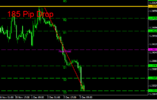

So we did get the close below the 1.2595 and the trend did change, so I am looking for trades to the down side on the EUR/USD. We've gotten about a 75 pip pullback from the bottom, but I think that the down cycle has completed. So I am going to wait for the 4 hr. Chart to become overbought before I entertain the idea of taking the short on this pair.

It is looking like it has a ways to go and according to my time-based indicator the drop won't occur until Tuesday at around 16:00 - 18:00, but that indicator has been known to be wrong. Nevertheless I'm going to be patient and wait for this pair to setup. I am looking at the 1.2550 level for the short, but again only if the technical are setup.

It is looking like it has a ways to go and according to my time-based indicator the drop won't occur until Tuesday at around 16:00 - 18:00, but that indicator has been known to be wrong. Nevertheless I'm going to be patient and wait for this pair to setup. I am looking at the 1.2550 level for the short, but again only if the technical are setup.