Sive Morten

Special Consultant to the FPA

- Messages

- 18,760

Monthly

Weekly FX Tading Report prepared by Sive Morten exclusively for ForexPeaceArmy.com

According to Reuters news dollar firmed for a second straight session on Friday after three consecutive days of losses, bolstered by safe-haven bids on worries about the health of the global economy with slow-downs evident in Europe, Japan, and China.

"Dollar strength is still on the table here going forward and the driver behind that is policy divergence," said Andrew Dilz, currency strategist at Tempus Consulting in Washington.

"We're seeing a rate hike in the United States by the second half of the year. At the same time, we're seeing fractures elsewhere in economic growth such as Europe."

"If the dollar stays stronger for a longer, it keeps inflation down and helps the Federal Reserve to keep rates low longer," said Jack Flaherty, portfolio manager for the GAM Unconstrained Bond Fund of about $17 billion, in New York. "We are waiting for a more attractive entry point on the dollar."

The euro, meanwhile, slumped on concerns about the region's economic weakness, specifically Germany. Worries about the euro zone were echoed by European Central Bank President Mario Draghi, who said on Friday that a slowdown in the euro zone's economic momentum could weigh further on the reluctance of companies and households to invest.

Global growth worries, which sent stocks and commodities down across the board, pushed the safe-haven yen to a five-week high against the euro. The drop in oil prices to a four-year low below $90 took its toll on the Norwegian crown.

All of that has made markets much more jittery as seen in a jump in the CBOE volatility index, a measure of investor anxiety, to highs not seen since early February. Analysts said the pickup in volatility means the dollar's road higher is likely to get bumpier.

Societe Generale strategist Kit Juckes said the dollar had rallied too far, too fast since July, on the back of strong data and a small change in the U.S. Federal Reserve's language.

Recent CFTC report just minor changes in sentiment. Open interest has shown light decrease, while short positions has increased slightly. This information doesn’t confirm that action to 1.67 area could start right now and doesn’t exclude possible lower action to next support. As you know CFTC also prepares “legacy” report, that is a newer version and it shows not just “non-commercial” positions, but “asset-managers/Institutional”. Thus, this chart shows solid increase of short positions within previous 3 weeks – right after Scotland voting.

Non-Commercial Shorts:

Non-Commercial Longs:

Open Interest:

As you know CFTC also prepares “legacy” report, that is a newer version and it shows not just “non-commercial” positions, but “asset-managers/Institutional”. Thus, this chart shows solid increase of short positions within previous 3 weeks – right after Scotland voting.

Asset managers/Institutional shorts:

That makes us to be cautious on any possible upward action right now. And mostly suggests a bit deeper move and starting point of our B&B “Buy” on monthly chart.

Technical

Again – research on GBP, two cents on EUR. As we’ve said earlier EUR is interesting right now only on long term picture and our target is the same as we’ve specified it 3 weeks ago – 1.2170. So keep long-term shorts. In short term perspective as market is oversold on daily and weekly chart and has passed through all targets and Fib levels – use retracement for short entry and take profits at lows of former day/week, depending on your trading time frame. Right now we could monitor for possible DRPO “Buy” on daily EUR. But this will be weak DRPO – it has no support at the back. Actually – that’s all, nothing more interesting there right now.

So, GBP...

As we’ve said on previous week, Scotland referendum has made an impact and adjusted normal market’s behavior. Right now USD grow also presses on market. As political turmoil has gone to history market will try to correct the skew that was made by political impact. This in turn, could give us promising setups on different time scales. At the same time we agree that setups that we will discuss today mostly tactical, although they could last for considerable period of time. Also we understand that Scotland’s referendum has changed political sentiment and will lead to changes in domestic political process. The fact that political reasons were existed for referendum and referendum itself has happened – already is negative for Kingdom currency. That’s why we are not count that GBP will return soon at the same top as it was before referendum. You can see big drop in open interest before referendum – that was exit of big players, out from cable. It needs time to bring them back.

