Forex and Cryptocurrencies Forecast for November 13 - 17, 2023

EUR/USD: How Mr. Powell Aided the Dollar

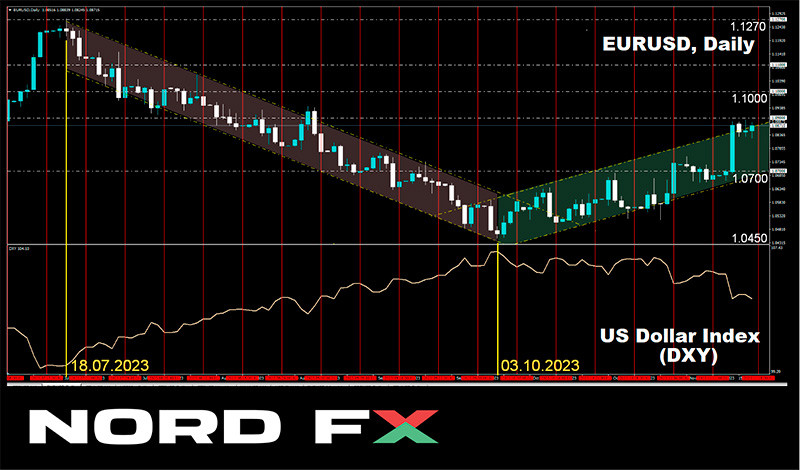

The past week witnessed few significant events, which reflected in EUR/USD pair's fluctuations around 1.0700. Notably, there was a slight increase in the Dollar Index (DXY), starting at 105.05 and reaching a peak of 105.97 by Friday, November 10. This growth was primarily attributed to the "hawkish" comments made by the Chair of the Federal Reserve.

On Thursday, November 09, Jerome Powell, participating in a discussion on monetary policy organized by the International Monetary Fund, affirmed that decisions at each Federal Reserve meeting are made "based on the totality of incoming data and its impact on the outlook for economic activity and inflation." Powell expressed uncertainty about the Fed's success in implementing sufficiently restrictive policies to gradually reduce inflation to 2%. Additionally, he noted the rapid growth of the U.S. GDP, suggesting that further economic acceleration could undermine the progress achieved in stabilizing the labor market.

Powell's comments were validated by the data on initial claims for unemployment benefits for the week ending November 04, totaling 217K, slightly below the previous figure of 220K. While the decrease is modest, it signifies a decline rather than an increase in unemployment.

Market interpretation of Powell's remarks hinted at the regulator's intention to raise the key interest rate once again. Consequently, the yield on 10-year U.S. Treasury bonds increased by almost 3%, surpassing the 4.6% mark, providing support to the dollar.

Downward pressure on EUR/USD was also exerted by macroeconomic statistics from the EU. In Germany, month-on-month inflation (CPI) showed a decrease from 0.3% to 0%. Retail sales volumes in the Eurozone as a whole declined by 0.3% in September after a 0.7% decrease in August. However, on an annual basis, this indicator dropped from -1.8% to -2.9%. Many analysts considered that such a decline in consumer activity ahead of the Christmas and New Year holidays could indicate the onset of a technical recession in the Eurozone before the end of the current year.

According to CME Group FedWatch data, markets are still pricing in a 90% probability that the Federal Reserve will leave the interest rate unchanged in December 2023. Economists at Finland's Nordea Bank believe that the U.S. Central Bank will maintain the federal funds rate at the current level of 5.50% even in 2024.

However, it seems that the interest rate hike cycle for the Euro has likely come to an end. According to strategists at Wells Fargo, one of the largest banks in the U.S., the bleak growth prospects for the Eurozone suggest that the tightening of the ECB's monetary policy is likely over. The recent successes in reducing inflation strengthen their belief that the peak of rate hikes [4.50%] has already been reached.

Both Nordea and Wells Fargo agree that the ECB will likely be compelled to start reducing borrowing costs in the early summer of next year. "We do not anticipate the first ECB rate cut until the June 2024 meeting, although thereafter, it will consistently cut the deposit rate by 150 basis points to 2.50% from mid-2024 to early 2025. Overall, we believe the risk of rate cuts by the ECB will be higher than previously expected or more aggressive."

Factors such as improved global risk appetite and a slowdown in the U.S. economy could support the Euro. However, the divergence in monetary policy between the Federal Reserve and the ECB will continue to exert downward pressure on EUR/USD. This applies to the currencies of other major countries as well – if their central banks keep current interest rates unchanged or, more so, begin to lower them, the dollar may further strengthen its positions.

