NanoAlpha

Private

- Messages

- 26

Like I said before, the 5 sec are not a problem at all. You can GUARANTEE not to be hit with a spike in those 5 sec. But I don't expect you to figure it out how.However you want to explain it, there's no trick nothing, does not matter if candles or ticks, simply you get the price you want or trading on 5 seconds interval is PURE GAMBLING and you'll be trading BO as if playing in the Casino as Pharaoh suggests.

Unlink you, I've done hundreds of test trades on their demo platform, and I know EXACTLY how they work, to the smallest detail. And some stuff is not written on the site.

But you are right, trading BO for the average trader is pure gambling. Just like playing black-jack is pure gambling for the average punter.

But for a card-counter, black-jack is a money making machine, since the odds are turned against the casino. For BO it's the same thing, for a BO card counter, the edge is even more massively in favor of the trader.

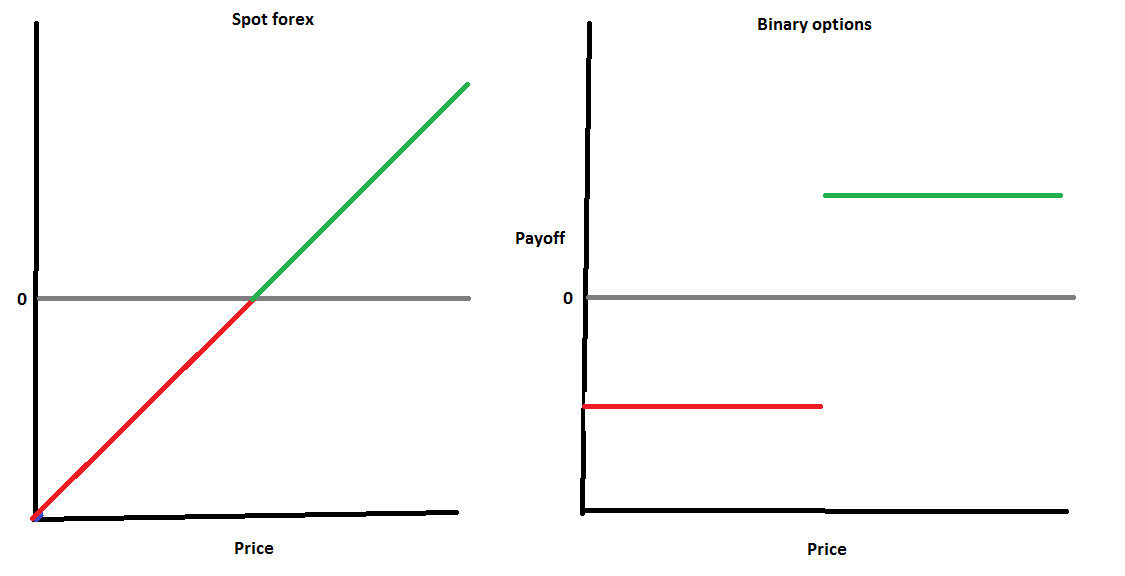

The standard retort is then "well, if you can predict prices, why not play pure forex where there are many honest brokers and no limits at all"? This retort can only come from someone who views BO as pretty much the same thing as spot forex, just with slight differences. Such a person doesn't understand the fundamental non-linearities underlying BO, which makes winning at it like shooting fish in a barrel, unlike spot forex.

The only reason why card-counters (quants) didn't descend yet on BO is because all the BO brokers are obvious scams. Dukas is the first one that might truly pay. We'll see.