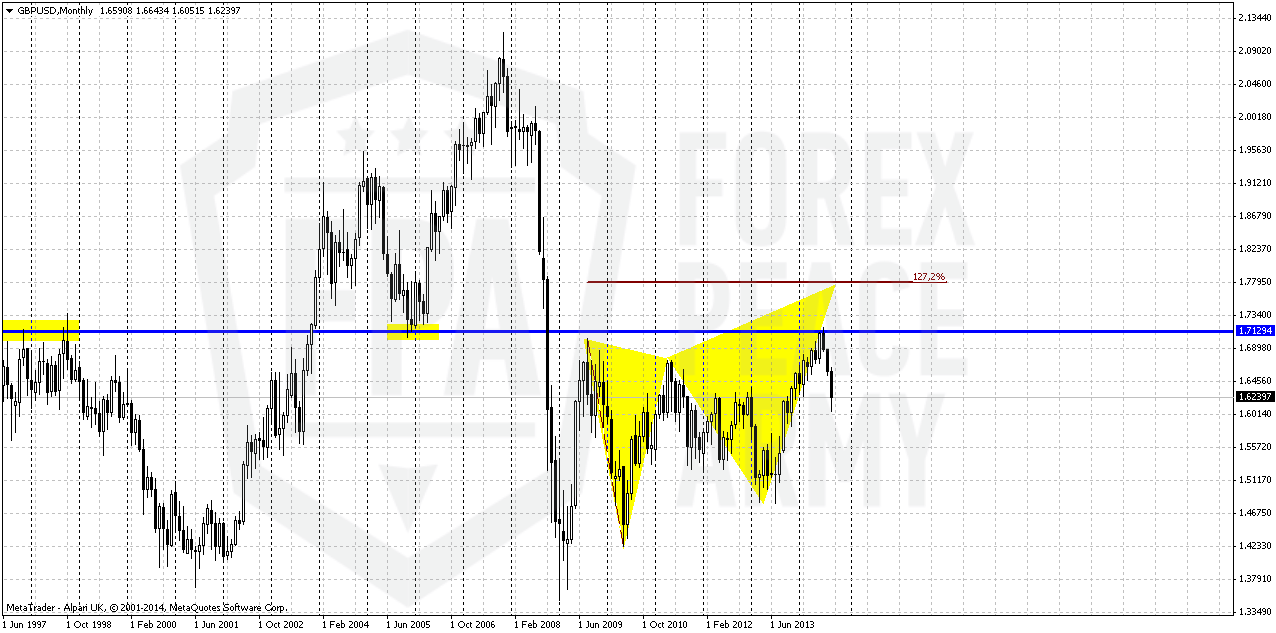

First of all take a look at long-term GBP chart. Here is long time 1.70-1.71 natural support/resistance area. Recall that before shadow of referendum has risen upon Great Britain – pound sterling was on nice upward march. BoE was at the eve of rate hiking and this has led to tremendous upside rally. In general market moves north longer than a whole year and has reached 1.70-1.71:

Rumors around Scotland voting have not appeared suddenly but previously they weren’t treated seariously as they should to. On autumn of 2014 public opinion surveys start to show that percent of “Yes” voters are not really small and approaches to 50%. And this has started to worry investors, forced them to leave cable and logically has led to negative impact on GB currency.

