Bitcoin Fundamental Briefing, July 2023

IT IS TOO QUIET

So, July looks a bit “special” month, not because of big events but because of unusual price action – it is too tight and too quiet. At first glance it might seem that nothing is happening around. After bit splash of positive on a background of BlackRock, Fidelity and others ETF files to SEC – market remains calm. But in reality there are few events that seem important to us.

First is, market reaction on recent positive events, such as decreasing of inflation, stable job market and consumption. Ripple tactical victory over SEC in lawsuit also had very short-term effect that has been reversed back in few hours. All markets have shown rally – currencies, gold, stocks, except Bitcoin. We’ve mentioned this moment in our regular videos. Inability of BTC to follow the major tendency tells on tactical weakness. And this is the reason why we suggest deeper retracement on BTC market in short-term.

It is even more uncertainty in longer-term. Signs of economy crisis become more evident, and not only in the US but in EU as well. Banking crisis is silenced a bit, but recent news on Pac West Bank and its takeover by Bank of California shows that crisis is not disappeared. Meantime, the Fed and US Treasury keep drying liquidity out of the market, taking it from Reverse Repo accounts by far, but very soon this source will be over. Despite that Crypto funds shows nice inflow in recent months – price is not rising. So, a lot of things that we need to find out.

MARKET OVERVIEW

Bitcoin miners, many of whom have traditionally held onto the cryptocurrency after creating the digital assets, have been selling the tokens during the current rise in prices.

The percentage of miner revenue sent to exchanges hit all-time highs in the past few weeks, to according to digital asset manager Grayscale’s June monthly newsletter, citing data from crypto analytics firm Glassnode.

“I think many of these miners learned their lessons in the past two years. Back then, they liquidated coins in the bear market when Bitcoin’s price was low and they really needed the cash,” said Colin Harper, head of content and research at crypto-mining services company Luxor Technologies. “Some miners are probably just using the recent move in Bitcoin to liquidate mined coins while the price is higher.”

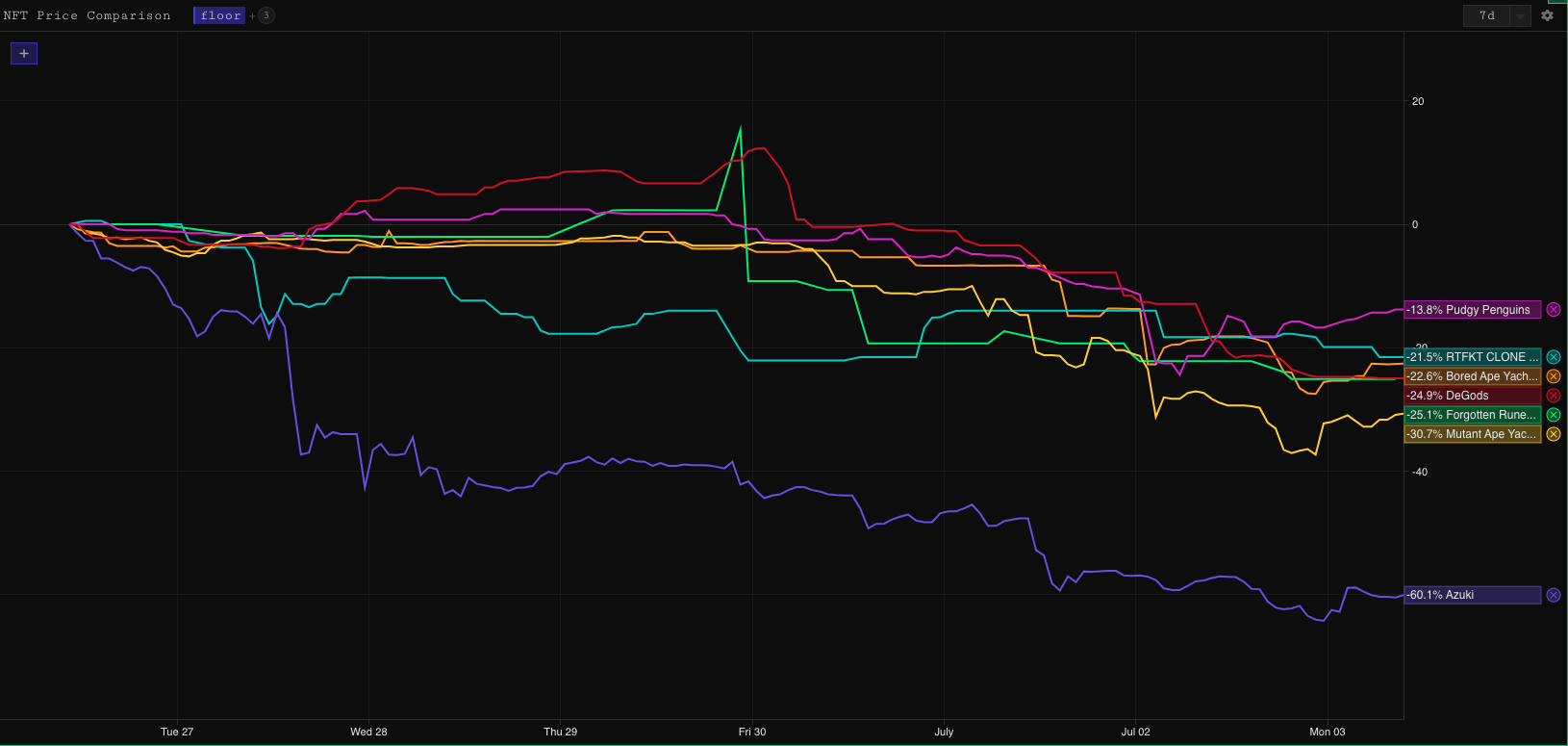

The nonfungible-token market witnessed a dramatic selloff over the last week, as prices of major collections tumbled amid growing investor doubts over just on how valuable NFTs should be.

