syamfx2020

Recruit

- Messages

- 0

Global equity markets slid lower today after the disappointing August services PMI readings from China and European regions. China pointed to a bigger-than-expected slowdown in services activity. The Caixin services purchasing managers' index in August increased by 51.8, which was less than the 53.6 reading that was predicted and the 54.1 reading from July. Eurozone area Services PMI drops to 47.9 in August from 50.9 in July, marking the fastest decline since Nov 2020. Services PMI in France decreased to 46 points in August from 47.1 points in July of 2023.

EQUITIES

US stock futures started the new week of trading on a mixed note as the markets are unsettled by swings in volatility caused by the latest US NFP and ISM PMI data released on Friday. While investors also started to bet on one more interest-rate hikes from the Federal Reserve following the hawkish comments from Fed President Mester. Moving ahead to the North American session, the investors should also closely monitor the release of US factory orders data.

OIL

Crude oil futures slightly reversed from the multi-month highs after the China service sector activity fell to an eight-month low in August. The key data for the oil prices rest of this week will once again be the weekly crude inventory report from API and EIA, the movement of the US dollar and the FED policymaker's comments.

CURRENCIES

In the currency market, EURUSD extended the slide and hit a fresh 12-week low 1.0759 driven by weaker-than-expected service PMI data from Eurozone and France. Meantime, European Central Bank (ECB) Chief Economist Philip Lane expressed cautious optimism that inflation is slowing but needs much more data to confidently declare victory. On the other hand, the Australian dollar plunged against the major currencies after the RBA decided to leave the cash rate target unchanged.

GOLD

The precious metal slipped to a fresh session low of $1933 and the upside pressure clearly weakened amid a solid ceiling in place due to broad-based dollar strength. The bearish sentiment was also fueled by hawkish comments from Cleveland Fed President Mester. "In the labor market, some progress is being made in bringing demand and supply into better balance, but the job market is still strong," Mester said.

Economic Outlook

On the data front, Reserve Bank of Australia (RBA) decided to leave the cash rate target unchanged at 4.10%. The central bank reiterated that some further monetary tightening may be needed to bring back inflation to the target range of 2 to 3% in a reasonable timeframe. RBA Governor Philip Lowe stated that higher interest rates are working towards achieving a more balanced economy, and due to the uncertain economic outlook.

