Zforex

zForex.com Representative

- Messages

- 30

"Central Bank Calls for Rate Hikes to Tackle Inflation as Global Markets React"

Fed officials, stressed the importance of implementing additional rate hikes to tackle inflation and achieve the central bank's targets in their speeches on Monday. Mary Daly, President of the Federal Reserve Bank of San Francisco, expressed the likelihood of needing "a couple more rate hikes over the course of this year." Similarly, Loretta Mester, Cleveland Fed President, emphasized the significance of higher rates to maintain sustainable inflation and suggested that the funds rate should rise further and stabilize to gather more economic information. Fed Vice Chair for Supervision Michael Barr highlighted the need for caution and resilience by advocating for increased capital for large U.S. banks.

Meanwhile, in Asia, investors await concrete measures from Beijing to strengthen the country's sluggish recovery, as China's struggling economy continues to impact markets. Chinese state-run financial newspapers have indicated potential property support policies and initiatives to improve business confidence.

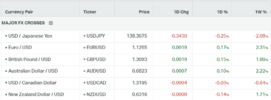

In the UK, wage growth data, which Bank of England Governor Andrew Bailey noted is contributing to inflation, underscores the pressure for higher interest rates. This data will play a crucial role in shaping the central bank's decision on rates in August, and the pound has reached its highest level against the dollar since April 2022.

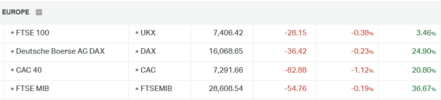

Additionally, Germany's annual inflation rate for June 2023 was confirmed at 6.4%, rebounding from May's low of 6.1%. After three months of deceleration, inflation has slightly risen again, primarily driven by food prices. This data suggests that inflation in the EU may remain persistent, potentially leading the European Central Bank to consider further rate increases.

Market anticipation is centered on tomorrow's U.S. Consumer Price Index (CPI) data, which will provide insights into the direction of inflation and influence the Federal Reserve's decisions in upcoming meetings, given that the possibility of two rate hikes remains.

Visit Website: https://zforex.com/

Fed officials, stressed the importance of implementing additional rate hikes to tackle inflation and achieve the central bank's targets in their speeches on Monday. Mary Daly, President of the Federal Reserve Bank of San Francisco, expressed the likelihood of needing "a couple more rate hikes over the course of this year." Similarly, Loretta Mester, Cleveland Fed President, emphasized the significance of higher rates to maintain sustainable inflation and suggested that the funds rate should rise further and stabilize to gather more economic information. Fed Vice Chair for Supervision Michael Barr highlighted the need for caution and resilience by advocating for increased capital for large U.S. banks.

Meanwhile, in Asia, investors await concrete measures from Beijing to strengthen the country's sluggish recovery, as China's struggling economy continues to impact markets. Chinese state-run financial newspapers have indicated potential property support policies and initiatives to improve business confidence.

In the UK, wage growth data, which Bank of England Governor Andrew Bailey noted is contributing to inflation, underscores the pressure for higher interest rates. This data will play a crucial role in shaping the central bank's decision on rates in August, and the pound has reached its highest level against the dollar since April 2022.

Additionally, Germany's annual inflation rate for June 2023 was confirmed at 6.4%, rebounding from May's low of 6.1%. After three months of deceleration, inflation has slightly risen again, primarily driven by food prices. This data suggests that inflation in the EU may remain persistent, potentially leading the European Central Bank to consider further rate increases.

Market anticipation is centered on tomorrow's U.S. Consumer Price Index (CPI) data, which will provide insights into the direction of inflation and influence the Federal Reserve's decisions in upcoming meetings, given that the possibility of two rate hikes remains.

Visit Website: https://zforex.com/