Data from crypto data platform Parsec shows that the floor price of Azuki has dropped by more than 60% in the past week, while that of other well-known NFT collections like Bored Ape Yacht Club, Mutant Ape Yacht Club and Pudgy Penguins dropped in a range of 14% to 31%.

“NFTs that looked good at 15 ETH no longer look as good anymore when they are at 5 ETH,” Delphi Digital’s Yau said. “Demand evaporated as prices fell.”

Everything in crypto falls at least 90% after the first bubble. NFTs, by virtue of being illiquid, should fall even more. — Omid Malekan

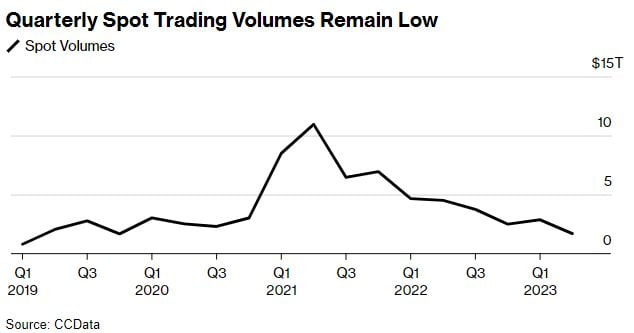

Trading volume on cryptocurrency exchanges in the three months ended in June was the lowest since the final quarter of 2019 despite a jump in activity during the final weeks of last month.

Volume on so-called centralized exchanges rose 16.4% to $575 billion in June, the first increase in three months, according to a report from researcher CCData. Overall, trading volume fell 40% to $1.7 trillion from the first quarter, and was down 62% compared with the year-earlier period, the researcher said.

Meanwhile, Binance’s market share of non-derivatives trading volume declined for the fourth consecutive month, dropping 1.4% to 42% in June. The biggest crypto platform’s market share fell the most among centralized exchanges, and it registered the lowest market share since August 2022.

Bitcoin dropped below $29,000 for the first time in over a month as the recent exorbitance over ETFs and a more favorable regulatory outlook eases.

“After a sharp rally spurred by spot ETF excitement, Bitcoin has consolidated for over a month around $30,000 as the market awaits incremental information regarding the probability of the myriad of filings coming to fruition,” said Spencer Hallarn, a derivatives trader at crypto investment firm GSR.

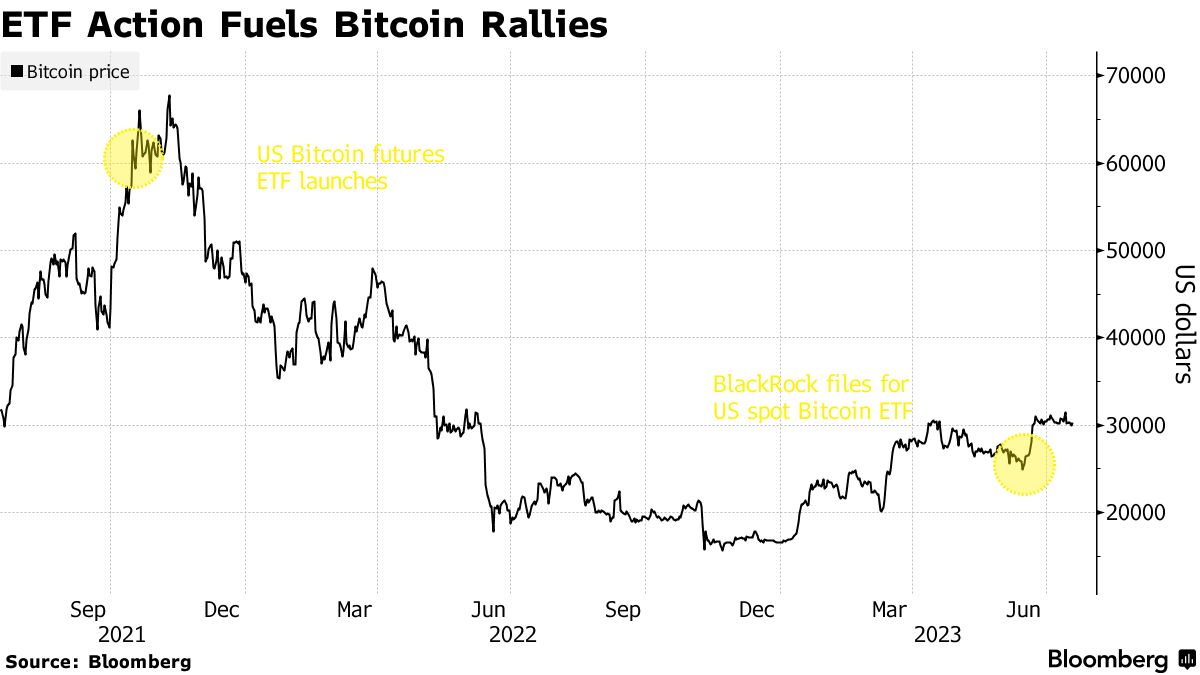

The recent jump in Bitcoin coincided with a raft of filings for Bitcoin exchange-traded funds in the US, driven in large part by an application by Wall-Street heavyweight BlackRock Inc. XRP had almost doubled after a federal judge said two weeks ago that the token wasn’t a security when offered to the public on exchanges.

“In the wake of the XRP ruling, the associated enthusiasm for [altcoins] and uptick in listings on exchanges has served to reverse the focusing effect of capital into the majors that had occurred over the last few months and has contributed to the loss of price momentum,” Hallarn said.

