Antony_NPBFX

NPBFX Representative (unconfirmed)

- Messages

- 1,098

USD/CAD: the Canadian currency is being held in an uptrend 01.11.2021

Good afternoon, dear forum visitors!

NPBFX offers the latest release of analytics on USD/CAD for a better understanding of the current market situation and more efficient trading.

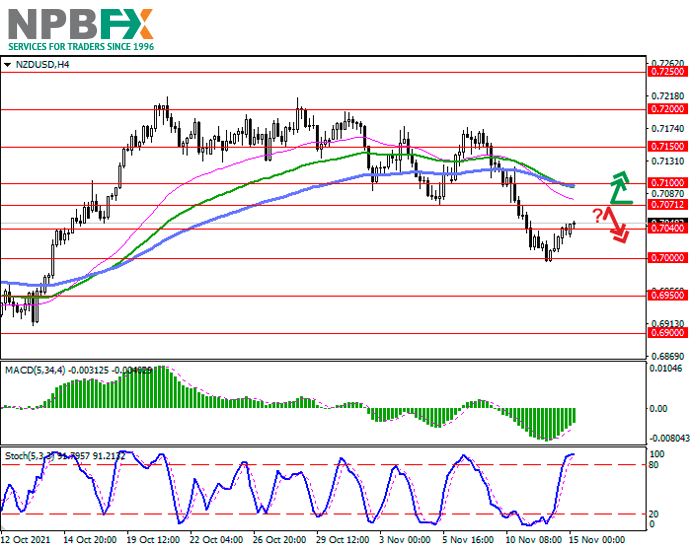

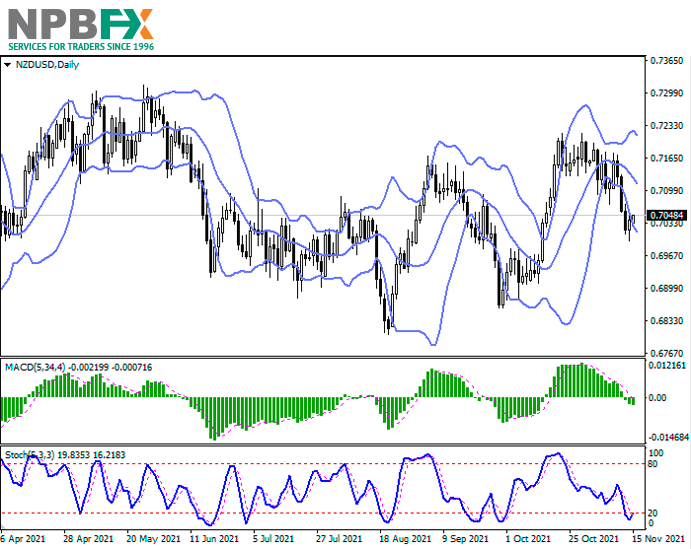

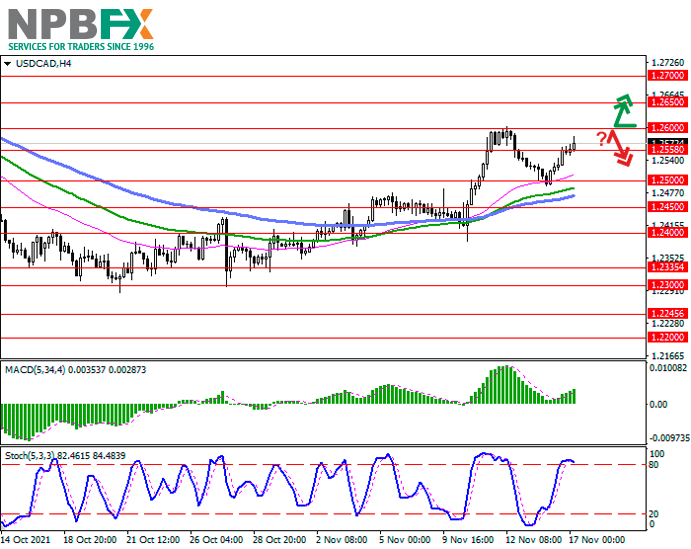

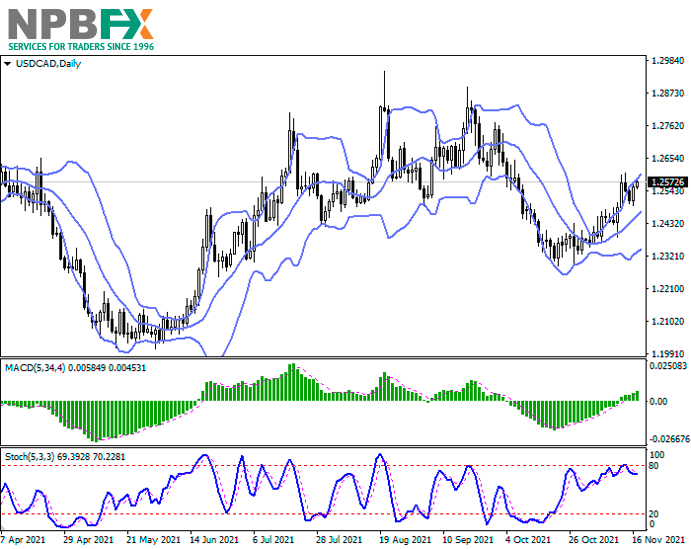

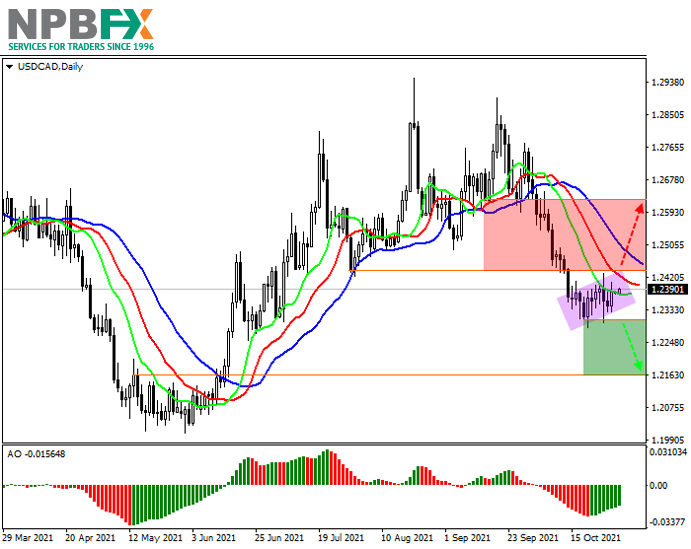