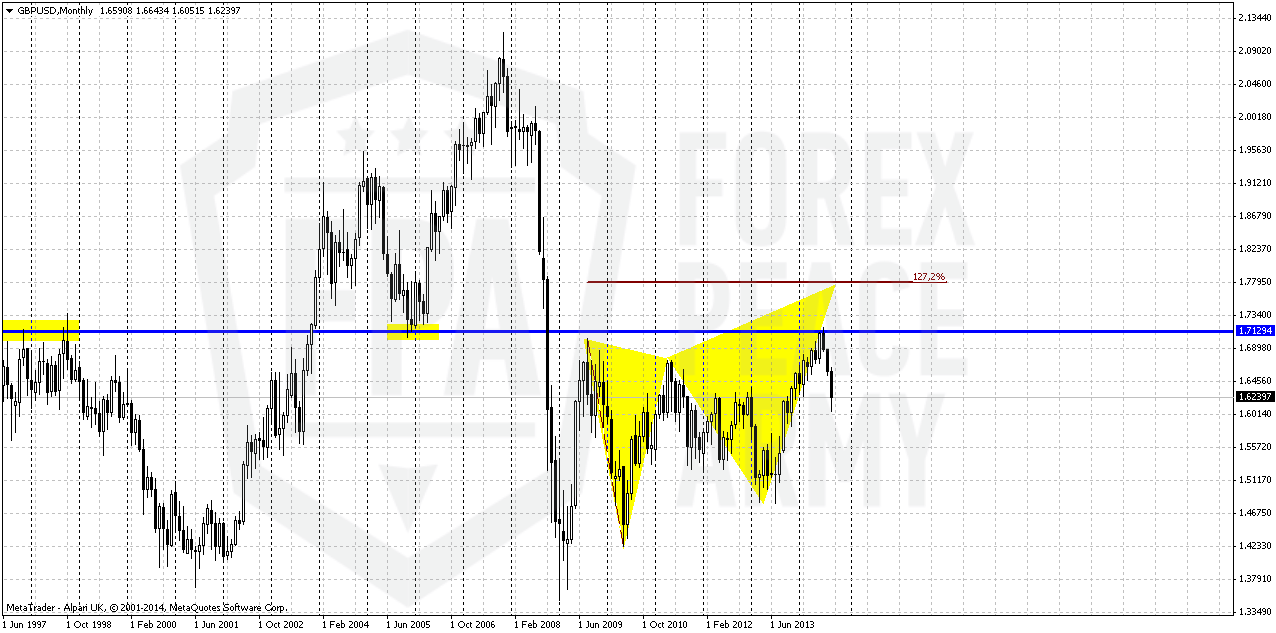

As political force was eliminated after voting – we see that market logically should return to previous action and at least return some previous looses. Besides, pure technical view suggests existing of previous upside momentum that has not dissapeared but was temporally muted by political mess. This leads to appearing of monthly DiNapoli B&B “Buy” setup, as it is shown no second chart:

On previous week I’ve missed to look at yearly pivots, and now we see even better picture. In the beginning of the year market has tested YPR1 and now stands at YPP. So, we have not just 50% Fib support.

According to B&B rules market has to reach some significant Fib support level within 3 periods of closing below 3x3 DMA. Although we previously expected that B&B has chances to start from 3/8 Fib support, but this has not happened. But following to rules – market can start B&B as from 50% Fib level as from 5/8.The major condition - this level has to be reached within 3 periods after 3x3 DMA has been crossed. And you can see that October is a third period. Hence – we know that B&B will start in October, but we do not know from which level – 50% or 5/8. Right now GBP stands at 50% support. As we’ve find out existing of YPP – situation has changed and chances on upward action right from here increases.

The target of this pattern is 5/8 Fib resistance of total move down after thrust up. As you will see later - right now this is 1.6717 area.

Although B&B is very reliable pattern because it is based not on some trader’s view or opinion or some men-invented patterns, but on real market mechanics, sometimes it still could fail. That’s why reaching of strong support and completion of other conditions are not enough to take position. Since this is monthly pattern – upward action should be visible on lower time frames and probably should start from some clear upside reversal pattern on daily chart. Advantage of this one B&B stands also with its political background – there was a “problem” that now is mostly gone, although some consecquences probably will remain. Anyway this should let market to return previous positions, at least partially and 5/8 upside retracement looks really as a mite and rather realistic target.

Previously we have been able to verify the need for a reversal pattern. If we took a long position blindly, only with the support - we would now be in a very uncomfortable situation.

