Antony_NPBFX

NPBFX Representative (unconfirmed)

- Messages

- 1,094

USD/CHF: USD wins back its losses 10.03.2021

Good afternoon, dear forum visitors!

NPBFX offers the latest release of analytics on USD/CHF for a better understanding of the current market situation and more efficient trading.

Current trend

USD is recovering against CHF during today's Asian session, recouping losses on Tuesday, when USD showed a decline across almost the entire spectrum of the market, responding to the correction in US bond yields. Macroeconomic statistics from Europe published yesterday did not have a noticeable impact on the instrument's dynamics. Eurozone GDP in Q4 2020 decreased by 0.7% QoQ after declining by 0.6% QoQ according to previous results. In annual terms, the rate of decline in the region's economy was revised from –5% YoY to –4.9% YoY.

Today, investors are focused on statistics from the US on the dynamics of consumer prices in February. Analysts do not expect a significant increase in inflation, but the indicators are extremely important, since they are used by the US Fed to determine the vector of monetary policy.

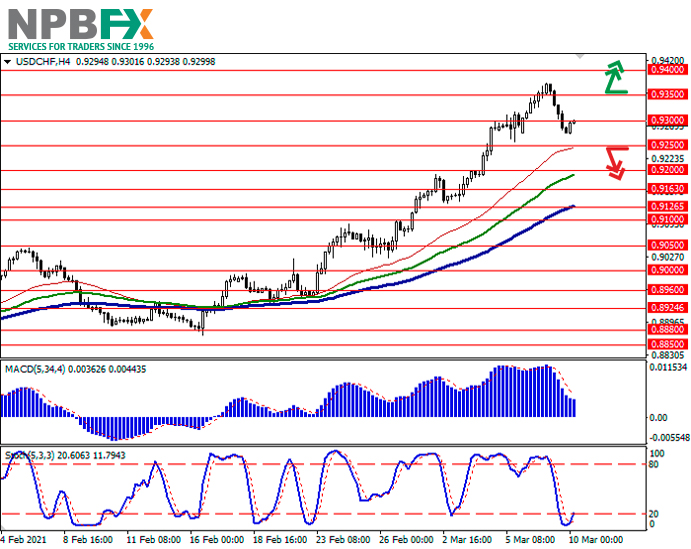

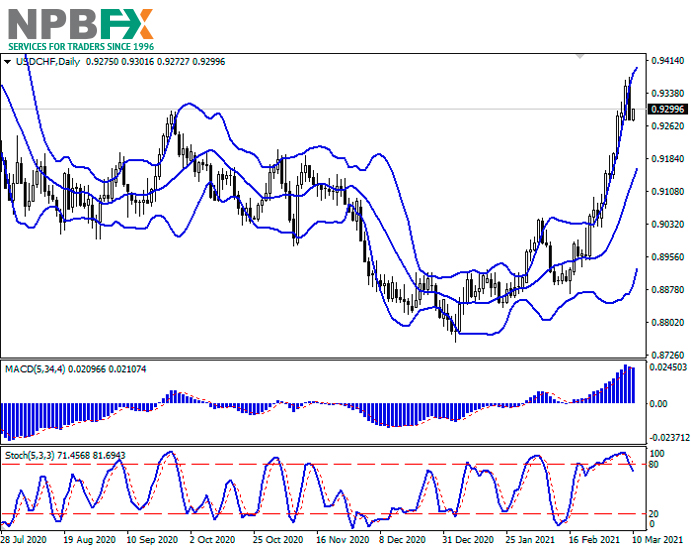

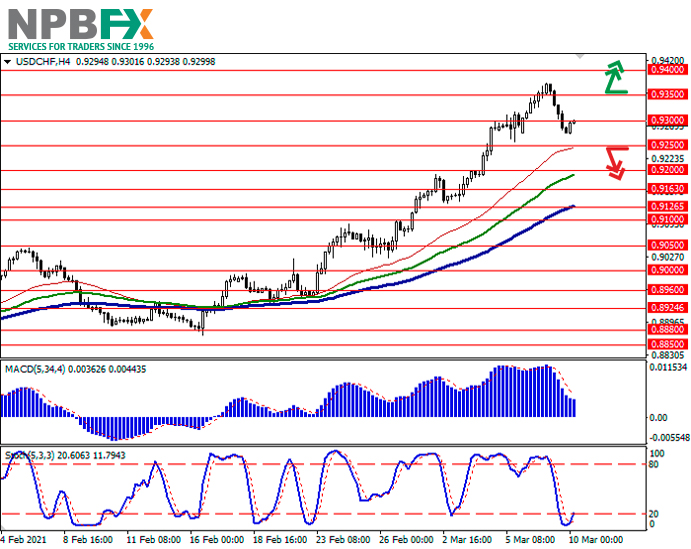

Support and resistance

Bollinger Bands in D1 chart show stable growth. The price range is slightly narrowed from below, being spacious enough for the current activity level in the market. MACD is reversing downwards forming a new sell signal (trying to consolidate below the signal line). Stochastic is showing similar dynamics, retreating from its highs, indicating the overbought USD in the ultra-short term.

