Sive Morten

Special Consultant to the FPA

- Messages

- 18,699

Sive, what is your perspective on it going through 3150 area? Seems like a close above 200 sma and 25x5 warrants pause in trading the confluence area. I am going to trade a small amount with my stop behind 2934 (61.8 fib). Let us know your thoughts though.

Hi Joshnix,

Personally I do not want to enter long. It is obvious that anything could happen, but probabilities suggests retracement and I do not want to struggle with it.

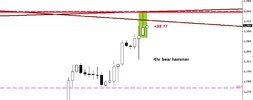

My trading plan - wait clear reversal pattern on daily around 1.2950-1.3130.

Currently to enter short is also not the case, since we do not have reasons for that. I think that when market struggles with daily overbought and creeping to monthly K-resistance better choice is to wait a bit.