stranik

Private, 1st Class

- Messages

- 35

It is your PERSONALITY who trades

As I was on the forum more than usual last week, I noticed this frustration that some of your expressed as well. I want to offer an advice hopping to help.

A little background -

I have been trading for few years, spent time on working out my 3Ms (Method, MoneyManagement, and Mind), read tons of TA books, studied extensively Mark Douglas, Ari Kiev... - I assume majority of us on this forum knows about them), but still had feeling that some piece of my trading strategy puzzle was missing.

Coincidently, about a year ago I started a project on an individual personality and how our genetics affect our career (from a different prospective, corporate organizational structure - in my other life ). Some learning and discoveries from that project shoot a bright light on my trading deficiency. And I decided to took a "pet" project of my own to dig more in the personality study related to traders...

). Some learning and discoveries from that project shoot a bright light on my trading deficiency. And I decided to took a "pet" project of my own to dig more in the personality study related to traders...

Long story short – to be a successful trader, you not only need to know your money management techniques, your trading method and its edge, and have a right mind set. But, most importantly, you need to know YOURSELF! Discover what type of personality you are born with. Are you a risk-taker or risk-avoider, need actions/changes or calm/stability, looking into getting all the details on a subject or just want to see the overall picture. The other important piece of that learning was for me that these qualities are coded in our genetics. Do you see a kid who wants to re-read each word in a book over and over, and another one who jumps through the pages and just wants to know how the story ended? Yes, obviously our life experiences shape us... but in a deep self we are who we are.

If you know who you are, next you should find a trading style that suits your personality. Can you wait few weeks (or days) for a patter to materialize or you need to trade news for few minutes and move on? For people of action monthly/weekly setups will bring losses, while for people of patience they will end up with profit.

I know that Sive has a different style and it does not suit my personality. Did I use his targets? Yes, occasionally I fall into that trap And I should admit those trades were not much success for me. Did I blame Sive for my losses? Obviously not! I am the one who set the order and clicked "buy" or "sell". No one forced me to do it, apart from either my greed or my fear. But now when I question myself why did I take a trade on EUR and it did not work, I know the answer!

And I should admit those trades were not much success for me. Did I blame Sive for my losses? Obviously not! I am the one who set the order and clicked "buy" or "sell". No one forced me to do it, apart from either my greed or my fear. But now when I question myself why did I take a trade on EUR and it did not work, I know the answer!

The main point – don't try to change yourself, but learn who you are and use this learning to your advantage.

Hope it helps,

stranik

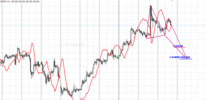

...Some of our forumers were frustrated concerning the term of B&B. They said it is “too long”. But guys, what have you expected? This is weekly pattern. Just imagine that you see not weekly but hourly chart – is it seems too long 4 hours to get the target? I guess not. The reason why you could think that it is too long is because you’ve chosen wrong time frame for trading that is not suitable for you by some reasons – either personality or money management (too large distances). Because this pattern has worked perfectly – it was not erased and it’s invalidation point was not hit. Pattern has reached the target after 4 periods...

As I was on the forum more than usual last week, I noticed this frustration that some of your expressed as well. I want to offer an advice hopping to help.

A little background -

I have been trading for few years, spent time on working out my 3Ms (Method, MoneyManagement, and Mind), read tons of TA books, studied extensively Mark Douglas, Ari Kiev... - I assume majority of us on this forum knows about them), but still had feeling that some piece of my trading strategy puzzle was missing.

Coincidently, about a year ago I started a project on an individual personality and how our genetics affect our career (from a different prospective, corporate organizational structure - in my other life

Long story short – to be a successful trader, you not only need to know your money management techniques, your trading method and its edge, and have a right mind set. But, most importantly, you need to know YOURSELF! Discover what type of personality you are born with. Are you a risk-taker or risk-avoider, need actions/changes or calm/stability, looking into getting all the details on a subject or just want to see the overall picture. The other important piece of that learning was for me that these qualities are coded in our genetics. Do you see a kid who wants to re-read each word in a book over and over, and another one who jumps through the pages and just wants to know how the story ended? Yes, obviously our life experiences shape us... but in a deep self we are who we are.

If you know who you are, next you should find a trading style that suits your personality. Can you wait few weeks (or days) for a patter to materialize or you need to trade news for few minutes and move on? For people of action monthly/weekly setups will bring losses, while for people of patience they will end up with profit.

I know that Sive has a different style and it does not suit my personality. Did I use his targets? Yes, occasionally I fall into that trap

The main point – don't try to change yourself, but learn who you are and use this learning to your advantage.

Hope it helps,

stranik