-

Please try to select the correct prefix when making a new thread in this folder.

Discuss is for general discussions of a financial company or issues related to companies.

Info is for things like "Has anyone heard of Company X?" or "Is Company X legit or not?"

Compare is for things like "Which of these 2 (or more) companies is best?"

Searching is for things like "Help me pick a broker" or "What's the best VPS out there for trading?"

Problem is for reporting an issue with a company. Please don't just scream "CompanyX is a scam!" It is much more useful to say "I can't withdraw my money from Company X" or "Company Y is not honoring their refund guarantee" in the subject line.

Keep Problem discussions civil and lay out the facts of your case. Your goal should be to get your problem resolved or reported to the regulators, not to see how many insults you can put into the thread.More info coming soon.

You should upgrade or use an alternative browser.

Discuss RoboForex.com

- Thread starter Administrator

- Start date

-

- Tags

- roboforex

Manager RF

RoboForex.com Representative

- Messages

- 32

RoboForex Ltd has a special brokerage license IFSC Belize "Trading in financial and commodity-based derivative instruments and other securities" under the number 000138/210.

For more info https://roboforex.com/about/company/regulation/

Vlad RF

RoboForex Representative

- Messages

- 487

Author: Andrey Goilov

Dear Clients and Partners,

The history of market development and the world’s economy shows that when it comes to an economic crisis, it never comes alone: one crisis will definitely be followed by another one, quite different from its predecessor.

Analysts and politicians agree that this is a serious problem threatening all the countries of the world. Financial crises are so harmful because people rely on the work of financial institutions every day. Banks give loans and credit cards so that their clients could afford more and buy things with maximal comfort, while insurance companies protect homes and cars from accidents and stealth – but in crises, all these processes get paralyzed and fall apart like a house of cards, pulling along stock markets.

In this article, I will speculate on the bright economic crises of the past and try to formulate the signs of an economic crisis that might happen in the future.

Why do economic crises happen?

In the market, you constantly see the dollar fall, or oil prices fall, and all this due to economic trouble in certain countries. There are plenty of reasons for another collapse to happen, and some of them seem absolutely absurd.

One frequently raised example is the “tulip-mania” that happened in the Netherlands in 1636. While the price of bulbs kept growing, people spent all their savings on those bulbs. At some point, the price stopped growing and began an aggressive decline, which led to unbelievable losses and a general slow-down of the development of the country’s economy.

The crisis of 2020, also called “the pandemic crisis”, was provoked by the emergence of the new coronavirus disease. Economic activity shrank all over the globe, unemployment sky-rocketed, while the earnings of people fell to record levels.

In the first case, you see an example of the so-called “crowd effect” when private investors become euphoric about something, invest massively in this, and inflate a bubble that later bursts and harms the economy of the whole country. This is a good illustration of the saying: “When a shoe shiner starts buying stocks, it is time to leave the market”.

In the second case, a very random reason made economies all over the world collapse, so that oil futures dropped below zero, which is a record decline in the history of the asset.

How to forecast an economic crisis?

There are several ways of making such forecasts, and some of them are already in our blog.

Time cycles

A collapse of the stock market and impressive growth of the USD happen every decade. After the Dow Jones index collapsed in 2008, a similar crash happened at the beginning of 2020.

Hence, you can calculate the date of the next economic crisis with a minor time lag. Based on this version, we should expect the next major crisis somewhere between 2028 and 2030, while the present growth of the stock market must be just speeding up.

Bottom line

Unfortunately, economic crises have always been around and will happen in the future. Every next such event is likely to be different from the previous one. However, several types of signals warn you of an approaching crisis, so that an experienced investor can leave the stock market and start buying the USD and gold.

One of the easiest ways to predict a crisis in advance is to analyze the bond’s yield: this chart predicted the two latest collapses of the Dow Jones and the stock market. This is an easy but informative and efficient way.