EUR/USD concluded the past week at the level of 1.0684. Currently, expert opinions regarding its immediate future are divided as follows: 25% voted for the strengthening of the dollar, 60% sided with the euro, and 15% maintained neutrality.

In terms of technical analysis, 85% of oscillators on the D1 chart are colored green, and 15% are neutral-gray. Among trend indicators, the ratio is 70% to 30% in favor of green.

The nearest support for the pair is located around 1.0620-1.0640, followed by 1.0480-1.0520, 1.0450, 1.0375, 1.0200-1.0255, 1.0130, and 1.0000. Bulls will encounter resistance around 1.0740, then 1.0800, 1.0865, 1.0945-1.0975, and 1.1065-1.1090, 1.1150, and 1.1260-1.1275.

Unlike the past, rather calm week, the upcoming one is expected to be more eventful. On Tuesday, November 14, data on Consumer Price Index (CPI) in the USA will be released, along with preliminary data on Eurozone GDP for Q3. The next day will bring statistics regarding retail sales volumes and Producer Price Index (PPI) in the United States. On Thursday, November 16, as usual, data on the number of initial claims for unemployment benefits in the U.S. will be reported. Finally, on Friday, a crucial inflationary indicator, Eurozone Consumer Price Index (CPI), will be disclosed.

GBP/USD: Dangerous Proximity to 1.2200

Recall that on November 3, the British currency received a strong bullish impulse following the release of U.S. labor market data. At that moment, GBP/USD literally surged upwards. On Monday, November 6, the pound rose again, reaching a height of 1.2427. However, it decided that it was time for the bulls to stop celebrating and that it was time for GBP/USD to return to the 1.2200 zone.

The trend reversal to the south was aided by statistics from the United Kingdom. In October, business activity in the country's construction sector increased only slightly, from 45.0 to 45.6. Meanwhile, orders in this sector have been declining for the fourth consecutive month, and they are already 20% lower than a year ago. The average mortgage rate now exceeds 8%, and the number of approved mortgage loans has been declining for the fourth consecutive month. Therefore, expecting a significant increase in business activity here is unlikely.

Although the GDP of the United Kingdom grew slightly in September, from 0.1% to 0.2%, it is likely to show a decline in the third quarter, from 0.2% to 0.0%, and remain at 0.6% on an annual basis. In such conditions, the Bank of England (BoE) is unlikely to raise interest rates in the near future. But it won't lower them either. BoE Chief Economist Hugh Pill recently stated that there is no need to raise rates to contain inflation but it is necessary to ensure the restrictive nature of monetary policy. In other words, the rate will remain the same, at 5.25%. As mentioned earlier, in such a situation, the advantage is likely to remain on the side of the dollar. This was clearly demonstrated by the market's reaction after the speech by Federal Reserve Chair Jerome Powell on November 9. As soon as he made a vague hint about rates, GBP/USD rapidly plummeted.

The past week concluded with the pair settling at the level of 1.2225. According to economists at Scotiabank, the 1.2200 zone may serve as a short-term support point; however, weakness below this level indicates the risk of continued losses and a retest of the 1.2000-1.2100 area. Regarding the median forecast for the near future, 60% of analysts voted for a new upward move of the pair, 20% voted for a downward movement, and 20% took a neutral position. Among the D1 oscillators, 50% indicate a southward direction, 15% indicate northward, and the remaining 35% indicate eastward. Among trend indicators, only 15% point upward, while the overwhelming majority (85%) signal a downward trend. In the event of a southward movement, the pair will encounter support levels and zones at 1.2040-1.2085, 1.1960, and 1.1800-1.1840, 1.1720, 1.1595-1.1625, 1.1450-1.1475. In the case of an upward movement, resistance levels will be at 1.2290-1.2335, 1.2430-1.2450, 1.2545-1.2575, 1.2690-1.2710, 1.2785-1.2820, 1.2940, and 1.3140.

Noteworthy in the upcoming week's economic calendar for the United Kingdom is Tuesday, November 14. On this day, a comprehensive set of data on the country's labor market will be released. Moving on to Wednesday, November 15, when the value of the British Consumer Price Index (CPI) for October will be disclosed. Finally, rounding off the week on Friday, November 17, we anticipate the announcement of retail sales volumes in the United Kingdom.

