Stan NordFX

NordFX Representative

- Messages

- 712

Forex Forecast and Cryptocurrencies Forecast for March 02 - 06, 2020

First, a review of last week’s events:

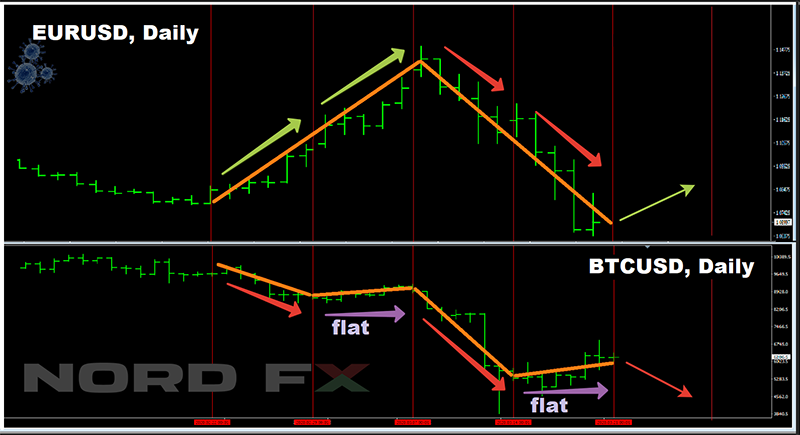

- EUR/USD. The situation in the financial markets is completely under the control of the coronavirus for many weeks in the run. And if many traders in 2019 complained about the lowest volatility of the EUR/USD pair in the history of its existence, the situation has changed dramatically in 2020. Yhe amplitude of its fluctuations exceeded 200 points last week alone, and the growth of the euro on Thursday 27 February was the fastest since May 2018. And all this due to the Covid-19 virus, which causes investors to avoid investing in risky assets, preferring quieter havens.

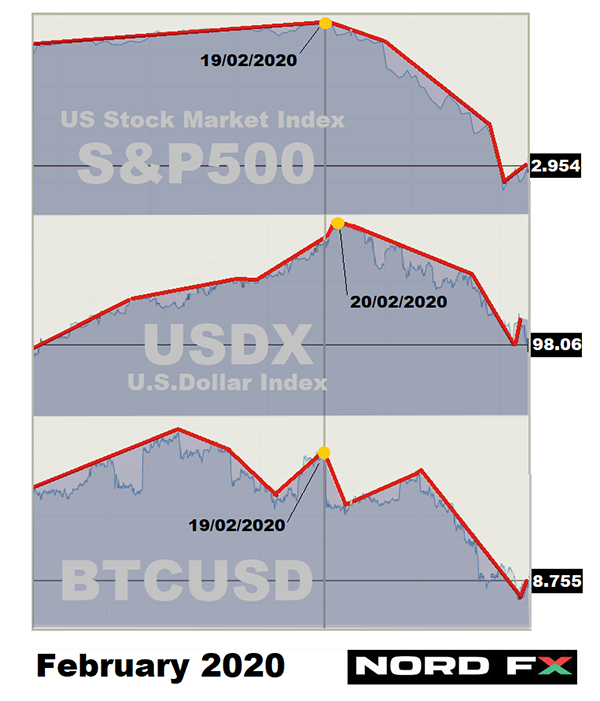

Global and US stock indices continue their decline, having fallen more than 10% from the February highs. Suffice it to say that only the S&P500 has lost about 15% since February 18. The information that more than 8 thousand people were monitored in California because of the epidemic only increased the panic among investors who are actively getting rid of both American stocks and US dollars.

