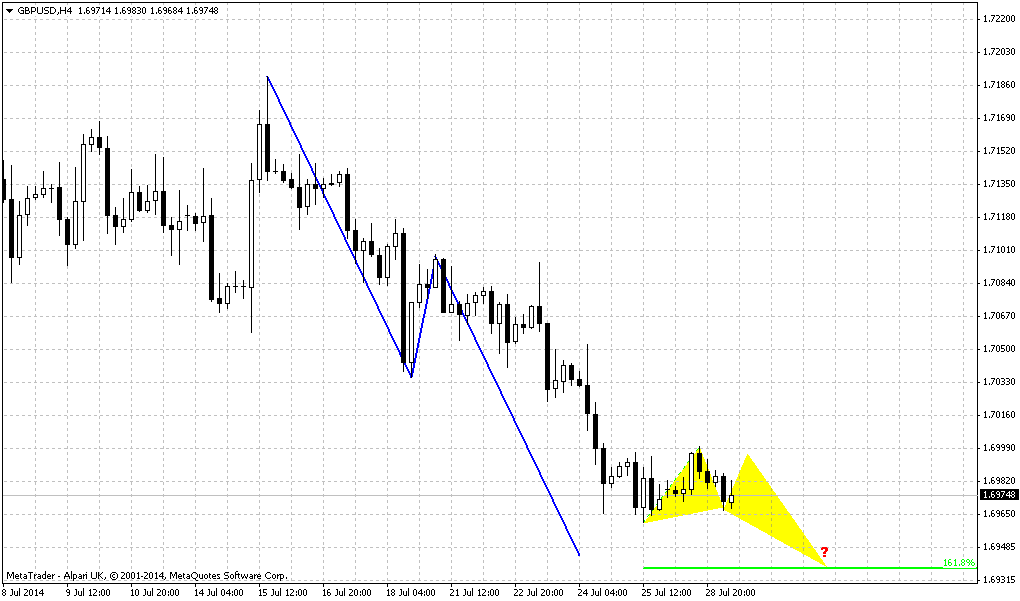

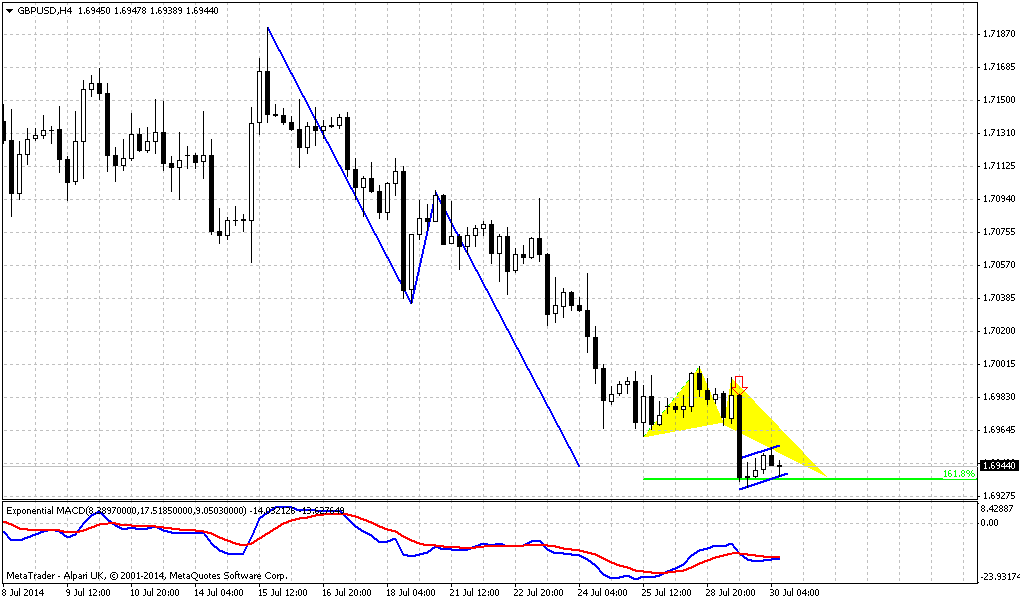

4-hour

Here trend is bearish. Nothing really interesting, guys, here. Yes, we have this hint on butterfly “buy” at 1.3408, but this is probably just “noise” around major levels. Major question will still stand around price action speed. If downward action will be fast, then market could move even lower than 1.3380, but this level is major one for next week. Our riding on downward action within previous 2 weeks was really nice and next important decision we probably will make only in August. Market right now stands very close to target and the potential room to it is not as important and not very attractive for trading.

Conclusion:

So, guys, EUR has reached hot point on big picture – edge of YPP, trend breakeven point and support area. Till the end of July we probably should get further direction. Although currently situation stands in favor of USD, but we can’t exclude surprises from Fed. Thus, it is not safe to take strategical positions right now and better to wait for beginning of the August.

In short-term situation tactical target at 1.3380 stands relatively close and to be honest our journey on the way to it is coming to an end. Thus, we can’t call you to take new short position since there is rather shy room till this area. But we should not think that we miss something, since with end of July clarity we probably will get new solid direction (despite whether it will be up or down) and will have enough time to take position.

The technical portion of Sive's analysis owes a great deal to Joe DiNapoli's methods, and uses a number of Joe's proprietary indicators. Please note that Sive's analysis is his own view of the market and is not endorsed by Joe DiNapoli or any related companies.