USD/JPY: Tough Times for the Yen Now, Good Times Ahead

The Bank of Japan (BoJ), in its meeting on October 31, decided to keep its monetary policy parameters unchanged, a stance it has maintained for a very long time. The regulator not only retained the negative interest rate at -0.1% but also kept the yield on 10-year government bonds (JGB) at the existing level. Some market participants were hopeful that, following inflation growth data, the BoJ would raise the yield ceiling from 1% to at least 1.25%. (It's worth noting that the yield on similar U.S. securities exceeded 4.6% on November 9.) However, instead of adjusting to clear signs of increasing inflationary pressure, the Bank of Japan continued to ignore them. This pushed USD/JPY to a peak of 151.71. It would have remained there if not for the U.S. labor market data on November 3, which brought it down to 149.34.

Many analysts believed that officials from the Ministry of Finance and the Bank of Japan (BoJ), with their verbal interventions and incantations, would keep the USD/JPY pair at these levels. If real yen purchases by the authorities were to occur, the pair was expected to continue its decline. However, this did not happen, and on November 10, the pair once again rose to the height of 151.59, concluding the five-day period not far from it at 151.51.

"Hardly surprising is USD/JPY upward trend," commented strategists at Commerzbank. "At current exchange rates, investments in the Japanese yen are simply not particularly attractive for foreign (and domestic) investors. [...] As long as Japan's monetary policy does not undergo a radical change, USD/JPY is likely to test another high soon. The Ministry of Finance will probably react again with the threat of interventions. However, if the Bank of Japan cannot resist making 'dovish' comments, and if the Ministry of Finance indeed intervenes, it will likely only temporarily prevent the rise in currency rates."

According to Dutch Rabobank, the slow pace of Japan's monetary policy normalization suggests that USD/JPY may continue trading above the 150.00 level in the coming weeks. However, the fear of actual interventions from the Japanese Ministry of Finance may impede its upward movement, and the market is likely to be very reluctant to push the pair towards 152.00 and beyond.

Meanwhile, analysts at the Singaporean United Overseas Bank (UOB) believe that the risk of the pair breaking above last week's peak near 151.80 has increased. This level is not far from last year's peak around 151.95, and if the dollar can breach this resistance zone, it is likely to continue its ascent to the 152.50 level in the next 1-3 weeks.

Despite forecasts of growth, experts, echoing officials from the Ministry of Finance and the Bank of Japan, persist in stating that the current weakness of the yen is unjust. "Any increase in rate hike speculation will allow USD/JPY to move lower next year," predicts Rabobank. "We believe," they write, "that in the second half of 2024, the pair could return below the 145.00 level." "Fair value, based on spreads, equity yields, and trading conditions [...] suggests that the dollar is significantly overvalued and should trade closer to 144.50," according to economists at Scotiabank.

However, the question of when this "fairness" will be restored remains open. Soon, according to Societe Generale. In their view, the yen will undoubtedly continue to disappoint for some time, but the downward reversal in USD/JPY is getting closer and closer.

In discussing the near-term prospects of the pair, 55% of analysts anticipate the strengthening of the yen, while 10% have taken a neutral stance. About 35% voted for the pair breaking above 152.00 at the time of the review. Technical analysis supports the latter group, with 100% of trend indicators and oscillators on D1 painted in green.

The closest support level is situated in the 150.00-150.15 zone, followed by 148.45-148.80, 146.85-147.30, 145.90-146.10, 145.30, 144.45, 143.75-144.05, and 142.20. The nearest resistance lies at 151.70-151.90 (October 2022 high), followed by 152.80-153.15 and 156.25.

Aside from the release of preliminary GDP data for Japan's Q3 on Wednesday, November 15, no other significant statistics regarding the state of the Japanese economy are scheduled for the upcoming week.

CRYPTOCURRENCIES: Market Scandals and Records

The past week was marked by two events: the Ethereum scandal and the subsequent rise of bitcoin and the overall crypto market. Let's start with the scandal.

Former Ethereum platform consultant, lawyer Steven Nerayoff, accused Vitalik Buterin and Joseph Lubin of fraudulent activities. He believes that the ETH co-founders were involved in machinations that exceed the scale of crimes committed by FTX CEO Sam Bankman-Fried (whom, by the way, the jury found guilty, facing up to 110 years in prison).

"Buterin's claims of attempting to create a decentralized currency are fake. It was centralized from the beginning, and today, this influence is even more concentrated," Nerayoff writes. "A small circle of ETH investors controls about 75% of all protocol assets. So now it's easy to manipulate the price or even set its upper or lower limit. Most of the trading you see on exchanges is fake or fictitious to create the appearance of liquidity," he continues with his revelations.

