Stan NordFX

NordFX Representative

- Messages

- 712

CryptoNews of the Week

- “Outlaw” and “The Siege” star Steven Seagal found himself implicated in advertising a cryptocurrency scam organized by a group of Serbian nationalists. According to the investigation, fraudsters deceived almost 500 people and lured away from them a total of $11 million in cryptocurrencies and fiat money.

Steven Seagal featured in promos for the new B2G coin as brand ambassador. The actor urged his followers in social media, 7 million people on Facebook and 100 thousand on Twitter, not to miss the chance with B2G.

Investors thought they were investing in mining and would earn up to 200% in 60-90 days. However, their money went into accounts controlled by a certain person of Serbian-Australian descent living in the Philippines.

Steven Seagal received $250,000 plus 750,000 B2G tokens for advertising. However, according to him, he broke the agreement when he had doubts about the "honesty of the project." According to Segal's manager, “the star fell victim to deception like everyone else.”

The charges were brought against 16 participants in the scheme, most of them of Serbian origin. They are accused of bank fraud and money laundering. This group performed about 20 cryptocurrency scams and defrauded investors for a total of $70 million. As for Segal, he agreed to pay a $300,000 fine for illegally advertising securities.

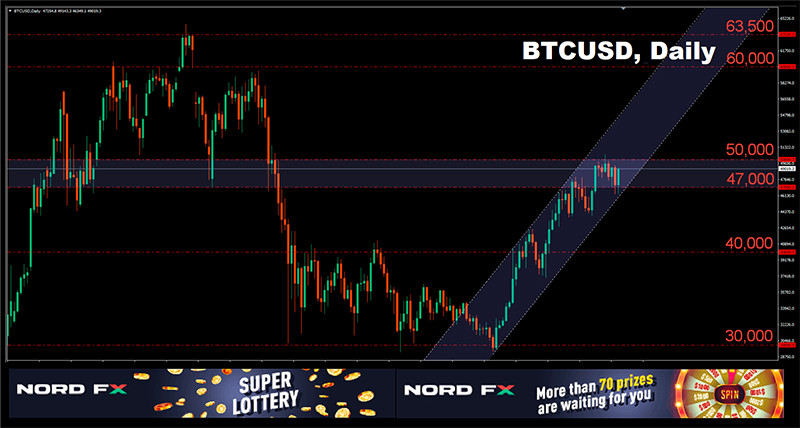

- Bloomberg Intelligence senior strategist Mike McGlone predicted bitcoin to rise to $100,000 in a new report. He noted the strong support for digital gold and Ethereum in recent months and the start of the growth phase of these assets. “Bitcoin seems to have found support around the $30,000 mark, just as it did at $4,000 in early 2019. We see parallels with those events and, apparently, bitcoin may well reach $100,000. "

The analyst added that the bulls are preparing for the next step in the cryptocurrency market. He also stressed that the BTC rate was below the 20-week moving average for a long time, which indicates a sell-off of this cryptocurrency among "weak" buyers.

"Bitcoin is becoming digital gold in the world going in this direction, and Ethereum is evolving as a platform for digitalizing finance," said senior strategist at Bloomberg Intelligence.

- AMC Theatres, a major cinema chain which owns 593 theaters in the United States and 335 abroad, will introduce the first cryptocurrency as a method to pay for tickets. The system for accepting cryptocurrency payments will be ready by the end of the year and is designed to increase sales amid the coronavirus pandemic, according to The Wrap.

- A well-known crypto strategist and trader nicknamed Crypto Dog predicts a serious bullish growth in BTC and ETH. "Bitcoin will get to $50,000 very soon." With regard to Ethereum, the analyst believes that with a new 30-day high of $3,182, ETH's all-time high is just around the corner.

As for the ETH/BTC pair, the strategist believes that it has upside potential of at least 40% from the current level of 0.07 BTC: "After crossing the 0.068 BTC level, I expect a strong rally to the level above 0.1 BTC."

- The Italian authorities have closed 32 Telegram groups in which thousands of people were offered to buy fake Green Pass. This document allows Italians who have already received at least one COVID-19 vaccine, recently recovered from the virus or tested negative, to visit cinemas, gyms, museums, restaurants, etc. Criminals preferred payments in cryptocurrency. There was no fixed price; on average, a fake document could be purchased for 500 euros or 588 dollars.

- Well-known cryptocurrency analyst Willy Wu believes that the bitcoin rate should rise in order to correct the supply/demand imbalance in the market. Based on fundamentals, Bitcoin's fair rate is $53,200, Wu said. However, he warned that fundamental factors do not allow forecasting for a short period, but with sufficient time, they will fully justify themselves.

Another analyst, Will Clemente, agreed with Wu's opinion and noted that, based on the bitcoin liquidity data from the Glassnode analytical platform, he predicted its growth to about $53,000 back on July 31.

- Israel's National Intelligence Agency Mossad has posted a job list on its website that features a tech expert on cryptocurrencies. The intelligence service did not specify what tasks the specialist would have to meet. However, the Ynet news outlet suggested that Mossad is interested in using the cryptocurrency, including for organizing payments to its agents.

