acetraderfx

AceTrader.com Representative

- Messages

- 1,109

WEEKLY USD/JPY TECHNICAL OUTLOOK

Last Update At 24 Mar 2014 00:15GMT

Trend Daily Chart

Sideways

Daily Indicators

Turning up

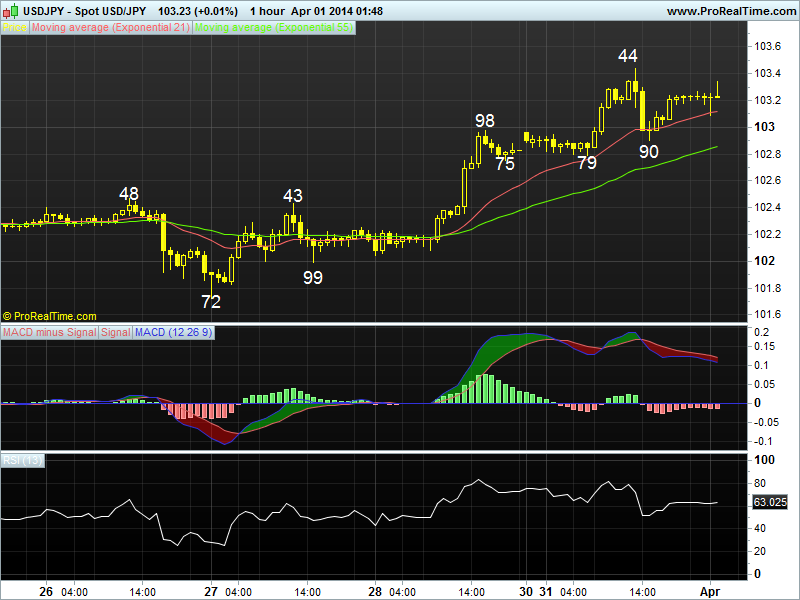

21 HR EMA

102.26

55 HR EMA

102.20

Trend Hourly Chart

Sideways

Hourly Indicators

Turning down

13 HR RSI

45

14 HR DMI

-ve

Daily Analysis

Consolidation b4 one more rise

Resistance

103.77 - Mar's high (07)

103.10 - Mar 12 high

102.69 - Last Wed's high

Support

101.94 - Last Tue's high

101.69 - Last Wed's European morning high

101.21 - Mar 14 low

. USD/JPY - 102.20... Dlr remained under pressure initially last week n retreated fm 101.94 to 101.27 on Tue due to safe-haven buying of yen following the annexation of Crimea by Russia, however, price rallied to 102.69 Wed after Fed's tapering move n hawkish remarks fm Fed chief Yellen b4 dropping back to 102.01.

. Looking at the bigger picture, dlr's nr term rise fm 101.21 (Mar 14 low)

to 102.69 signals the fall fm Mar's peak at 103.77 has ended there earlier n as daily technical indicators are turning up, suggesting further 'volatile' trading abv Feb's bottom at 100.76 wud be seen n with upside bias. Looking ahead, a daily close abv 103.10 (Mar 12 high) wud encourage for a re-test of 103.77 later this month, however, only a firm breach there wud indicate decline fm 105.45 (2013 5-year peak made in Dec) is still being retraced n bring another leg of correction fm 100.76 twd 104.22, bring the equality projection of 100.76-103.77 measured fm 102.21, n then twd 104.50/60.

. Today, as long as 102.01 (reaction low fm 102.69) holds, buying dlr on

dips in anticipation of a re-test of 102.69 is favoured, abv, 103.00/10. Only

below 101.94 (prev. res) wud abort this bullish scenario, risk 101.77, 101.49.

Last Update At 24 Mar 2014 00:15GMT

Trend Daily Chart

Sideways

Daily Indicators

Turning up

21 HR EMA

102.26

55 HR EMA

102.20

Trend Hourly Chart

Sideways

Hourly Indicators

Turning down

13 HR RSI

45

14 HR DMI

-ve

Daily Analysis

Consolidation b4 one more rise

Resistance

103.77 - Mar's high (07)

103.10 - Mar 12 high

102.69 - Last Wed's high

Support

101.94 - Last Tue's high

101.69 - Last Wed's European morning high

101.21 - Mar 14 low

. USD/JPY - 102.20... Dlr remained under pressure initially last week n retreated fm 101.94 to 101.27 on Tue due to safe-haven buying of yen following the annexation of Crimea by Russia, however, price rallied to 102.69 Wed after Fed's tapering move n hawkish remarks fm Fed chief Yellen b4 dropping back to 102.01.

. Looking at the bigger picture, dlr's nr term rise fm 101.21 (Mar 14 low)

to 102.69 signals the fall fm Mar's peak at 103.77 has ended there earlier n as daily technical indicators are turning up, suggesting further 'volatile' trading abv Feb's bottom at 100.76 wud be seen n with upside bias. Looking ahead, a daily close abv 103.10 (Mar 12 high) wud encourage for a re-test of 103.77 later this month, however, only a firm breach there wud indicate decline fm 105.45 (2013 5-year peak made in Dec) is still being retraced n bring another leg of correction fm 100.76 twd 104.22, bring the equality projection of 100.76-103.77 measured fm 102.21, n then twd 104.50/60.

. Today, as long as 102.01 (reaction low fm 102.69) holds, buying dlr on

dips in anticipation of a re-test of 102.69 is favoured, abv, 103.00/10. Only

below 101.94 (prev. res) wud abort this bullish scenario, risk 101.77, 101.49.

Last edited by a moderator: