liveforexdaytrading.com

Private, 1st Class

- Messages

- 71

Hello,

We have seen some risk off in the markets this week as stocks got sold with the fiscal cliff in the US looming. The USD got a bit stronger as some technical resistance was taken out in the USD index. Gold was not doing much though. Overall I feel the situations in the USD pairs are pretty neutral. The weekly charts suggest rather a bullish scenario with the recent fall in EUR/USD and GBP/USD just being retraces in an uptrend. AUD/USD is caught in a sideways range anyway. The JPY look a bit more exciting at the moment and also saw some decent price action with the JPY weaken. We are still below the weekly trend line though which is still pointing down. Once the JPY cross pairs break out of the wedge we could be up a serious run. The Live Forex Day Trading European session ended up at break even for the week.

EUR/USD is continuing its march down but you see also some buyers stepping in in front of the 1.2640 support. This area was never been re-tested yet and I was calling are re-test a few weeks back. It got pretty close with 1.2670 low but some Euro strength lifted the pair back to 1.2800. This was a re-test of the September major low swing point. The pair closed about right in the middle of these levels on Friday and also between the 5 day and 20 day VWAP. I am neutral right now since we could already see the start of wave 3 here in the weekly chart (see prev. post) without going to exactly 1.2640.30. Time will tell.

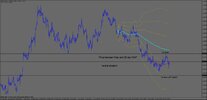

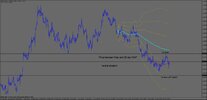

GBP/USD also making new lows here on the daily chart. The pair almost hit the 261.% Fibonacci projection level now in the daily chart. Heavy support waits at 1.5750 and slightly below that area is the 61.8 retracement level from the run up. You could argue a bit here about at what point the run up started and how to draw the retracement but I just went with the July 12th low. In the end it does not really matter that much it just shows you that the pair is still just in a retrace from an up move. Like in the EUR/USD it is hard to say if the pair goes much lower before turning around again or we see the next wave to the upside soon. I think the market want at least to see 1.5800-1.57500 before possibly going higher. Right now it is a guessing game with no clear direction in the weekly chart and volatility still drying up.

AUD/USD is still neutral. The latest sell-off in stocks would suggest more AUD weakness on risk-off but Gold is still stable. The charts don’t tell me much here. This pair seems to go nowhere at the moment and you can still look at the chart from the previous weeks to get the picture.

Regards,

Marco

We have seen some risk off in the markets this week as stocks got sold with the fiscal cliff in the US looming. The USD got a bit stronger as some technical resistance was taken out in the USD index. Gold was not doing much though. Overall I feel the situations in the USD pairs are pretty neutral. The weekly charts suggest rather a bullish scenario with the recent fall in EUR/USD and GBP/USD just being retraces in an uptrend. AUD/USD is caught in a sideways range anyway. The JPY look a bit more exciting at the moment and also saw some decent price action with the JPY weaken. We are still below the weekly trend line though which is still pointing down. Once the JPY cross pairs break out of the wedge we could be up a serious run. The Live Forex Day Trading European session ended up at break even for the week.

EUR/USD is continuing its march down but you see also some buyers stepping in in front of the 1.2640 support. This area was never been re-tested yet and I was calling are re-test a few weeks back. It got pretty close with 1.2670 low but some Euro strength lifted the pair back to 1.2800. This was a re-test of the September major low swing point. The pair closed about right in the middle of these levels on Friday and also between the 5 day and 20 day VWAP. I am neutral right now since we could already see the start of wave 3 here in the weekly chart (see prev. post) without going to exactly 1.2640.30. Time will tell.

GBP/USD also making new lows here on the daily chart. The pair almost hit the 261.% Fibonacci projection level now in the daily chart. Heavy support waits at 1.5750 and slightly below that area is the 61.8 retracement level from the run up. You could argue a bit here about at what point the run up started and how to draw the retracement but I just went with the July 12th low. In the end it does not really matter that much it just shows you that the pair is still just in a retrace from an up move. Like in the EUR/USD it is hard to say if the pair goes much lower before turning around again or we see the next wave to the upside soon. I think the market want at least to see 1.5800-1.57500 before possibly going higher. Right now it is a guessing game with no clear direction in the weekly chart and volatility still drying up.

AUD/USD is still neutral. The latest sell-off in stocks would suggest more AUD weakness on risk-off but Gold is still stable. The charts don’t tell me much here. This pair seems to go nowhere at the moment and you can still look at the chart from the previous weeks to get the picture.

Regards,

Marco