ATFX-A Global Leader in Online Trading

ATFX Market Outlook, 2020 Feb 24

Personal opinions today:

U.S. manufacturing and services PMI unexpectedly fell in February. The preliminary reading of the U.S. Services PMI for February was 49.6. For the first time since 2018, the US services PMI fell below the 50-point boom-bust line, reflecting uncertainty about the outlook for the U.S. service sector. Dow futures fell as investor confidence faltered. This morning in Asia, Dow futures opened lower and gold surged higher.

The new coronavirus case is not over yet, and the global economy is uncertain. At the weekend meeting of the G20 economies meeting, most leaders called on the world's central banks to safeguard the economy. But the investment risk aversion sentiment continues to rise, the gold market has become one of the main hedging tools. Gold prices rose sharply today in Asia, hitting a seven-year high and crude oil prices fell.

First up today, ECB President (Christine Lagarde)speech followed by Germany's IFO business climate index for February. Investors are hoping for positive news on the Euro monetary policy for European currency. In the evening U.S. market session, keep an eye on Canada wholesale sales and the Dallas Fed business activity index. Gold prices have room to rise and crude oil prices to come downward as money flows into the safe-haven gold market ahead of tomorrow's release of Germany's Q4 GDP, the UK's February retail sales data and a speech by the Bank of England's chief economist and monetary policy committee looking at the limits on European currency gains.

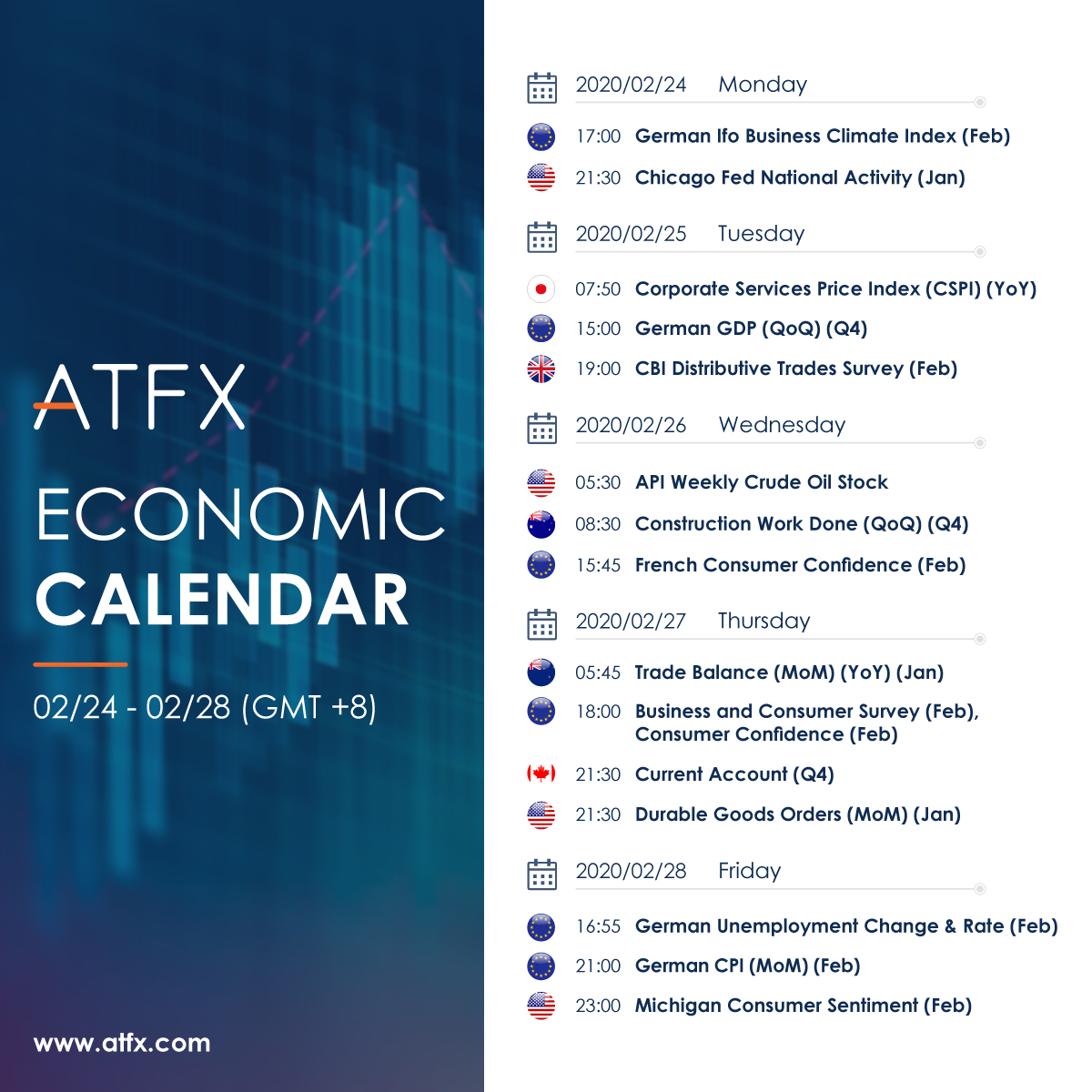

[Important financial data and events]

Note: * refers to the degree of importance

Japan Holiday, The Tokyo stock exchange was closed

16:20 ECB President Christine Lagarde speech ***

17:00 German IFO business climate index ***

21:30 Canada wholesale sales **

23:30 US Dallas Fed business activity index ***

EURUSD

1.0850/1.0860 resistance

1.0800/1.0790 support

Germany and the eurozone are unexpected to report a surprise rise in their preliminary PMI for manufacturing in February, which should bullish the Euro. Separately, U.S. manufacturing and services PMI fell in February, unnerving investors, while the U.S. dollar index fell and the euro rose against the dollar and euro-linked crosses, while indirectly bullish on the Swiss franc. Whether the Euro can rise against the dollar could be key in the afternoon when ECB President Christine Lagarde delivers a speech and Germany's February IFO business climate index. Technically, last week's high of 1.0860 resistance is one of the key resistance levels at present.