Nerayoff also suspects the existence of a secret agreement between the Ethereum network administration and high-ranking US officials, such as SEC Chairman Gary Gensler and former SEC Chairman Jay Clayton, which was concluded during the initial stages of the altcoin's launch. Earlier, the lawyer speculated that the full-scale attack on Ripple by US regulatory bodies could have been sponsored by influential ETH holders. In his opinion, Ripple's adversaries may include individuals connected to the SEC, the Department of Justice, the FBI, and even some Ripple employees.

Interestingly, crypto investigator Truth Labs made similar revelations. However, unlike Steven Nerayoff, they believe that it is not the US but the Chinese conglomerate Wangxian Group that has decisive influence over the Ethereum network, and organizations close to the Communist Party of China (CPC) control almost 80% of mined ETH. Truth Labs also claims that Wangxian was one of the early sponsors of the Ethereum network in 2015. This group is also credited with creating Buterin's original wallets.

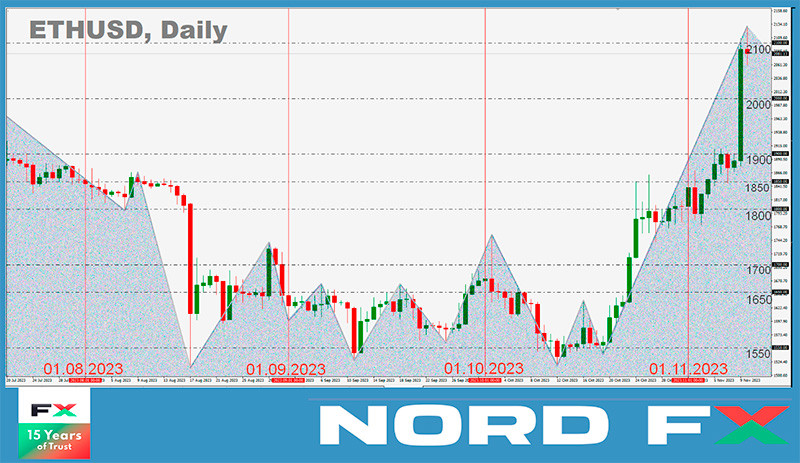

Whether Nerayoff and Truth Labs can substantiate their accusations is a big question. For now, the price of ETH is rising and reached a maximum of $2,130. As for the leading cryptocurrency, on Thursday, November 9, BTC/USD broke through the $37,000 resistance and set a local high at $37,948: it last traded there in May 2022.

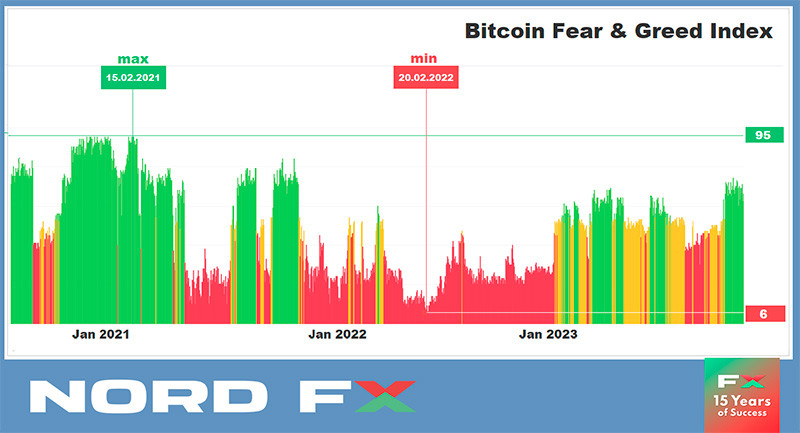

The development of the bullish trend in BTC has led to the updating of annual and historical indicators. The net capital inflow into the crypto market over the last 30 days reached $11 billion, a record for 2023. Institutions added $767 million to crypto funds over the last six weeks, surpassing last year's record of $736 million and reaching the level at the end of 2021. Open interest in bitcoin futures on the Chicago CME Exchange is also at the December 2021 level ($3.7 billion). Long-term holders continue to accumulate bitcoins, bringing their holdings to 14.9 million BTC (more than 70% of the total BTC issuance). The volume of their purchases exceeded 25,000 coins per month. Short-term investors and speculators have also become more active, influenced by the FOMO (Fear of Missing Out) effect.

The list of records could go on, but what concerns everyone more is what comes next. If the current dynamics continue, demand for digital gold will keep growing, and supply will continue to decline. In that case, new local or even historical records and highs may be on the horizon.

