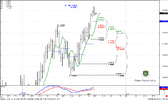

EUR/USD Daily Update, Tue 08, March, 2011

Good morning,

Our first part of trading plan has been accomplished - market has hit 1.4033 area and turns to some retracement.

As you remember, now we should estimate the possible depth of this retracement. It could be twofold:

1. If it will be B&B "Buy" smaller retracement (possibly to 1.39 only)

2. If it will be DRPO "Sell" - deeper retracement (1.38 area is possible)

But from daily time frame perspective we can't estimate it yet.

Daytraders:

Market has hit the target. Daily trend is bullish. So, you have no context for enter short - wait for some pullback. Initial level to watch is 1.39.

Intraday traders:

Look at 60-min chart. Market turns to retracement. You can enter on the short side from 1.40 area with target at 1.39-1.3920. Stop could be placed to 1.4030. This is just a scalp trade for running on a possible daily retracement. Take a look - AB-CD pattern makes an Agreement with 1.3920-1.3901 support area. That's your target. Don't marry any short possition, because daily trend is bullish.