Weekly

On weekly chart trend is bearish. We do not have many clues here. Previously we’ve mentioned high wave pattern that has appeared right after voting and we’ve said depending on breakout direction market will follow in the same one. In fact, right now we have simple task – understand from which level B&B will start. Right now here is GBP at MPS1, YPP and 50% support, level of oversold coinsides with 5/8 Fib level. Recent week mostly was inside one, attempt to move higher was shallow and has not changed the view on weekly chart.

Daily

Here we have two moments to discuss. First one is untouched 1.27 extension of butterfly pattern. Now we understand why this has happened – mostly due reaching of YPP that brings strong additional support to market.

Second – take a look that we’ve got bullish grabber that could get absolutely special meaning right now. Previously we mostly stand on point that downward continuation is more probable that starting of B&B right from 50% support. Right now – odds change in favor of second scenario and appearing of stop grabber could be valuable advantage. This is not the type of grabbers that we prefer to trade but may be we do not need it to, since we already should have long position as we’ve discussed in our weekly research. That was the first stage in our plan by the way. But grabber could serve as some kind of indicator. If market really will start move up with B&B, then grabber probably will survive. Conversely, taking out of grabber’s lows will suggest that upside action has not started yet. If you want you can trade grabber separately as independent pattern. This is also not forbidden. But again, for us the major value of this grabber is in possibility to take long position, but to get confidence with current upward action, or get warning on possible downward continuation.

By the way, in fact, on daily we had another B&B “Sell” that was completed…

4-hour

When we speak on “long term” pattern on big picture and then talk on “extended” reversal pattern that could be the trigger of monthly B&B – we assume particularly what we’ve said. Thus, on 4-hour chart we see butterfly and it is “extended” one by itself. But take broader view – we could get reverse H&S that could become true reversal pattern and current butterfly will be just a part of it. Besides, we already in this trade.

4-hour chart shows tactical riddle. If grabbers will work – market should turn to some sort of AB=CD that has target right at daily overbought. If this will not happen and market will drop to 1.5950 lows – action to 1.5750 will become more realistic. That’s being said coming week will be mostly tactical, we continue to hold longs, and watch what will happen with grabber and AB=CD...

Conclusion:

So, we are tempted by appetite setup on monthly chart of GBP that looks promising, at least right now. Since this pattern is forming on big picture – it could lasts for weeks and particularly by this reason it looks attractive. Currently we’ve estimated the target of this pattern at 1.6717

In shorter-term perspective situation is relatively positive. Since we already have long position, we’ve found that market stands on Yearly Pivot as well among other support indicators; cable has not bad chances to start upward action from here. On coming week we mostly will watch for tactical issues – whether market will turn to upside AB=CD or continue move down.

The technical portion of Sive's analysis owes a great deal to Joe DiNapoli's methods, and uses a number of Joe's proprietary indicators. Please note that Sive's analysis is his own view of the market and is not endorsed by Joe DiNapoli or any related companies.

Weekly FX Tading Report prepared by Sive Morten exclusively for ForexPeaceArmy.com

According to Reuters news dollar firmed for a second straight session on Friday after three consecutive days of losses, bolstered by safe-haven bids on worries about the health of the global economy with slow-downs evident in Europe, Japan, and China.

"Dollar strength is still on the table here going forward and the driver behind that is policy divergence," said Andrew Dilz, currency strategist at Tempus Consulting in Washington.

"We're seeing a rate hike in the United States by the second half of the year. At the same time, we're seeing fractures elsewhere in economic growth such as Europe."

"If the dollar stays stronger for a longer, it keeps inflation down and helps the Federal Reserve to keep rates low longer," said Jack Flaherty, portfolio manager for the GAM Unconstrained Bond Fund of about $17 billion, in New York. "We are waiting for a more attractive entry point on the dollar."

The euro, meanwhile, slumped on concerns about the region's economic weakness, specifically Germany. Worries about the euro zone were echoed by European Central Bank President Mario Draghi, who said on Friday that a slowdown in the euro zone's economic momentum could weigh further on the reluctance of companies and households to invest.

Global growth worries, which sent stocks and commodities down across the board, pushed the safe-haven yen to a five-week high against the euro. The drop in oil prices to a four-year low below $90 took its toll on the Norwegian crown.

