SOLID ECN LLC

Solid ECN Representative

- Messages

- 513

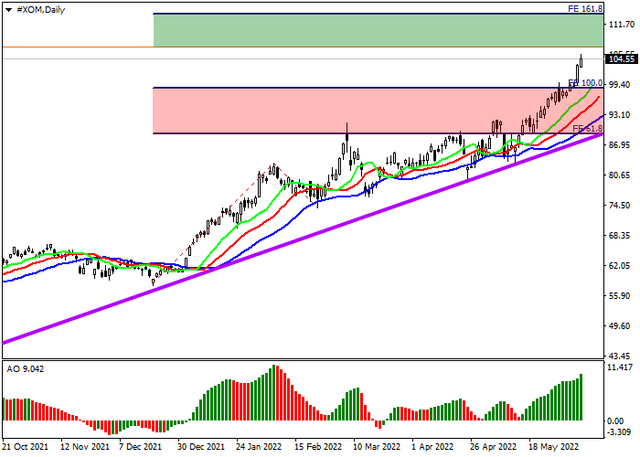

The shares of ExxonMobil Corp., one of the largest oil companies in the world, grew due to rising energy prices and are now trading near the level of 104.

An uptrend is forming on the daily chart of the asset, within which the rate renews global highs. The price has now broken the 100.0% underlying trend level of Fibonacci extension at 99.

On the 4-hour chart, it is seen that the global growth will continue soon, and the trading instrument will try to reach the full trend of 161.8% of the Fibonacci extension around 114. This scenario is supported by the readings of technical indicators: fast EMAs on the Alligator indicator expand the range of fluctuations, and the AO oscillator histogram forms rising bars high in the buying zone.