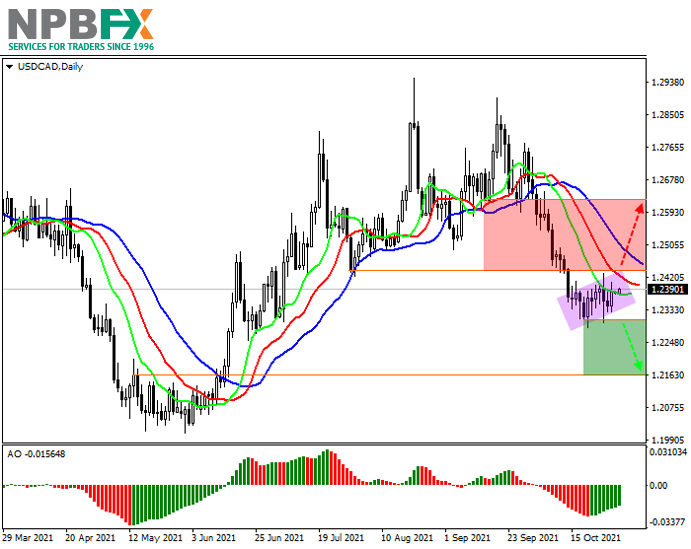

Current trend

USD/CAD is showing neutral dynamics against the background of the growth of USD quotes, being at 1.2387. CAD is holding onto an uptrend following the release of Canadian GDP, which rose 0.4% in August after falling 0.1% in July. In addition, investors reacted positively to the increase in September Raw Material Price Index by 2.5% after –2.4% shown a month earlier. The Industrial Product Price Index climbed 1.0% in September after recording a 0.3% decline in August.