As a result, thanks to sharply increased demand for funding currencies such as the euro and the yen, the continuous growth of the dollar, which we observed from 01 to 20 February, has finally stopped. And those traders who had enough nerves and money to withstand a drawdown on long positions of 310 points, were able to breathe a sigh of relief. The pair has been growing all week, reaching a local high at 1.1053 on Friday, February 28, followed by a correction and a finish at 1.1030;

- GBP/USD. If the dollar does not feel very well against the background of the coronavirus, the British pound feels even worse against the background of the consequences of Brexit. The bearish forecast, which was supported by the majority of experts (55%), turned out to be absolutely correct: the pair continued to move in the medium-term downward channel and, as expected, after several attempts, broke the February 20 low of 1.2850. Then the fall became a landslide and, after flying for a few hours about 125 points, it found the local bottom at 1.2725. This was followed by a rebound up, and the pair ended the five-day period at 1.2820;

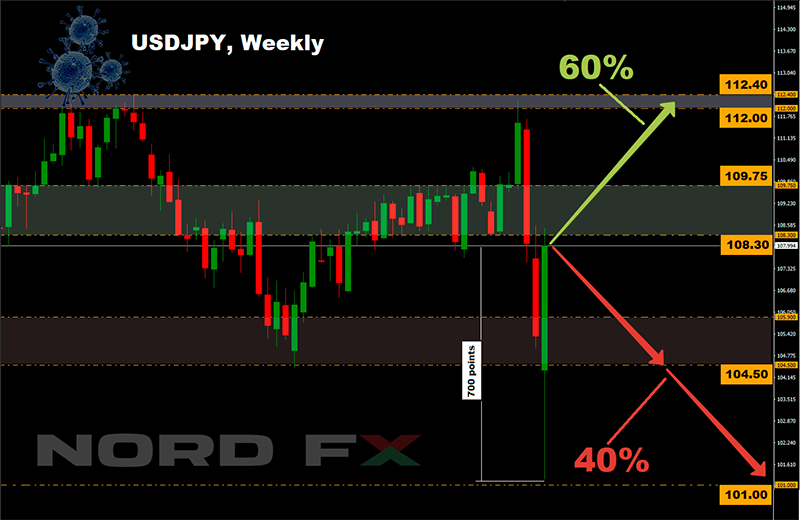

- USD/JPY. The vast majority of analysts (75%) had predicted the growth of the Japanese currency, but no one had expected such a result. The flight from the dollar and the growing demand for hedging currencies allowed the yen to demonstrate a phenomenal growth of 410 points: starting the week at 111.60, the dollar fell to 107.50 on Friday evening, updating the lows of 2020. As for the final chord of the week, after the correction, it sounded in the 108.00 zone;