- Bridgewater Associates billionaire founder Ray Dalio does not rule out bitcoin growth, but still prefers gold. Dalio has stated that he holds a "very small volume" of bitcoin. “If you put a gun to my head and let me choose only one of the two, I’ll choose gold,” he said.

At the same time, the billionaire admitted that bitcoin is still an important tool for diversifying portfolios: "There are certain assets that are worth holding to diversify a portfolio, and bitcoin is a kind of digital gold."

- The US Senate sent a bill to the House of Representatives on Tuesday, August 10, according to which miners, wallet developers, liquidity providers in DeFi protocols, etc. can be required to report to the IRS on the activities of their users. However, as it stands, the bill's requirements are not technically feasible, for which the document has been repeatedly criticized by the most prominent representatives of the crypto industry, including Elon Musk.

- Due to a hacker attack, the protocol for communication of various blockchains Poly Network lost $611 million. This is the largest damage in the entire history of the space of decentralized finance and cryptocurrencies as such. The previous anti-record was held by the Japanese exchange Coincheck, which lost over $500 million in NEM tokens in 2018.

The current attack stole $273 million in Ethereum blockchain tokens, $253 million in Binance Smart Chain blockchain tokens and $85 million in USDC stablecoin.

- Tom Lee, head of the analytical company Fundstrat, recalled the "golden rule" for crypto investors on CNBC. He has always encouraged to buy bitcoin every time once the quotes cross the 200-day moving average (MA 200) from the bottom up. Starting in 2017, in three out of five cases, the closing of the daily candle above this line was the beginning of a gradual increase in trading volumes and the development of long-term upward trends that lasted from 4 months to a year.

Two failures, according to Tom Lee, do not in any way cancel his "golden rule", since in these cases the BTC rate managed to rise enough for traders to protect their positions from any loss.

Tom Lee also reiterated his prediction that he sees bitcoin in the region of $100-120k in 2022. The new wave of demand will be driven by rising global inflation and technological changes in cryptocurrency.

Note that Tom Lee is the brother of the creator of Litecoin, but this time he did not discuss the future of this coin.

#eurusd #gbpusd #usdjpy #btcusd #ethusd #ltcusd #xrpusd #forex #forex_example #signals #forex #cryptocurrencies #bitcoin #stock_market

https://nordfx.com/

- “Outlaw” and “The Siege” star Steven Seagal found himself implicated in advertising a cryptocurrency scam organized by a group of Serbian nationalists. According to the investigation, fraudsters deceived almost 500 people and lured away from them a total of $11 million in cryptocurrencies and fiat money.

Steven Seagal featured in promos for the new B2G coin as brand ambassador. The actor urged his followers in social media, 7 million people on Facebook and 100 thousand on Twitter, not to miss the chance with B2G.

Investors thought they were investing in mining and would earn up to 200% in 60-90 days. However, their money went into accounts controlled by a certain person of Serbian-Australian descent living in the Philippines.

Steven Seagal received $250,000 plus 750,000 B2G tokens for advertising. However, according to him, he broke the agreement when he had doubts about the "honesty of the project." According to Segal's manager, “the star fell victim to deception like everyone else.”

The charges were brought against 16 participants in the scheme, most of them of Serbian origin. They are accused of bank fraud and money laundering. This group performed about 20 cryptocurrency scams and defrauded investors for a total of $70 million. As for Segal, he agreed to pay a $300,000 fine for illegally advertising securities.

- Bloomberg Intelligence senior strategist Mike McGlone predicted bitcoin to rise to $100,000 in a new report. He noted the strong support for digital gold and Ethereum in recent months and the start of the growth phase of these assets. “Bitcoin seems to have found support around the $30,000 mark, just as it did at $4,000 in early 2019. We see parallels with those events and, apparently, bitcoin may well reach $100,000. "

The analyst added that the bulls are preparing for the next step in the cryptocurrency market. He also stressed that the BTC rate was below the 20-week moving average for a long time, which indicates a sell-off of this cryptocurrency among "weak" buyers.

"Bitcoin is becoming digital gold in the world going in this direction, and Ethereum is evolving as a platform for digitalizing finance," said senior strategist at Bloomberg Intelligence.

- AMC Theatres, a major cinema chain which owns 593 theaters in the United States and 335 abroad, will introduce the first cryptocurrency as a method to pay for tickets. The system for accepting cryptocurrency payments will be ready by the end of the year and is designed to increase sales amid the coronavirus pandemic, according to The Wrap.

- A well-known crypto strategist and trader nicknamed Crypto Dog predicts a serious bullish growth in BTC and ETH. "Bitcoin will get to $50,000 very soon." With regard to Ethereum, the analyst believes that with a new 30-day high of $3,182, ETH's all-time high is just around the corner.

As for the ETH/BTC pair, the strategist believes that it has upside potential of at least 40% from the current level of 0.07 BTC: "After crossing the 0.068 BTC level, I expect a strong rally to the level above 0.1 BTC."

