- Forex, Gold, BTC Market Analysis | Trading Signals

- Sive Morten- Currencies, Gold, Bitcoin Daily Video

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

FOREX PRO Weekly November 05-09, 2012

- Thread starter Sive Morten

- Start date

-

- Tags

- indicator & signal

alexoptimistic

Private, 1st Class

- Messages

- 114

DRPO: what is it, please? (stupid question?) :|

Sive Morten

Special Consultant to the FPA

- Messages

- 18,676

Hello Mr. Morten!

I was very discouraged today because I missed the bearish move. The fact is that it was not difficult to go short. The price just revisited the 61.8 disrespected target. It was a DRPO lol Sell right in that area on M15, so in theory it should be easy.

Hi Georgeta,

you should not be upset by this. There will be another moves that you will catch.

The truth is that I cannot dream to go short on a strong up move like that but someone like you can do that. That is because you had a Bearish view all this time.

If you will get the relief by that - I also missed this move and I can't catch such sort of them.

But actually - we should be happy rather than upset. Why? Because we were with our trading plan. Our plan was to enter short from K-resistance and WPP. Market has not reached it, so we didn't enter. We have accomplished trading plan and were disciplined. That's much more important rather than missing of some curious move down.

How could you predict this move? Is it just the development of the Weekly flag? I dont know if I will ever be able to spot something like that. Is it all hopeless?

Actually, I do not quite understand about which particular move you are speaking from perspective of weekly time frame. Splash up on 4-hour chart was due completement of AB=CD pattern and there was 15-min butterfly Buy as well, I do not confuse something...

Anu,

I agree but we did not really even hit "price level" to join downward move.

After we had major thrust up, about 90 pips, and after just hitting 127.2% extension with ONE BAR on the 4hr chart, MOST would suspect (at least I did) upward move would continue, AT LEAST to 161.8 area + WPP and maybe even hitting k-resistance on 4hr.

The fact that there was ONLY ONE BAR UP and hitting 127.2% extension and then we see a 140 pip down move that has even retested the lows AND went below it is very interesting in my opinion.

Maybe Sive will have different opinion but for me, it was hard to join the downward move. It was very fast and unexpected.

At first, I thought it would just be a 3/8 retracement to 1.2840 level of the thrust up but obviously that was not the case.

I do not think it would have been logical to enter short @ 1.2870 area (which was the high) because:

1) ALL intraday charts bullish

2) ONE big thrust up and we hit target of 127.2% extension for hourly AB-CD.

3) Not yet touch WPP, or even minor 5/8 resistance, or even k-resistance on h4 - all these targets were ~25 pips higher

Also, for the DRPO, for me at least,I believe it also would have been hard to enter short based solely on that pattern because first of all, it was on 15 minute chart. Second of all, target of DRPO which was 1.2830 was INSIDE the 38.2 + 61.8 support of the swing up that we had during elections last night. This led me to believe that it could just be a retracement down to 3/8 support or MAYBE even to 5/8 support and then continue to the upside and eventually hitting 161.8% extension of hourly AB-CD, WPP, and k-resistance on 4hr TF.

Very good insight, Brandon. That were my thoughts either. Great discussion, guys.

As a conclusion - we have to stick with trading plan, and not to hunt after strong moves that stand beyond of trading plan. So, I have to say that we have to miss this move, rather to be upset by this fact.

Hi, Sive.

Thank you for the reply

I watched action of gold and euro that day, and as you said, there is some resemblance,

but it's very difficult to track it, especially for my level of knowledge,

and it's best to leave them separate

I have one fundamental question.

How should we look at the Bank of England decisions and overall GB economic situation ?

Of course, they make decisions for GBP, but GB is member of EU too.

Do their decisions or GB economic condition also have an impact on EUR ?

I understand that Germany and France have the most influence, but I can't put GB in EU picture correctly

Thank you.

Hi Pardus.

Actually I do not know

To be serious, I never investigate this, since most of my interest stands in relation of EUR to USD. In fact, I do not have any assets that are nominated in pounds. I suspect that changing of GBP policy will hardly have solid impact on EU economy, but mostly it will be expressed in move of EUR/GBP pair as it usually happens.