Worldcoin, the token of the crypto project co-founded by OpenAI Chief Executive Officer Sam Altman, rallied on its first day of trading as investors piled into the hype around artificial intelligence. The token jumped to as high as $3.58 from the initial price of $1.70, data compiled by CoinMarketCap showed.

Worldcoin, Altman’s eyeball-scanning crypto project uses a small device called an “orb” to scan people’s eyeballs in order to generate a a unique digital identity. That identity, or World ID, grants its holder “proof of personhood” in the Worldcoin parlance.

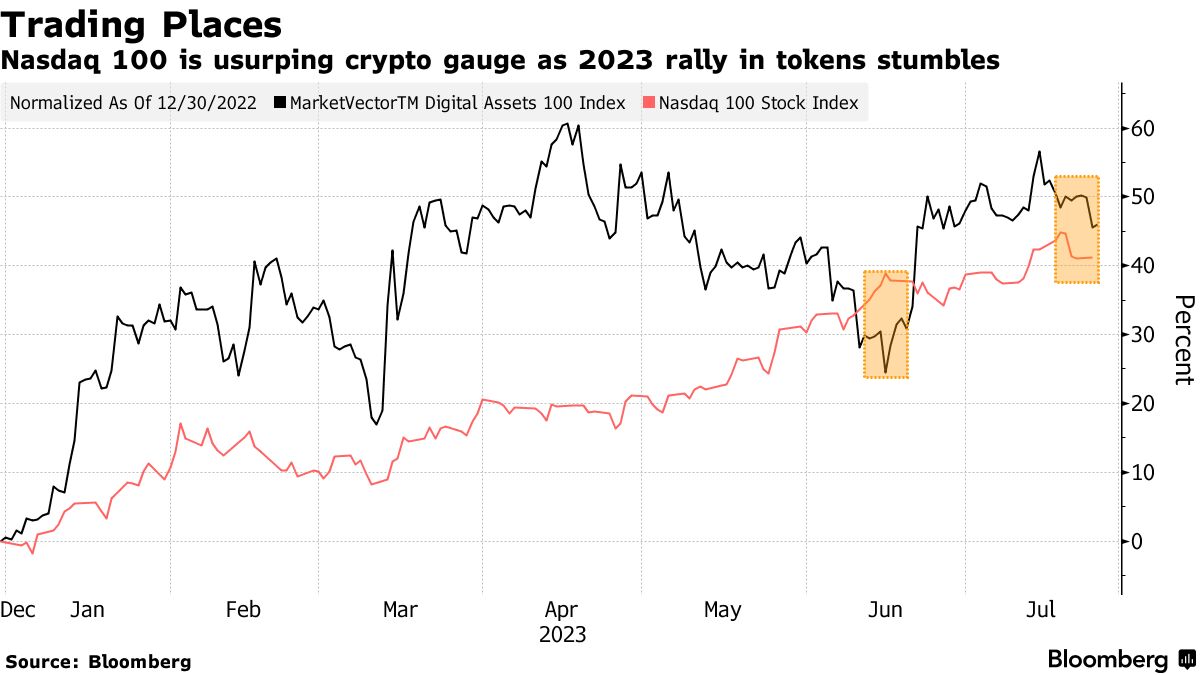

The year-to-date climb in a gauge of the top 100 digital tokens has cooled to 46%, not far above a 42% jump in the Nasdaq 100 Index of tech stocks. Hype over artificial-intelligence products has boosted the equity measure, which briefly topped the MVIS CryptoCompare Digital Assets 100 Index in June.

“The rally has lost momentum following the initial excitement sparked by the ETF news, and there are no other visible catalysts on the horizon,” said Caroline Mauron, co-founder of digital-asset derivatives liquidity provider OrBit Markets. But downside risk “should be limited as the Fed is near the end of the current rate hiking cycle, which should support risk assets including crypto.”

