Best Time To Trade Forex

When is the best to trade Forex?

Market participants often wonder – what is the best time to trade Forex to get the best results? And what are the best hours to maximize your returns and concentrate on trading? In this article, we’ll try to give answers to these questions and figure out the best trading hours.

Although, it’s a matter of personal preferences when to trade – in the morning or in the evening – and it also depends on the trader and his daily schedule, let’s see when it’s best to enter the market to make higher profits and when you should avoid trading.

Best time to trade Forex

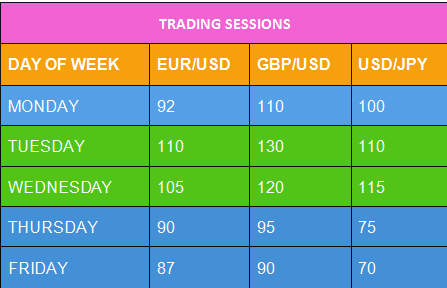

The European trading session is the most volatile session. It’s widely known, that on some particular days markets move more actively than on others. The chart below shows average volatility in pips for three major currency pairs on business days:

As we can see, the highest volatility in all three pairs is observed on Tuesday and Wednesday. On Friday, active trading is only registered until 5PM GMT, then the price movement slows down.

Therefore, we recommend entering the market on the days when volatility is the highest. Periods of high market volatility are the best to enter the market and maximize your profit.

Trading sessions

Now that we’ve figured out the days of the week, it’s time to determine the most favorable trading time. As you know, Forex trading takes place 24 hours a day five days a week. However, currencies move at a different speed at different times. Although the foreign exchange market is a decentralized market, a significant amount of money comes from banks, and they have a certain schedule. Forex trading day is divided into 3 key sessions: Asian, European and American. Each one has its own characteristics and a set of rules.

During the Asian session, the markets of Tokyo, Beijing and Canberra start moving faster. Throughout the night session, the market is calm because European and American banks are closed during this time. Due to weak activity, the volatility is low, the price often fails to breach its key levels and usually consolidates within a corridor. For this reason, most traders refrain from trading at night.

The Euro, the pound sterling and other European currencies demonstrate high volatility during the European session. Very often the trend that begins on the European trading session continues into the American session. Traders interested in European currencies can track them using expert analytics from AMarkets.

The peaks of highest volatility are usually observed at the end of the European and the beginning of the American session. Major currency pairs move very actively during this time interval. When the American session begins, the trend may reverse. Besides, important economic reports that can trigger volatility spikes in dollar pairs are generally released in the evening.

Best intraday trading intervals

9.20 – 9.50 First minutes of the European session. Trading volume is significant. This interval has great profit potential, but it’s very risky too. So, it would be better for novice traders better to stay away from the market during this time.

9.40 – 10.10. Trading volume is high but it’s less than during the first thirty minutes. This interval is the most optimal for trading – liquidity is sufficient, the prices are moving fast enough, but the market situation has already stabilized.

10.25 – 10.30. Markets stabilize, volatility decreases, most market participants close their trades. This time interval is the best to start planning your future trades.

10.30 – 11.10. This time period can be called the low-risk range of the morning trades.

11.15 – 14.15. Best time to take a break. The breakouts during this period of time are very inaccurate, the price starts moving sideways. Avoid trading in this interval, because you can easily lose your profit now.

14.10 – 15.00. Most trends have already formed. There’s no sense in entering the market now.

15.10 – 15.25. If you enter the market at this time, follow the trend and be cautious. Around 15:30 the trends may stop or even reverse.

15.20 -16.00. The last 30 minutes of the day session, it’s better to refrain from trading now as major market players start adjusting their portfolios. The environment is too risky, although high volatility during this period can make you some good money.

Most dangerous times to trade

Now, let’s consider the periods when it gets too risky to trade. You should obviously avoid trading during these times, if you don’t want to say goodbye to your funds.

The end of the week, namely Friday. It is difficult to predict market behavior on Friday’s trading session. This is one of those days when the majority of traders suffer losses. Why does this happen? The answer is very simple. Although some traders lock in their profits to safely leave for the weekend or close their trades to avoid larger losses on Monday, many traders on the contrary, enter the market to “jump on the last train” and make quick money. However, prices start going up and down, especially in the afternoon, which can cause substantial losses.

Holidays. Banks are usually closed on holidays, as a result, market activity is low. On holidays, the risk of losing your deposit increases, so it would be better for you to stay out.

No one can predict with a 100% certainty, where the price will move after the release of the news, statements or reports, especially if they are important. At this moment the price movement resembles the movement of a pendulum and its behavior is often chaotic. Of course, you can try to guess the direction of the market, and make good money. But trading this way is like playing in a casino, and everyone knows – the Forex market is not a game you can play.

As a rule, high-impact data on the economic calendar can influence the price and market behavior; such data can be viewed in the corresponding section on AMarkets online broker’s website. We recommend exiting the market 1.5 hour before the publication of reports and refraining from trading for about the same amount of time after the news is released.

It’s obvious that no trader can open trades 24 hours a day, at some point, he will need to step away from his computer and rest. That’s why it’s very important to be systematic and well organized to manage your working time wisely. Enter the market when it demonstrates good trade dynamics. This way, you’ll be able to better monitor market developments and identify successful trading instruments with the highest profit potential.

Author Profile

AMarkets CFD & Forex Online Broker

To open real account with AMarkets, Click Here.

To learn more about AMarkets, Click Here.

To contact AMarkets, Click Here.

Info

1831 Views 0 CommentsComments

Table of Contents

Recent

-

Bitcoin Fundamental Briefing, April 2024 Bitcoin Fundamental Briefing, March 2024 Demystifying Cryptocurrency Nodes: Deep Dive into Polygon Node Ecosystem Strategies for Trading Forex on a Budget Bitcoin Fundamental Briefing, February 2024 Bitcoin Fundamental Briefing, January 2024 Strategic Asset Allocation Techniques for Currency Traders Bitcoin Fundamental Briefing, December 2023