SOLID ECN LLC

Solid ECN Representative

- Messages

- 514

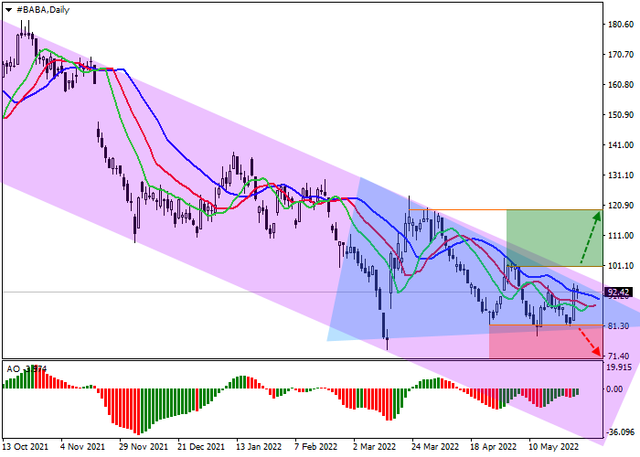

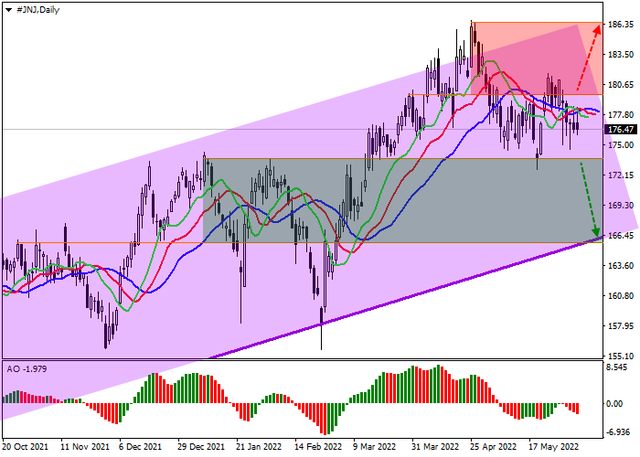

The shares of Alibaba Group Holdings Ltd., one of the largest companies in the world in the field of Internet commerce, are correcting, trading at 92. On the daily chart, a wide downwards channel with dynamic boundaries 70.00–100.00 is formed, within which the price is held for a long time near the resistance line, unsuccessfully trying to break it.

On the four-hour chart, the local Triangle pattern is formed, the upper border of which coincides with the resistance line of the global channel around 100.

At the moment, there is no clear signal from the indicators for the subsequent movement yet but, given the factor of the pattern, the growth potential prevails: fast EMA on the Alligator indicator is actively approaching the signaling line, and the histogram of the AO indicator forms upward bars.