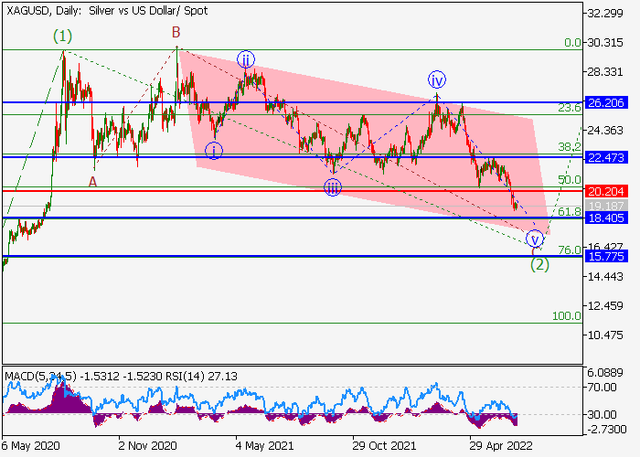

Silver - the instrument is developing correctional dynamics

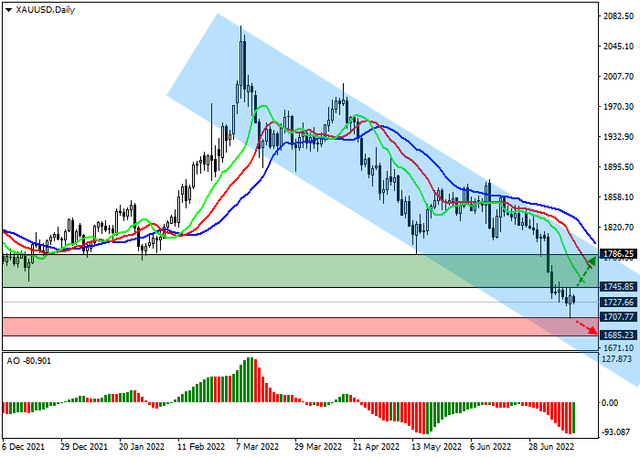

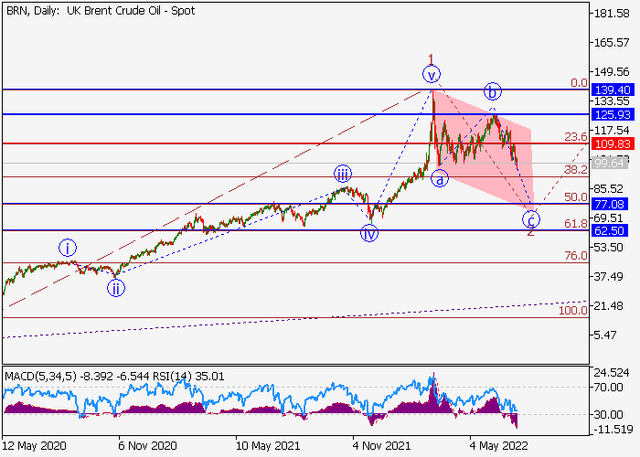

Trading activity remains subdued this morning as analysts await the publication of key macroeconomic statistics on US consumer inflation for June, the current forecasts for which suggest acceleration from 8.6% to 8.8%, which will be a new record since December 1981. Faster growth is also not ruled out, which could put significant pressure on the US Federal Reserve when choosing the next measures to tighten monetary policy. The regulator's meeting will be held next week, and at the moment a rate hike of 50 or 75 basis points is expected. About 10% of analysts suggest an increase of 100 basis points at once, but this is possible only in the event of a sharp acceleration of inflation in the country.

Additional pressure on the positions of silver is exerted by the situation with the incidence of coronavirus in China, where outbreaks of infections are still observed, which, coupled with the policy of "zero tolerance", leads to new quarantine restrictions, which, in turn, are causing the fall in demand for industrial goods, as well as raw materials, including oil, copper and silver.

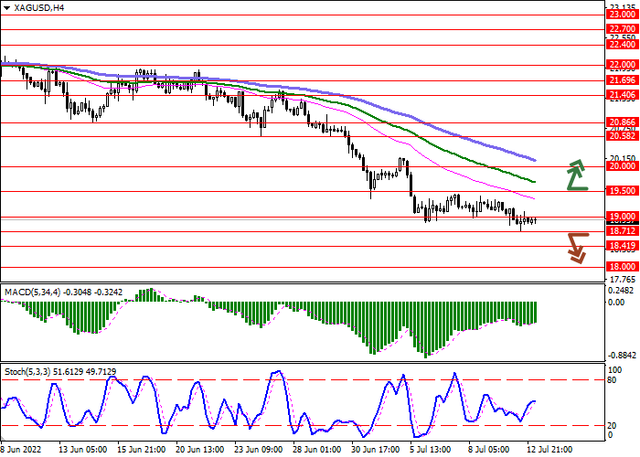

Bollinger Bands in D1 chart demonstrate a stable decrease. The price range is almost unchanged, but it remains rather spacious for the current level of activity in the market. MACD indicator tries to reverse to growth and to form a new buy signal (the histogram should consolidate above the signal line). Stochastic is showing a similar trend, trying to retreat from its lows, signaling that silver is oversold in the ultra-short term.

Resistance levels: 19, 19.5, 20, 20.58 |

Support levels: 18.71, 18.41, 18, 17.5