Sive Morten

Special Consultant to the FPA

- Messages

- 18,706

EUR/USD Daily Update, Wed, 14 September 2011

Good morning,

On daily time frame there is nothing really new, just one important thing - market has corrected oversold and actually has not barriers to continue move down. So we need to be aware of retracement finish.

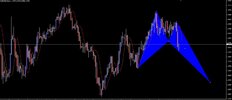

All major information on hourly chart. We see gradual move in parallel channel.

Upswings equals approx. 160-200 pips. Also we see that market forms multiple AB-CD patterns. The next target is 1.3750-1.3787. So, here two moments to watch:

1. If market will not reach it, reverse back and touch lower border - this is first sign that breakout is hear;

2. If market will take out 1.3550 area. In this case it will show downward breakout and erase all AB-CD's since C-point will be destroyed.

Be ready that market could show AB-CD retracement after breakout. This is very common for channels.

Currently I suspect that market hardly will reach 1.618's targets around 1.3850 area, since the way of behavior a bit different. But still we can't exclude that, especially if market will show upward break of channel and some upside acceleration.

Good morning,

On daily time frame there is nothing really new, just one important thing - market has corrected oversold and actually has not barriers to continue move down. So we need to be aware of retracement finish.

All major information on hourly chart. We see gradual move in parallel channel.

Upswings equals approx. 160-200 pips. Also we see that market forms multiple AB-CD patterns. The next target is 1.3750-1.3787. So, here two moments to watch:

1. If market will not reach it, reverse back and touch lower border - this is first sign that breakout is hear;

2. If market will take out 1.3550 area. In this case it will show downward breakout and erase all AB-CD's since C-point will be destroyed.

Be ready that market could show AB-CD retracement after breakout. This is very common for channels.

Currently I suspect that market hardly will reach 1.618's targets around 1.3850 area, since the way of behavior a bit different. But still we can't exclude that, especially if market will show upward break of channel and some upside acceleration.