Jason Rogers

FXCM Representative

- Messages

- 517

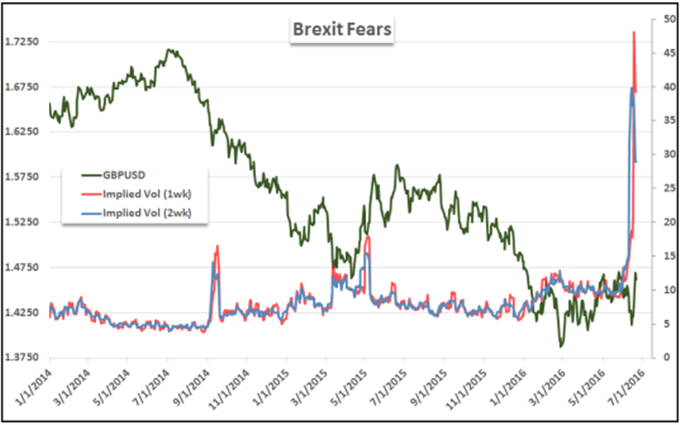

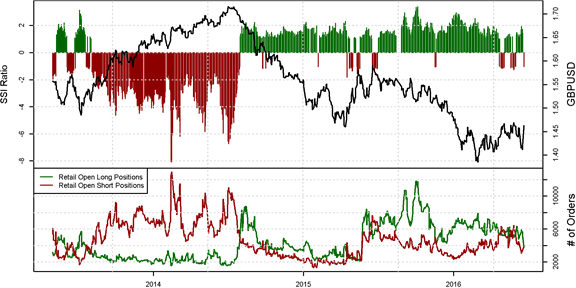

Retail Crowd Flips Positioning in GBP/USD on Approach to Brexit Vote

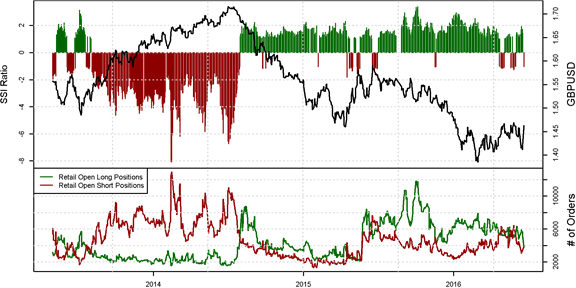

The Speculative Sentiment Index (SSI) is a contrarian indicator to price action, and the fact that the majority of traders are short gives signal that the GBP/USD may continue higher. The ratio of long to short positions in GBP/USD stands at -1.05 as 49% of traders are long.

The trading crowd has flipped from net-long to net-short from Friday and last week. On Friday, the ratio was 1.45; 59% of open positions were long.

Long positions are 25.6% lower than on Friday and 33.0% below levels seen last week. Short positions are 13.0% higher than on Friday and 18.9% above levels seen last week. The combination of current sentiment and recent changes gives a further bullish trading bias.

The Speculative Sentiment Index (SSI) is a contrarian indicator to price action, and the fact that the majority of traders are short gives signal that the GBP/USD may continue higher. The ratio of long to short positions in GBP/USD stands at -1.05 as 49% of traders are long.

The trading crowd has flipped from net-long to net-short from Friday and last week. On Friday, the ratio was 1.45; 59% of open positions were long.

Long positions are 25.6% lower than on Friday and 33.0% below levels seen last week. Short positions are 13.0% higher than on Friday and 18.9% above levels seen last week. The combination of current sentiment and recent changes gives a further bullish trading bias.