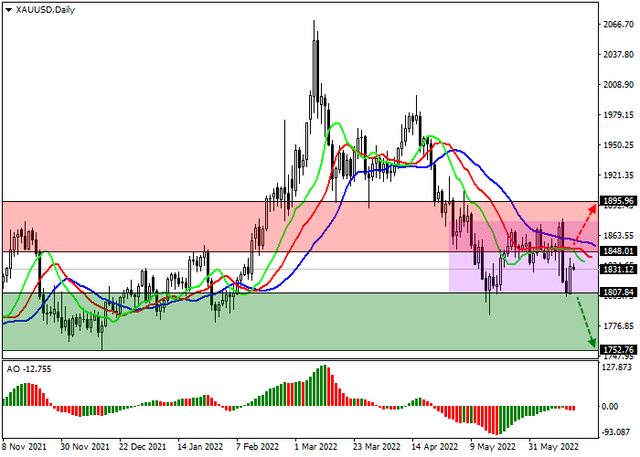

Gold prices show a corrective decline, retreating from their local highs from May 9, updated at the beginning of the week. Investors are taking profits on long positions opened last Friday, when the demand for XAU/USD increased again after the publication of multidirectional macroeconomic statistics on inflation in the US. The released data showed an acceleration of the indicator in May to 8.1%, which was a new record high since December 1981. On a monthly basis, the country's Consumer Price Index accelerated from 0.3% in April to 0.7%, and the Core CPI excluding Food and Energy, slowed down to 6.0% from 6.2%, which is quite obvious, because the reason for the current negative dynamics in the United States is the rise in energy prices.

In turn, the revision of inflation data is likely to lead to a more aggressive policy of the US Federal Reserve, aimed at tightening monetary conditions. In particular, the regulator may decide to either raise interest rates more quickly, for example, by 75 basis points at once, or continue the planned correction of the value after two meetings in June and July. Earlier it was assumed that officials would take a break after two rate hikes in the summer, to assess the impact of the measures taken on the economy and consumer price growth.

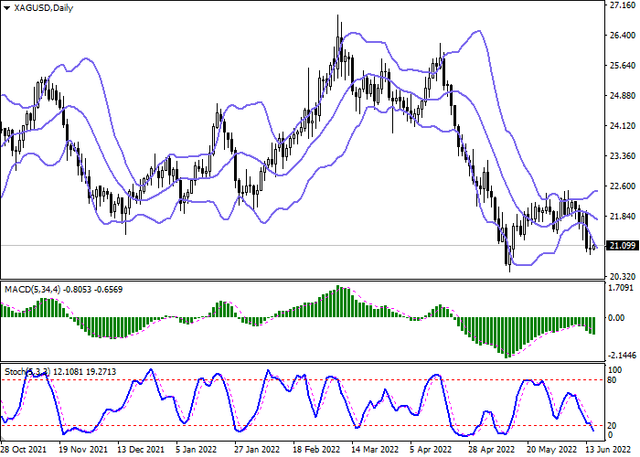

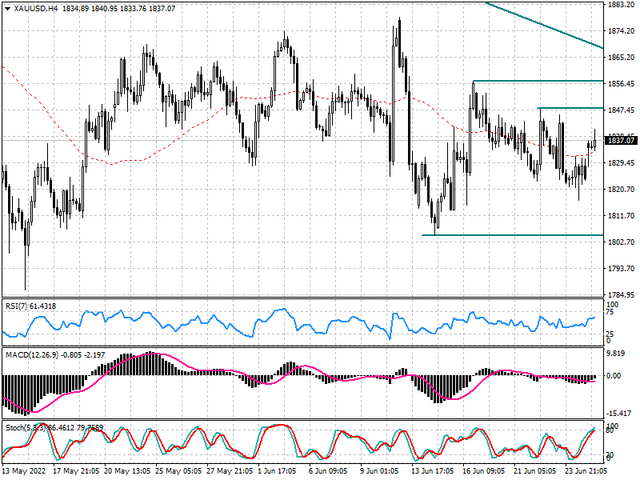

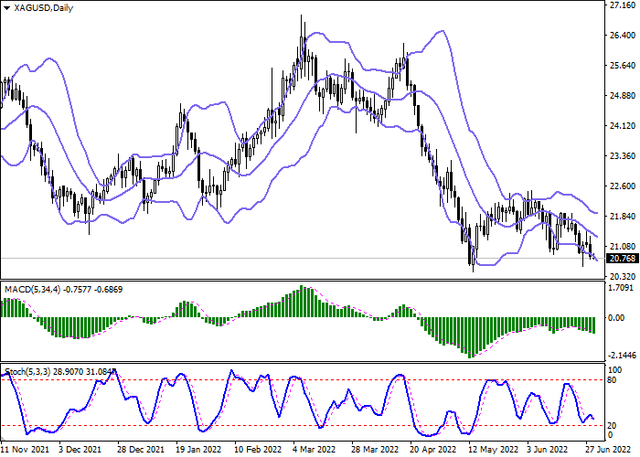

Bollinger Bands in D1 chart demonstrate flat dynamics. The price range is expanding; however, it fails to catch the surge of last week's "bearish" sentiments. MACD is growing preserving a weak buy signal (located above the signal line). Stochastic is showing similar dynamics; however, the indicator line is already approaching its highs, indicating the risks of overbought instrument in the ultra-short term.

Resistance levels: 1869.49, 1878.84, 1900, 1920 | Support levels: 1850.20, 1823.09, 1800, 1775