Antony_NPBFX

NPBFX Representative (unconfirmed)

- Messages

- 1,094

Intel Corp.: technical analysis 02.02.2024

Good afternoon, dear forum visitors!

NPBFX offers the latest release of analytics on Intel Corp. for a better understanding of the current market situation and more efficient trading.

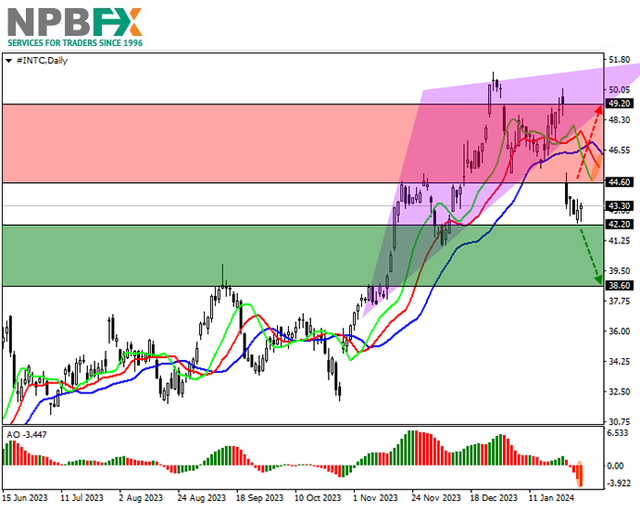

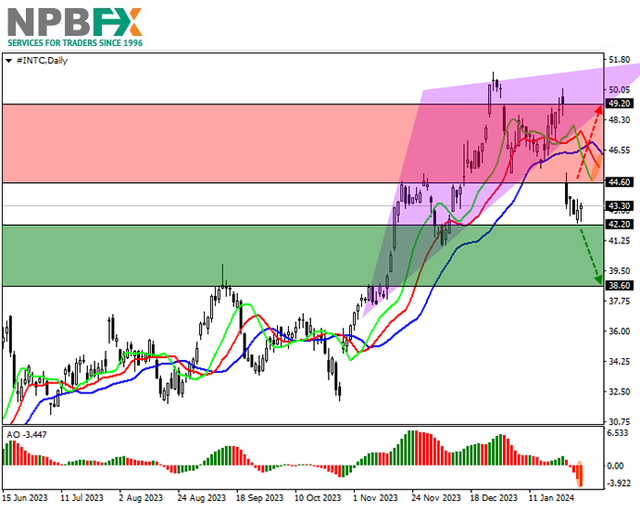

Shares of Intel Corp., a global giant in the development and sale of electronic devices and computer components, are trading in a corrective trend at 43.00.

On the daily chart, the price is responding to a reversal signal from the Head and shoulders pattern with the Neckline at 45.00.

On the four-hour chart, the likelihood of a decline is supported by the recent price gap of 49.20–44.60, and consolidation below the local low of 42.00 will allow the quotes to reach the area of 38.00. On the other hand, the asset may begin to work out the gap, rising to 49.00.

Technical indicators keep a sell signal: the EMA fluctuation range on the Alligator indicator is actively expanding downwards, and the AO histogram is forming corrective bars in the sale zone.

Trading tips

Short positions may be opened after the price declines and consolidates below 42.20 with the target at 38.60 and stop loss 44.00. Implementation period: 7 days or more.

Long positions may be opened after the price rises and consolidates above 44.60 with the target at 49.20. Stop loss – 42.00.

Use more opportunities of the NPBFX analytical portal: weekly FOREX forecast

You can learn more about the current situation and get acquainted with the weekly analytical forecast in the "Video reviews" section on the NPBFX portal. Weekly video reviews contain trends, key levels, trading recommendations for such popular instruments as GBP/USD, EUR/USD, USD/CHF, AUD/USD. In order to get free and unlimited access to video forecast and other useful instruments on the portal, you need to register on the NPBFX website.

If you have any questions about trading instruments, you can always ask an analyst in the online chat on the portal and get a free consultation of an experienced specialist.

Use the current recommendations of analysts on Intel Corp. and trade efficiently with NPBFX.

Good afternoon, dear forum visitors!

NPBFX offers the latest release of analytics on Intel Corp. for a better understanding of the current market situation and more efficient trading.

Shares of Intel Corp., a global giant in the development and sale of electronic devices and computer components, are trading in a corrective trend at 43.00.

On the daily chart, the price is responding to a reversal signal from the Head and shoulders pattern with the Neckline at 45.00.

On the four-hour chart, the likelihood of a decline is supported by the recent price gap of 49.20–44.60, and consolidation below the local low of 42.00 will allow the quotes to reach the area of 38.00. On the other hand, the asset may begin to work out the gap, rising to 49.00.

Technical indicators keep a sell signal: the EMA fluctuation range on the Alligator indicator is actively expanding downwards, and the AO histogram is forming corrective bars in the sale zone.

Trading tips

Short positions may be opened after the price declines and consolidates below 42.20 with the target at 38.60 and stop loss 44.00. Implementation period: 7 days or more.

Long positions may be opened after the price rises and consolidates above 44.60 with the target at 49.20. Stop loss – 42.00.

Use more opportunities of the NPBFX analytical portal: weekly FOREX forecast

You can learn more about the current situation and get acquainted with the weekly analytical forecast in the "Video reviews" section on the NPBFX portal. Weekly video reviews contain trends, key levels, trading recommendations for such popular instruments as GBP/USD, EUR/USD, USD/CHF, AUD/USD. In order to get free and unlimited access to video forecast and other useful instruments on the portal, you need to register on the NPBFX website.

If you have any questions about trading instruments, you can always ask an analyst in the online chat on the portal and get a free consultation of an experienced specialist.

Use the current recommendations of analysts on Intel Corp. and trade efficiently with NPBFX.