Pound to dollar

1.29701.2980 resistance

1.2890/1.2880 support

The UK manufacturing PMI beat market expectations in February, while the U.S. manufacturing and services PMI unexpectedly fell in February and British pound rebounded. For now, U.S. economic data for February are likely to remain weak, and the British government will formally discuss a deal with the European Union's Brexit committee. If the EU accepts the Brexit deal, it could bullish the pound. The British pound is still expected to be pulled by economic data from the UK and US and is still expected to consolidate between 1.28 and 1.29, with significant resistance to 1.2980 seen above. Believe, wait for really good UK news, the pound is expected to test the 1.31 or 1.32 levels.

Australian dollar

0.6630/0.6640 resistance

0.6590/0.6580 support

The RBA issued minutes of its monetary policy meeting, it was considering further interest rate cuts to stimulate the economy. In addition, Australia's weak job data, the strong dollar trend further bearish the Australian dollar. Fundamental and technical analysis changes the direction of the Australian dollar against the U.S. dollar, the Australian dollar is expected to continue to lower the U.S. dollar during this period, also indirectly bearish on the New Zealand dollar. Keep an eye on U.S. economic data this week. If U.S. economic data continues to be weak in February, the U.S. dollar will fall and the Australian and New Zealand dollars will gain.

Dollar to yen

111.85/112.05 resistance

111.25/111.15 support

U.S. manufacturing and services PMI unexpectedly fell in February, shaking investor confidence and sending Dow futures and the Nikkei down, with the dollar following the yen. In addition, investors need to pay attention to Japan's fiscal year settlement, corporate capital repatriation to Japan. In the past, demand for yen funds has risen and the dollar could reverse its decline to 109 against the yen at any time. Currently, technical resistance is at 112. Dow Jones industrial average futures rose without a surge in U.S. economic data. It is recommended to keep an eye on the risk of the dollar falling against the yen at any time.

USDCAD

1.3280/1.3290 resistance

1.3230/1.3220 support

As crude oil prices rise, the Canadian dollar gains. On the contrary, the current global economic uncertainty, crude oil prices did not rise further, bearish on the Canadian dollar. Separately, the U.S. dollar rebounded against the Canadian dollar after Canada reported weak retail sales data for January. Estimated tonight Canadian wholesale data forecast value, bearish on the Canadian dollar, USDCAD would test the 1.3280 or 1.3290 resistance again. Early, OPEC announcement to step up production cuts could boost oil prices, potentially indirectly, the Canadian dollar. The U.S. dollar could test $1.3220 against the Canadian dollar.

US crude oil futures

52.40/52.65 resistance

50.15/49.90 support

U.S. manufacturing PMI fell in February, hurting crude oil prices. If OPEC comes up with an early agreement on the content and extent of the cuts and meets to discuss them on March 6, it is believed that prices could stabilize. Technically, crude oil prices has broken support at $52.55, believing it has an opportunity to test the $50 level. The current resistance level is $52.65.

Gold

1679/1681 resistance

1651/1649 support

Low-interest rates and loose monetary policy by Central Banks around the world have boosted demand for gold as a safe haven and hedge. Moreover, U.S. manufacturing and services PMI fell in February, Dow futures fell and money flowed into gold, which surged above $1,650 after rising to $1,680 before adjusting sharply. However, it is believed that at $1680 or above, a large number of short positions coming. On Wednesday, U.S. new home sales and Q4 GDP data on Thursday are expected to support U.S. economic growth forecasts and limit gold's gains. Investors are more likely to take the opportunity to adjust to gold prices.

U.S. Dow Jones industrial average futures US30

28880/29050 resistance

28545/28380 support

U.S. manufacturing and services PMI unexpectedly fell in February, while Dow futures fell. Earlier this analysis pointed out that the federal reserve announced the reduction of the scale of bond purchases, reducing the market liquidity, adverse to financial markets. And uncertainty about the global economy sent Dow futures lower. For now, U.S. data for February and the global mood are unnerving markets. If Dow futures break 28880 resistance, expect to test 29059 resistance and up. But important support breaks 28790, so wait for 28545 or 28380 support.

BTCUSD:

10255 / 10555 resistance

9850 / 9650 support

Investors worried the federal reserve to reduce the size of the purchase of bonds, the market liquidity reducing, affecting the financial markets and US economic growth. During the Dow future fell after US manufacturing and services PMI fell unexpected, the bitcoin test rebounded. If Dow future keeps downward, the bitcoin would be upward.

Enjoy trading! The content is for reference only. Please do ensure that you understand the risk.

Registered Australian Accountant/ Certified Professional Manager / Certified Financial Advisor Experienced Investor / Media Market Commentator Martin Lam has Over 17 years’ experience in global investment market. Familiar with the worldwide stock indices, precious metals such Gold and Silver, Crude oil and Forex. He operated Martin Currency Trading Company and had partnership with a number of well-known international financial corporations and institutions. Before he join ATFX, he was TeleTrade Greater China development and Sales Director. Mr. Lam attends Hong Kong Now TV and China CCTV finance channel once a week. He also had regularly invited by different media, such as DBC Digital Financial Channel, Hong Kong Economic Times, The Standard, Ming Pao to share his experience to trade in Forex, Precious metals, Crude oil and worldwide stock indices

Legal: AT Global Markets Limited (ATGM, registration number 24226 IBC 2017). ATGM is an International Business Company in Saint Vincent and the Grenadines.