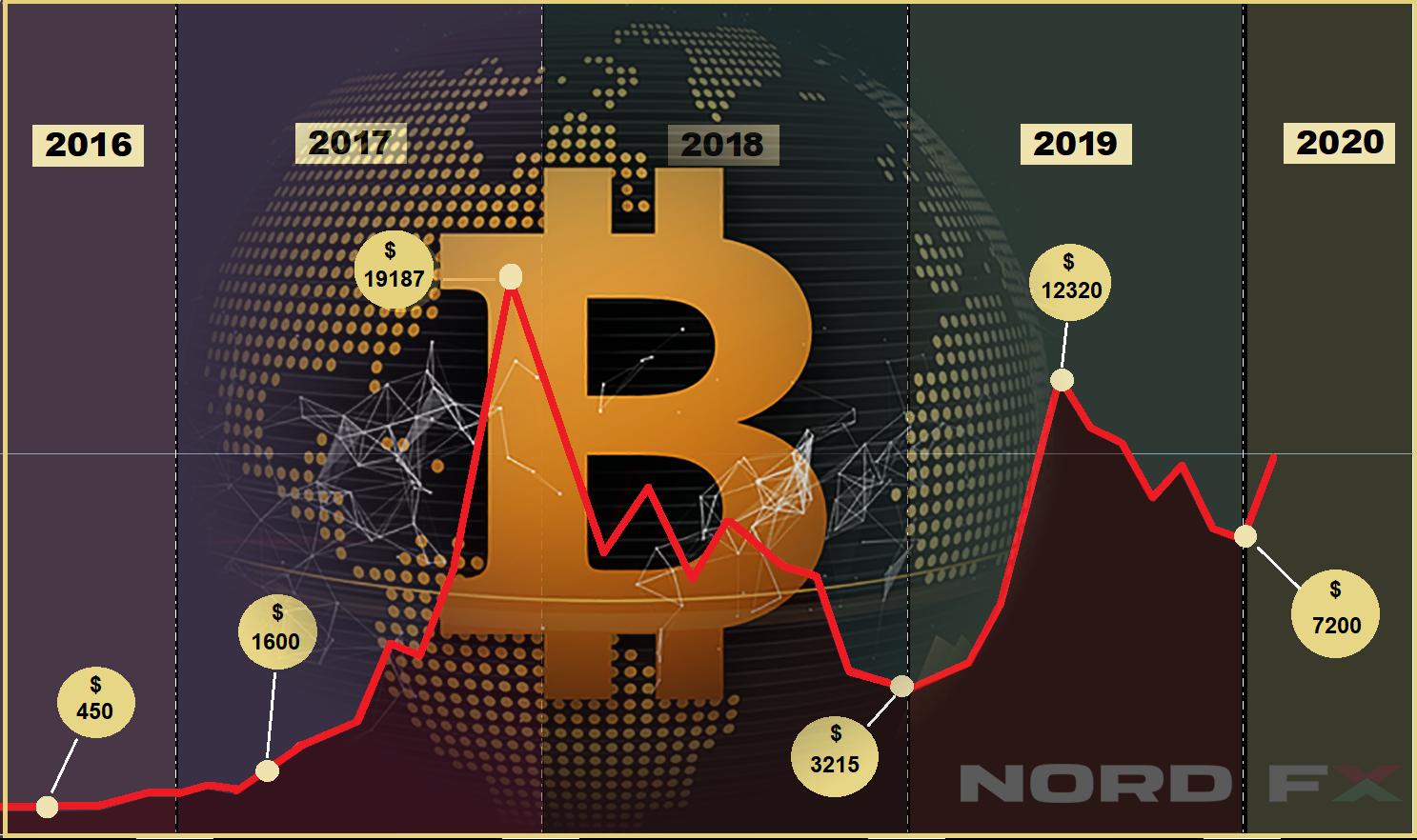

– cryptocurrencies. It is possible that the Wall Street old wolf, Warren Buffett, who turned his back on cryptocurrencies with disdain, is right. All sorts of Bitcoin gurus and crypto enthusiasts have recently criticized him, convincing us that BTC has become a reliable asset - a safe haven in which one can safely invest their funds. What do we see in reality?

The euro and the yen have been rising against the dollar all week. And if Bitcoin is a hedge asset as well, its quotes would also have to go up. But it was exactly the opposite. The dollar was flying down, and Bitcoin, along with top altcoins, including Ethereum (ETH/USD), Litecoin (LTC/USD) and Ripple (XRP/USD), were flying down even faster. Having fixed a monthly low of $8.455 on February 28, the BTC/USD pair lost almost 12.5% of its value over the week. The total capitalization of the crypto market decreased by 15%, and the Crypto Fear & Greed Index, froze in a state of "fear", having fallen to the level of 40.

As for the forecast for the coming week, summarizing the opinions of a number of experts, as well as forecasts made on the basis of a variety of methods of technical and graphical analysis, we can say the following:

- EUR/USD. According to the Chicago Mercantile Exchange (CME) analysts' forecasts, the probability of an interest rate cut at the next meeting of the US Federal reserve on March 18 is 90%. (For reference: at the beginning of February, this figure was only 10%). If this happens, we can expect the dollar to fall. Data on the labor market, which will traditionally be published on the first Friday of the month, March 06, can also play against the US currency. Thus, according to forecasts, the NFP indicator may fall from 225K to 176K. On the other hand, the ISM business activity index is likely to stay above the critical 50.0 mark, which is a positive factor. In this situation, it is likely that reports from the front of the fight against coronavirus will continue to determine the quotes of the EUR/USD pair.