Read more at R Blog - RoboForex

Sincerely,

RoboForex team

Vlad RF

RoboForex Representative

- Messages

- 487

Author: Timofey Zuev

Dear Clients and Partners,

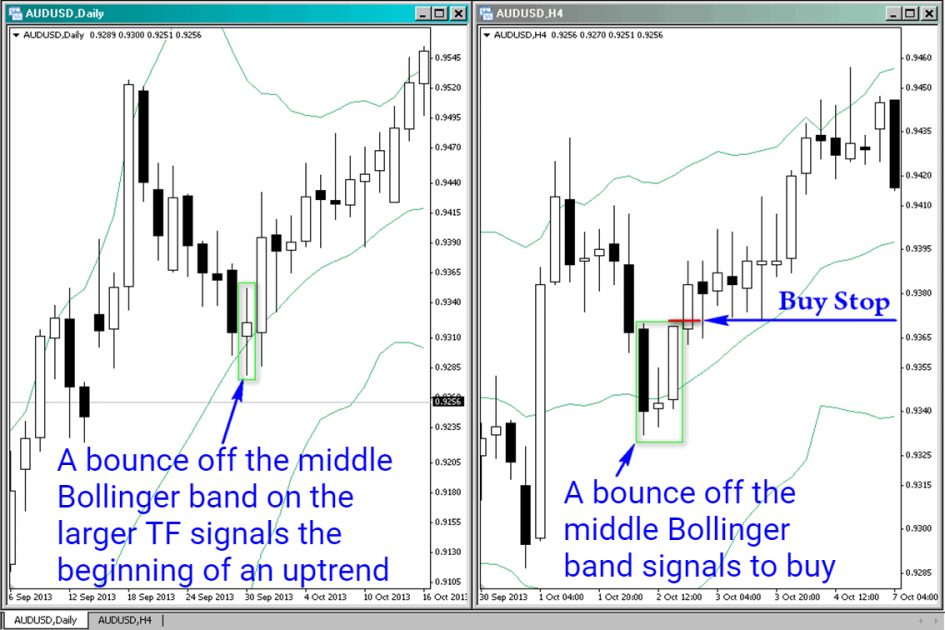

Among the most popular indicators for stock trading, there are the Bollinger Bands. They are very sensitive to market volatility and might act as not only support/resistance levels but as target levels as well. The Bollinger strategy is based exactly on these peculiarities of the indicator. It is applicable to periods from M1 to MN, for any instrument in Forex, stock, or futures markets.

A signal to buy by the strategy

To use the strategy, you need two price charts:

- The first one reflects your working timeframe.

- The second one represents a TF 3-5 times larger than your working TF.

The efficacy of the Bollinger strategy on timeframes smaller than H1 depends on the size of the spread in your instrument. For a signal to buy to appear, the following conditions must be fulfilled:

- On the chart with the older timeframe, one of the two events must happen. The first option is a bounce off the middle Bollinger band of a widespread candlestick pattern (Pin Bar, Engulfing, etc.). The second option is the price crossing the indicator band and closing on the opposite side from that where it opened. Depending on the direction of the bounce/crossing of the middle Bollinger band, we set the direction of trading on the smaller TF. This trend is considered actual before it reverses, i.e. the Bollinger band gets crossed in the opposite direction. There are more special conditions: if, for example, the candlestick that is crossing the middle Bollinger line touches the upper line, do not start looking for a trading signal on the smaller TF.

- After you detect the trend on the larger TF, look for a Bollinger trading signal on the smaller one. A direct signal to buy is a bounce off the middle or lower indicator line.

An example of a signal to buy

Money management for the Bollinger strategy

You should risk by a comfortable deposit/lot percentage. This is the rule of thumb. If you still feel uncomfortable, increase your TFs. Personally, I recommend to risk the same percentage of a fixed deposit in each trade; the percentage should be below 2%.

However, as long as I do not have trustworthy statistics about the efficacy of the trading strategy, I strongly insist on backtesting. If you have never used this indicator before, train yourself on a demo account and feel the character of the Bollinger bands.

Read more at R Blog - RoboForex

Sincerely,

RoboForex team

marionuevo

Recruit

- Messages

- 2

RoboForex Contest

RoboForex Representative

- Messages

- 182

This week, the ContestFX project invites everyone to take part in the following competitions:

The 122nd competition of "Demo Forex" entered its second week.

The 309th competition of "Week with CFD" has just started.

442nd competition of "Trade Day" will start 12.05.2021 at 12:00.