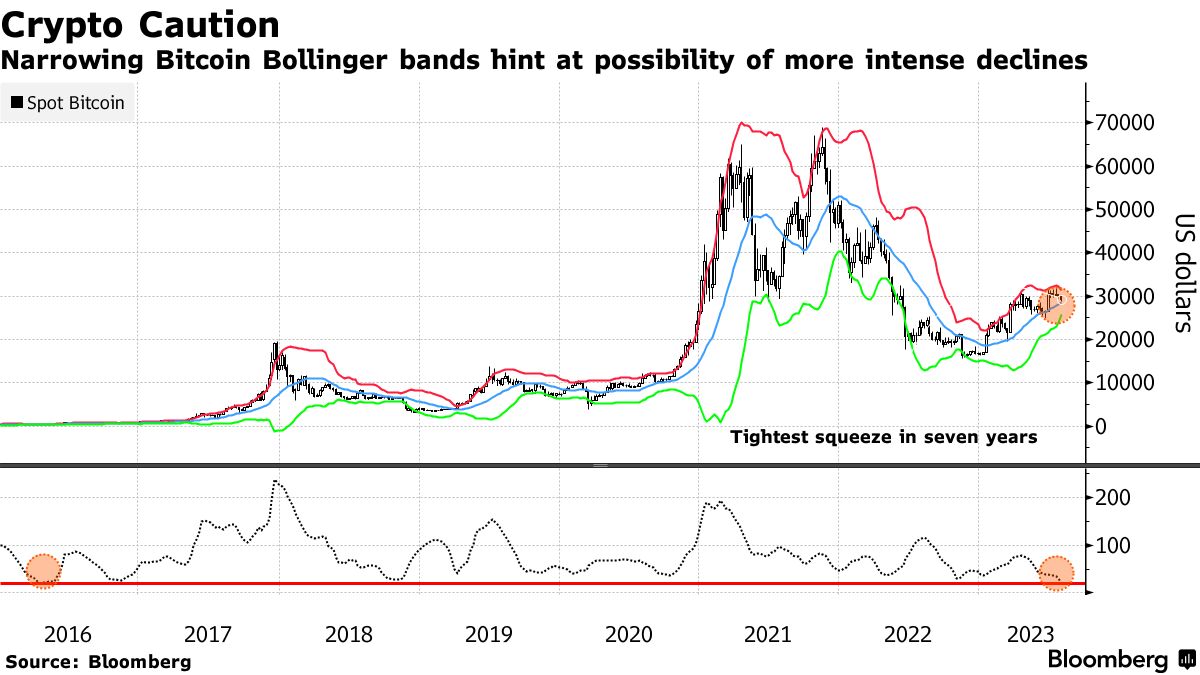

Some chart patterns signal caution. Bitcoin’s 20-week Bollinger bandwidth has shrunk to the narrowest in seven years. That suggests moves in the largest digital asset could become more intense, potentially on the way down if key thresholds give way. The Bollinger study is a way of analyzing volatility.

Bitcoin’s drop “should extend toward $26,000/$25,000 before finding support,” Tony Sycamore, a market analyst at IG Australia Pty, wrote in a note.

A metric tracking how much Bitcoin is being bought and sold has slid to a 30-month low as the largest digital asset holds below $30,000. The seven-day average of Bitcoin spot trading volume on July 22 was the least since around the start of 2021 amid subdued price swings, K33 Research said.

“The crypto market currently finds itself in a proper summer slumber,” Head of Research Bendik Schei and Senior Analyst Vetle Lunde wrote in a note. “Nonetheless, lengthy slowdown periods have a tendency to be followed by surging volatility enhanced by overleveraged traders conditioned for a low-volatility environment.”

Bitcoin’s year-to-date rebound — fueled in part by optimism that the US may allow spot exchange-traded funds investing directly in the token — has cooled and traders are now assessing where the next price catalyst may come from.

Investors are awaiting an expected Federal Reserve interest-rate hike on Wednesday. Some commentators are optimistic that a global wave of monetary tightening is coming to an end as inflation moderates. Any such signals from the Fed could bolster global markets.

K33 Research said Bitcoin activity could pick up in August and September as regulators decide whether to approve the spot ETF applications in the US.

“We are seeing renewed interest from relative value players to position for a larger move towards the end of the third quarter,” said Caroline Mauron, co-founder of digital-asset derivatives liquidity provider OrBit Markets.

ETF HYPE

The best argument in favor of approving new Bitcoin exchange-traded funds is that they already exist, tracking futures. Sadly for the crypto crowd, that’s also the best argument for why nobody needs a new one.

Proponents say that the arrival of a US spot ETF would open the floodgates to a new wave of investors, potentially ushering in more than $50 billion of demand. A fresh batch of applications led by asset management titan BlackRock Inc. re-ignited optimism that the Securities and Exchange Commission may finally give its blessing after more than a decade of denials, powering a 20% Bitcoin rally since mid-June.

On the other side, nay-sayers are skeptical that a US spot fund would be a true game changer. After all, everyone who has wanted access to exchange-traded Bitcoin products that do virtually everything a spot tracker will do has been able to get it, albeit somewhat imperfectly — for more than two years. And for the most part, they haven’t cared.

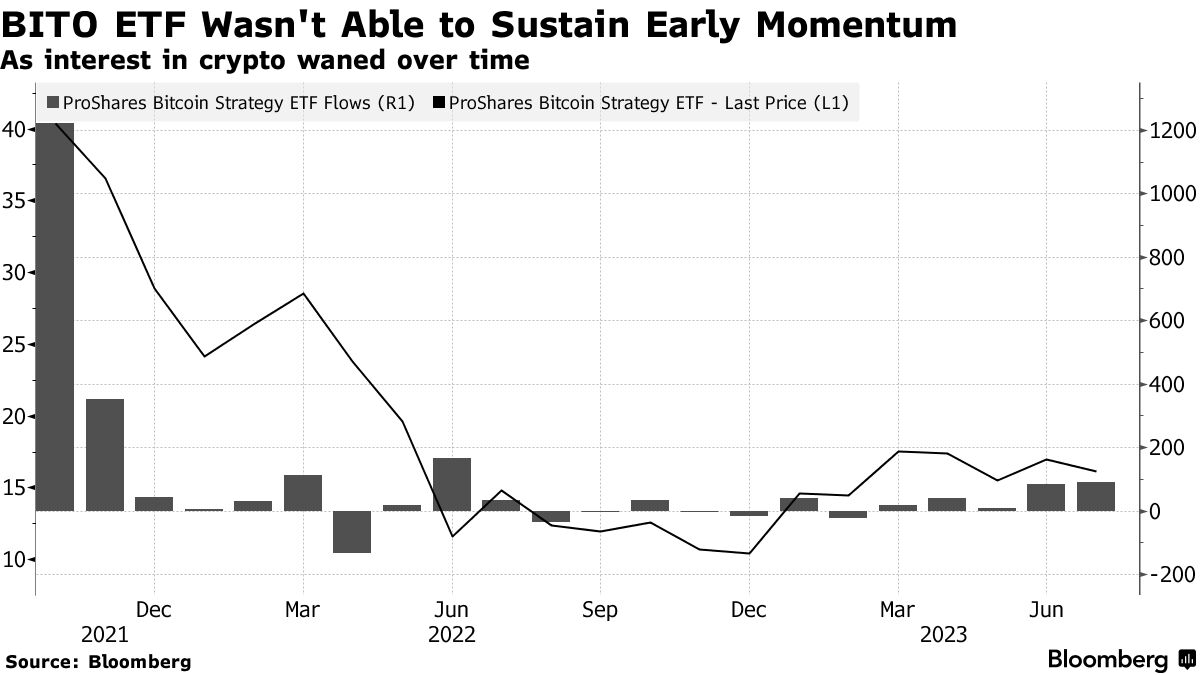

The debut of the first US Bitcoin futures-backed ETFs happened back in October 2021 — in an eye-catching way. The ProShares Bitcoin Strategy ETF (ticker BITO) experienced roughly $1 billion in turnover right from the get-go. That acted as a catalyst for Bitcoin hitting an all-time high of nearly $69,000 just weeks later.