All of that has made markets much more jittery as seen in a jump in the CBOE volatility index, a measure of investor anxiety, to highs not seen since early February. Analysts said the pickup in volatility means the dollar's road higher is likely to get bumpier.

Societe Generale strategist Kit Juckes said the dollar had rallied too far, too fast since July, on the back of strong data and a small change in the U.S. Federal Reserve's language.

Recent CFTC report just minor changes in sentiment. Open interest has shown light decrease, while short positions has increased slightly. This information doesn’t confirm that action to 1.67 area could start right now and doesn’t exclude possible lower action to next support. As you know CFTC also prepares “legacy” report, that is a newer version and it shows not just “non-commercial” positions, but “asset-managers/Institutional”. Thus, this chart shows solid increase of short positions within previous 3 weeks – right after Scotland voting.

Non-Commercial Shorts:

Non-Commercial Longs:

Open Interest:

As you know CFTC also prepares “legacy” report, that is a newer version and it shows not just “non-commercial” positions, but “asset-managers/Institutional”. Thus, this chart shows solid increase of short positions within previous 3 weeks – right after Scotland voting.

Asset managers/Institutional shorts:

That makes us to be cautious on any possible upward action right now. And mostly suggests a bit deeper move and starting point of our B&B “Buy” on monthly chart.

Technical

Again – research on GBP, two cents on EUR. As we’ve said earlier EUR is interesting right now only on long term picture and our target is the same as we’ve specified it 3 weeks ago – 1.2170. So keep long-term shorts. In short term perspective as market is oversold on daily and weekly chart and has passed through all targets and Fib levels – use retracement for short entry and take profits at lows of former day/week, depending on your trading time frame. Right now we could monitor for possible DRPO “Buy” on daily EUR. But this will be weak DRPO – it has no support at the back. Actually – that’s all, nothing more interesting there right now.

So, GBP...

As we’ve said on previous week, Scotland referendum has made an impact and adjusted normal market’s behavior. Right now USD grow also presses on market. As political turmoil has gone to history market will try to correct the skew that was made by political impact. This in turn, could give us promising setups on different time scales. At the same time we agree that setups that we will discuss today mostly tactical, although they could last for considerable period of time. Also we understand that Scotland’s referendum has changed political sentiment and will lead to changes in domestic political process. The fact that political reasons were existed for referendum and referendum itself has happened – already is negative for Kingdom currency. That’s why we are not count that GBP will return soon at the same top as it was before referendum. You can see big drop in open interest before referendum – that was exit of big players, out from cable. It needs time to bring them back.

First of all take a look at long-term GBP chart. Here is long time 1.70-1.71 natural support/resistance area. Recall that before shadow of referendum has risen upon Great Britain – pound sterling was on nice upward march. BoE was at the eve of rate hiking and this has led to tremendous upside rally. In general market moves north longer than a whole year and has reached 1.70-1.71:

Rumors around Scotland voting have not appeared suddenly but previously they weren’t treated seariously as they should to. On autumn of 2014 public opinion surveys start to show that percent of “Yes” voters are not really small and approaches to 50%. And this has started to worry investors, forced them to leave cable and logically has led to negative impact on GB currency.

As political force was eliminated after voting – we see that market logically should return to previous action and at least return some previous looses. Besides, pure technical view suggests existing of previous upside momentum that has not dissapeared but was temporally muted by political mess. This leads to appearing of monthly DiNapoli B&B “Buy” setup, as it is shown no second chart:

On previous week I’ve missed to look at yearly pivots, and now we see even better picture. In the beginning of the year market has tested YPR1 and now stands at YPP. So, we have not just 50% Fib support.

According to B&B rules market has to reach some significant Fib support level within 3 periods of closing below 3x3 DMA. Although we previously expected that B&B has chances to start from 3/8 Fib support, but this has not happened. But following to rules – market can start B&B as from 50% Fib level as from 5/8.The major condition - this level has to be reached within 3 periods after 3x3 DMA has been crossed. And you can see that October is a third period. Hence – we know that B&B will start in October, but we do not know from which level – 50% or 5/8. Right now GBP stands at 50% support. As we’ve find out existing of YPP – situation has changed and chances on upward action right from here increases.

