Investizo

Investizo Representative

- Messages

- 7

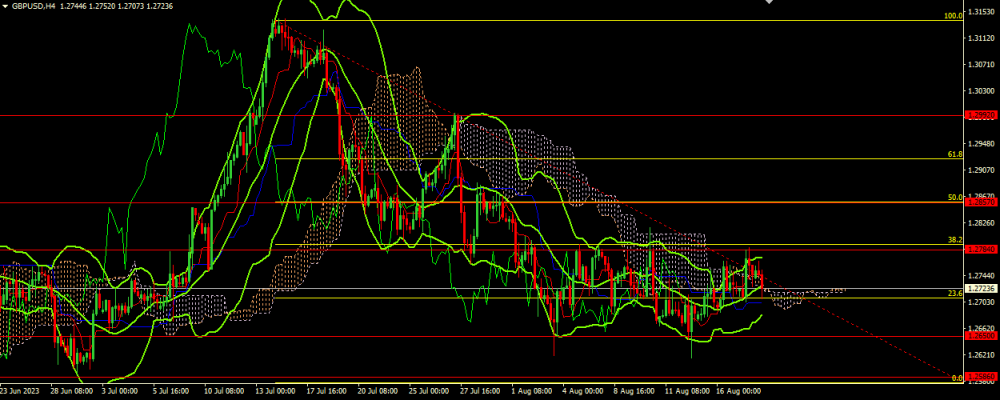

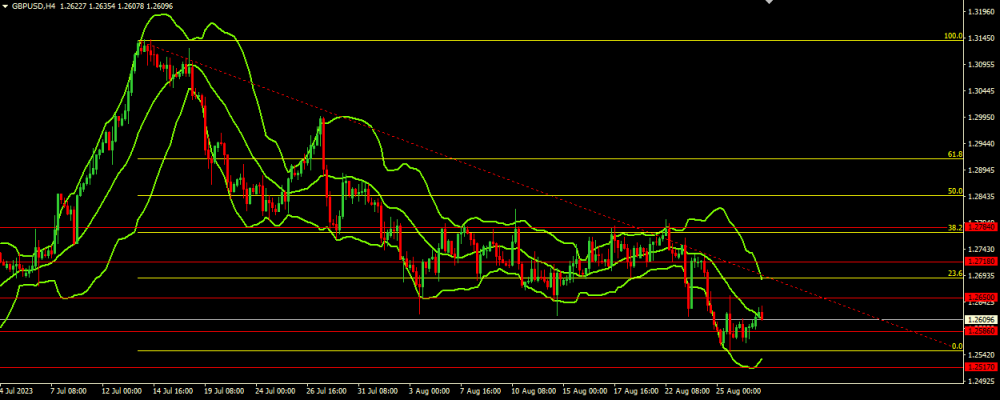

Fundamental analysis of GBP/USD

The GBP/USD pair is trading around 1.26900, recovering from a one and a half month low as traders await the release of important economic data from the UK and the US. This small rally comes despite a cautious atmosphere in global markets and uncertainty surrounding major risk events.

Read more

The GBP/USD pair is trading around 1.26900, recovering from a one and a half month low as traders await the release of important economic data from the UK and the US. This small rally comes despite a cautious atmosphere in global markets and uncertainty surrounding major risk events.

Read more