SOLID ECN LLC

Solid ECN Representative

- Messages

- 514

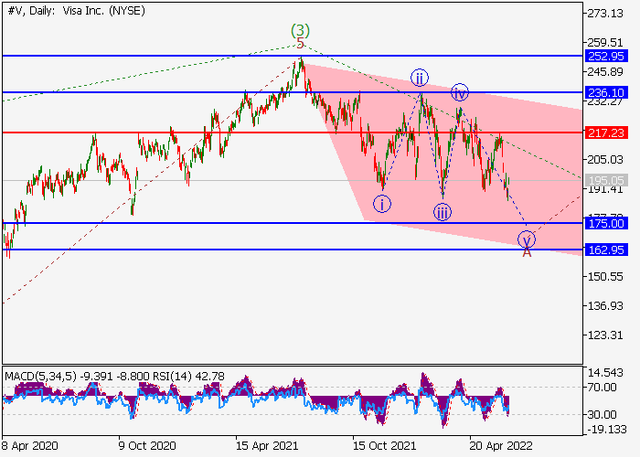

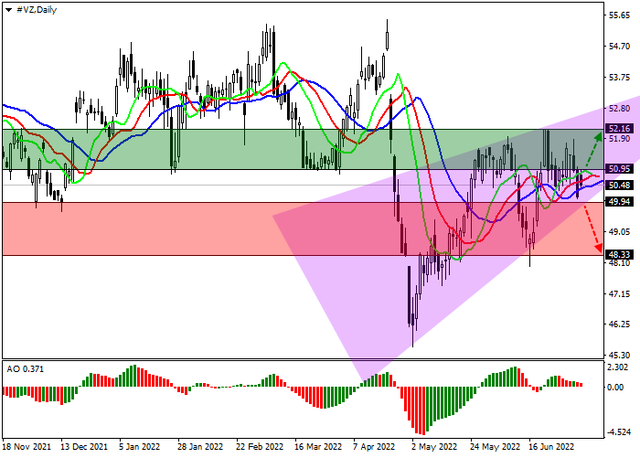

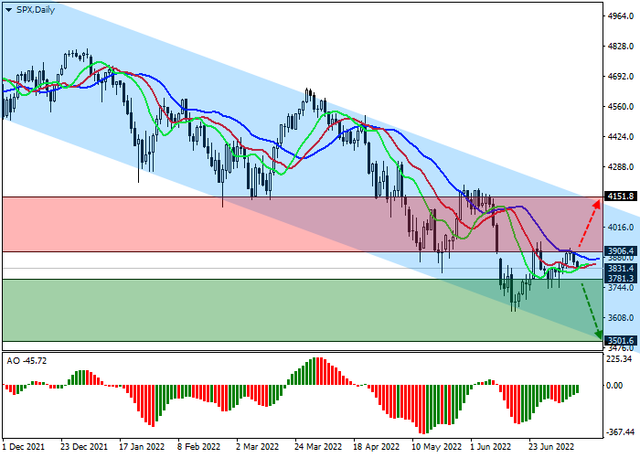

Visa - The price may fall

If the assumption is correct, the price of the asset will fall to the levels of 175 – 162.95. In this scenario, critical stop loss level is 217.23.