The target of this pattern is 5/8 Fib resistance of total move down after thrust up. As you will see later - right now this is 1.6717 area.

Although B&B is very reliable pattern because it is based not on some trader’s view or opinion or some men-invented patterns, but on real market mechanics, sometimes it still could fail. That’s why reaching of strong support and completion of other conditions are not enough to take position. Since this is monthly pattern – upward action should be visible on lower time frames and probably should start from some clear upside reversal pattern on daily chart. Advantage of this one B&B stands also with its political background – there was a “problem” that now is mostly gone, although some consecquences probably will remain. Anyway this should let market to return previous positions, at least partially and 5/8 upside retracement looks really as a mite and rather realistic target.

Previously we have been able to verify the need for a reversal pattern. If we took a long position blindly, only with the support - we would now be in a very uncomfortable situation.

Weekly

On weekly chart trend is bearish. We do not have many clues here. Previously we’ve mentioned high wave pattern that has appeared right after voting and we’ve said depending on breakout direction market will follow in the same one. In fact, right now we have simple task – understand from which level B&B will start. Right now here is GBP at MPS1, YPP and 50% support, level of oversold coinsides with 5/8 Fib level. Recent week mostly was inside one, attempt to move higher was shallow and has not changed the view on weekly chart.

Daily

Here we have two moments to discuss. First one is untouched 1.27 extension of butterfly pattern. Now we understand why this has happened – mostly due reaching of YPP that brings strong additional support to market.

Second – take a look that we’ve got bullish grabber that could get absolutely special meaning right now. Previously we mostly stand on point that downward continuation is more probable that starting of B&B right from 50% support. Right now – odds change in favor of second scenario and appearing of stop grabber could be valuable advantage. This is not the type of grabbers that we prefer to trade but may be we do not need it to, since we already should have long position as we’ve discussed in our weekly research. That was the first stage in our plan by the way. But grabber could serve as some kind of indicator. If market really will start move up with B&B, then grabber probably will survive. Conversely, taking out of grabber’s lows will suggest that upside action has not started yet. If you want you can trade grabber separately as independent pattern. This is also not forbidden. But again, for us the major value of this grabber is in possibility to take long position, but to get confidence with current upward action, or get warning on possible downward continuation.

By the way, in fact, on daily we had another B&B “Sell” that was completed…

4-hour

When we speak on “long term” pattern on big picture and then talk on “extended” reversal pattern that could be the trigger of monthly B&B – we assume particularly what we’ve said. Thus, on 4-hour chart we see butterfly and it is “extended” one by itself. But take broader view – we could get reverse H&S that could become true reversal pattern and current butterfly will be just a part of it. Besides, we already in this trade.

4-hour chart shows tactical riddle. If grabbers will work – market should turn to some sort of AB=CD that has target right at daily overbought. If this will not happen and market will drop to 1.5950 lows – action to 1.5750 will become more realistic. That’s being said coming week will be mostly tactical, we continue to hold longs, and watch what will happen with grabber and AB=CD...

Conclusion:

So, we are tempted by appetite setup on monthly chart of GBP that looks promising, at least right now. Since this pattern is forming on big picture – it could lasts for weeks and particularly by this reason it looks attractive. Currently we’ve estimated the target of this pattern at 1.6717

In shorter-term perspective situation is relatively positive. Since we already have long position, we’ve found that market stands on Yearly Pivot as well among other support indicators; cable has not bad chances to start upward action from here. On coming week we mostly will watch for tactical issues – whether market will turn to upside AB=CD or continue move down.

The technical portion of Sive's analysis owes a great deal to Joe DiNapoli's methods, and uses a number of Joe's proprietary indicators. Please note that Sive's analysis is his own view of the market and is not endorsed by Joe DiNapoli or any related companies.