Electric Cars Increase Demand for Lithium: Which Companies Will Attract Attention?

Author: Eugene Savitsky

Dear Clients and Partners,

Brass is the main metal for the global green energy transition. However, there is another metal which is vital for the process, and this is lithium. This article is devoted to this material, primarily used in batteries and energy storage units. Unlike brass quotes, lithium quotes are trading near their all-time highs instead of falling. Over the past two years, lithium prices increased by 1,280%. This article explains what this metal is like and which companies produce and sell it.

Lithium

Lithium is a light, soft alkaline metal of silvery white colour. It is used rather widely, including in chemical electricity sources, metallurgy, electronics, nuclear energy, healthcare, lubricants, space industry, glass industry, etc. The main consumers of lithium are glass industry (29%) and energy (27%).

The main lithium mines are situated in the so-called Lithium Triangle on the territory of Argentina, Bolivia, and Chile. This region holds about 70% of global lithium reserves. The Top 5 list of countries with largest reserves features Bolivia, Argentina, Chile, Australia, and China.

How lithium is mined

There are two ways of mining lithium. The first one is the ore method. It implies construction of a mine or quarrying. The metal itself is produced from pegmatite minerals. The second way is producing lithium from water solution.

The second method costs less: the solution is pumped up to the surface from the depth of several meters. It fills up huge pools and then evaporates under the sun, leaving in the pools a concentrate that is gathered and transported to the plant. There lithium is separated from the white flour, pressed in bricks, and sent to customers.

The second method is only used in countries with dry climate. In many Northern lands this method can hardly be used because water will need to be heated up in the process of gathering lithium, and this implies additional costs. So, only countries with extremely cheap energy carriers can afford this.

What Free float value is considered optimal?

The optimal Free float value for both traders and investors is in the range of 40–80%. Such volumes of free float shares provide some kind of protection against market fluctuations, increase the instrument's liquidity, and afford an opportunity to buy or sell an asset at any time. In other words, the higher the Free float ratio, the more liquid the instrument is and the more opportunities investors have.

What influences lithium prices

As said above, lithium is widely used and has always been in demand. However, the volumes required by the global market used to be much smaller than these days, and lithium companies managed to satisfy the demand fully. The situation changed abruptly when humanity started mass production of electric cars because lithium is used in batteries. So, the metal price started growing at once.

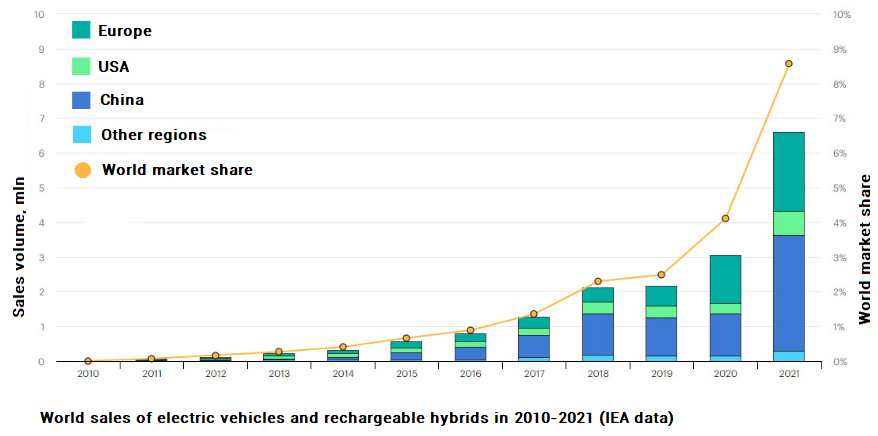

Take a look at the diagram of global sales of electric cars. Since 2014, sales of electric cars have been growing. In 2018 and 2019, sales volumes remained at a more or less equal levels, i.e. there was a minor pause. However, in 2020 and 2021, sales doubled.

The dynamics of electric cars sales and lithium prices correlate. Hence, the main demand for lithium is created by the car industry. And the more electric cars appear, the higher becomes the demand for the metal.

Risks and lithium ETFs

The first ones to mention are political risks, i.e. limitations imposes on the business of foreign companies in certain countries, like in Chile. These situations will have a good influence on lithium prices, which means the price might grow after such events, yet the companies that get the limitations imposed on them will suffer a stock price decline. To avoid the risks entailed by investing in one company, investors might consider lithium ETFs, such as Global X Lithium & Battery Tech ETF (NYSE: LIT) or Amplify Lithium & Battery Technology ETF (BATT).

The second risk bases itself in active investments in lithium mining that might make the supply exceed the demand. In this case, lithium quotes will start declining, and companies that have invested in increasing production will fail their financial liabilities because their income will fall.

Read more at R Blog - RoboForex

Sincerely,

RoboForex team