acetraderfx

AceTrader.com Representative

- Messages

- 1,109

Last Update At 15 Apr 2013 00:17GMT

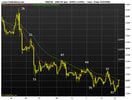

Trend Daily Chart

Sideways

Daily Indicators

Falling

21 HR EMA

0.9290

55 HR EMA

0.9304

Trend Hourly Chart

Down

Hourly Indicators

Falling

13 HR RSI

46

14 HR DMI

-ve

Daily Analysis

Consolidation b4 decline resumes

Resistance

0.9383 - Prev. sup, now res

0.9367 - Last Tue's high

0.9340 - Last Thur's high

Support

0.9263 - Fri's 5-week low

0.9231 - 61.8% r of 0.9024-0.9567

0.9185 - Feb's 20 low

. USD/CHF - 0.9286 ... Dlr remained under pressure throughout last week n price ratcheted lower fm Tue's high of 0.9367 to a 5-week low of 0.9263 Fri in part due to renewed cross buying in chf (eur/chf fell fm Tue's high of 1.2212 to 1.2156 Fri) b4 staging a minor recovery today.

. Current weakness suggests the decline fm Mar's 0.9567 high to retrace the recent entire rise fm Feb's low of 0.9024 remains in progress n as long as res at 0.9367 holds, decline to 0.9231 (61.8% r of 0.9024-0.9567) is envisaged, below wud encourage for further weakness to previous chart sup at 0.9185, having

said that, anticipated low readings on hourly oscillators shud prevent steep fall below latter lvl n reckon 0.9150 wud contain downside n yield a much-needed rebound later. On the upside, abv 0.9367 res wud be the 1st sign a temporary low has been made, however, a breach of 0.9445 (prev. sup, now res) is needed to

confirm aforesaid correction fm 0.9567 is over.

. Today, selling dlr on intra-day recovery in anticipation of such decline is favoured with stop abv 0.9340 res, break wud risk gain twds 0.9367 res.