Market Insight

Dollar index

Pushing up..still think will exceed 81,84 peak before retrace..maybe at ADP or GDP..

eurusd

looks like 1,3380 before retrace..

picture in previous post about eurusd

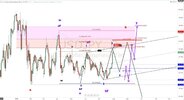

gbpusd

I like checking others analysis to check mine...changed my count a bit, looks much better...2 targets at 1,6917

usdjpy

this one is strange..pushing and pushing..probably we are in 5th...but possible also pullback to 101,9 before last push up...well, I think we are topping and will not break above 102,25

Dollar index

Pushing up..still think will exceed 81,84 peak before retrace..maybe at ADP or GDP..

eurusd

looks like 1,3380 before retrace..

picture in previous post about eurusd

gbpusd

I like checking others analysis to check mine...changed my count a bit, looks much better...2 targets at 1,6917

usdjpy

this one is strange..pushing and pushing..probably we are in 5th...but possible also pullback to 101,9 before last push up...well, I think we are topping and will not break above 102,25