The_onesie_trader

Private, 1st Class

- Messages

- 30

i forgot about this. Which VPS provider do you use? It is extremely rare for vps provider to go down. When recording, you would record with another [reliable] broker's live account side by side or cascaded to show the connection was working with other brokers. Also you could have a browser window open with the recording. Refresh manually or a website that tracks internet connectivity.

the vps was the one the provide for free when u do enough lots,, forexvps.net/kb

https://www.forexvps.net/kb

I would advise traders to always manage their take profit and stop losses privately (manually or using EA). This requires an always-on computer (vps) Setting your stop loss and tp with your broker is just asking for asymmetric slippage. If it was an exchange or a "real" ecn where the stops/limits are triggered fairly, following strict rules that applied to everyone equally, and with post-trade reporting available, then ok. But 99% of mt4 broker (including a-book) I would handle TP/SL myself and submit everything as a market order.

I try and use a ea so no hard stops as when I was trading heavier around 100 lots open at once id get targeted by spread so id just let the ea handle the risk

I was hoping you would attach the text logs of the complete session....Or at least the times when the trades were opened and when they were closed. Can you show the screenshot journal log record of when you entered/opened those two trades?

Also attach the trading history (all tabs showing, disable "auto-arrange" and resize if needed) of the two auto-closed trades.

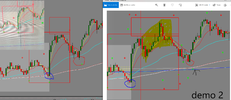

attached is the journal for the day over laps by a few entrys so nothing missing.. they where the last 2 trades placed at where the highlighted blue bit is attached is also myfx book history on last account before games where played.. I had the same issues as I have with ic markets in the end.. would freeze my feed and cause my ea to play games..

strange thing at my last broker was my account manger had left (sacked) I noticed feed issues a lot then one day I was frozen for 2 15m candles while I went 50 pips in profit then pulled the market away my stops where infront yet didn't honour them for 50 pips.. they then unfroze the charts changed candles 3 times and currently speaking with them about there manipulation..