Yet the early momentum didn’t carry through — the fund never saw the same amount of flows as it did then.

“Look at what we saw on futures front — it was a lot of money that went in Day One, but then — for all intents and purposes — it paused,” Jillian DelSignore, managing director and head of strategic growth and solutions at FLX Networks, said in an interview. “I think we’ll definitely see multiple billions of dollars come in. I do think it will be a very early momentum-driven asset growth, and then the question mark for me is what happens from there. Does it quiet down?”

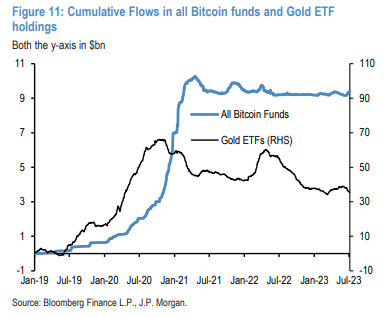

JPMorgan joined the debate in recent days, arguing that any US spot Bitcoin ETF approval won’t be transformational for the sector because such products have existed in Canada and Europe for years without having seen tremendous inflows. There’s been little investor interest, argues strategist Nikolaos Panigirtzoglou, and existing funds have failed to benefit from outflows out of gold ETFs.

“I don’t think you’re going to see massive flows into these spot ETFs,” said David Donabedian, chief investment officer of CIBC Private Wealth US. “I don’t get the sense that there is massive pent-up demand to have Bitcoin exposure.”

Bloomberg Intelligence draws a different conclusion when looking at Canada and Europe. Demand in the US, where the ETF market is larger and where the vehicles are much more widely used, could end up being stronger.

Crypto exchange-traded products account for around 1% of all Canadian ETF assets; carrying that same logic over to the US would equate to an asset potential of around $54 billion, BI analysts Athanasios Psarofagis and James Seyffart said. For context, roughly $137 billion sits in US commodity ETFs overall.

BlackRock Chief Executive Officer Larry Fink, a one-time crypto skeptic, recently added his voice to those who see Bitcoin as an agent for diversification.

“It has a differentiating value versus other asset classes, but more importantly, because it’s so international it’s going to transcend any one currency,” Fink said Friday in an interview with CNBC.

Fink called Bitcoin an “international asset” and said the money manager wants to use its heft to make it less expensive and easier to invest in the cryptocurrency.

“It costs a lot of money right now to transact Bitcoin,” Fink said Wednesday in an interview on Fox Business. “We hope our regulators look at these filings as a way to democratize crypto.”

“We look at this as an opportunity,” Fink said. “We work really closely with our regulators. Bitcoin can represent an alternative, international asset akin to “digitizing gold,” Fink said. Initially, he said, he was skeptical because “it was heavily used for, let’s say, illicit activities.”

Proponents point on plenty of reasons why a spot fund could turn out to attract more attention than the futures funds ever did. It would allow financial advisers easier access; it could potentially be cheaper than the futures ETFs; and it wouldn’t have costs associated with it — or limitations on contracts — that are embedded in the futures product.

“In all my years of covering ETFs, I have never seen a prospective product with more hype. There’s a reason for that, and it’s my belief the pre-launch hype will be met with record demand,” said Nate Geraci, president of The ETF Store, an advisory firm.

“While futures-based Bitcoin ETFs have done an admirable job of tracking the spot price of Bitcoin, they haven’t been perfect,” he added.

BITO, for instance, is down 60% since its inception on a price basis and 54% as measured by total return, versus Bitcoin’s 51% drop.

“Investors want the real deal. They don’t want to hassle with potentially significant tracking error,” Geraci said.

On a background of this hype the new fantastic forecasts immediately have appeared. Thus, Tim Draper, founding partner of Draper Associates and DFJ, says on “Bloomberg Crypto.” that he sees Bitcoin rising to $250,000 by 2025.

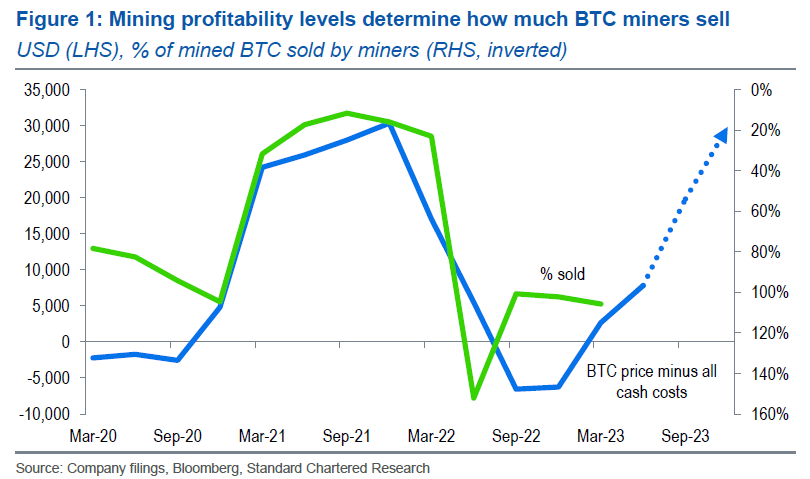

Standard Chartered is ramping up its bullish Bitcoin prediction, targeting as much as $120,000 by the end of 2024 — almost quadruple the current price — as increasingly cash-rich miners reduce sales of the token.

