2020 in Review: 3 Key events of the past year worth recalling

With 2020 in the rearview mirror, we can finally look back and analyze this tremendous year. So much has changed in our lives, it’s just unbelievable:

- we started wearing masks (back in 2019, such an idea would seem ridiculous and absurd)

- we spent two months in a full lockdown

- many of us tried to work remotely for the first time

The list goes on. Without any doubt, the pandemic has changed people’s lives on a global scale. But apart from the novel coronavirus infection, there were many other interesting events that are worth recalling. Let’s take a closer look at the three key events of 2020 in this article.

- The Australian wildfires: AUD crash and recovery

- 2020 US Presidential Election and its impact on the financial market

- Oil wars

1. Australia’s wildfires: the collapse and recovery of the Australian dollar

Bushfires in Australia are seasonal. When they started in mid-2019, traders ignored them.

In early 2020, analysts estimated that fires had burnt roughly 47 million acres of land. This natural disaster of unprecedented scale caused Australian investors to start selling the AUD.

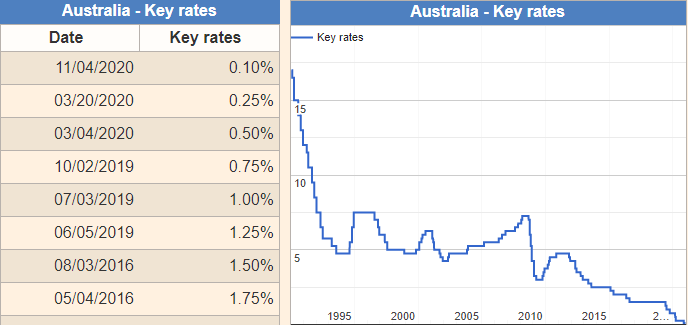

Traders hoped the government would cut the key rate to stimulate the economy after the disaster. And so it happened: The Reserve Bank of Australia lowered its key rate to a record low of 0.10%:

Note: The Aussie’s key rate is now at its record lows

When the RBA began to cut rates in March, the Aussie fell even lower against the US dollar. But when the key rate approached zero and the wildfires were finally extinguished, the AUD/USD pair began to grow rapidly:

The quarantine and bushfires reduced AUD value by -20%, but after the situation in the country and the world stabilized, the AUD/USD pair went up by + 40%. By the way, the Australian dollar keeps rising.

2. The president-elect of the United States

The election of the new US president was probably the most anticipated event of 2020.

Trump’s main rival was Joe Biden, a politician, senator and vice president under the Obama administration.

At first, a few believed in Biden’s victory. However, the same happened with Trump, when Hillary Clinton was about to take the place of President Obama, but it was Trump who seized the presidency after all.

Nevertheless, on November 3, the election results were announced: 51.3% voted for Biden. Of course, the market anticipated this result and began to react in advance.

The S & P500 index was flat for two months, but after Joe Biden’s victory was confirmed, it left its consolidation range and began to ascend:

At the same time, the US dollar weakened, while the Euro and the Japanese Yen rose in value.

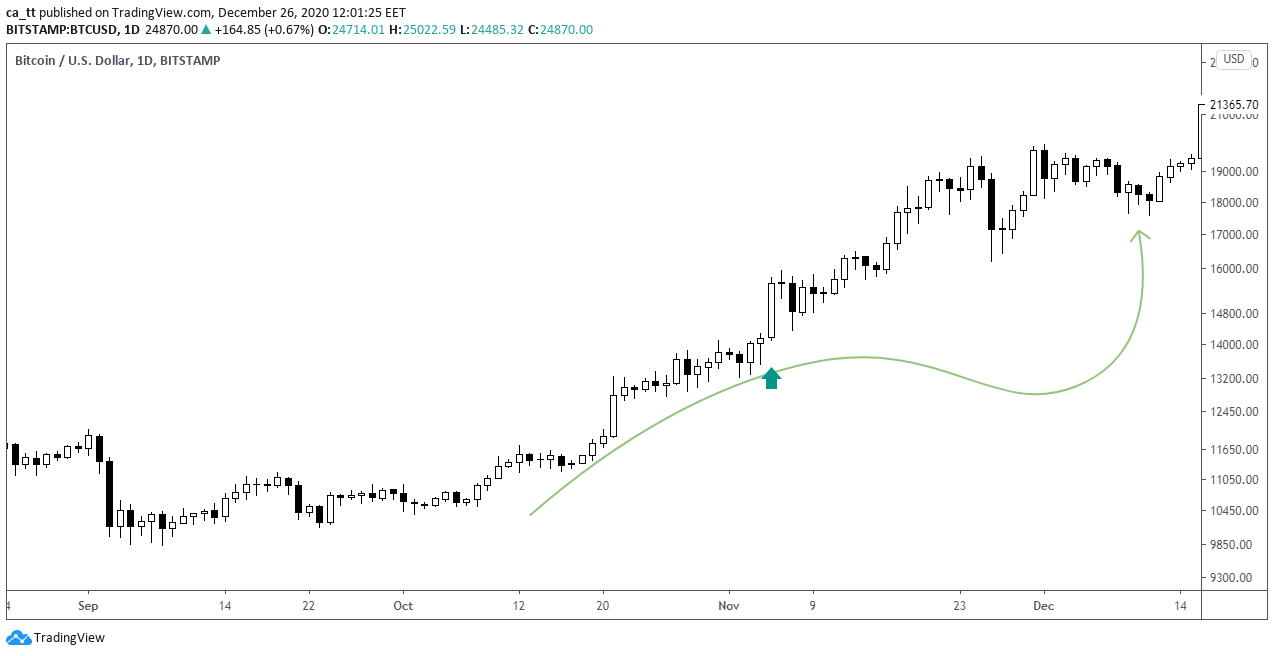

During the election time, investors were uncertain about the outcome, so they invested money in yen and bitcoin:

On the charts, we have highlighted the dates with the arrows when Biden’s victory was announced.

