Investizo

Investizo Representative

- Messages

- 7

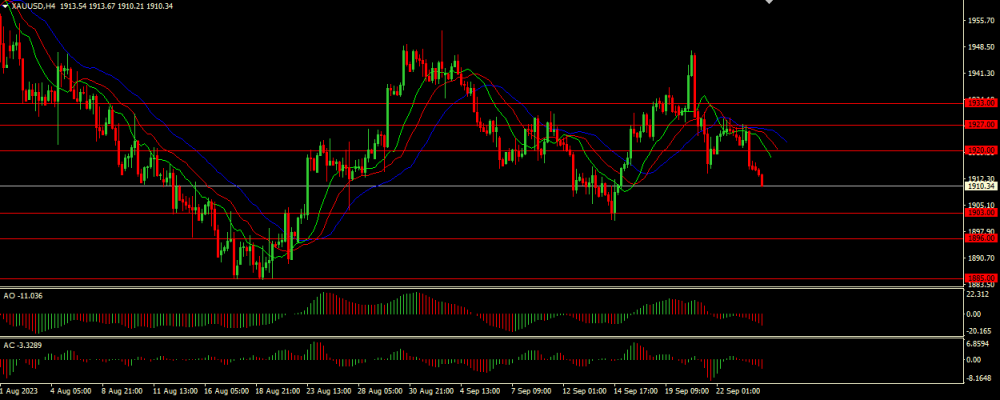

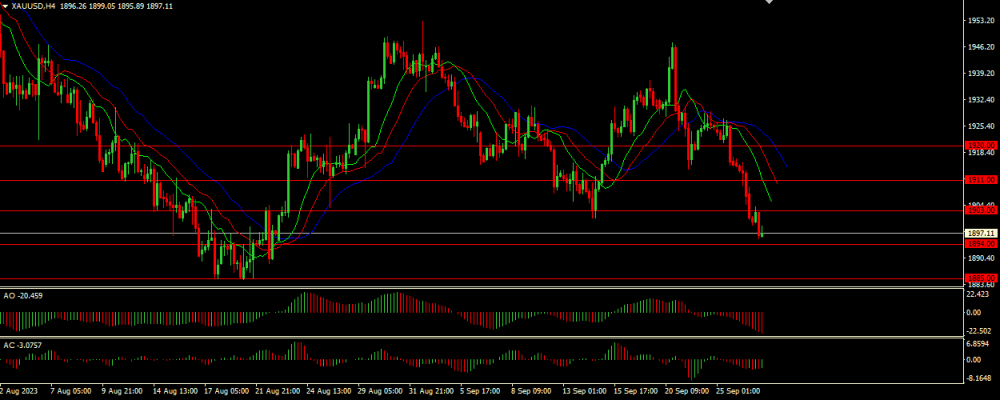

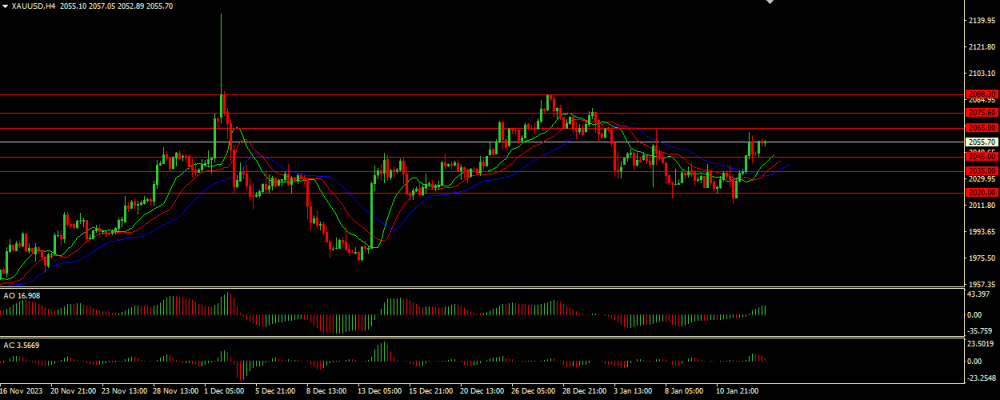

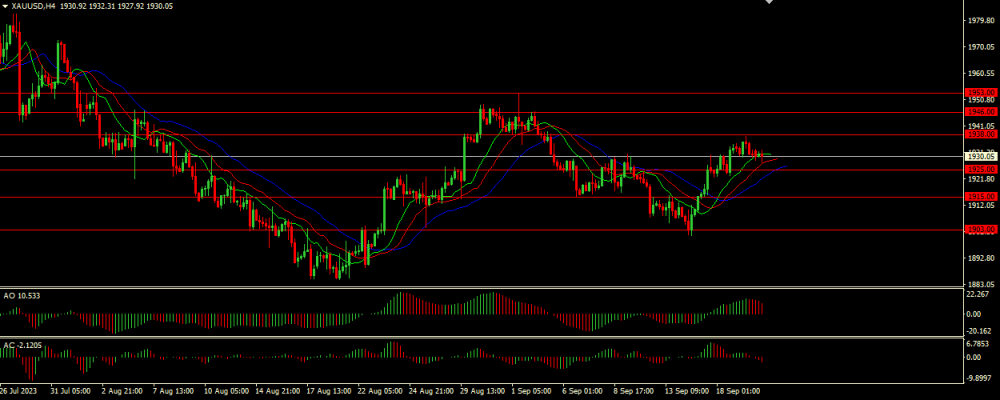

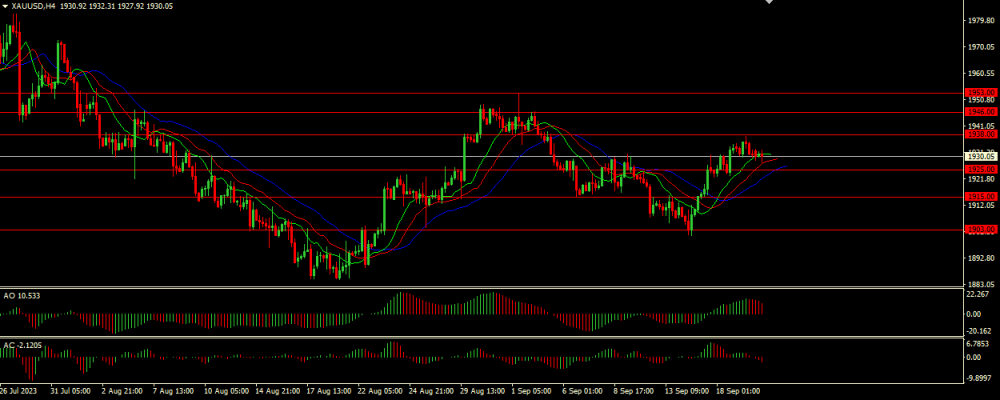

Fundamental analysis of XAU/USD

On Wednesday, gold prices are holding near 1930.00.Public opinion believes that the Fed will maintain current interest rates, but concerns are growing about the possibility of an interest rate hike later this year. Treasury yields remain stubbornly high, suggesting that the market expects a hawkish but passive stance from the Fed. The complexity of the outlook is compounded by rising oil prices and comments from Treasury Secretary Janet Yellen, who emphasized the need to adjust U.S. economic growth and potential interest rates to achieve the inflation target. This economic situation suggests that interest rates may continue to rise over time. The Fed's tightening stance could put downward pressure on gold prices, especially in light of recent U.S. economic data releases.

Read more

On Wednesday, gold prices are holding near 1930.00.Public opinion believes that the Fed will maintain current interest rates, but concerns are growing about the possibility of an interest rate hike later this year. Treasury yields remain stubbornly high, suggesting that the market expects a hawkish but passive stance from the Fed. The complexity of the outlook is compounded by rising oil prices and comments from Treasury Secretary Janet Yellen, who emphasized the need to adjust U.S. economic growth and potential interest rates to achieve the inflation target. This economic situation suggests that interest rates may continue to rise over time. The Fed's tightening stance could put downward pressure on gold prices, especially in light of recent U.S. economic data releases.

Read more