“Increased miner profitability per BTC mined means they can sell less while maintaining cash inflows, reducing net BTC supply and pushing BTC prices higher,” Geoff Kendrick at Standard Chartered wrote Monday.

Bold Bitcoin price predictions are nothing new. Among the most bullish is from Ark Investment Management’s Cathie Wood, who doubled down on her prediction that Bitcoin will hit $1 million by 2030 as recently as November.

Standard Chartered forecast in April that Bitcoin could reach $100,000 per coin by the end of next year. That underestimated the impact higher miner profitability would have on reducing the supply of Bitcoin in the marketplace, they now say, and expect the price to hit $50,000 by the end of this year before jumping to as much as $120,000 in 2024.

“At recent prices, they [miners] have been selling 100% of new BTC; at USD 50,000 we think they would sell 20-30%,” Kendrick wrote.

Still, the blowback from 2022’s crypto market drop and series of collapses across the industry — some of which are still unfolding — has cooled a chunk of its investor base to the space. Collectively, retail investors have lost billions to scams and frauds, trading volumes have plummeted and liquidity in the market has dried up.

In other words, the number of people who potentially might be interested in investing in Bitcoin has significantly dwindled since the highs.

“I’m not sure if there is a ton of hype around Bitcoin where an everyday investor who maybe isn’t as engaged in the market is wanting to buy Bitcoin at the moment,” Alex Coffey, TD Ameritrade senior trading strategist, said. “Several years ago, it was surging, it was the talk of the town, so there was a lot more interest.”

“Sticky inflation and economic recession concerns are still longer-term risks that we have to be cautious about,” said Youwei Yang, chief economist at bitcoin miner BTCM.

Michael Sonnenshein, chief executive officer of Grayscale, talks about the fight against the Securities and Exchange Commission to convert the Grayscale Bitcoin Trust into an ETF. The SEC rejected Grayscale’s plan to convert the Bitcoin trust to an ETF last year. Sonnenshein says a decision could come by the end of the fall at the latest, but he also says a ruling could come down at any time. By law SEC has to make decision within 240 days, since the file been accepted.

But we could get the first test even earlier and see on effect. The first Bitcoin ETF in Europe will be launched after a 12-month delay. Initially, Jacobi Asset Management announced that its Bitcoin ETF would be placed on the Euronext Amsterdam exchange in July 2022. So the launch should happen a year after. This is reported by the FT. BCOIN will be 100% backed by Bitcoins.

THE REAL BACKGROUND OF ETFs

I do not know about you, guys, but I can’t shake off the feeling that something big stands behind this sudden ETF rush. Maybe I surprise less if it comes from Grayscale or some others purely crypto companies, but it comes from Wall Street, big transnational corporations with total AUM above 27 Trln. And they come not just one by one but together and in the same time moment. Total bitcoin capitalization now just is around 700 Bln – what they forget there? If even they get together 10% (as it is suggested by Bloomberg Intelligence above), each fund will get around $8-10 Bln in assets, but in absolutely new under-regulated business. Is it worth the efforts?

Second is, magical L. Fink metamorphoses. In 2018, during the aforementioned interview with Bloomberg, Fink said that BlackRock was “looking at” the blockchain technologies, but added, “I don’t believe any client has sought out crypto exposure.”

“I have not heard from any one client that they’re looking to buy a cryptocurrency,” he famously said at the time. And the video clip of this interview was making the rounds on Twitter on Friday, following the news of BlackRock filing for bitcoin ETF.

Now on July 25, Blockware’s Joe Burnett commented on a 2022 BlackRock report on optimal Bitcoin allocation. Remarkably, the asset manager recommended 84.9% BTC (!!!), 9.06% stocks, and 6.04% bonds. Burnett commented that:

“If all investors follow BlackRock’s optimal BTC allocation, Bitcoin will be worth more than 5x the total value of all equities, real estate, and bonds.”

Re-posting his stock-to-flow model on July 25, analyst ‘PlanB’ said that things were in the early stage of a bull market, adding:

“Of course BlackRock wants to buy cheap, just before ETF approval, and just before stage-2 full-blown bull market.”

This is just words, of course. Besides, 5 years is a big term, everything is changing and investing views and preferences are most of all. The most interesting are the numbers that we have. First is, recent Glasnode report. It shows that Big whales of all categories are reducing their positions –

Whale entities have seen their aggregate balance decline throughout Bitcoins history. The chart below reinforces this, with Whale entities accounting for 46% of the total supply, down from 63% in early 2021. It is important to note that here, Whale entities will include exchanges, as well as large centralized holdings such as ETF products, GBTC, WBTC, and corporate holdings like Microstrategy.

To remove Exchanges from the dataset, we can isolate only coins flowing between Whale entities and exchanges. The chart below shows that the aggregate Whale balance has declined by 255k BTC since 30 May.

This is the largest monthly balance decline in history, hitting -148k BTC/month. This indicates that there are noteworthy shifts happening within the Bitcoin Whale cohort worth diving deeper into.