Technical Outlook and Review

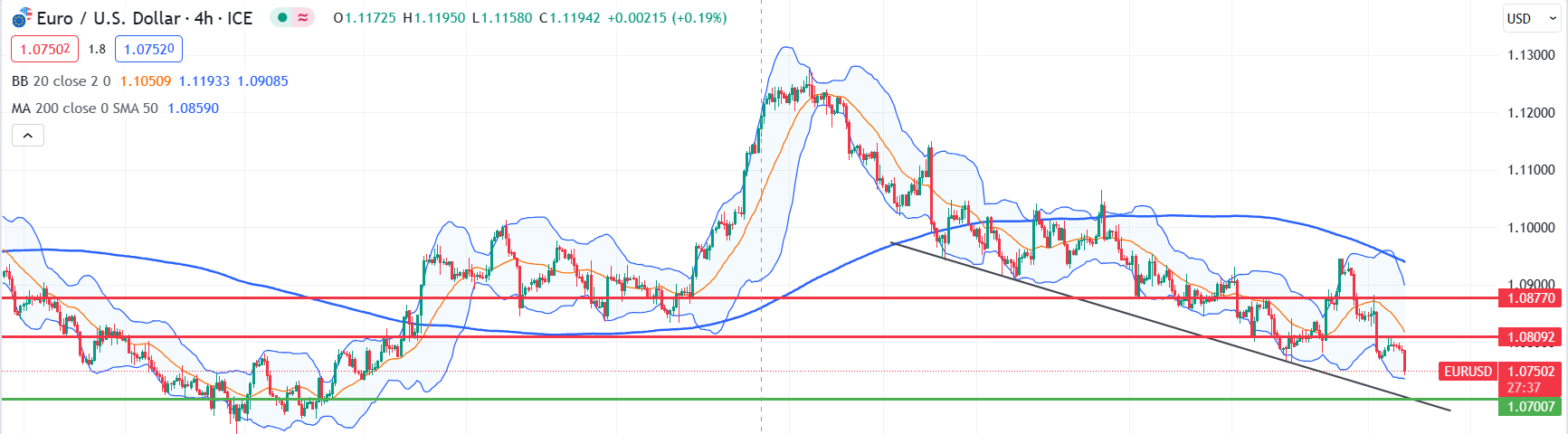

EURUSD: Technically the current price action signals suggest that the medium-term bearish trend remains intact. For today, the next key support level is located at 1.0700. On the upper side, 1.0800 is the first immediate resistance zone to watch for today, if the pair breaks and closes above this area then the next supply level to watch is around 1.0830/40.

The important levels to watch for today: Support- 1.0730 and 1.0700 Resistance- 1.0770 and 1.0800.

GOLD: The precious metal remains under pressure a clear breakdown of the support at $1930 could open space for further declines while only recovery to $1952 would reverse the short-term negative trend.

The important levels to watch for today: Support- 1928 and 1924 Resistance- 1945 and 1940.

Quote of the day – My experience with novice traders is that they trade three to five times too big. They are taking 5 to 10 percent risks on a trade when they should be taking 1 to 2 percent risks - Bruce Kovner.

EQUITIES

US stock futures started the new week of trading on a mixed note as the markets are unsettled by swings in volatility caused by the latest US NFP and ISM PMI data released on Friday. While investors also started to bet on one more interest-rate hikes from the Federal Reserve following the hawkish comments from Fed President Mester. Moving ahead to the North American session, the investors should also closely monitor the release of US factory orders data.

OIL

Crude oil futures slightly reversed from the multi-month highs after the China service sector activity fell to an eight-month low in August. The key data for the oil prices rest of this week will once again be the weekly crude inventory report from API and EIA, the movement of the US dollar and the FED policymaker's comments.

CURRENCIES

In the currency market, EURUSD extended the slide and hit a fresh 12-week low 1.0759 driven by weaker-than-expected service PMI data from Eurozone and France. Meantime, European Central Bank (ECB) Chief Economist Philip Lane expressed cautious optimism that inflation is slowing but needs much more data to confidently declare victory. On the other hand, the Australian dollar plunged against the major currencies after the RBA decided to leave the cash rate target unchanged.

GOLD

The precious metal slipped to a fresh session low of $1933 and the upside pressure clearly weakened amid a solid ceiling in place due to broad-based dollar strength. The bearish sentiment was also fueled by hawkish comments from Cleveland Fed President Mester. "In the labor market, some progress is being made in bringing demand and supply into better balance, but the job market is still strong," Mester said.

Economic Outlook

On the data front, Reserve Bank of Australia (RBA) decided to leave the cash rate target unchanged at 4.10%. The central bank reiterated that some further monetary tightening may be needed to bring back inflation to the target range of 2 to 3% in a reasonable timeframe. RBA Governor Philip Lowe stated that higher interest rates are working towards achieving a more balanced economy, and due to the uncertain economic outlook.

Technical Outlook and Review

EURUSD: Technically the current price action signals suggest that the medium-term bearish trend remains intact. For today, the next key support level is located at 1.0700. On the upper side, 1.0800 is the first immediate resistance zone to watch for today, if the pair breaks and closes above this area then the next supply level to watch is around 1.0830/40.

The important levels to watch for today: Support- 1.0730 and 1.0700 Resistance- 1.0770 and 1.0800.

GOLD: The precious metal remains under pressure a clear breakdown of the support at $1930 could open space for further declines while only recovery to $1952 would reverse the short-term negative trend.

The important levels to watch for today: Support- 1928 and 1924 Resistance- 1945 and 1940.

Quote of the day – My experience with novice traders is that they trade three to five times too big. They are taking 5 to 10 percent risks on a trade when they should be taking 1 to 2 percent risks - Bruce Kovner.