Hi Alex,DRPO: what is it, please? (stupid question?) :|

DRPO is Double Repenetration pattern - specific DiNapoli directional pattern. If you will use search tool, you, probably will find explanation here, since I've given it million of times. Or you can read it in DiNapoli Book "Trading with DiNapoli Levels."

I can hardly imagine that someone could follow Sive's advices and lose in the Forex market. He is very knowledgeable and extremely conservative.

Although I listen to him religiously every morning, but unfortunately, during the day the greed and stupidity put hand in hand and cause me open trades that are far away from what Sive has told me the same morning. :-((

Is there any person who follows Sive advices point by point?

If there is such a person, I would like to ask him sell me his signal.

I am sure among the thousands of traders who follow Sive, there are many like me.

If you are the one, please let me/us know. This could be a win win situation for everybody.

You could have an additional income beside your trades by sharing your signal. This will also cause you to stick even strickter to Sive's guidances.

Takers anyone? If for any legal reason this is against FPA's guidelines, we can form this community outside of FPA.

Bernard

Although I listen to him religiously every morning, but unfortunately, during the day the greed and stupidity put hand in hand and cause me open trades that are far away from what Sive has told me the same morning. :-((

Is there any person who follows Sive advices point by point?

If there is such a person, I would like to ask him sell me his signal.

I am sure among the thousands of traders who follow Sive, there are many like me.

If you are the one, please let me/us know. This could be a win win situation for everybody.

You could have an additional income beside your trades by sharing your signal. This will also cause you to stick even strickter to Sive's guidances.

Takers anyone? If for any legal reason this is against FPA's guidelines, we can form this community outside of FPA.

Bernard

squidge42

Corporal

- Messages

- 140

Sive or anyone.

Firstly thanks as ever for the insight, much appreciated.

Whilst I'm clear on retracement, I'd appreciate your thoughts on Fibo expansion/extension as I read conflicting guidance with patterns.

I understand Dinapoli targets as being 61.8, 100, 127.2 (unofficial) and 161.8 percent of an AB leg measured from point C.

If we take most guidance I've read on patterns (ABCD, butterflies etc)the extension or expansion is measured from point A, how do we determine which to use, the charts on here dont always make it clear.

Finally what constitutes a perfect BC retracement - some guidance say 61.8 , others say >23.6 <100, from my observation 50% seems best on Eur/Usd. and how strict should we be on matching time..I know Dinapoli doesn't really factor in time too much

Firstly thanks as ever for the insight, much appreciated.

Whilst I'm clear on retracement, I'd appreciate your thoughts on Fibo expansion/extension as I read conflicting guidance with patterns.

I understand Dinapoli targets as being 61.8, 100, 127.2 (unofficial) and 161.8 percent of an AB leg measured from point C.

If we take most guidance I've read on patterns (ABCD, butterflies etc)the extension or expansion is measured from point A, how do we determine which to use, the charts on here dont always make it clear.

Finally what constitutes a perfect BC retracement - some guidance say 61.8 , others say >23.6 <100, from my observation 50% seems best on Eur/Usd. and how strict should we be on matching time..I know Dinapoli doesn't really factor in time too much

Sive Morten

Special Consultant to the FPA

- Messages

- 18,676

Sive or anyone.

Firstly thanks as ever for the insight, much appreciated.

Whilst I'm clear on retracement, I'd appreciate your thoughts on Fibo expansion/extension as I read conflicting guidance with patterns.

I understand Dinapoli targets as being 61.8, 100, 127.2 (unofficial) and 161.8 percent of an AB leg measured from point C.

If we take most guidance I've read on patterns (ABCD, butterflies etc)the extension or expansion is measured from point A, how do we determine which to use, the charts on here dont always make it clear.

Finally what constitutes a perfect BC retracement - some guidance say 61.8 , others say >23.6 <100, from my observation 50% seems best on Eur/Usd. and how strict should we be on matching time..I know Dinapoli doesn't really factor in time too much

Hi Squidge,

well you've touched a bit delicate topic. The point is that all extensions and all "A" points are valid, but some of them has greater importance. This is a bit more art rather than science and demands experience. When you choose ABC try to understand how market moves, where it expanding and where it contracting. Thus, "A" points of expanding moves will give you more reliable ABC patterns.

