[Consistent actions lead to consistent results]

I remembered my first trading system.

It was a Bollinger Band mean reversion strategy.

You buy when the price is at the lower band and sell when it’s at the upper band.

The first few trades I did were winners, then the losses came and I figured this trading strategy doesn’t work.

So, I moved on.

Next, I chanced upon harmonic patterns.

I spent half a year learning how to draw these patterns (guess I’m a slower learner).

At the start, I had some wins but slowly, the losses kicked in and eroded all my profits.

Again, I told myself…

“This trading strategy doesn’t work. Let’s try something else.”

This brought me to the world of

price action trading, support and resistance,

candlestick patterns, etc.

Again, the same pattern repeated itself.

I had some winners, some losers, and I gave up the strategy.

One day, I asked myself…

“Why does this always happen?”

“Why am I not getting any consistency in my trading?”

“It’s always a few winners and then the losses pile up and take everything away.”

Do you know what I realized?

The problem was me.

I was hopping from one trading strategy to the next.

My actions were inconsistent. And because my actions were inconsistent, I got inconsistent results (duh).

So, don’t make my mistakes.

If you want consistent results from trading, you must have consistent actions.

Stick to one trading strategy, master it—and then move on.

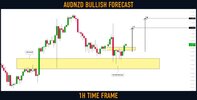

NZDUSD.

NZDUSD. NZDUSD.

NZDUSD.

Dollar Index (#DXY) daily time frame

Dollar Index (#DXY) daily time frame  #GBPUSD daily time frame

#GBPUSD daily time frame #USDCAD daily time frame

#USDCAD daily time frame #EURNZD daily time frame

#EURNZD daily time frame