Hi Geert,

I had the same problems during my initial steps in trading. The major reason is that we can't separate major from the minor. Major is overall context - direction in which you have to trade.

It seems that there is a too much emotional action in your trading. In fact, trading is just your action in a row with what your analysis tells you. First you have to get a context - up or down. IF you have down context - you can't Buy, no matter expect you retracement up or not. IF context is down, you can use this retracement to sell the rally at better level, but not to buy.

First - context. How to creat it-that is a very large question.

Second - overbought/oversold analysis.

IF you have strong down context but you at oversold - you should wait. Since retracement could be significant. The same is for overbought.

Third - stop placement. Use significant levels to hide stops, not just money stops.

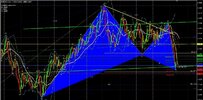

And the last thing - try to use strong areas of higher time frames to enter market, such as Confluence areas and/or Agreements in a row with context. So, if even market will break it - on lower time frame it will respect it and you will have time to move your stop to b/e.

In our Forex Military School will be chapters dedicated to trading plan creating and multiple time frame analysis. I strongly suggest you to read them. And chapter about harmonic patterns - it could be useful for stop placing.