- The Italian authorities have closed 32 Telegram groups in which thousands of people were offered to buy fake Green Pass. This document allows Italians who have already received at least one COVID-19 vaccine, recently recovered from the virus or tested negative, to visit cinemas, gyms, museums, restaurants, etc. Criminals preferred payments in cryptocurrency. There was no fixed price; on average, a fake document could be purchased for 500 euros or 588 dollars.

- Well-known cryptocurrency analyst Willy Wu believes that the bitcoin rate should rise in order to correct the supply/demand imbalance in the market. Based on fundamentals, Bitcoin's fair rate is $53,200, Wu said. However, he warned that fundamental factors do not allow forecasting for a short period, but with sufficient time, they will fully justify themselves.

Another analyst, Will Clemente, agreed with Wu's opinion and noted that, based on the bitcoin liquidity data from the Glassnode analytical platform, he predicted its growth to about $53,000 back on July 31.

- Israel's National Intelligence Agency Mossad has posted a job list on its website that features a tech expert on cryptocurrencies. The intelligence service did not specify what tasks the specialist would have to meet. However, the Ynet news outlet suggested that Mossad is interested in using the cryptocurrency, including for organizing payments to its agents.

- Bridgewater Associates billionaire founder Ray Dalio does not rule out bitcoin growth, but still prefers gold. Dalio has stated that he holds a "very small volume" of bitcoin. “If you put a gun to my head and let me choose only one of the two, I’ll choose gold,” he said.

At the same time, the billionaire admitted that bitcoin is still an important tool for diversifying portfolios: "There are certain assets that are worth holding to diversify a portfolio, and bitcoin is a kind of digital gold."

- The US Senate sent a bill to the House of Representatives on Tuesday, August 10, according to which miners, wallet developers, liquidity providers in DeFi protocols, etc. can be required to report to the IRS on the activities of their users. However, as it stands, the bill's requirements are not technically feasible, for which the document has been repeatedly criticized by the most prominent representatives of the crypto industry, including Elon Musk.

- Due to a hacker attack, the protocol for communication of various blockchains Poly Network lost $611 million. This is the largest damage in the entire history of the space of decentralized finance and cryptocurrencies as such. The previous anti-record was held by the Japanese exchange Coincheck, which lost over $500 million in NEM tokens in 2018.

The current attack stole $273 million in Ethereum blockchain tokens, $253 million in Binance Smart Chain blockchain tokens and $85 million in USDC stablecoin.

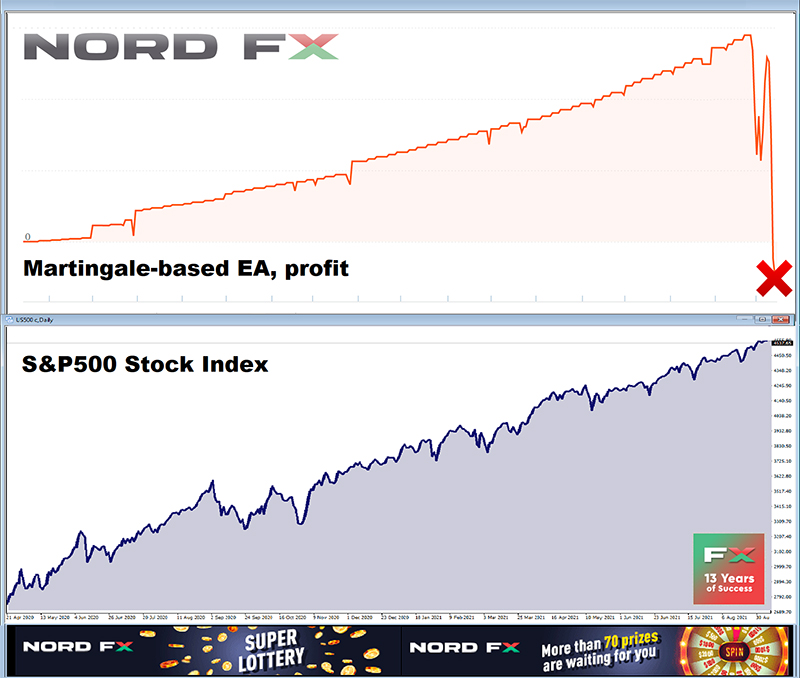

- Tom Lee, head of the analytical company Fundstrat, recalled the "golden rule" for crypto investors on CNBC. He has always encouraged to buy bitcoin every time once the quotes cross the 200-day moving average (MA 200) from the bottom up. Starting in 2017, in three out of five cases, the closing of the daily candle above this line was the beginning of a gradual increase in trading volumes and the development of long-term upward trends that lasted from 4 months to a year.

Two failures, according to Tom Lee, do not in any way cancel his "golden rule", since in these cases the BTC rate managed to rise enough for traders to protect their positions from any loss.

Tom Lee also reiterated his prediction that he sees bitcoin in the region of $100-120k in 2022. The new wave of demand will be driven by rising global inflation and technological changes in cryptocurrency.

Note that Tom Lee is the brother of the creator of Litecoin, but this time he did not discuss the future of this coin.

#eurusd #gbpusd #usdjpy #btcusd #ethusd #ltcusd #xrpusd #forex #forex_example #signals #forex #cryptocurrencies #bitcoin #stock_market

https://nordfx.com/