At the time of writing this forecast, 60% of experts, supported by 70% of oscillators and trend indicators, look to the north, expecting the pair to grow. The goals are 1.1055, 1.1100, 1.1175 and 1.1240. The opposite view is supported by 40% of analysts and 30% of indicators that are in the overbought zone or colored red. Supports are 1.0950 1.0900, 1.0830 and the February 20 low 1.0777;

- GBP/USD. In contrast to the dollar, the probability of reducing the interest rate on the British pound, on the contrary, falls. According to Bank of England Board member John Cunliffe, who has been responsible for financial stability since 2013, the regulator expects the inflation to rise. Due to the positive dynamics of the labor market and the growth of average wages, the consumer price index may even exceed the target level of 2%. And in such a situation, lowering interest rates is simply not necessary.

In addition to Cunliffe's statements, markets are concerned about what Bank of England Governor Mark Carney will say in his speech on Thursday 05 March. Among the main issues is the reaction of the British regulator to the fall in stock markets due to the coronavirus epidemic. In addition, investors are also interested in the purpose for which the Bank of England is increasing its gold reserves. The UK has recently purchased a record amount of this metal worth $5.33 billion in Russia alone, which is 12 times higher than the usual volume of purchases.

Given the difference in the impact of the Covid-19 epidemic on the US and UK markets, as well as the upcoming reduction in interest rates by the Fed, most experts (65%) prefer bulls, expecting the GBP/USD pair to return to the 1.3000-1.3070 zone, and possibly even 100 points higher. Graphical analysis on D1, as well as 15% of oscillators on H4 and D1 that give signals the pair is oversold, agree with this development.

A minority of analysts (35%), most oscillators (85%), and almost 100% of trend indicators side with the bears;

- USD/JPY. It is clear that the absolute majority of indicators here are colored red. However, it is already 25% of the oscillators that are in the oversold zone, which may indicate if not a complete reversal of the trend, then at least a strong upward correction. 65% of analysts also expect the pair to rise. The nearest resistance level is 109.25, the nearest target is a return to the zone of 109.65-110.25, the next target is the height of 112.00. It can be achieved by reducing the panic in global stock markets caused by success in the fight against the coronavirus. Over the past week, the number of Covid-19 patients decreased by an average of 1,600 people per day. And in the coming week, the number of cured patients may exceed 50% of the number of cases.

Of course, we would very much like to see the epidemic of this infection go down. But if this does not happen in the next few days, the dollar may continue to fall, and the pair will break through the support of 107.50, 106.65, 105.65 one after another and approach the August 2019 low in the area of 104.45;

– cryptocurrencies. Against the background of space forecasts of his colleagues, the head of the Binance crypto exchange, Changpeng Zhao, behaved interestingly, making a statement that looks more like persuasion. According to him, if Bitcoin does not double in price as a result of the halving, the industry will face big problems. The number of miners will begin to decrease. In addition, the asset risks losing the support of large investors who expect its value to grow. "In May, miners will lose part of their earnings in cryptocurrency terms. Bitcoin should compensate for this event in dollars. If the asset is not able to provide the miners with at least similar conditions, most of the players will simply leave the industry. This cannot be allowed to happen!”, - Zhao convinces his colleagues.

Whether his persuasions will work in the future is unknown, but the majority of experts (45%) are pessimistic so far, expecting a decline in the BTC/USD pair to the $8,000-8,250 zone. There are currently 30% of optimists among analysts. In their opinion, the fall of the last two weeks is just a correction, and we will soon see Bitcoin storm the height of $10,500 once again. As for the remaining quarter of the experts, they have not been able to form an opinion.

Roman Butko, NordFX

Notice: These materials should not be deemed a recommendation for investment or guidance for working on financial markets: they are for informative purposes only. Trading on financial markets is risky and can lead to a loss of money deposited.

#eurusd #gbpusd #usdjpy #usdchf #forex #forex_example #signals #forex #cryptocurrencies #bitcoin

https://nordfx.com/