Antony_NPBFX

NPBFX Representative (unconfirmed)

- Messages

- 1,093

The Winner is Presented with iPhone 11 Pro and $1000! Summing up the results of the November Battle of Traders

Hello, dear forum users!

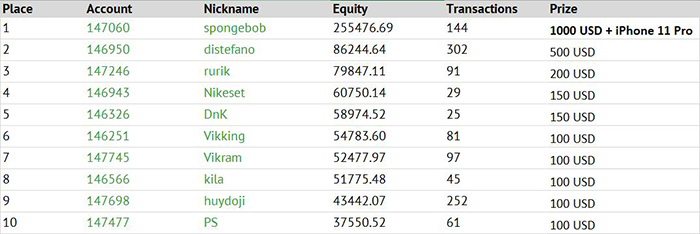

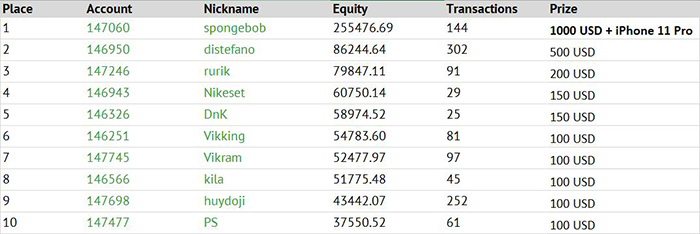

Since November, the Battle of Traders contest has opened its second annual cycle. The successful start is evidenced by the general statistics of the contest month and the table with trading results of 10 winners. Trade leader of the contest was so effective that additionally to $1000 he managed to win the grand prize – the brand-new iPhone 11 Pro! At the end of November, the trader increased the initial capital of $5000 by 5 (109%)! Congratulations to the winner with nickname spongebob (account number 147060) and we wish him to achieve no less impressive profit figures on the NPBFX real account! We have already recorded the interview with the winner and it will be published very soon. It should be noted that the winner participated in the Battle of Traders for the first time, he lives in Indonesia.

The greatest number of deals on trading account in November was made by a trader with nickname VNK0111 (account number 147060) – 3604 deals! Trader used a minimum trading lot from 0.01 to 0.05. In the Battle of Traders contest participants can apply any trading strategy for both manual and automated trading.

Total 1817 traders took part in the November Battle. More than 90% of the participants have completed the contest with a positive balance. However, in order to be among the winners, you need to fulfill two main conditions of the contest: To increase the initial capital by at least 30% and to close at least 10 trades. Who managed to be ahead of the contest and entered the top 10 winners? Money prizes from NPBFX are awarded to the participants with the following nicknames: spongebob, distefano, rurik, Nikeset, DnK, Vikking, Vikram, kila, huydoji, PS.

Would you like to get a real trading deposit as a gift for New Year holidays? It can be $100, $150, $200, $500, $1000 and also a grand prize–the brand-new iPhone 11 Pro, which will also be in the January draw!

Hurry up to participate and start 2020 as a winner together with a reliable broker - NPBFX!

Sign up for the January Battle of Traders contest

Hello, dear forum users!

Since November, the Battle of Traders contest has opened its second annual cycle. The successful start is evidenced by the general statistics of the contest month and the table with trading results of 10 winners. Trade leader of the contest was so effective that additionally to $1000 he managed to win the grand prize – the brand-new iPhone 11 Pro! At the end of November, the trader increased the initial capital of $5000 by 5 (109%)! Congratulations to the winner with nickname spongebob (account number 147060) and we wish him to achieve no less impressive profit figures on the NPBFX real account! We have already recorded the interview with the winner and it will be published very soon. It should be noted that the winner participated in the Battle of Traders for the first time, he lives in Indonesia.

The greatest number of deals on trading account in November was made by a trader with nickname VNK0111 (account number 147060) – 3604 deals! Trader used a minimum trading lot from 0.01 to 0.05. In the Battle of Traders contest participants can apply any trading strategy for both manual and automated trading.

Total 1817 traders took part in the November Battle. More than 90% of the participants have completed the contest with a positive balance. However, in order to be among the winners, you need to fulfill two main conditions of the contest: To increase the initial capital by at least 30% and to close at least 10 trades. Who managed to be ahead of the contest and entered the top 10 winners? Money prizes from NPBFX are awarded to the participants with the following nicknames: spongebob, distefano, rurik, Nikeset, DnK, Vikking, Vikram, kila, huydoji, PS.

Would you like to get a real trading deposit as a gift for New Year holidays? It can be $100, $150, $200, $500, $1000 and also a grand prize–the brand-new iPhone 11 Pro, which will also be in the January draw!

Hurry up to participate and start 2020 as a winner together with a reliable broker - NPBFX!

Sign up for the January Battle of Traders contest