Antony_NPBFX

NPBFX Representative (unconfirmed)

- Messages

- 1,094

Hewlett-Packard Co.: technical analysis 26.02.2024

Good afternoon, dear forum visitors!

NPBFX offers the latest release of analytics on Hewlett-Packard Co. for a better understanding of the current market situation and more efficient trading.

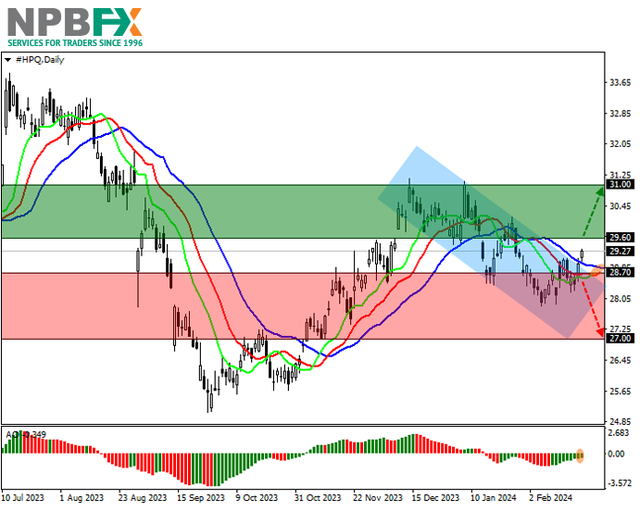

Shares of Hewlett-Packard Co., the American information technology giant, are trading at 29.20.