Current showings of the indicators do not contradict the further development of the correctional decline in the short term.

Resistance levels: 0.9300, 0.9350, 0.9400, 0.9450.

Support levels: 0.9250, 0.9200, 0.9163, 0.9126.

Trading tips

To open new short positions, one can rely on the breakdown of 0.9250. Take-profit – 0.9163. Stop-loss – 0.9300. Implementation time: 1-2 days.

The return of the "bullish" trend to the market with the breakout of 0.9350 may become a signal for new purchases with the target of 0.9450. Stop-loss – 0.9300.

Use more opportunities of the NPBFX analytical portal: E-book

If you just recently started to be interested in trading on FOREX and would like to deepen your knowledge, an electronic Beginner's Guide to FOREX Trading will be an excellent helper for you here. The book consists of 5 chapters and reflects fundamental concepts of the foreign exchange market to start successful trading. From the main chapters of the E-book you can learn about the concepts and history of FOREX, currencies and trend lines, technical indicators, types of orders, trading on news, psychology of trading, risk management and much more.

You can read a Beginner's guide to FOREX Trading online or download it free of charge from the NPBFX analytical portal in the "Education" section. In order to get unlimited access to the E-book and other useful instruments on the portal, you need to register on the NPBFX website.

If you have any questions about trading instruments, you can always ask an analyst in the online chat on the portal and get a free consultation of an experienced specialist.

Use the current recommendations of analysts on USD/CHF and trade efficiently with NPBFX.

Good afternoon, dear forum visitors!

NPBFX offers the latest release of analytics on USD/CHF for a better understanding of the current market situation and more efficient trading.

Current trend

USD is recovering against CHF during today's Asian session, recouping losses on Tuesday, when USD showed a decline across almost the entire spectrum of the market, responding to the correction in US bond yields. Macroeconomic statistics from Europe published yesterday did not have a noticeable impact on the instrument's dynamics. Eurozone GDP in Q4 2020 decreased by 0.7% QoQ after declining by 0.6% QoQ according to previous results. In annual terms, the rate of decline in the region's economy was revised from –5% YoY to –4.9% YoY.

Today, investors are focused on statistics from the US on the dynamics of consumer prices in February. Analysts do not expect a significant increase in inflation, but the indicators are extremely important, since they are used by the US Fed to determine the vector of monetary policy.

Support and resistance

Bollinger Bands in D1 chart show stable growth. The price range is slightly narrowed from below, being spacious enough for the current activity level in the market. MACD is reversing downwards forming a new sell signal (trying to consolidate below the signal line). Stochastic is showing similar dynamics, retreating from its highs, indicating the overbought USD in the ultra-short term.

Current showings of the indicators do not contradict the further development of the correctional decline in the short term.

Resistance levels: 0.9300, 0.9350, 0.9400, 0.9450.

Support levels: 0.9250, 0.9200, 0.9163, 0.9126.

Trading tips

To open new short positions, one can rely on the breakdown of 0.9250. Take-profit – 0.9163. Stop-loss – 0.9300. Implementation time: 1-2 days.

The return of the "bullish" trend to the market with the breakout of 0.9350 may become a signal for new purchases with the target of 0.9450. Stop-loss – 0.9300.

Use more opportunities of the NPBFX analytical portal: E-book

If you just recently started to be interested in trading on FOREX and would like to deepen your knowledge, an electronic Beginner's Guide to FOREX Trading will be an excellent helper for you here. The book consists of 5 chapters and reflects fundamental concepts of the foreign exchange market to start successful trading. From the main chapters of the E-book you can learn about the concepts and history of FOREX, currencies and trend lines, technical indicators, types of orders, trading on news, psychology of trading, risk management and much more.

You can read a Beginner's guide to FOREX Trading online or download it free of charge from the NPBFX analytical portal in the "Education" section. In order to get unlimited access to the E-book and other useful instruments on the portal, you need to register on the NPBFX website.

If you have any questions about trading instruments, you can always ask an analyst in the online chat on the portal and get a free consultation of an experienced specialist.

Use the current recommendations of analysts on USD/CHF and trade efficiently with NPBFX.