liveforexdaytrading.com

Private, 1st Class

- Messages

- 71

Hello,

Weekly review:

We have seen finally some volatility kicking in the currency market last week and some extensions of the tight ranges we have seen during the dull summer weeks. The FED announced that they would do QE3 “fairly soon” in case of no improvement of the US economy here in the near future. You got the expected moves in Gold, EUR/USD and GBP/USD on the “almost” announcement of more stimulus for the economy. Equity market and AUD/USD took a dive though which might have looked kind of strange but given the recent run in stocks it was a well-deserved break. A classic sell the news scenario.

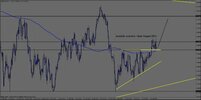

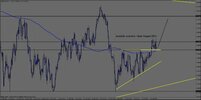

We have seen a very technical move here in the EUR/USD last week. The pair broke the 61.8% retracement level after the FOMC meeting minutes. We saw a nice retest of that area where the pair bounced to new highs. The move was a bit larger than I expected. The prices overshoot the 200% Fibonacci expansion level drawn from the low of the first impulse wave to the top of that wave and to the bottom of the 2nd retracement wave. Overall it was a perfect 5 wave pattern with an ABC correction afterward. Wave C could bring the pair down to 1.2450 again and complete the 100% Fibonacci expansion correction. Form here look for further upside moves.

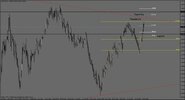

GBP/USD finally broke the daily resistance level as anticipated. The pair got to the 200% Fibonacci expansion level without much hesitation. Nevertheless there was a bit consolidation which I identified as the 4th wave in the up move. The 5 wave pattern was completed at the 200% FE level and we already got an ABC correction pattern. Let’s see if we get the complete re-test of 1.5775 again. I don’t think it is completely necessary here because we already got the retest in the hourly chart but it would look nice on the daily chart. I certainly will look here for long again next week.

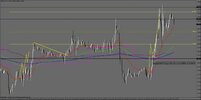

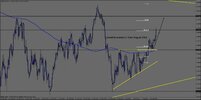

AUD/USD is the hardest to read here. It was the only pair which really followed the Equity market weakness despite USD weakness in general. It has been also very choppy for this pair last week. It looked like it would move higher without testing the trend line support and made a new high in the 2H chart. That turned out to be a fake and a lower low followed immediately. We got the test of the trend line and a break right to the old 61.8% FE level. Bulls tried to bring the pair on Friday back above the trend line and we close basically right at the trend line support. I would say the battle for the bull is not completely lost here but it is getting critical. I am pretty neutral on the pair right now and will probably avoid it to trade until I see a clearer direction.

Regards,

Marco

Weekly review:

We have seen finally some volatility kicking in the currency market last week and some extensions of the tight ranges we have seen during the dull summer weeks. The FED announced that they would do QE3 “fairly soon” in case of no improvement of the US economy here in the near future. You got the expected moves in Gold, EUR/USD and GBP/USD on the “almost” announcement of more stimulus for the economy. Equity market and AUD/USD took a dive though which might have looked kind of strange but given the recent run in stocks it was a well-deserved break. A classic sell the news scenario.

We have seen a very technical move here in the EUR/USD last week. The pair broke the 61.8% retracement level after the FOMC meeting minutes. We saw a nice retest of that area where the pair bounced to new highs. The move was a bit larger than I expected. The prices overshoot the 200% Fibonacci expansion level drawn from the low of the first impulse wave to the top of that wave and to the bottom of the 2nd retracement wave. Overall it was a perfect 5 wave pattern with an ABC correction afterward. Wave C could bring the pair down to 1.2450 again and complete the 100% Fibonacci expansion correction. Form here look for further upside moves.

GBP/USD finally broke the daily resistance level as anticipated. The pair got to the 200% Fibonacci expansion level without much hesitation. Nevertheless there was a bit consolidation which I identified as the 4th wave in the up move. The 5 wave pattern was completed at the 200% FE level and we already got an ABC correction pattern. Let’s see if we get the complete re-test of 1.5775 again. I don’t think it is completely necessary here because we already got the retest in the hourly chart but it would look nice on the daily chart. I certainly will look here for long again next week.

AUD/USD is the hardest to read here. It was the only pair which really followed the Equity market weakness despite USD weakness in general. It has been also very choppy for this pair last week. It looked like it would move higher without testing the trend line support and made a new high in the 2H chart. That turned out to be a fake and a lower low followed immediately. We got the test of the trend line and a break right to the old 61.8% FE level. Bulls tried to bring the pair on Friday back above the trend line and we close basically right at the trend line support. I would say the battle for the bull is not completely lost here but it is getting critical. I am pretty neutral on the pair right now and will probably avoid it to trade until I see a clearer direction.

Regards,

Marco