Second, it depends on time. You can choose too large or wide ABC. May be it will work, but it will be beyond your trading plan scale.

Speaking about ratios - all of them important. 50% does work perfect on EUR/USD and I also like to use it. Other ratios just let you understand the power of the move. For example, if market shows thrust and just 0.382 retracement after that - you may take bet on 1.0-1.27, or even 1.618 AB-CD, while if retracement after thrust 0.618 - it's probably better count only on 0.618 extension or 1.0.

Last edited:

Sive I am looking ahead a little to see what to expect next week. I see that at current levels, unless we see a major reversal up that the weekly is about to cross below the MACDP. What I normally do with my trading plan is close my position on Friday before that happens and then enter short near a Fibo/retest of the MACDP. I have been short since 1.3020. The other thing I noticed is that Daily should be getting close to oversold. I only have the detrended oscillator which does not show price. If we see 1.2699-1.2668 today I will close and then sell again on a retrace to challenge the MACDP on the weekly. My short term (5 days) is at least a test of 1.26

Sive Morten

Special Consultant to the FPA

- Messages

- 18,676

Sive I am looking ahead a little to see what to expect next week. I see that at current levels, unless we see a major reversal up that the weekly is about to cross below the MACDP. What I normally do with my trading plan is close my position on Friday before that happens and then enter short near a Fibo/retest of the MACDP. I have been short since 1.3020. The other thing I noticed is that Daily should be getting close to oversold. I only have the detrended oscillator which does not show price. If we see 1.2699-1.2668 today I will close and then sell again on a retrace to challenge the MACDP on the weekly. My short term (5 days) is at least a test of 1.26

Hi Joshnix,

Reasonable plan. I do not have any position currently as well - wait how current week will end.

Synchronicity

Sergeant

- Messages

- 182

Hi BenOmI can hardly imagine that someone could follow Sive's advices and lose in the Forex market. He is very knowledgeable and extremely conservative.

Although I listen to him religiously every morning, but unfortunately, during the day the greed and stupidity put hand in hand and cause me open trades that are far away from what Sive has told me the same morning. :-((

Is there any person who follows Sive advices point by point?

If there is such a person, I would like to ask him sell me his signal.

I am sure among the thousands of traders who follow Sive, there are many like me.

If you are the one, please let me/us know. This could be a win win situation for everybody.

You could have an additional income beside your trades by sharing your signal. This will also cause you to stick even strickter to Sive's guidances.

Takers anyone? If for any legal reason this is against FPA's guidelines, we can form this community outside of FPA.

Bernard

Your request contains the seeds of its own destruction. “during the day the greed and stupidity put hand in hand “

It would be no different if someone sent you signals, in fact it would be worse because if you have read and understood Sives analysis you at least know why you should be choosing particular entry/exit points. If you blindly follow someone else’s signal you have no idea why so would be more prone to change what was planned.

If you read back this area of the forum you will see much discussion of the real secret to trading success. It is not all about pinpoint analysis. The correct mindset and discipline are essential too. Any system with a decent win/loss ratio can be made to work if traded well enough!

I suggest that you read Trading in the Zone by Mark Douglas. This will help you to eradicate all the negative behaviours and become what you seek to be – a consistently successful trader.

All the best

Michael

WaveRider

Master Sergeant

- Messages

- 350

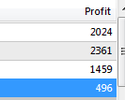

Thanks Sive. You did great this week. A few weeks ago, I read your article about scaling into a position. I saw this down trend coming by watching bond yield divergence and got in at near the top. Here are my open positions. The last one I closed today. On each of these I opened a small position, took some profit and moved stops to break even. Every rally, I opened another small position and did the same thing. This is the live account and they are going to keep running. Thanks for the advice and for your great service here.

Attachments

Similar threads

- Replies

- 1

- Views

- 67

- Replies

- 0

- Views

- 44

- Replies

- 11

- Views

- 299

- Replies

- 5

- Views

- 213

- Forex, Gold, BTC Market Analysis | Trading Signals

- Sive Morten- Currencies, Gold, Bitcoin Daily Video