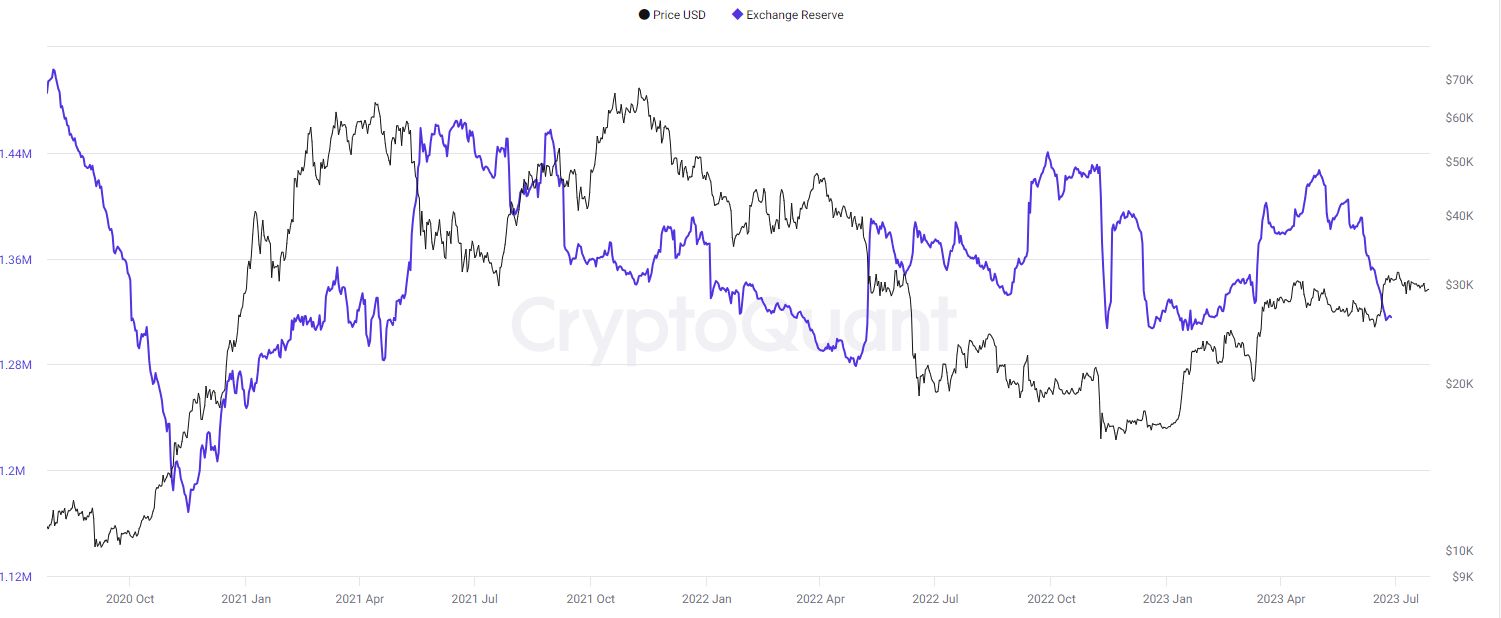

But this is not all yet. The dynamic of cash flows on exchanges remain depressed. News and verbal interventions, of course, have gone powerful, but the price is more or less in place, and there are no powerful movements on the outflow of BTC from spot exchanges –

or the inflows of derivatives –

which could confirm the belief of the broad market in these statements.

It looks like the market has been fed up with the mythology of a bright tomorrow for 14 years and is now trading from the facts. It’s good that the market has become such an adult behavior.

In general, it is a very interesting movie with the arrival of such large institutions. And then it’s time to echo the crypto-sceptics and also ask “What’s the point in general? What for? Why?”. There are no reasonable explanations other than stupefying the market and inarticulate philosophical muttering in the information field.

To be honest, It is interesting to watch when the centralized indoctrination will begin, in which a sane concept of what to do after the capitalization of the crypto becomes many, many trillions, what complex useful use will be proposed for it.

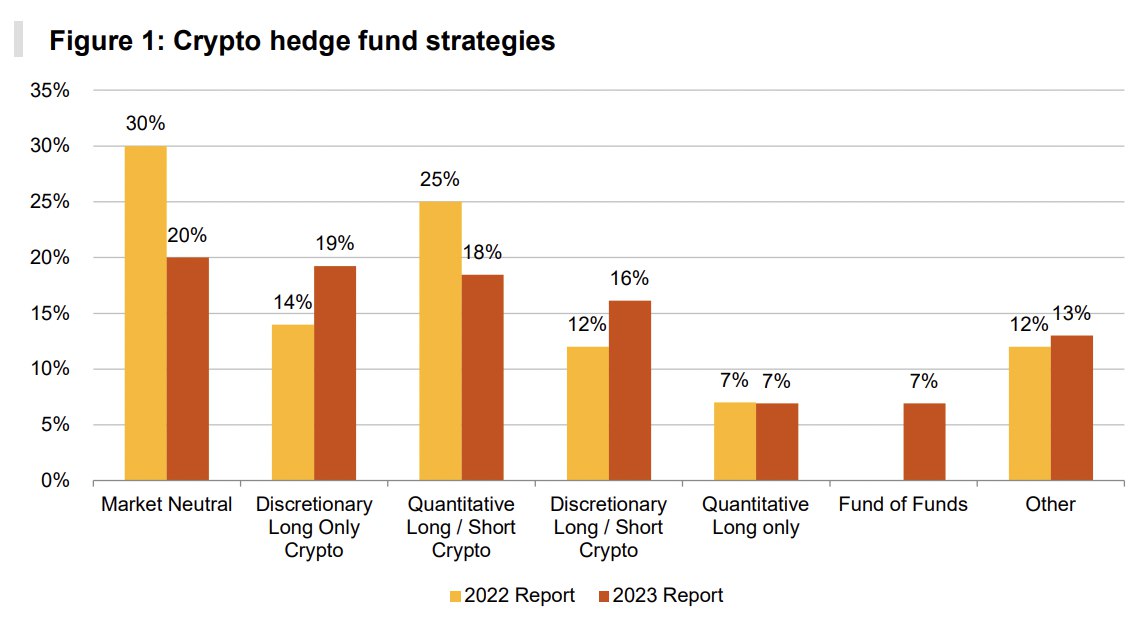

And all this is happening on the background of rising interest to crypto market among institutional investors, as PWC reports. The hedge fund managers are gradually becoming more bullish about the crypto:

And in a sense, it remains a mystery why some completely moronic tales about AI can move company stocks up, and bullish mood and positive news about the possible launch of an ETF (albeit with unknown results by far) cant move the crypto up. The price is still in the sidewall.

