NFP Preparation

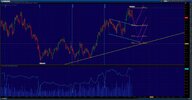

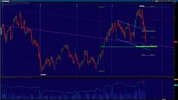

I attach May's NFP picture and an updated picture for tomorrow's session. Will it happen again?, possibly but I'm sure I'm not the only one noticing this pattern, therefore one day it might blow the account of those who take it for granted.

Anyway I think it can be a good guide. If the pattern repeats and I happen to be inside the trade, perhaps is a good opportunity to leave 1/2 of the position as a runner

Last month the NFP behaved a little strangely and I only operated the the JPY. Lets hope this time it behaves better.

I only know one way to trade the NFP with some degree of control:

- placing the trade after the news,

- wait for the stop grabbing manoeuvre and the main impulse to end (4-6 minutes)

- Enter at the 50f 61f retracement of the main impulsive on a pattern (pinbar or engulfing)

- target 127f, 161f. If tomorrow we get a trust down I will only take 1/2 at 161f extension. The rest I will leave as a runner

If anyone knows a different technique it would be great if the can share it

It works most of the time, but last month it didn't give an entry on the EURUSD; in fact, price retrace up the entire trust down.