We've repeatedly listed the factors contributing to the current BullRally. The key ones include the anticipated approval of SEC Bitcoin spot ETFs, the halving in April 2024, and the potential reversal of the Federal Reserve's monetary policy. Markus Thielen, Head of Research at Matrixport, reminded that after the end of the Fed's tightening cycle in January 2019, digital gold increased fivefold. However, Thielen cautioned against expecting a repeat of such dynamics but agreed that the leading cryptocurrency could "move significantly" in 2023 and 2024. According to his calculations, bitcoin tends to grow on average by 23% during the pre-Christmas period of November-December this year.

In addition to the growth drivers mentioned earlier, MicroStrategy founder Michael Saylor identified several factors that, in the medium term, could lead to a tenfold increase in the price of Bitcoin. According to Saylor, a positive development will be the soon-to-come new rules for accounting for Bitcoin reserves by companies in the United States. "In perspective, this will open the door for corporations to adopt Bitcoin as a treasury asset and create shareholder value," Saylor believes.

The entrepreneur also pointed to the positive effect of regulatory and law enforcement actions by authorities, including the trial of the former CEO of the collapsed FTX exchange. According to Saylor, "all these early crypto cowboys, tokens being unregistered securities, unreliable custodians" were passively benefiting bitcoin. To take the crypto industry to a new level, it needs "parental supervision." MicroStrategy's founder also thinks there is a need to "move away from the 100,000 tokens" that are merely used for speculation, back to bitcoin. "When the industry shifts its focus away from small shiny coins that distract attention and destroy shareholder value, I believe it will move to the next level, and we will get a 10x increase from the current level," Saylor concluded.

Note that this is not the most impressive forecast. CEO of ARK Investment, Catherine Wood, believes that in the next decade, the price of digital gold will exceed $1 million. (Note: Charlie Munger, Warren Buffett's longtime partner, recently criticized Bitcoin again, calling it a "tainted product" and adding to his previous descriptions like "the most foolish investment," "rat poison," and a "venereal disease.")

If we talk about the forecast for the near future, according to Rachel Lin, CEO of the SynFutures exchange, by the end of November, the first cryptocurrency could reach $47,000. "The past weeks have strengthened October's reputation as Uptober, with bitcoin gaining almost 29%. Even more interesting is that historically November outperforms October with an average bitcoin return of over 35%. If this November brings a similar profit, the asset will reach around $47,000," she calculated.

As an additional positive factor, Lin noted the growth in the number of users and transactions. In her opinion, the surge in spot trading volume with a noticeable increase in the number of payments over $100,000 is particularly noteworthy. "This is a clear indicator of increased institutional interest. Large players are consolidating positions in digital assets, especially in BTC," the specialist believes.

Despite the prevailing optimism, the analyst under the alias Doctor Profit believes that investors should be prepared for corrections and the emergence of "black swans," similar to those before the 2020 halving amid the COVID-19 outbreak. The expert does not exclude the possibility that bitcoin may drop to $26,000 before the upcoming April 2024 halving.

As of the writing of this review on Friday, November 10, BTC/USD is trading at $37,320. The total market capitalization of the crypto market is $1.42 trillion, compared to $1.29 trillion a week ago. The Crypto Fear & Greed Index has increased from 65 to 70 points and continues to remain in the Greed zone.

In conclusion of the review, let's delve into our irregular segment of crypto life hacks. So, what do you do if you've lost the password to your crypto wallet? The answer comes from Rain Lõhmus, co-founder of Estonian LHV Bank. During the ICO in July 2015, he acquired 250,000 ETH for $75,000. On November 10, 2021, when the price of Ethereum reached an all-time high of around $4,800, Lõhmus's holdings grew to $1.22 billion. Even now, they are valued at over $500 million. Throughout this time, the coins remained dormant. At some point, the businessman discovered that he had lost the wallet password and now intends to recover it using artificial intelligence. "My plan," he stated, "is to create an AI version of Rain Lõhmus and see if it can retrieve its memories." The banker shared his plans. (By the way, the artificial intelligence ChatGPT predicted that the value of Ethereum by the beginning of 2024 would range from $3,000 to $10,000. If this happens, Lõhmus could become a billionaire again—assuming he finds the wallet password.)

NordFX Analytical Group

Notice: These materials are not investment recommendations or guidelines for working in financial markets and are intended for informational purposes only. Trading in financial markets is risky and can result in a complete loss of deposited funds.

#eurusd #gbpusd #usdjpy #btcusd #ethusd #ltcusd #xrpusd #forex #forex_example #signals #cryptocurrencies #bitcoin #stock_market

https://nordfx.com/