Is the price “held” artificially? This can be done with relatively little money through settlement futures on CBOE. In fact, having several billion dollars, you can slowly put pressure on the market and stay with a small profit, taking the time value. But in this case we have to see huge raising of trading volume and cash flows…

CONCLUSION:

Taking in consideration all facts that we know, we see opposite things. Market society takes no steps to prepare for ETF approval by SEC and take positions in advance. It seems that either market doesn’t believe in ETF approval, or suggest that no significant effect will happen. On the opposite side – the wall street companies. They stubbornly all together have set files to the SEC.

We see only one explanation to this phenomenon. To understand it better, re-read conclusion part from our previous report. We suggest that Fed rate hike cycle, beyond the common purpose of inflation fight, has secondary, non-public target – banking sector consolidation. Banking crisis is not disappeared, it is gradually ripening and soon step in an active stage. SVB was just the “first test”, that was successful and has shown outstanding results – JP Morgan due to takeover has got 20% return on capital in IIQ statement and bought excellent quality assets 4-5 times under market price. This tendency will continue soon.

Steps that are taking by US Treasury and the Fed, cutting liquidity in the system and pumping cash out of Reverse Repo into new US bonds issues, rising of banking capital solvency ratio, keeping QT just tighting the rope around small and mid banks’ neck.

Keeping rate hike cycle and we suggest that the Fed will raise rate more is aimed on re-distribution money out of the stock market into bonds, preferably the new issues. Yields should keep rising.

Launching the “Fed Now” system together with centralization of banking sector should at some point concentrate majority of banking transactions through the Fed under cover of “better, faster and cheaper transactions” slogan.

No doubts that SEC will approve ETF. It is difficult to believe that SEC, the Fed and BlackRock, Fidelity, JP Morgan, Invesco and all the others are in opposite teams. I mean not legally, but in terms of coordinated financial policy. And if market do not want to participate in newly created ETFs, they will start pumping it by its own cash, grabbing all free BTC out of the market and putting them as a collateral to ETFs. But only until the moment when public will step-in and it will be self-supporting process.

SEC will keep pressure on Binance, (and not only SEC) pressing it out of this market. While Coinbase as US domiciled company should survive. Not occasionally it was mentioned as major transaction agent for ETFs deals and source of BTC fair market price. So, Coinbase will serve operations and interest of all this ETF machine. Crypto market will become highly centralized also, because all spot BTC, ETH could be bought out by big banks. Total capitalization of big four cryptos is around 1.5 Trln, not too much for companies with 27 Trln AUM with almost unlimited loan lines from the Fed.

Keep it short, we suggest that major target is to put cryptocurrency market under control. In fact, possible rally is just a by-product of this process, secondary moment. Although traders somehow treat it as a major object of all this stuff around ETFs.

Why US financial authorities take efforts for centralization of banking system? Usually such things are needed to reach the high level of control, near to 100% over participants of transactions – government spending, companies, banks, different funds, social organizations and me and you – just all the people. The reasons are beyond of our information abilities. One of the possible reasons are political. We do not see what’s going on in the deep state. But even on the surface, with available information we see big problems in the US economy, massive dollar refusing across the board, uncontrolled US national debt rising, political confrontation among major global powers – US, China, Russia, EU. For the US it means the concentration of the whole power in the hands of bankers.

It means that real situation in the US is worse than it seems on surface and political fight is at highest level ever. We’re entering Election run year. Too many legal probes around political elites right now. Democrats’ power is backed by bankers. That’s why these efforts probably is the tool of Democrats in political fight that should help them to stay at power and in the head of the country.

Total financial control is a power that could let them to manage social processes, start or stop unrests, sabotage “undesirable” government spending and a lot of other things. We think that something bigger than just “new vector of Wall Str. business” stands behind this ETFs, and we suggest that it relates to politics.

Author Profile

Sive Morten

At the Forex Peace Army, he is known as an author of Forex Military School, which quite unique free forex trading course. We do not know of any other free forex trading education covering such a broad spectrum of forex market concepts in such details while keeping it easy to understand and practically use.

As if that wasn't enough, he is the part of the Shoulders of Giants Program. He shares with his fellow traders at FPA his view and forcast of the Gold Market, Currency Market, and Crypto Market in form of weekly analytics and daily video updates.

* Complete Forex Trading Course by Sive Morten >>

* Sive Morten Forex , Gold , and Crypto Analysis >>

Info

560 Views 0 CommentsComments

Table of Contents

Recent

-

Bitcoin Fundamental Briefing, April 2024 Bitcoin Fundamental Briefing, March 2024 Demystifying Cryptocurrency Nodes: Deep Dive into Polygon Node Ecosystem Strategies for Trading Forex on a Budget Bitcoin Fundamental Briefing, February 2024 Bitcoin Fundamental Briefing, January 2024 Strategic Asset Allocation Techniques for Currency Traders Bitcoin Fundamental Briefing, December 2023