In turn, USD again exceeded the psychological level of 94 points in the USD Index and is now trading at 94.230. Investors reacted positively to the publication of statistics by the University of Michigan. Consumer Expectations Index in October amounted to 67.9 points, which is higher than the predicted 67.2 points. The Consumer Sentiment Index was 71.7 points, which exceeded the September value at around 71.4 points.

Support and resistance

On the global chart, the price is correcting, completing the formation of the Flag, the local pattern of the trend continuation. The fluctuation range of the EMAs on the Alligator indicator begins to gradually narrow, and the histogram of the AO oscillator is trading in the sell zone, forming local upward bars.

Resistance levels: 1.2436, 1.2622.

Support levels: 1.2305, 1.2163.

Trading tips

If the asset continues declining and the price consolidates below 1.2305, short positions can be opened with the target at 1.2163. Stop-loss – 1.2400. Implementation time: 7 days and more.

If the asset reverses and continues growing globally and the price consolidates above 1.2436, long positions will be relevant with the target at 1.2622. Stop-loss – 1.2360.

Use more opportunities of the NPBFX analytical portal: economic calendar

Be ready for any market changes through global events using the economic calendar on the NPBFX portal. The calendar contains all the most important events of the world economy and prognoses for them. In order to get free and unlimited access to the economic calendar and other useful instruments on the portal, you need to pass a one-time registration on the NPBFX website.

If you have any questions about trading instruments, you can always ask an analyst in the online chat on the portal and get a free consultation of an experienced specialist.

Use the current recommendations of analysts on USD/CAD and trade efficiently with NPBFX.

Good afternoon, dear forum visitors!

NPBFX offers the latest release of analytics on USD/CAD for a better understanding of the current market situation and more efficient trading.

Current trend

USD/CAD is showing neutral dynamics against the background of the growth of USD quotes, being at 1.2387. CAD is holding onto an uptrend following the release of Canadian GDP, which rose 0.4% in August after falling 0.1% in July. In addition, investors reacted positively to the increase in September Raw Material Price Index by 2.5% after –2.4% shown a month earlier. The Industrial Product Price Index climbed 1.0% in September after recording a 0.3% decline in August.

In turn, USD again exceeded the psychological level of 94 points in the USD Index and is now trading at 94.230. Investors reacted positively to the publication of statistics by the University of Michigan. Consumer Expectations Index in October amounted to 67.9 points, which is higher than the predicted 67.2 points. The Consumer Sentiment Index was 71.7 points, which exceeded the September value at around 71.4 points.

Support and resistance

On the global chart, the price is correcting, completing the formation of the Flag, the local pattern of the trend continuation. The fluctuation range of the EMAs on the Alligator indicator begins to gradually narrow, and the histogram of the AO oscillator is trading in the sell zone, forming local upward bars.

Resistance levels: 1.2436, 1.2622.

Support levels: 1.2305, 1.2163.

Trading tips

If the asset continues declining and the price consolidates below 1.2305, short positions can be opened with the target at 1.2163. Stop-loss – 1.2400. Implementation time: 7 days and more.

If the asset reverses and continues growing globally and the price consolidates above 1.2436, long positions will be relevant with the target at 1.2622. Stop-loss – 1.2360.

Use more opportunities of the NPBFX analytical portal: economic calendar

Be ready for any market changes through global events using the economic calendar on the NPBFX portal. The calendar contains all the most important events of the world economy and prognoses for them. In order to get free and unlimited access to the economic calendar and other useful instruments on the portal, you need to pass a one-time registration on the NPBFX website.

If you have any questions about trading instruments, you can always ask an analyst in the online chat on the portal and get a free consultation of an experienced specialist.

Use the current recommendations of analysts on USD/CAD and trade efficiently with NPBFX.