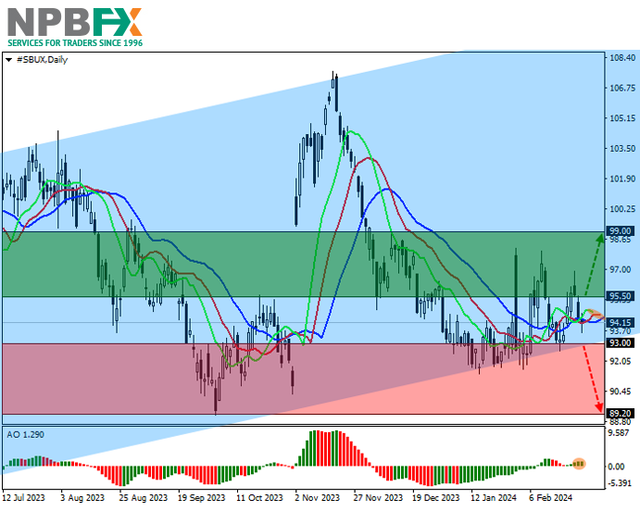

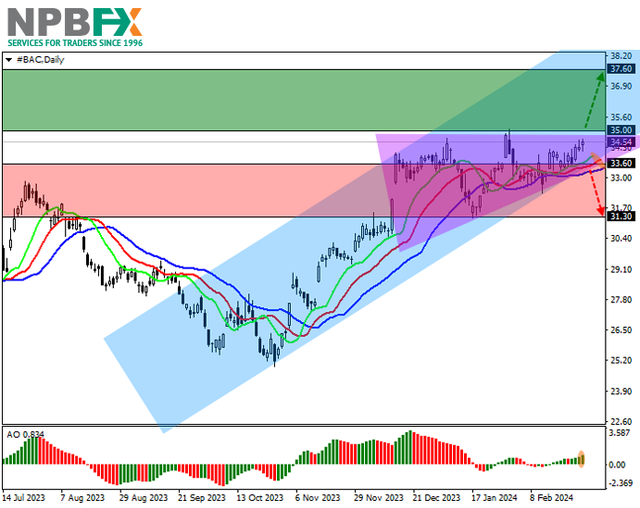

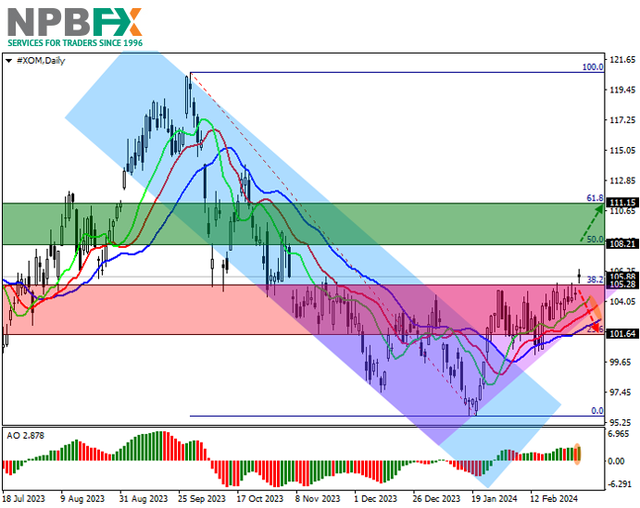

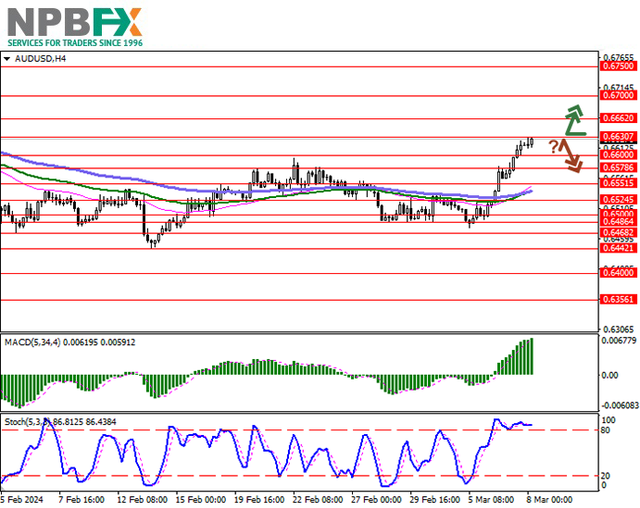

On the daily chart, the price is correcting, trying to consolidate above the resistance line of the local downward channel of 29.00–28.00.

On the four-hour chart, the downward range can work as a Flag continuation trend pattern. For its implementation, the quotes should consolidate above 29.00. If successful, the next resistance level will be the high of 30.00 and then the global target of 31.00.

Technical indicators are weakening the sell signal: fast EMAs on the Alligator indicator are approaching the signal line, and the AO histogram is forming corrective bars, approaching the transition level.

Trading tips

Long positions may be opened after the price rises and consolidates above 29.60 with the target at 31.00. Stop loss – 29.00. Implementation period: 7 days or more.

Short positions may be opened after the price declines and consolidates below 28.70 with the target at 27.00. Stop loss – 29.20.

Use more opportunities of the NPBFX analytical portal: analytics

You can find more actual analytical reviews on other popular currency pairs, metals and CFDs on the NPBFX online portal. Daily analytics with charts, current market prognoses and trading scenarios in the Feed section are available. Get free and unlimited access to the online portal after registering on the official website of NPBFX Company.

If you have any questions about trading instruments, you can always ask an analyst in the online chat on the portal and get a free consultation of an experienced specialist.

Use the current recommendations of analysts on Hewlett-Packard Co. and trade efficiently with NPBFX.

Good afternoon, dear forum visitors!

NPBFX offers the latest release of analytics on Hewlett-Packard Co. for a better understanding of the current market situation and more efficient trading.

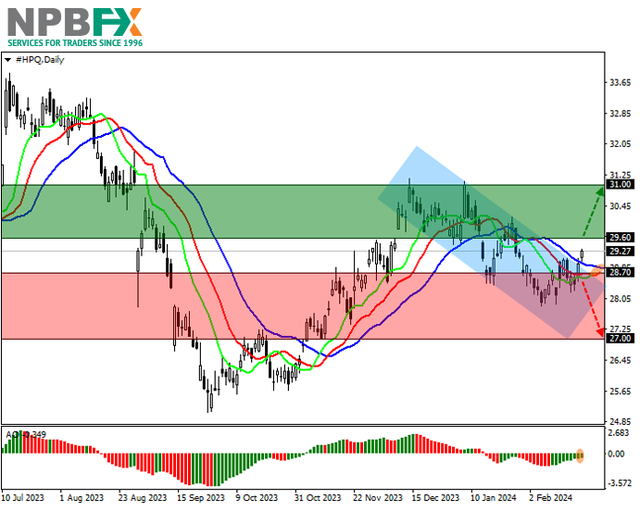

Shares of Hewlett-Packard Co., the American information technology giant, are trading at 29.20.

On the daily chart, the price is correcting, trying to consolidate above the resistance line of the local downward channel of 29.00–28.00.

On the four-hour chart, the downward range can work as a Flag continuation trend pattern. For its implementation, the quotes should consolidate above 29.00. If successful, the next resistance level will be the high of 30.00 and then the global target of 31.00.

Technical indicators are weakening the sell signal: fast EMAs on the Alligator indicator are approaching the signal line, and the AO histogram is forming corrective bars, approaching the transition level.

Trading tips

Long positions may be opened after the price rises and consolidates above 29.60 with the target at 31.00. Stop loss – 29.00. Implementation period: 7 days or more.

Short positions may be opened after the price declines and consolidates below 28.70 with the target at 27.00. Stop loss – 29.20.

Use more opportunities of the NPBFX analytical portal: analytics

You can find more actual analytical reviews on other popular currency pairs, metals and CFDs on the NPBFX online portal. Daily analytics with charts, current market prognoses and trading scenarios in the Feed section are available. Get free and unlimited access to the online portal after registering on the official website of NPBFX Company.

If you have any questions about trading instruments, you can always ask an analyst in the online chat on the portal and get a free consultation of an experienced specialist.

Use the current recommendations of analysts on Hewlett-Packard Co. and trade efficiently with NPBFX.