358th competition of "KingSize MT5" will start on 13.05.2021 at 20:00.

To participate in our demo competitions, you need to go through a simple registration procedure just once and you'll be able to use the funds received as a reward to perform trading operations on the Forex market without investing your personal savings.

Join us!

Sincerely,

RoboForex Contest

marionuevo

Recruit

- Messages

- 2

Monday. Still the same.No recommended at all. Ordered a withdraw on monday evening (past 00:00 server time of Tuesday). Today is Saturday. No response at all. 2 tickets opened at support. No response. 2 Useless calls to my personal manager. No solution. 4000+ € in the pocket of someone not me. SCAM.

davtrent55

Recruit

- Messages

- 207

Vlad RF

RoboForex Representative

- Messages

- 487

Author: Andrey Goilov

Dear Clients and Partners,

Speculating commodities is yet another opportunity for investors to make money. Such goods are most often resources that sustain the world economy, and any changes in the latter lead to commodity price fluctuations.

Many traders are discouraged from trading commodities because trading principles are hard to perceive, while a simple habit of trading currency pairs is strong. If you do decide to take up trading commodities, from this article you will get to know what these goods are, what influences their price, and how to trade them.

What are primary commodities?

In this article, I am going to use primary commodities and just commodities as synonyms. Commodities are raw materials meant for further processing and producing some products. Commodities include the results of agricultural work, such as grain, or mineral resources, such as oil, gas, gold, and a much longer list of goods.

This type of asset is characterized by lengthy trends. Currency pairs get into flats sometimes (which means the quotations demonstrate no clear direction), while oil demonstrates directed movements most of the time. This peculiarity is to be kept in mind when trading such assets. Experienced traders advise opening positions with at least a 6-months perspective.

What commodities are there?

All commodities can be split into categories, which are as follows.

Energy

Energy carriers are WTI and Brent oil, natural gas, fuel oil, gasoline, etc. Note that Brent has been in a stable uptrend since April 2020. At that time, the quotations were as low as 16 USD per barrel while by now they have reached 70 USD.

Economic stimulation during the coronavirus pandemic made oil prices grow all over the world. Large banks have already started talking about the renewal of a long-term cycle of oil price growth with the aim above 120 USD per barrel. If you are particularly interested in this commodity, I recommend an article devoted to it:

Metals

This group contains gold, silver, platinum, copper, and other precious and mined metals. In crises and turmoil, investors often put their money in gold because it is considered a protective asset.

This metal has, indeed, been growing since mid-2018, and in 2020 it renewed another all-time high. The world economy is now coming back to normal, which means oil prices have shrunk somewhat; the danger of a crisis has passed, but traders are still expecting another attempt of growth in the nearest future. We also have an article about gold in our blog, with examples and details:

Closing thoughts

Trading commodities is peculiar in several ways. Such instruments are characterized by strong trend movements and increased volatility. Quite probably, the analysis of commodity markets by Ichimoku or Simple Moving Averages will give you better entry ideas than graphic instruments of tech analysis.

One point of gold or oil costs more than that in currency pairs, so it will be wise to start with a demo account and a strict system of risk management. However, risks are no reason for leaving these instruments unattended as you can always opt for a conservative trading option.

Read more at R Blog - RoboForex

Sincerely,

RoboForex team

Manager RF

RoboForex.com Representative

- Messages

- 32

Dear marionuevo,No recommended at all. Ordered a withdraw on monday evening (past 00:00 server time of Tuesday). Today is Saturday. No response at all. 2 tickets opened at support. No response. 2 Useless calls to my personal manager. No solution. 4000+ € in the pocket of someone not me. SCAM.

The company's support team has already provided a response to your ticket.

If you have any additional questions, you can always contact the Support Service through the contacts mentioned on our website for help.

Dear davtrent55,Do you have cryptos too?

The number of instruments for trading depends on the chosen account type.

The current list of instruments, available for trading on all types of accounts at RoboForex, can be found on the "Contract Specifications" page of our website.

Similar threads

- Replies

- 7

- Views

- 8K

- Replies

- 5

- Views

- 41

- Replies

- 7

- Views

- 55

- Replies

- 2

- Views

- 1K

- Replies

- 4

- Views

- 1K