Now Trump is busy challenging election results in court. He is seeking to throw out voting results in several states. Meanwhile, President-elect Joe Biden is preparing for his inauguration on January 20, 2021.

3. 2020 Russia–Saudi Arabia oil price war

When quarantine and lockdowns started, the oil began to lose in value: it gradually slipped from $ 70 to $ 50 per barrel. The pandemic has caused investors to withdraw their money from oil futures and switch their attention to safer assets like gold, euro and yen.

On 5-6 March 2020, the OPEC meeting took place. The meeting was attended by oil exporting countries: representatives of Saudi Arabia, Africa, the United States and Russia.

For the first time in the history of OPEC, the members failed to agree on a massive supply cut. The United States and Saudi Arabia wanted to cut oil production to bring oil prices back to their previous levels while Russia said it wasn’t going along with further output cuts.

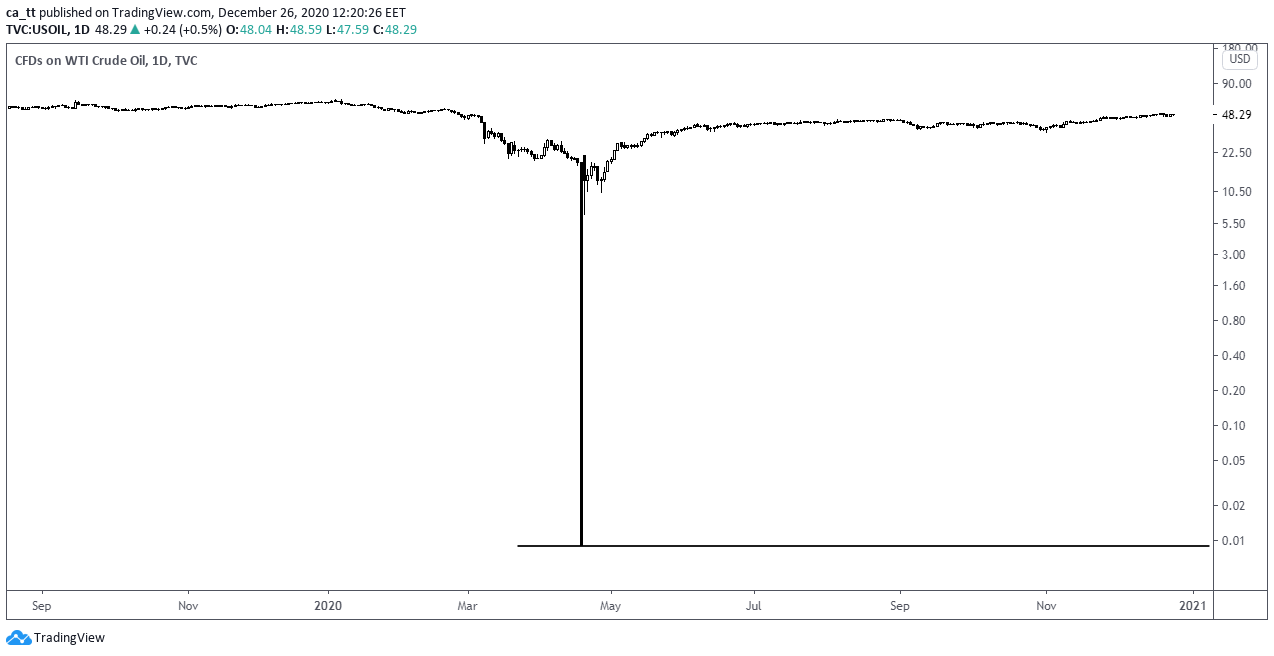

When the information about OPEC’s decision spread across mass media, the oil price collapsed: on March 9, the market opened 11% lower, at $33 mark. For the next two months, the prices for all oil brands plummeted:

- Brent oil dropped to $16

- Texas oil futures fell to – $37. For the first time in history, WTI crude prices went negative.

The charts show this historic drop in oil prices as the dip to zero:

Now, both WTI and Brent oil recovered and are now trading at around $ 50 per barrel, which is -25% lower than in the pre-pandemic levels.

Summing up

We remember 2020 as the year when we started wearing masks and washing our hands 20 times a day.

But not only our habits have changed, but also our life as we know it. We have faced more crises in one year than other people experienced in their lifetime.

The best we can do now is to learn from history. No crisis lasts forever. The Australian dollar, oil, bitcoin and the S & P500 all hit their rock bottom in 2020 and managed to recover. Some of them even updated new all-time highs.

All this leads to a simple conclusion:

Recession will be always followed by subsequent growth. The past 2020 has proved it.

Author Profile

AMarkets CFD & Forex Online Broker

To open real account with AMarkets, Click Here.

To learn more about AMarkets, Click Here.

To contact AMarkets, Click Here.

Info

171 Views 0 CommentsComments

Table of Contents

Recent

-

Bitcoin Fundamental Briefing, April 2024 Bitcoin Fundamental Briefing, March 2024 Demystifying Cryptocurrency Nodes: Deep Dive into Polygon Node Ecosystem Strategies for Trading Forex on a Budget Bitcoin Fundamental Briefing, February 2024 Bitcoin Fundamental Briefing, January 2024 Strategic Asset Allocation Techniques for Currency Traders Bitcoin Fundamental Briefing, December 2023