Larry Williams Forecast 2014 - euro currency

Last of his forecasts in this thread because I think we are not intersted in lumber, soybeans, treasury bonds...

About euro Mr. Williams is very cautios...he speaks about positions of non-commercials...he expects euro strenghtening..

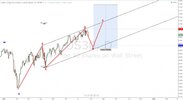

Here is my big picture..from July 2008 1,6037...I spoke about D3, Flat with low 1,1875 and Flat corrective but I am more&more sceptical about it...

..here I see 2 possibilities..maybe you will find my chart messy but it is as it is, to me is clear&understandable...

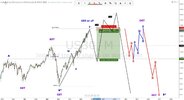

1. to me closest is Flat with ED wave c...red W is aF, X is bF, 1ED in place and we are in Flat corrective 2ED in wave cF as ED...here is the question I spoke about in my eurusd insigh...how to unfold ED..is wave c = 1ED in place or not..how deep...this is what we will get in near future..how high is also the matter of future BUT not above 1,5143..if this is 2ED..

In this picture I drew second option as Flat, HH as wave c monthly in place, meanwhile in daily insight there is ED as cF 4ED, HH not in place..

2. this pattern I do not like because I respect swings most of all...this one could be CT..W = wave a (this is why I do not like because it looks lake nice ZZ), than combined/complex ZZ into ACT, then BCT, CCT and DCT (all acceptable) and we are in E...here is THE catch..E could be in place and we are headed toward parity...or this is 1st ZZ of DZZ wave E with target above current HH and all the way to 1,4927...E can also be CT so we could get ups&downs in future but this I do not like again!

Good trading to all and good luck with fastfingers at FOMC!

ps

There is a mistake in my chart, blue 5ED is on wrong high, should be on 1,3992 peak..sorry, not on purpose..