Still noise between 2997 and 2820 in my book.The DB will not be activated until 2997 has been taken out. Until 2997 has been taken out I'm bearish

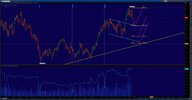

I think I also see bearish flag forming on daily tf

Still noise between 2997 and 2820 in my book.The DB will not be activated until 2997 has been taken out. Until 2997 has been taken out I'm bearish

......hmmmmm....seems like the Euro Zone are not quite finish with making money from the forex market for their monthly payroll and expenses....1.299 levels and seems hell bend on touching or even breaking resistance??

...hmmm.. most probably payroll & expenses for month of May 2013 was higher than expected

I supposed the Americans will soon kick-in with recouping their monthly payroll & expenses and the EUR/USD will probably sky dive....

Agree with you, from current area I will scale in short position targeting 1.287-1.291 area. From there I will long, targeting >1.314-1.32.Probably not. Maybe a retracement after hitting 100% of upward AB-CD on daily but right now seems pretty bullish. We have 25x5 SMA at around 1.3100 so maybe market will touch that level and then respect the 25x5 SMA. Only if market will take out 1.2850 will I start to think about shorts. Right now, I am bullish and will wait for retracement to long this dip.

Note that daily overbought is @ around 1.3100 area also so expect some respect at 1.3100. Maybe this will give us the dip to buy into.

View attachment 9548